Never argue with an idiot. They will drag you down to their level and beat you with experience.

Mark Twain

Stock Forecast: Why a Market Crash is Unlikely

In recent years, naysayers have predicted a market crash, but we have always disagreed and believed that the market would continue to rise. Despite being proven wrong time and time again, these naysayers persist in their pessimism and continue to make dire predictions in the hope that they will eventually be proven right. In October, they began predicting a repeat of the 1987 stock market crash, but we quickly rejected these claims. Here’s a brief excerpt from the article we published at that time.

They never let up on pushing this sewage onto the unsuspecting masses. This is a clear example of insanity in action, mouthing the same thing repeatedly with the desperate hope that this time the outcome will be different. The outcome will not be different this time, at least not yet. These guys should focus on writing fiction, for reality seems to elude them completely. For years we have stated (and rightly so) that until the sentiment changes, this market will continue to soar higher and higher.

Looking Beyond Omens: A Practical Approach to Predicting Market Performance

It’s become common for some to predict a market crash based on supposed omens that have a poor track record of accuracy. In reality, one should first determine the overall trend and consider several underlying forces before attempting to predict where the market is headed.

Unfortunately, there are those who read a book or two, memorize someone else’s theories, and suddenly believe themselves to be experts. Both fundamentals and technicals are useless when used in isolation. One must look at the emotions driving the markets and consider what the masses are thinking or doing.

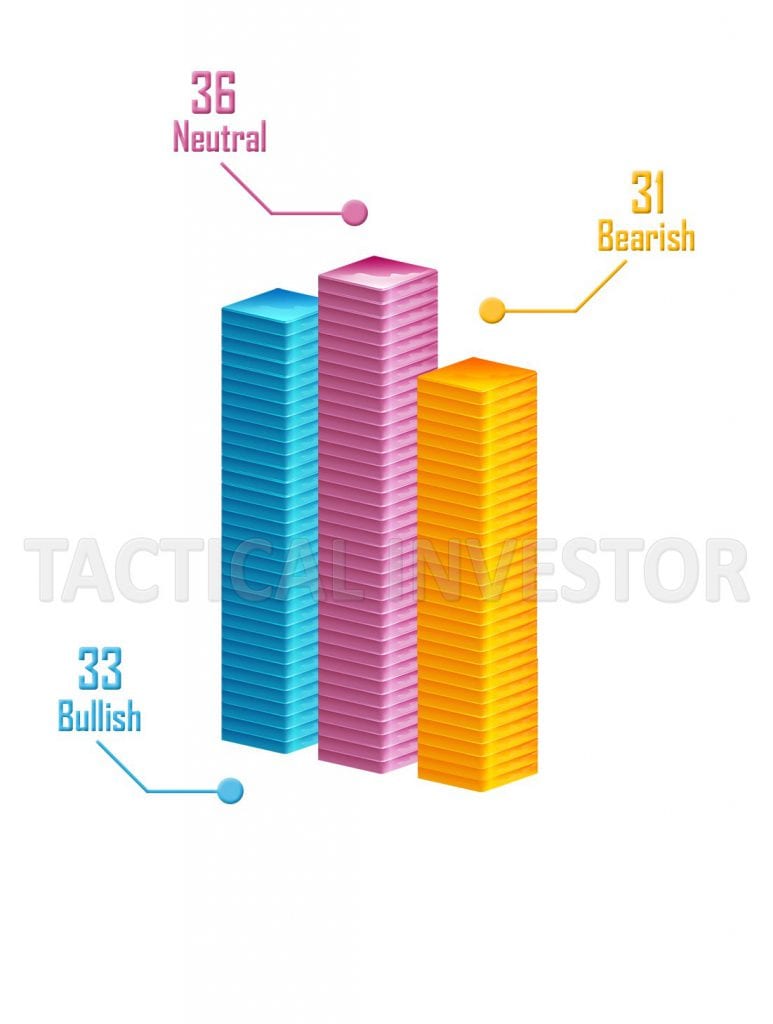

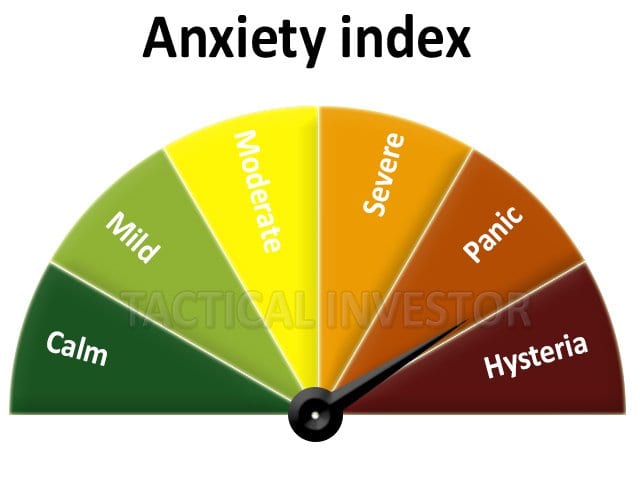

When analyzing sentiment data, it becomes clear that stock markets tend to crash during euphoria, and currently, the masses are far from happy. In conclusion, relying on omens and unfounded predictions is not a reliable way to predict market performance. Instead, careful consideration of the overall trend and underlying forces and an understanding market sentiment is necessary for accurate predictions. Stock markets always crash on a note of euphoria, and the masses are far from being happy.

Wall Street Experts Good For Nothing but Hot Air

Over the past 20 years, the US markets have experienced two brutal crashes, and on both occasions, most of the so-called “Wall Street experts” were caught unawares. The two cases in question are the housing bust and the dot-com bubble. Furthermore, many top economists failed to predict the Great Recession of 2008. However, these same experts also failed to predict one of the biggest bull markets of all time.

In other words, while experts may have a wealth of knowledge and experience, their predictions often miss the target. Market crashes and economic recessions can come as a surprise, just as bull markets can exceed expectations.

Masses are not embracing one of the Most Hated Bull Markets in History

The images below speak a thousand words, so we don’t need to add any commentary.

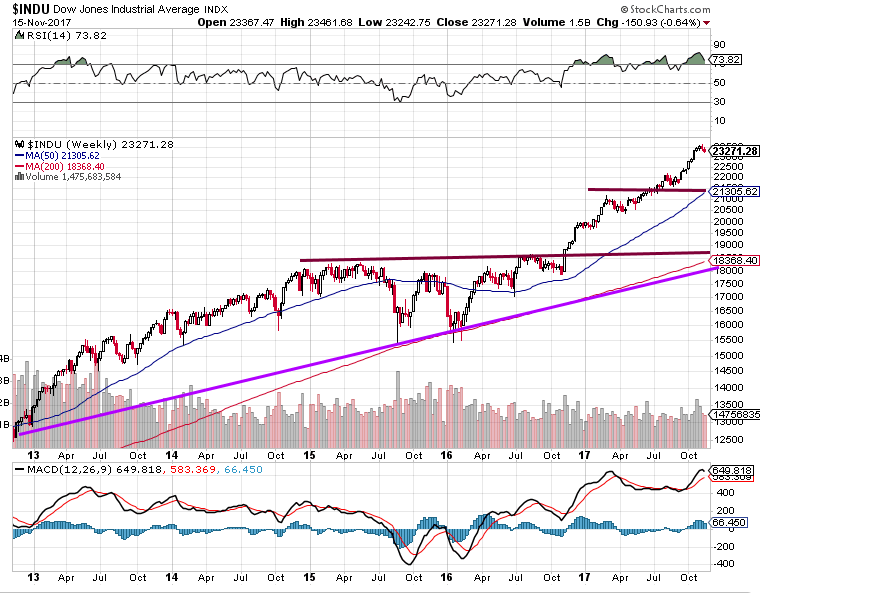

Stock Forecast: The Technical Outlook

Currently, the Dow is trading in extremely overbought ranges. However, any potential pullback is likely to end in the 21,000-21,500 range. To gain momentum, a correction would need to close below this level on a weekly basis. While the trend remains positive, the probability of a Dow crash is quite low.

At most, the Dow may test its breakout point, which falls within the 18,900-19,200 range, unless the trend turns negative or the masses suddenly become enthusiastic about the market. Currently, the trend is strong and shows no signs of weakness. It’s important to remember that markets can remain irrational for extended periods, and traders who bet against them may face significant losses.

Inflation remains a non-issue on a worldwide basis.

Central banks worldwide are either standing down or opting for rate cuts. This indicates that while the economy is improving somewhat, the global economy is far from healthy and low rates will continue to dominate the scene. In a lower rate environment, corporations borrow more money, and the new game is to use this money to buy back shares and, in doing so, magically improve the EPS.

Markets More Likely to Pull Back than Crash in 2018

We have a history of accurately predicting the performance of the Dow. When the Dow was trading below 20K, we stated that the next target would be 21K, which was achieved in a few short months. After that, we raised the target to 22K and 23K. Currently, we believe that the Dow is likely to test 28,000-28,500, with a potential overshoot to 30K before it crashes. Our subscribers can expect an in-depth analysis of the path the Dow will take to achieve this target.

It’s essential to be wary of so-called experts who often dish out faulty information. A simple search will reveal that over 90% of them have a poor track record and have given advice that would have resulted in significant losses. Clearly, these “Dr’s of Doom” are simply trying to sell their advice for a fee, without any intention of following it themselves. We urge you to carefully consider the source of your investment advice and look to those with a proven track record of success.

Forget Stock Market Crash in 2018 but have a game plan for a substantial pullback:

View firm corrections through a bullish lens. This game plan will remain valid until the masses turn bullish or the trend turns negative. The stronger the deviation, the better the opportunity.

You can’t make anything idiot-proof because idiots are so ingenious.

Ron Burns

Article Summary and Overview

- Naysayers have been predicting a market crash, but the trend remains positive.

- Omens and unfounded predictions are not reliable ways to predict market performance

- Wall Street experts have missed the target with their predictions in the past

- The Dow is trading in highly overbought ranges, but a potential pullback is likely to end in the 21,000-21,500 range

- Inflation remains a non-issue on a worldwide basis

- Central banks are standing down or opting for rate cuts, indicating that the global economy is far from healthy

- Markets were more likely to pull back than crash in 2018, and a game plan for a substantial pullback is recommended

Other Stories of Interest

1987 stock market crash anniversary discussions- nothing but rubbish ( Oct 24)

Dow 22K Predicted In July 2017; Next Target Dow 30k? (Oct 15)

Anxiety and Greed Index Don’t Support Stock Market Crash (Oct 14)

Fed States Inflation is not an issue? (Oct 13)

Is Bitcoin a Bubble or Good Investment? (Oct 9)

Stock market crash; the best time to buy stocks (Oct 6)

Nasdaq’s Achievement Topples Stock Market Crash Argument (Oct 5)

Stock Market Crash 2018; Another Buying Opportunity (Oct 5)

Masses Trained to fear Market Crashes; why not embrace them? (Sept 27)

Buy When the Blood in the Streets is flowing Freely (Sept 13)

Dow 21K Predicted In August 2016 (Sept 9)

Minimum wage hike ignores the impact of AI; companies will opt for Robots (Sept 8)

Should You Be Worried About Inflation Rate In 2017? (Sept 6)

Wage Deflation here to stay: Robots Replacing Workers (Sept 5)

Price of Copper Signalling Inflation or higher Stock Market Prices (Sept 4)