Decoding the Bitcoin Bubble: Beyond the Hype

Updated Nov 2023

The current trend in cryptocurrencies, analyzed through sentiment, is drawing parallels to historical bubbles like the dot-com and tulip mania. While acknowledging the similarities, it’s crucial to recognize the unique dynamics in today’s financial landscape. We find ourselves in an era characterized by easy money, a distinct factor differentiating the current scenario from past instances of speculative fervour.

The comparison to past bubbles, such as the dot-com era and tulip mania, serves as a cautionary tale, emphasizing the need for vigilance. However, a critical distinction emerges when we consider the prolonged impact of easy money on the current market dynamics. In the present era, where monetary policies and economic conditions facilitate a continuous influx of liquidity, the traditional timelines associated with the “feeding frenzy” stage or the bubble phase may significantly extend.

Contrary to historical precedents, where bubbles tended to burst relatively quickly, today’s financial landscape suggests a potential for an extended duration of the bubble phase. The availability of easy money introduces a unique element that can sustain market vitality for a more prolonged period, potentially twice as long or even more before the eventual correction.

This nuanced perspective invites a cautious optimism. While acknowledging the similarities to historical bubbles, acknowledging a prolonged bubble phase prompts a reevaluation of traditional market timing strategies. Investors need to navigate the current landscape with an understanding that the dynamics fueling the cryptocurrency market’s exuberance may persist for an extended period.

The trajectory of cryptocurrencies is driven by sentiment, which follows historical patterns. However, the current landscape is shaped by the pervasive influence of easy money, which deviates from the conventional circuit of market bubbles. It is important to note that Bitcoin is likely to experience multiple boom and bust phases before the ultimate bubble burst. For investors willing to take risks, leveraging robust pullbacks can be a strategic move, allowing them to invest funds in measured lots. The sharp pullback observed from November 21 to December 2022 is a pertinent example, providing ample opportunities for investors to implement and capitalize on this strategic approach.

The Crowd is still not Euphoric over Bitcoin.

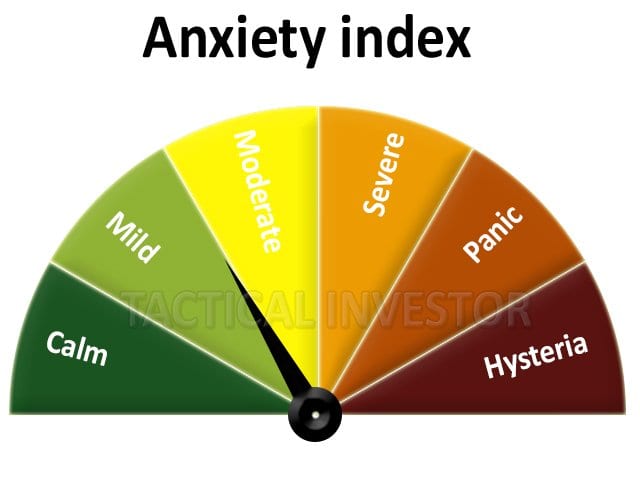

While the masses are pretty excited, according to our Anxiety gauge, there is still room for this market to run. The gauge would have to move to the Calm zone and remain in this zone for at least three weeks on end.

The Optimum Bitcoin Strategy

In the ever-fluctuating seas of the cryptocurrency market, discerning the optimal Bitcoin strategy demands a contrarian perspective. While critics highlight Bitcoin’s lack of intrinsic value, it’s imperative to acknowledge that traditional currencies, like the US dollar, share a similar dilemma. However, the dollar’s longstanding history and broader acceptance offer a contrasting narrative. As you sail through this volatile landscape, consider diversifying your portfolio across various cryptocurrencies, harnessing the potential of emerging digital assets.

Contrary to conventional wisdom, it’s not just about investing; it’s about strategically navigating uncharted waters. Embrace the unconventional notion that calculated risk-taking can be a pathway to financial evolution. Instead of shying away from the volatility, leverage it to your advantage. The traditional mantra of not investing more than you can afford to lose echoes wisdom, yet it fails to capture the essence of potential gains in this dynamic realm.

Amidst the speculative allure of Bitcoin, challenge the status quo and explore the possibilities of a nuanced investment approach. It’s not merely about caution; it’s about orchestrating a symphony of calculated moves that defy the norms, ushering you into the forefront of this transformative financial frontier. Embrace the uncertainty with strategic diversification, for in the volatility lies the potential for unprecedented rewards. Don’t invest money you can’t afford to lose.

Two ways to invest in the Bitcoin Market without buying Bitcoins

When it comes to investing in the Bitcoin market, alternative options are available for those who wish to participate without directly purchasing Bitcoins. These approaches provide opportunities to benefit from the Bitcoin market’s performance without navigating the complexities of owning and storing cryptocurrencies. Let’s explore two popular methods:

1. GBTC (Grayscale Bitcoin Trust):

GBTC is a trust offered by Grayscale Investments that holds Bitcoin as its underlying asset. It allows investors to gain exposure to Bitcoin’s price movements without actually owning the cryptocurrency. GBTC’s value tends to closely track the performance of the Bitcoin market, providing investors with a way to capitalize on Bitcoin’s price fluctuations. One notable advantage of GBTC is its liquidity, making it easy for investors to enter and exit positions quickly. This liquidity enables investors to take advantage of short-term market movements and potentially generate returns quickly. However, it’s important to note that GBTC can be highly volatile, as it closely follows the volatility of the Bitcoin market itself.

2. ARKW (ARK Next Generation Internet ETF):

For investors who prefer a more stable approach to investing in the Bitcoin market, ARKW offers an alternative. ARKW is an exchange-traded fund (ETF) managed by ARK Invest that focuses on companies involved in disruptive technology, including cryptocurrencies and blockchain technology. While ARKW does not directly hold Bitcoin, it includes companies exposed to the cryptocurrency market. By investing in ARKW, individuals can indirectly participate in the potential growth of the Bitcoin market, benefiting from the success of companies involved in the cryptocurrency ecosystem. This investment avenue provides a relatively less volatile option than directly investing in Bitcoin or Bitcoin-related instruments. However, it’s essential to understand that various factors beyond the Bitcoin market influence the performance of ARKW, as it encompasses a broader range of disruptive technologies.

These investment options allow individuals to engage with the Bitcoin market without directly purchasing and managing cryptocurrencies. Each approach has its own characteristics, including risk profiles and potential returns. Investors need to conduct thorough research, evaluate their risk tolerance, and consider their investment goals before deciding on an investment strategy. Consulting with a financial advisor or investment professional can also provide valuable guidance in navigating the complexities of the Bitcoin market and selecting the most suitable investment approach.

Bitcoin Outlook

Bitcoin’s outlook beckons a closer examination through the lenses of contrarian and mass psychology perspectives. In the short to intermediate term, the cryptocurrency appears to be navigating the treacherous waters of the Bubble phase. This phase, characterized by heightened speculation and inflated valuations, suggests a need to release significant pressure before the next substantial upward charge.

Contrarians, who thrive on market dissonance, may see this as an opportune moment. They recognize that the market sentiment often overshoots both upside and downside. In the current scenario, the apparent bubble signals a potential for an exaggerated downward correction. This contrarian perspective encourages a strategic approach, advocating the utilization of robust pullbacks as entry points.

However, the mass psychology surrounding Bitcoin is a complex interplay of fear and greed. Fear may grip investors as the market experiences strong pullbacks, leading to panic selling and further driving the downward momentum. Understanding and navigating this collective psychology becomes crucial for investors.

Taking a step back, adopting a contrarian viewpoint aligns with the idea of going against the prevailing sentiment. While the masses may be caught in the frenzy of the bubble, contrarians recognize the cyclical nature of markets and the potential for a rational correction.

In practical terms, this suggests a cautious yet opportunistic stance. Strong pullbacks align with the contrarian ethos and reflect an understanding of mass psychology. It involves a strategic balance of entering positions at favourable moments while having the discipline to take profits and patiently wait for more opportune times to reinvest.

The Bitcoin outlook prompts a nuanced strategy when viewed through the prisms of contrarian and mass psychology perspectives. Embracing the contrarian spirit allows for a calculated approach in the face of market exuberance while recognizing the impact of mass psychology provides insights into the behavioural dynamics that can influence market movements. As the cryptocurrency market evolves, these perspectives serve as valuable tools for investors navigating the complexities of Bitcoin’s price dynamics.

Bitcoin Bubble Alert: November 2023 Update – Beyond the Glitter

BTC establishes a foundation with the settling dust, gearing up for a higher rally. We rode the initial wave, securing profits in October 2023, strategically allowing BTC to release steam before its anticipated ascent. Here are key insights from past market updates, shedding light on our approach to this dynamic market.

The majority of the targets we listed have been achieved, and currently it is trading in the extremely overbought range on the weekly charts. At this juncture, the risk-to-reward ratio does not favour opening new positions. While it might briefly trade up to 33K and possibly beyond, traders would be better off using any surge to scale out of positions in BTC and GBTC.

If Bitcoin pullbacks to the neutral or oversold range on the weekly chart, we will consider adding new positions. Since it missed the higher end targets, there’s a good chance it could test the 23-25k range again. Sometime in September or early October, it may attempt to challenge the 33K mark. Market Update August 16, 2023

We successfully scaled out of GBTC with a modest gain. Bitcoin is currently in a consolidation/correction phase, and there’s a higher likelihood that it might undergo a test of the 23K range, with a variance of approximately 500 dollars. Considering this, we have provided new entry points for GBTC, operating under the assumption that it will trade within the range of 23K to 23.5K. Market Update Aug 22, 2023

Shifting our focus to the world of Bitcoin, the pattern is showing signs of strengthening. As we closely monitor its performance throughout the week, it’s worth noting that Bitcoin is currently trading in the extremely overbought range on weekly charts. Despite this, we are considering deploying a quarter of our funds into it. The rationale behind this move is the strong long-term potential, with the possibility of it surging to 45,000 USD. However, the short-term pattern, until recently, suggested that it might be prudent to wait for a pullback before making any investment decisions. Interim update (posted in the Forum on October 26th)

Embrace sharp pullbacks until BTC reaches the 48 to 51 range. At this point, consider taking some money off the table and closely monitoring the position. While the potential exists for BTC to reach as high as 60K, caution is advised beyond 51K, venturing into more risky territory in this naturally volatile market.

Feed Your Intellect: Articles for the Mind

Stock market crash; best time to buy stocks