Blood In The Streets: That’s The Best Time To Buy

Updated March 30, 2023

Polarisation is the new ViX for this Market. Since Trump was elected, we noticed something interesting: economic news seems to have less impact than Geopolitical developments. Polarisation has had the effect it intended to trigger; the masses and the markets are focusing on the wrong issues, so we can expect a slew of legislation favouring the corporate world to be passed with little to no resistance. This, in turn, will help push stocks even higher as corporations will have even less to worry about being liable for using questionable methods to boost their earnings. Stock Market Crash 2018 is wishful thinking, but if the market should pull back firmly, jump in and buy.

In the last Market update (available to premium subscribers only), we spoke of how the markets operate in a way that appears to make no sense and how they are working more and more like an insane person. Ask a madman how he is, and he might respond by telling you that “ the road needs to be fixed”. The answer has nothing to do with your question and, on the surface, has no pattern whatsoever, but if you turned around and looked at the road, you might notice that it needs repairs. All you had to do was alter the angle of observance, and in doing so, you spotted something that most would have missed.

Stock Market Crash Predictions: Don’t Listen To The Experts

When There Is Blood on the Streets, It’s Time To Buy

What if you asked him another question instead of declaring him insane, for example, “ Are you hungry?”. To which he responds, “ I hurt my toe yesterday”. You learnt something from the first question, so instead of trying to figure out the answer, you decide to look down, and you notice he is not wearing a shoe on the right foot, and the toe is wrapped up in a bandage.

What is the pattern here? The guy is not responding to your inquiries; maybe he is not as insane as he appears, or maybe he thinks your questions are silly. The second thing to conclude is that he is more concerned with reality than possibility. Thus, the information is not useless; it appears to be ineffective because most would be ready to evaluate this person based on what they deem to be sane or insane. In other words, they would follow SOP (standard operating procedure).

Markets March to their Drumbeat and not to yours

This is what is going on in the markets today. If you ask the market a question based on what worked in yesteryear, then the answer is going to sound insane. However, the answer is not insane. The person asking the same question over and over again and expecting a new outcome is the one that is insane. The markets spoke years ago and continued to speak, but no one listens; experts keep asking the same question.

Markets march to their drumbeat, not yours. The logical way to examine this market is to stop looking at what it should be doing and instead focus on what it’s doing and why it’s doing this. The markets are erratic because people today are acting as if they are insane. Everyone has an emotional stake in every possible outcome. A market is nothing but a seething cauldron of emotions. The crowd is insane, so don’t expect anything different from the market.

Blood on the Streets Moment Approaching in 2018?

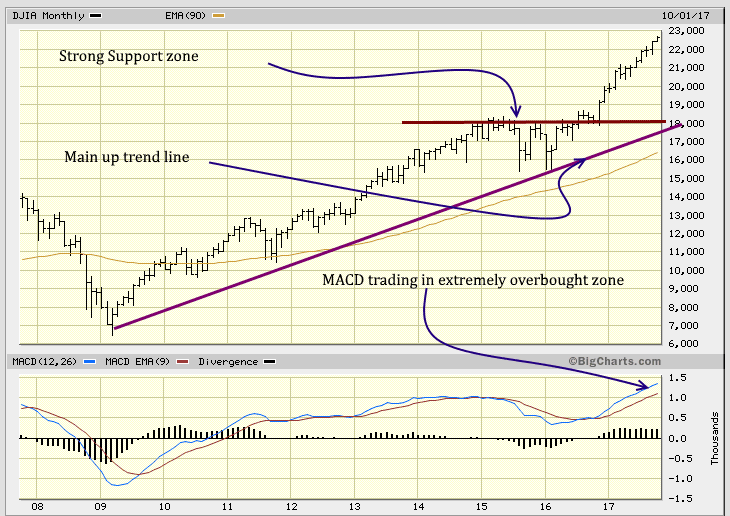

The chart speaks for itself; the markets are trading in extremely overbought ranges. Traders should be cautious when committing too much money to this market. Open positions in oversold stocks or stocks that have taken a beating but whose future appears to be turning around. Make sure you have stops in place. Having said that, markets can trade in the overbought ranges for months on end. Each bar in the above chart represents a month’s worth of data, and you can see that this phenomenon that we just mentioned occurred from Oct 2012 until Aug 2015. A strong pullback is possible, but Stock Market Crash 2018 is a low-probability event.

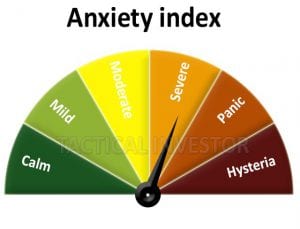

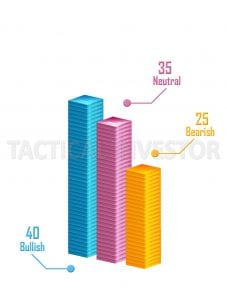

Market Sentiment Does Not Support A Crash

Game Plan. Whenever There’s Blood on The Streets Buy

The stock market has been trending in the overbought ranges for an extended period, so what’s the plan? In such situations, you have only two options. We have already put the 1st option to work: forget what the markets are doing, focus on the trend, and wait for the indicators to move to the oversold ranges.

What happens if our proprietary technical indicators refuse to pull back? Option 2 comes into play: focus on stocks trading in the extremely oversold ranges; the emphasis should be on the monthly charts. Most new plays we issue are trading in the oversold ranges on the monthly charts. In such a mature bull market, it’s challenging to spot stocks trading in the oversold range on the monthly chart. Sometimes, we must go through 200 stocks to find one possible candidate, and sometimes we find nothing.

If the indicators move into the oversold range and the markets don’t pull back strongly, then the follow-through reaction (upward move) is going to be very strong. Market Update Sept 1, 2017

In such conditions, we suggest you buy some stocks but focus on stocks trading in the oversold to extremely oversold zones. But build up cash, so when the market pulls back, you have the capital to deploy into top stocks selling at a discount.

Masses will throw the baby out with the bathwater.

We are almost positive that the masses will panic extremely fast during the next pullback, and in doing so they will throw the baby out with the bathwater. Instead of the Dow pulling back 1500 points, it will probably shed double that amount before a bottom takes hold.

But oh my, what a great buying opportunity this will prove to be, provided the trend is up. There is no indication that it will change even if the Dow sheds 3000 points. If the Market crashes in 2018, it will be another splendid buying opportunity. Until the masses embrace this market, the bull will continue to charge higher.

Tactical Investor Update Aug 2019

Experts are notorious for issuing dates and dire predictions, but on both counts, if one bothers to track their performance, one will find that monkeys with darts fare much better.

We stated this to our subscribers on the 11th of July 2019.

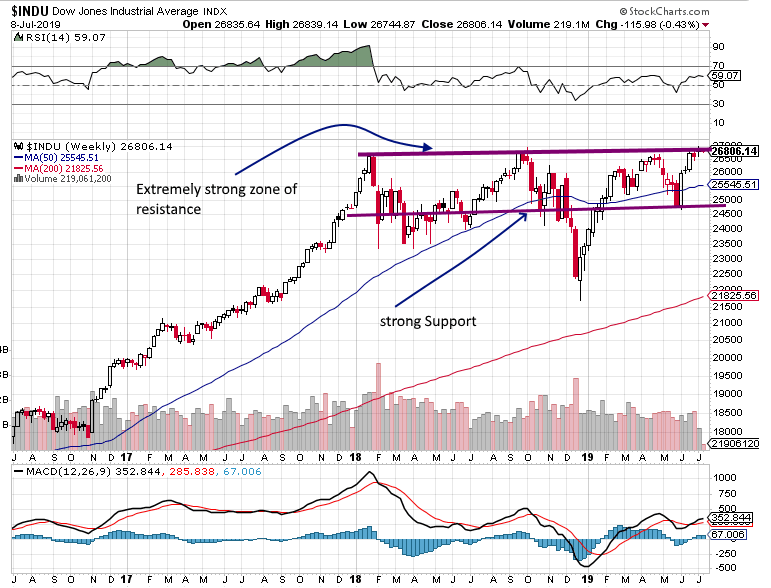

Looking at the chart below, it would be easy to conclude that we are about to push the “triple top” theory, but we are not. We are looking at the picture in terms of very strong resistance and very strong support zones. The Dow has tried to trade above the 26,800-27,000 range for almost 19 months. Furthermore, these attacks have been widely spaced out. Hence, the Dow is now at an inflexion point”; it either blasts above 27,000 and, in doing so, former resistance turns into strong support.

The masses complain about better prices when their wish comes true. They panic and flee to the hills, which they call investing. They either oscillate between misery or euphoria and have a dangerously short lifespan. The crowd is too scared and nervous to support a stock market crash outlook. If the market pulls back strongly and there is blood in the streets, then the astute investor should back the truck up and load it with quality stocks.

Blood on the Streets FAQ

Q: What is the significance of polarisation in the market and its impact on economic news?

A: Polarisation in the market shifts focus from economic news to geopolitical developments, potentially leading to legislation favouring corporations and higher stock prices.

Q: How does the market operate in a seemingly irrational manner?

A: The market operates based on its own drumbeat, often defying conventional logic and expectations.

Q: How can traders navigate the erratic nature of the market?

A: Traders should focus on what the market is doing and why rather than trying to impose their own expectations.

Q: What is the relevance of the “blood on the streets” concept in investing?

A: The “blood on the streets” moment refers to a market pullback, presenting an opportunity to buy undervalued stocks.

Q: How can traders determine if a market crash is imminent?

A: Market sentiment and technical indicators should be considered to assess the probability of a crash.

Q: What strategies can be employed during an extended period of overbought market conditions?

A: Traders can focus on trends and indicators moving into oversold ranges or identify oversold stocks on monthly charts.

Q: How should traders prepare for a market pullback?

A: Building up cash reserves and monitoring oversold stocks can allow for capital deployment at discounted prices.

Q: Why is it important to avoid panicking during a market pullback?

A: Panicking can lead to selling off quality stocks at lower prices, and missing out on potential buying opportunities.

Q: How do experts’ predictions compare to market performance?

A: Experts’ predictions often fall short, while astute investors should assess market conditions independently.

Q: What should astute investors do during a market pullback with blood in the streets?

A: They should take advantage of the opportunity to purchase quality stocks at lower prices.

Enrich Your Knowledge: Articles Worth Checking Out

Investor Sentiment and the Cross Section of Stock Returns: Exploring the Hot Connections

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

Embracing Facial Recognition Technologies: The Future of Payments!