Nasdaq Crash Warnings: Experts Love To Spin Lovely Yarns

Updated Dec 2022

Most experts have chosen the wrong field; writing fables would have probably been better.

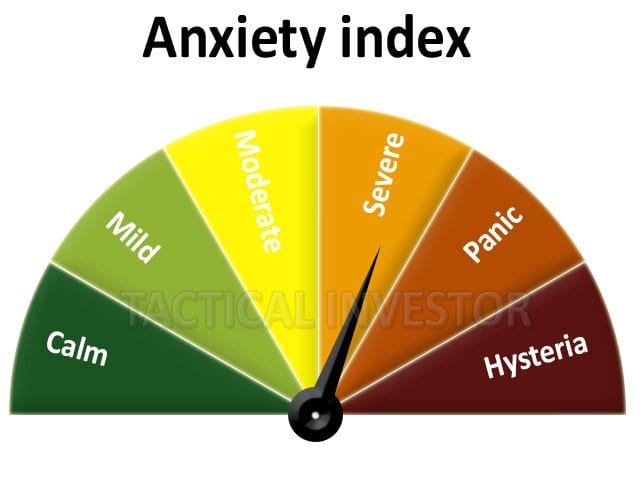

The actual phase of a bull market starts after it has taken out its old highs. Until this moment occurs, it’s not a real bull market. The Nasdaq recently achieved this milestone; this was not an easy feat, as it took the Nasdaq 15 years to break through the vital zone of resistance illustrated In the chart below. A market typically doubles after breaking out to new highs, especially if it has struggled to achieve this for 15 years. The Nasdaq should trade to the 9800-10,500 range before putting in a long-term Top.

Therefore until this occurs, the most likely outcome is that it will experience corrections ranging from Mild to vigorous along the way up. Focus on the opportunity factor and not the Nasdaq Crash yarn factor.

An expert who has stated the same thing over and over again, hoping for a new outcome

Experts: always on the wrong side of the market

Experts felt the same way when we stated in Aug of 2016 that the Dow was gearing up for a move to 21K. However, these targets were hit at the beginning of this year. Since then, we have issued higher targets, the second of which was 22k, also recently breached.

The main reason for this stance boils down to market sentiment, the masses have not embraced this bull market, and therefore it is destined to trend higher. We dedicate excessive time to mass sentiment analysis and studying the masses’ mindset. Mass Psychology is very clear on this subject; the groups need to embrace this market with gusto; until they do, the market will trend higher.

Experts would have felt the same if someone had told them the Dow would be trading past 21K after dropping below 7,000 in 2009.

Conclusion

We don’t expect the upward journey to be smooth; along the way up, we expect the market to experience corrections ranging from mild to wild. As long as the primary trend is up, all corrections have to be viewed through a bullish lens. Hence a Nasdaq Crash-type event should be viewed through the same lens as when reading a book based on fiction.

The NASDAQ has just validated the statement that we first put out in 2014:

This Bull Market will trend to levels that will shock the most ardent of bulls.

This has proved to be true every year since, and this stance will remain valid until the trend changes. Buy when the masses panic and flee when they are joyous.

Research on Crowd Antics

- “Why the Average Investor’s Investment Return Is So Low” (Forbes): https://www.forbes.com/sites/advisor/2014/04/24/why-the-average-investors-investment-return-is-so-low/?sh=31ad35bb111a

- “Why the Average Investor Underperforms the Market” (The Balance): https://www.thebalancemoney.com/why-average-investors-earn-below-average-market-returns-2388519

- “Why the Average Investor Loses Money in the Stock Market” (Investopedia): https://www.investopedia.com/ask/answers/lose-money-stock-market-crashes/

Other Stories of interest

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie, The Masses, Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Stock Market Crash 2018; Another Buying Opportunity (Oct 5)

Masses Trained to fear Market Crashes; why not embrace them? (Sept 27)

Buy When the Blood in the Streets is flowing Freely (Sept 13)

Dow 21K Predicted In August 2016 (Sept 9)

Minimum wage hike ignores the impact of AI; companies will opt for Robots (Sept 8)

Should You Be Worried About Inflation Rate In 2017? (Sept 6)

Wage Deflation here to stay: Robots Replacing Workers (Sept 5)

Price of Copper Signalling Inflation or higher Stock Market Prices (Sept 4)

Rate of Inflation not an issue according to Bond Market (Sept 2)

Worst Stock Market Crash of our lifetime; is this a possibility? (Aug 23)