TSM Stock Price: A Testament to Consistent Growth and Innovation

Updated Jan 13, 2024

Taiwan Semiconductor ManufacturingLimited (TSM), the world’s leading dedicated independent (pure-play) semiconductor foundry, continues to dominate the global technology sector. Based in Hsinchu, Taiwan, TSM is acclaimed for its trailblazing role in manufacturing integrated circuits and semiconductors, the heart of countless electronic devices.

TSM’s unrivalled business model differentiates it from integrated device manufacturers who design, manufacture, and sell their devices. Instead, TSM concentrates solely on manufacturing, translating into lucrative partnerships with multiple tech giants, enabling them to produce designs without investing in their expensive manufacturing facilities. This strategy has proven extraordinarily successful, reflected in TSM’s client roster, which boasts many of the tech industry’s biggest names.

In terms of financial performance, TSM’s record is remarkable. The company generated a whopping $54.11 billion in revenue in 2023, reinforcing its supremacy in the semiconductor industry. The gross income for the year stood at $26.2 billion, while the net income was approximately $17.6 billion. These figures are a testament to TSM’s vital financial health and efficient operations, and they have directly influenced the upward trajectory of the TSM stock price.

As for production, TSM continues its relentless pursuit of innovation. The company is now moving towards advanced 2nm technology, set to revolutionize the efficiency and power of semiconductors. This development is anticipated to strengthen TSM’s market position further and potentially boost the TSM stock price.

In terms of demand, the ongoing global chip shortage has further amplified the demand for TSM’s products. With new developments in technology fields such as AI, IoT, and electric vehicles, the demand for semiconductors is expected to continue its upward trend.

Taiwan Semiconductor’s unique business model, robust financial performance, and commitment to innovation firmly establish it as a central figure in the global tech industry. The TSM stock price is a reflection of the company’s success and its promising future.

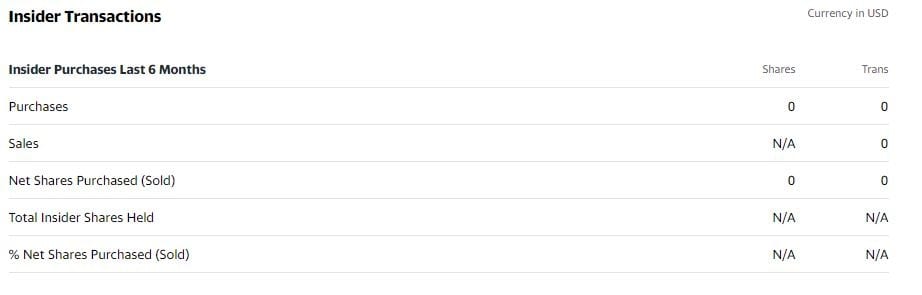

TSM Insider transactions

There is no activity regarding insider transactions, so we will not obtain any helpful information from this metric. Let’s move to the EPS trend projections for the next few years.

TSM Stock EPS Projections

As they say, the trend is your friend, and TSM’s EPS is in a nice healthy uptrend. Hence, traders should view strong pullbacks as opportunities. We would use pullbacks in the 30% plus ranges to open new longs, and risk-takers could consider getting into long-term options.

TSM Stock Price Forecast

From a technical perspective, the stock is currently in a consolidation phase, gathering momentum for an upward trend. This adjustment period is natural, especially following the AI hype mini bubble that inflated valuations across the sector. Should the stock dip into the 81-84 range, it could present an excellent opportunity for a long-term investment. Even within the 89 to 90 range, it remains a viable entry point for a sound long-term investment.

If the stock can achieve a monthly close at or above 109, it may set the stage for testing the 141 to 148 range. The potential exists for it to ascend further, reaching as high as 190 to 210 before reaching its peak. This stock is worth considering for strategic portfolio growth, using substantial pullbacks to enhance one’s position.

TSM Latest News

Taiwan Semiconductor Manufacturing Company (TSMC) continues to spearhead the semiconductor technology industry, persistently expanding the realm of attainable advancements through its sophisticated manufacturing processes. Their recent 3nm and 2nm chips affirm their unwavering dedication to innovation and technological progression.

The 3nm process, which went into volume production in 2023, has signalled an impressive stride forward regarding power efficiency and performance. Utilized in a range of high-performance applications, including the latest Apple A15 Bionic and M2 chips powering the newest iPhones and Macs, the 3nm process provides a 10-15% speed improvement and a 25-30% power reduction compared to the preceding 5nm process.

Currently stealing the limelight is TSMC’s 2nm process. TSMC has announced that they have successfully developed a functional chip using this process, a pivotal landmark in semiconductor technology. The 2nm process is anticipated to enhance performance and power efficiency substantially. Although specific details about the 2nm process are still confidential, it is expected to revolutionize various applications, from high-performance computing to AI and machine learning.

Looking ahead, TSMC has already laid the groundwork for the next epoch of semiconductor technology. The company has disclosed plans for a 1nm process in the research and development phase. This process will provide even more significant performance and power efficiency improvements.

In addition to reducing nm size, TSMC is investing in advanced packaging technologies, such as the 3DFabric technology. This innovative technology allows for the stacking of chips, leading to higher performance and lower power consumption. 3DFabric technology is expected to find broad application in various domains, from high-performance computing to AI and machine learning.

In conclusion, TSMC’s latest offerings, particularly the 3nm and 2nm chips, represent monumental advancements in semiconductor technology. Given their relentless commitment to innovation and technological advancement, we can anticipate witnessing even more groundbreaking developments from TSMC in the future.

Captivating Article Worthy of Exploration

Uncovering the Influence of Drug Company Payments on Healthcare

Central Banks Prime Directive-Rob the Poor to Pay the Rich

Paris erotic museum cleans up at closing-down sale

Brexit on Steroids-Trump Win Triggers Massive Stock Market Rally

Trump-eting the Trump Stock Market

Millennials Dominate Peak Shopping Days

Trump Trade War Stock Market & Dominant Trends

On The Road To Silver & Gold Mining In Mexico

Unaffordable Obamacare-50 percent cannot afford over 100 per month

Bears State Crude Oil Destined to Crash-Utter Rubbish

Pension Crisis Intensifies-35K New York Teamsters Face pension cuts

China factory activity at 22-month high & High Tensions in Libya

Sofia robot: The Sex Bot That Looks &Talks Like a Human

Trump Salary: Sleeping on the Job or a Sacrifice for America?

CNN’s 2018 Ratings Drop as Viewers Tune Out

Selling Puts vs Buying Calls: Unleashing Advantages Safely