The Power of Mass Psychology in Financial Success

Updated Feb 10, 2023

Introduction:

Venture into the fascinating realm of mass psychology, which sheds light on the emotional and attitudinal influences that shape collective behaviour. This discipline is crucial for comprehending decision-making in domains such as marketing, politics, and finance, as it decodes societal currents.

By delving into the intricacies of mass psychology, you can understand the mechanisms driving trends and leverage this knowledge to unlock financial success. Essentially, mass psychology reveals the foundations of group decisions, trends, and events across various fields, offering a key to comprehending collective behaviour and improving decision-making in all aspects of life.

Discover the potent synergy of individual minds merging into a formidable force. Understanding mass psychology can become a beacon of success in generating wealth and mastering decision-making.

Decoding Mass Psychology: A Contrarian’s Insight

Defying the Crowd: Exploring the Underbelly of Mass Psychology! This thought-provoking study goes against conventional wisdom, delving into the darker side of group behaviour and decision-making. From exploring why people follow the masses blindly to the dangers of conformist thinking, it uncovers the driving forces behind herd mentality, revealing how to use this knowledge to your advantage and make bold, contrarian moves in the face of popular opinion—a must-read for anyone seeking a contrarian edge in life and business.

To be wise is to be open; to be open is to be knowledgeable; to be knowledgeable is to understand that you really know nothing. Sol Palha

Mass psychology, the emotional and behavioural influence of a group of individuals on one another, is a timeless phenomenon that has only recently come to light. From flocks of birds to shoals of fish, it’s evident in nature that creatures tend to follow a leader. Yet, contrary to popular belief, evidence suggests that humans are not always rational in their decision-making, as emotions, biases, and cultural influences often override rational thought.

This leads to the formation of herding behaviour, which has far-reaching implications in fields such as investing. For the contrarian investor, understanding the principles of mass psychology and how to think independently from the crowd is essential in making well-informed decisions. For a more comprehensive look at the subject, consider reading the entire article titled How to Use Mob Psychology to Invest in the Markets.

Navigating Markets: The Essence of Mass Psychology

Mass psychology may have its roots in the emotional and behavioural influence of the herd, but the savvy contrarian investor knows better. The masses may follow the crowd like a flock of sheep, but success in investing lies in marching to the beat of your drum. So, when the Market is awash with pessimism, and the streets resemble a scene from a horror movie, it’s time to buy low with a smile and a twinkle in your eye.

Mass psychology may have its roots in the emotional and behavioural influence of the herd, but the savvy contrarian investor knows better. The masses may follow the crowd like a flock of sheep, but success in investing lies in marching to the beat of your drum. So, when the Market is awash with pessimism, and the streets resemble a scene from a horror movie, it’s time to buy low with a smile and a twinkle in your eye.

And when the masses are so excited that they’re doing the investing equivalent of a conga line, it’s time to sell high, tip your hat, and bid them farewell. Remember, the only thing more beautiful than making a profit is making it while thumbing your nose at conventional wisdom. The astute investor purchases when the crowd panics and sells when the mob jumps up joyfully.

The Collective Mind: Fundamental Ideas and Applications in Group Psychology

Going against the grain has never been more crucial in investing. Research and data-driven analysis reveal the significance of mass psychology in the realm of investing. The masses may follow each other like lemmings, but astute contrarian investors know that true financial success lies in taking a different approach. By studying and understanding the masses’ behavioural patterns and emotional drivers, they can identify when to make a bold, counterintuitive move informed by research and data.

The dot.com boom in the late ’90s serves as a cautionary tale about blindly following the crowd. True market leaders forge their own path, swim against the tide, and make decisions based on thorough analysis. Be a savvy investor, embrace your contrarian instincts, and guide yourself to financial success through research and data-driven analysis. Be the contrarian, carve your own way, and enjoy the rewards of thinking beyond conventional norms.

The Impact of Collective Psychology on Informed Investment Decisions

Contrarian investing is about swimming against the tide and bucking the trend of conventional wisdom. The astute and contrarian investor had the foresight to see the limitless potential of the Internet despite the scepticism and lack of interest from the masses. By recognizing the paradigm-shifting potential of this new technology and the dynamics of mass psychology, they were able to make bold and strategic investments. The result? They reaped the rewards of their informed and counterintuitive approach, swimming against the tide and beating the market.

The Internet revolution showed that the key to financial success in investing combines research, analysis, and a willingness to challenge conventional wisdom and take a contrarian stance. In adopting this stance, these investors beat the market, rewrote the rules of investing, and proved that being a contrarian can lead to immense financial success.

The Crowd’s Mindset: The Perils of Group Thinking

The masses’ negative perception of a particular sector provides a prime opportunity for the astute and contrarian investor to act. Such was the case with the Internet sector in the 1990s. The foresighted investor opened positions in this sector while the masses were still sceptical and took a wait-and-see approach. When the masses finally jumped on the bandwagon in mid to late 1998, the astute investor had already established a strong position. The subsequent market frenzy and eventual sector implosion serve as a reminder that following the crowd and herd mentality can lead to devastating losses. In contrast, a contrarian approach can lead to substantial rewards. The Internet sector provides a vivid example of the power of a contrarian and informed investment strategy.”

The Collective Mindset: Unveiling Investment Strategies

The leaders were alarmed at this behaviour, as they should have been, since this frenzy was unsustainable. History indicates that the masses have never been on the right side of the markets going back to the Tulip Mania. One can see how the big players employ mass Psychology to fleece the masses; the topic is succinctly in this article: Psychological & Economic Deception Wall Street’s Weapon of Choice.

Back to the dot.com bubble, knowing the end was near, they started to sell towards the end of 1999 and move their assets into cash and bonds while the feeding frenzy continued. In March 2000, the markets began to correct, and by the end of the year, the primary uptrend line was violated, and the market was ready to crash. By 2002, the market had lost more than 70% of its value, and many of the masses who had momentarily tasted wealth moved to a state of poverty that they could not have envisioned a few months back.

Revealing the Core Principles of Mass Formation Psychology

- The leaders represent less than 2% of the population yet take in more than 90% of the profits.

- When something is popular, the end is very near. One must do the opposite of what one’s emotions dictate regarding the markets.

- When an investment is viewed with disdain or frowned upon, the time to open a position is close.

- You must learn to fight the fear of selling out too fast after taking a position; remember, it won’t just go up. It could likely go down slightly or move sideways for months or even a year. The one area you can draw comfort from is this: the longer the sideways action, the stronger the upward move will be when it finally transpires.

Critical Aspects of Group Psychology: Expanding Perspectives

- Keep extra money on hand to open additional positions better if the opportunity arises.

- In all likelihood, you will have a 50-100% decrease in the first stage of the bull market, meaning that your shares could double and then shed a significant portion of the gains. This is known as the shakeout phase, whereby the weak hands are forced out of their positions and sell at or very close to the bottom. Holding on to the position usually leads to huge rewards.

- When the investment becomes popular with the masses, pay close attention to market sentiment. Perform simple trend line analysis on all your holdings. Once the primary uptrend shows signs of wear, start banking your profits and tighten your stops.

- Wait patiently for the next opportunity to show up; there is always another chance.

Maximizing Profits: Integrating Mass Psychology and Technical Analysis

Mass psychology, while seemingly straightforward, is a potent tool for understanding market trends and making investment decisions. It’s a study of the collective sentiment, emotions, and behaviors of market participants, often referred to as the crowd or herd. When combined with technical analysis, which involves studying price charts and market data to identify trends and patterns, it significantly improves the risk-to-reward ratio in trading and investing.

Despite its simplicity, the challenge lies in resisting the herd mentality. The crowd often reacts emotionally, chasing trends too late and making decisions based on biases rather than facts and data. This leads to common mistakes like buying at market peaks and selling at bottoms.

By integrating mass psychology with technical analysis, one can better time market entries and exits. For instance, when technical indicators signal an overbought or oversold condition, but crowd sentiment remains extremely greedy or fearful, it presents an opportunity for counter-trend trades with a favourable risk-reward outlook.

Understanding the emotional drivers of the crowd also helps traders avoid common pitfalls like greed, fear, impatience, and confirmation bias. By maintaining an independent perspective and disciplined approach, traders can execute high-probability trades while the crowd reacts impulsively. Thus, the blend of mass psychology and technical analysis becomes a key to consistent success in the market.

Mass Psychology: Key Insights for the Big Picture

Mass psychology, a straightforward yet powerful concept, is key to understanding the emotional undercurrents that drive financial markets. It involves identifying the dominant emotion—be it greed, fear, euphoria, or panic—that influences the majority of market participants at a given time. Recognizing these emotional states can help traders spot early signs of trend changes, a skill that is crucial for both short-term trading and long-term portfolio management.

Contrarian investing, a strategy that often piques the interest of those familiar with mass psychology, involves going against popular opinion and the herd mentality. Contrarians make independent trading decisions based on an objective assessment of fundamentals, data, and trends, rather than the noise and emotions of the crowd.

The combination of mass psychology and contrarian signals can be a powerful formula for success in trading and investing. This approach allows traders to capitalize on excessive bullish or bearish sentiment that has become disconnected from reality, enabling them to execute counter-trend trades backed by behavioral analysis.

However, it’s important to remember that successful contrarian investing requires more than just going against the crowd—it requires careful consideration of market dynamics and a disciplined approach to trading. By understanding how emotions and biases drive the behavior of the masses, traders can avoid common pitfalls and make more informed decisions.

Embrace the Trend: Your Faithful Companion

There is no tool more potent than Crowd Psychology. The crowd drives the market, and emotions are the driving force behind the masses. Therefore, you must understand what emotions are driving the groups at any given moment. Understand the sentiment, and you know the market. Only then should one look into trying to master technical analysis. Fundamental analysis is fundamentally flawed as the data is provided in a standard format.

This means anyone looking at the data will arrive at the same conclusion. In an extensive reading of recent books by psychologists, psychoanalysts, psychiatrists, and inspirational lists, I have discovered that they all suffer from one or more of these expression complexes: italicizing, capitalizing, exclamation-pointing, multiple-interrogating, and itemising.

These are all forms of what the psychos themselves would call if they faced their condition frankly, rhetorical over compensation. James Thurber 1894-1961

Understanding psychology is critical to becoming a better investor. If you understand the emotion driving the market, you will be light years ahead of the competition.

Navigating Market Psychology for Smarter Investing

Understanding the emotional extremes of greed and fear in the market can be instrumental in identifying potential trend reversals. This can be achieved by spotting divergences between market sentiment and quantitative indicators. Tools that track mass psychology, such as put/call ratios, trader positioning data, and survey responses measuring investors’ risk appetite, can reveal discrepancies between these measures of crowd emotion and what price action and momentum indicators suggest. Such discontinuities could foreshadow an impending trend change as mass psychology reverts to the mean.

Keeping a pulse on sources that track mass psychology, such as surveys, online discussions, and news coverage, can help identify instances where consensus views diverge significantly from underlying company-specific or macro data. This divergence can signal a potential sentiment overreaction, providing opportunities for well-researched investors to capitalize on by pursuing positions at odds with the prevailing group biases.

Acting contrarian—buying when others are panic selling or taking profits when euphoria sets in—can lead to better prices than the crowd. This approach is based on the understanding that the average investor often chases momentum, positioning pro-cyclically. Timely counter-trend trades informed by behavioural clues pointing to greed or fear extremes can allow investors to snatch up undervalued assets or take profits ahead of expected crowd behaviour.

Strategic trades can be formulated around events likely to evoke strong emotions, such as elections, crises, or monetary policy shifts. Anticipating how such triggers may influence mass psychology through different stages of the reaction process provides a framework for strategically entering or exiting positions attuned to expected behavioural flows.

Tools of the Trade: Deciphering Market Sentiment with Precision

Here are some examples of specific tools that can help track and measure mass psychology in the markets:

– Sentiment surveys (AAII Bull Bear Ratio, Investors Intelligence) – Weekly polls of individual investors that monitor bullish/bearish percentages.

– CBOE Put/Call Ratio – Measures the volume of put options against call options on the S&P 500 index to gauge risk appetite.

– Dark Pool Index – Provides a contrarian indicator by measuring large institutional traders’ hidden buy/sell order imbalances.

– Hulbert Financial Digest Sentiment Index – Rates the views of investment letter writers on a -100 to +100 scale based on their market recommendations.

– Options risk reversal – Shows relative demand for upside vs downside bets by tracking put/call pricing differentials of at-the-money options.

– CFTC Commitments of Traders – Reports by asset class on positions held by commercial traders vs speculators to identify speculative flows.

– StockTwits sentiment analysis – Language processing of tweets about stocks to quantify bullish vs bearish sentiment momentum.

– Volatility indexes (VIX, VXO, VStoxx) – Measures implied volatility in the options markets, which tends to rise as sentiment deteriorates.

– Market breadth indicators (NYSE Advance/Decline, uptick/downtick) – Tracks trading activity breadth to identify confirmation or divergence of sentiment trends.

Tracking these tools over time can provide invaluable behavioural market insights beyond price action alone.

How Can Diverse Sentiment Surveys Help You Unlock Market Psychology?

Here are some additional sentiment surveys that can provide insights into investor psychology and mass market sentiment:

– American Association of Individual Investors (AAII) Sentiment Survey – Weekly survey of AAII members measuring bullish, bearish and neutral outlooks.

– National Association of Active Investment Managers (NAAIM) Exposure Index – Weekly survey of NAIM members gauging average equity exposure levels.

– Bank of America Merrill Lynch Fund Manager Survey – Monthly survey polling institutional investors on their asset allocations and market views.

– Conference Board Consumer Confidence Index – Monthly measure of consumer confidence levels based on household surveys.

– UBS Investor Sentiment Index – Weekly survey gauging optimism/pessimism levels among high-net-worth individuals.

– SentimenTrader Smart/Dumb Money Index – Uses options trade sentiment data to measure positions of smart vs dumb money groups.

– State Street Investor Confidence Index – Monthly survey of buy/sell recommendations from investment advisors globally.

– Investors Intelligence Bullish Consensus – Weekly survey of advisory newsletters tracking bullish recommendations.

– National Australia Bank Business Survey – Monthly business sentiment survey measuring conditions in various sectors.

– Economic Policy Uncertainty Index – Economic uncertainty index constructed using newspaper coverage frequency of policy-related economic uncertainty.

Tracking multiple sentiment polls provides a more robust viewpoint of prevailing crowd psychology versus relying on just one or two indicators.

Exploring the Dynamics of the Crowd Mind

The masses are unaware that everything is manipulated, from the food you eat to the information you are provided. Hence, they cannot come up with a plan. 80% of the work involved in finding a workable solution is correctly identifying the problem. The mass media and the top players understand that if they alter your perception, they can control your actions.

In other words, if the angle of observance is altered, so is your perception. If you understand this simple principle, then you will be in control of your perceptions. Most experts focus on the tree or the forest; in both instances, they fail to see the big picture. This is why most experts are on par with rubbish- a smelly substance that has a strong effect but produces nothing of value. We firmly suggest that you read or view Plato’s allegory of the cave. It will open your eyes to the basic concepts of Mass Psychology and why so-called experts are almost always wrong.

Experts on the Dynamics of the Hive Mind

“It is crowds rather than isolated individuals that may be induced to run the risk of death to secure the triumph of a creed or an idea, that may be fired with enthusiasm for glory and honour… Such heroism is without doubt somewhat unconscious, but it is of such heroism that history is made.” “He is no longer himself but has become an automaton who has ceased to be guided by his will.”

“It is crowds rather than isolated individuals that may be induced to run the risk of death to secure the triumph of a creed or an idea, that may be fired with enthusiasm for glory and honour… Such heroism is without doubt somewhat unconscious, but it is of such heroism that history is made.” “He is no longer himself but has become an automaton who has ceased to be guided by his will.”

“In a crowd, every sentiment and act is contagious and contagious to such a degree that an individual readily sacrifices his personal interest to the collective interest.”

“Ideas being only accessible to crowds after assuming an effortless shape must often undergo the most thoroughgoing transformations to become popular. It is especially when we are dealing with somewhat lofty philosophical or scientific ideas that we see how far-reaching the modifications they require to lower them to the level of the intelligence of crowds…. However great or true an idea may have been, it is deprived of almost all that constituted its elevation and greatness by the mere fact that it has come within the intellectual range of crowds and exerted an influence upon them.” “Most men, especially among the masses, do not possess clear and reasoned ideas on any subject outside their speciality. The leader serves them as a guide.”

“How numerous are the crowds that have heroically faced death for beliefs, ideas, and phrases that they scarcely understood!”

“Were it possible to induce the masses to adopt atheism, disbelief would exhibit all the intolerant ardour of religious sentiment and, in its exterior forms, would soon become a cult. “In crowds, the foolish, ignorant, and envious persons are freed from the sense of their insignificance and powerlessness, and are possessed instead by the notion of brutal and temporary but immense strength. ”consciously on men’s minds is the only real tyranny because it cannot be fought against.”(The Crowd: A Study of the Popular Mind – Gustave Le Bon)

Michael Montaigne’s Profound Wisdom: Unforgettable Quotes

Mr Montaigne was a sagacious man, and the quotes listed below provide a window into the inner workings of the mass mindset and can be used to improve one’s understanding of Mass Psychology. Ignorance is the softest pillow on which a man can rest his head. Rejoice in the things that are present; all else is beyond thee. Michel de Montaigne

A wise man never loses anything if he has himself.

In true education, every encounter shapes knowledge: a playful jest from a young attendant, an unintended mishap by a servant, even casual conversation—each contributes to the curriculum.

Time etches more creases in the mind than on the countenance, reminding us of the profound wisdom borne within.

Insights from Carl Jung: Unveiling the Psychology of Crowds

“…if people crowd together and form a mob, then the dynamism of the collective man are let loose – beasts or demons that lie dormant in every person until he is part of a mob. Man in the mass sinks unconsciously to an inferior moral and intellectual level, to that level which is always there, below the threshold of consciousness, ready to break forth as soon as the formation of a mass activates it.”

“The bigger the crowd, the more negligible the individual.”

“A group experience occurs on a lower level of consciousness than an individual’s experience. This is because when many people gather together to share one common emotion, the total psyche emerging from the group is below the level of the individual psyche. If it is a huge group, the collective psyche will be more like an animal’s psyche, which is why the ethical attitude of large organizations is always doubtful. The psychology of a large crowd inevitably sinks to the level of mob psychology. If I have a so-called collective experience as a group member, it takes place on a lower level of consciousness than if I had the experience alone.”

Summing It Up: A Final Reflection

Weird crowd behaviour, which can be deciphered using mass psychology, sheds light on intriguing aspects of human nature. In conclusion, mass psychology, a peculiar yet fascinating branch of social psychology, delves into studying the behaviour of large groups of individuals. It aims to comprehend why people act the way they do in a group setting and how the thoughts, convictions, and emotions of others peculiarly influence this behaviour.

It serves as a vital tool for anyone seeking to comprehend the conduct of large groups and make well-informed decisions, be it in business, investing, or everyday life. The contrarian approach to mass psychology embraces challenging conventional wisdom and daringly venturing amidst the currents of popular opinion.

By understanding the principles of mass psychology, investors can identify when to make counterintuitive moves informed by research and data. The Internet revolution of the late 1990s exemplifies how the astute and contrarian investor can achieve financial success by challenging conventional wisdom and swimming against the tide. In the realm of investing, understanding the principles of mass psychology is essential to make well-informed decisions.

Initially published on June 15, 2015, it has been continuously enhanced throughout the years—latest Revision Completed in Feb 2024

References

Sir John Templeton’s Template for success: Templeton.org

Five pieces of advice from John Bogle: NY Times

The armchair millionaire: Lewis Schiff

Extraordinary Popular Delusions and the Madness of Crowds: Charley Mackay

Study Shows The Power Of Social Influence – 5 Ways To Avoid The Herd Mentality: Forbes

Herd mentality: Are we programmed to make bad decisions?: Science Daily

Mob Mentality: The Madness of the Crowd: Brain World

Propaganda and Indoctrination: Noam Chomsky

The Crowd, A Study of the Popular Mind: Gustave Le Bon: Gutenberg

Five warning signs of market euphoria: Investopedia

Impact of Mass Media Use on Youth. NCBI Resources: NCBI Resources

Homerun definition: The free dictionary

The pros and cons of mass media: Waldern University

Why people lose money in the markets: The Balance

Prepare for massive stock market opportunities: Market Watch

What is mass hysteria: Medical News Today

Any Monkey can beat the Market: Forbes

How a Cat & Some Monkeys Outperformed Experts: The Fool

Russian Chimpanzee Outperforms 94% of Bankers: Dailymail.co.uk

From Our Archive: A Diverse Range of Articles to Explore

The Gamblers Mindset: The Enigmatic Urge to Embrace Loss

Mass Psychology Mastery: Unleashing Financial Success Secrets

Brain Control: Domination via Pleasure

Yipee Yeah Yipey Yoh: Is Now a Good Time To Buy Bonds

The Perils of Following the Flock: Understanding Sheep Mentality

Psychology of Investing: Escape the Herd, Avoid Financial Destruction

Palladium Metal Price Unveiled: Impact on the Hydrogen Economy

Simplifying the Complex: Understanding Psychology for Dummies

What is Hot Money: Unraveling the Significance and Endurance

Zero to Hero: How to Build Wealth from Nothing

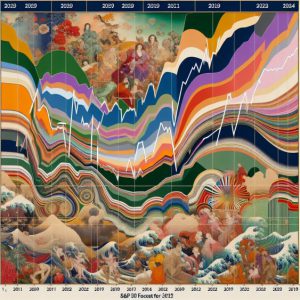

S&P 500 Forecast 2024: Charting Projected Targets

Unraveling Crowd Behavior: Deciphering Mass Psychology

Stock Market Predictions for 2018: Reflecting on Past Insights

Investing for Dummies: Navigating Disasters with Confidence

Thanks for the great blog post!

I’ve actually created a similar article about ‘7 Trading Psychology Ideas from Dr. Brett Steenbarger.

I think you’ll love it and it’d be beneficial to your followers, as well.

Here’s the link if you’d like to take a look:

http://www.intelligenttrendfollower.com/trading-psychology-brett-steenbarger/

Jay