Navigating the Market: A Closer Look at S&P 500 Forecast

Jan 29, 2024

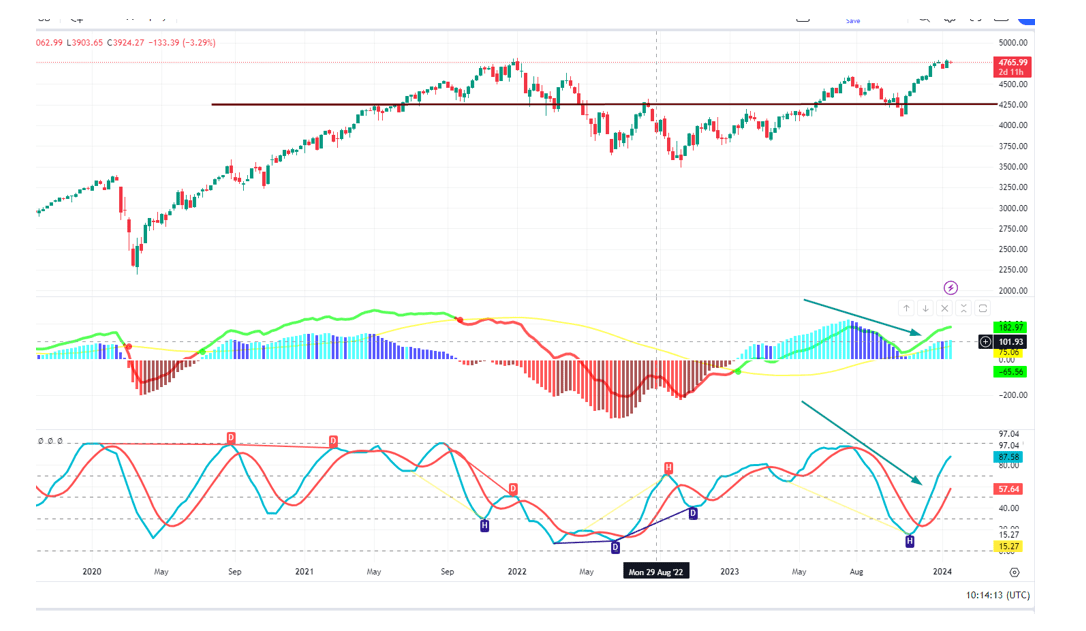

The S&P 500, often referred to as SPX, recently reached and slightly surpassed the 4800 mark. Now, let’s delve into the critical factors that could impact the market, with a keen eye on a potential correction.

The key to predicting market movements lies in understanding sentiment. Several weeks ago, bullish sentiment soared to 56 but took a step back, forming a base instead of maintaining its upward trajectory. To avoid a situation reminiscent of 2022-2023, where bullish sentiment lingered unusually low, we must see it surge to 60 multiple times. Failure to do so might indicate a minor pullback to the 40-45 range, followed by a potential rally.

The Nuances of Mass Psychology

Beyond sentiment analysis, we must consider mass psychology. It involves delving into the details behind sentiment moves. For a sustained bullish market, the masses must not just be bullish but almost euphoric, with markets trading technically in the highly overbought zone. One event is insufficient; the bullish sentiment needs to balance after nearly 19 months below its historical average of 39 (now at 38.5).

In light of the balancing act required for a bullish market, caution is advised. Our approach involves three plans: Plan A, B, and Plan C (not discussed now).

Plan A: The Standard Approach

The standard plan is to wait for the markets to release a substantial amount of steam.

Plan B: Adapting to Market Sentiment

If the sentiment doesn’t follow the expected trajectory, markets may release less steam. For instance, the SPX might test the 4200 to 4300 range, possibly overshooting to 4020 to 4050. This move could push the markets into the oversold range, prompting a strategic re-entry based on the evolving sentiment scenario.

Understanding sentiment and mass psychology and having adaptable plans is crucial for navigating the dynamic landscape of financial markets, especially in the context of the S&P 500 forecast.

Right off the bat, we employ various technical indicators, cycling through them, including some undisclosed ones. This emphasizes our primary focus on market psychology; technical analysis, while applicable, takes a secondary role. From a purely technical standpoint, one could argue that the SPX might hold at 4250. While a 500-point pullback is substantial, it’s not a serious one in this context. A severe pullback for the SPX would involve shedding 840 to 1020 points, presenting a potential monumental buying opportunity if it occurs.

The equivalent of a 500-point pullback in the SPX for the Dow would roughly translate into a move to the 34,500 to 35,100 range, give or take 200 points in either direction. If bullish sentiment doesn’t soar as outlined, we’ll shift our focus to the technical picture. The overall breadth of the market has improved, providing broad support for the current rally—a positive development. However, we’ll closely monitor the situation during a pullback, especially in tech stocks, as they might experience more significant percentage losses.

Conclusion

We avoid fixation on a specific outcome, prioritizing the determination of the psychological state of the crowd. If there’s no extreme euphoria, a market crash, in our view, is nothing more than a sharp correction. We’ll focus on technicals if bullish sentiment doesn’t follow the projected trajectory, indicating that the subsequent correction won’t be significant until the masses are highly optimistic. In short, we’re adaptable, and the moment the SPX pulls back by 200-250 points, we’ll fine-tune our buying list.

While it’s early now, we issue an advanced warning that when we make a move, expect a flurry of up to 18 new buys. This includes buys for all portfolios, not just the Main AI portfolio. In the interim, patience and discipline are essential. We might issue an unofficial short on NVDA or a similar stock via puts for more aggressive players. Note that while we’ll monitor it, there’s a high probability it’ll be an unofficial play.

Articles That Offer In-Depth Analysis

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?