A champion is afraid of losing. Everyone else is afraid of winning. Billie Jean King

Stock Market Sentiment Index: Ignite Your Instincts, Conquer the Chaos, Triumph!

Updated April 30, 2024

Investing is all about not allowing one’s emotions to do the Talking; once your emotions start talking, your money starts walking away from you.

The financial crisis of 2008 scarred many individuals and scared them away even more; in addition to the Great Recession, one can see that the average Joe can come up with many reasons to avoid the stock market. However, simple market sentiment analysis could have saved many people from losing a significant portion of their wealth. To make matters worse, the unemployment rate remains stubbornly high, and wages, in most instances, are dropping instead of rising, which means that many Americans have little to no disposable income left after expenses. Don’t believe the twisted statistics issued by the BLS (Bureau of Labour Department) for one second; those statistics are on par with toilet paper.

Unveiling Truths: Transforming Misconceptions into Investor Power!

And false Perceptions lead to False Beliefs. Market Sentiment suggests that most individuals assume that they need a lot of money to invest in the markets. Individuals making $30,000 or less per year are more likely to avoid the stock market, citing insufficient funds as one of the main reasons. There appears to be a misconception that one needs much money to invest in the markets. Nothing could be further from the truth. One can start with small amounts and slowly add to this base over the years.; the power of compounding is incredible. If you start young enough, even putting away $50-$100 a month can add up to a sizable bundle by retirement.

Embrace the Unknown: Conquer Fear, Master Success!

According to market sentiment analysis, the average person thinks investing in the markets is risky. The solution is simple: understand what you are getting into and, in doing so, get rid of the fear.

This is just another misconception that has grown mainly after the devastating crisis 2008. If investing for the long haul and in quality stocks, then investing is one of the surest ways of making money and building a sustainable nest egg. However, as with most individuals, one must understand what one is getting into and not plunge into the markets blindly. If you know the sentiment driving the market, over 80% of your job is done. Hence, getting a better gauge of the subject market sentiment is imperative. Mass psychology is superb in this area, as it helps people identify what the masses are doing at any given point.

Shaky Investor Confidence: Many Americans View Investing as Tough

We are referring to financial education and not higher education from institutes such as colleges or universities. We would even go as far as to suggest what these institutes teach regarding the stock market is useless. As with everything in life, if one wants to master a new skill, one must set aside time for this endeavour. If you are going to talk the talk, then be ready to walk the walk. Don’t expect some expert to guide you to the promised land, for you will find that you are more likely to be welcomed into Hell instead of discovering paradise.

Regarding the stock markets, it would be wise to look at the history of the markets, study past stock market crashes, and examine the events that led to the collision and that set the foundation for the next bull run. Then, paper trade before deploying your hard-earned cash?

If you rely on a financial advisor, how will you know if he is not selling you a sack of sawdust if you know nothing? In most cases, people set themselves up to lose in the markets or to be taken advantage of; it takes two to tango. Surveys by bank rate show that Millennials were twice as likely as any other group to cite a lack of financial knowledge as their main reason for avoiding the markets. If this trend persists, they will be ten times more likely to ask the government for handouts when they retire.

Most Americans Distrust the Financial Markets

Yes, one could say there is a valid reason to fear the markets as many Millennials have grown up in an era of financial disasters; two of the most painful ones were the dot.com bubble and the Financial Crisis of 2008, later known as the Great Recession.

However, again, a lack of financial knowledge and the wrong perspective provide the foundation for this fear. Fear is a useless emotion in the stock markets; the best time to buy is when blood flows freely. The translation of so-called disasters always provides opportunities for astute investors. Additionally, one could have easily sidestepped both disasters by paying attention to market sentiment; in both instances, the masses were euphoric and thought the bull market could last forever.

Nothing lasts forever; when the masses are ecstatic, it is time to leave the party. Disaster can be viewed as an opportunity or a tragedy, depending on one’s perspective. Alter the angle of observance and the perspective changes. Thus, if you can gauge the market’s sentiment, you can avoid stock market crashes and get in on the early stage of the next bull run.

Market Sentiment: Americans’ Inadequate Retirement Planning

According to Bankrate, a mere 25% of Americans actively monitor their investments and retirement accounts more than once a month. Interestingly, these same individuals can spend countless hours engrossed in texting or scrolling through social media platforms like Facebook, often referred to as “Face Crack.”

While checking investments daily is unnecessary, being aware of current trends and market sentiment can make a significant difference. This knowledge can help individuals make informed decisions, secure profits, and avoid potential losses.

Ideally, individuals should clearly understand their desired retirement savings and develop a practical plan. Without a well-thought-out strategy, they may resort to impulsive and fear-driven actions when they realize that time has slipped away, leaving their accounts in a dismal state similar to their inception.

By dedicating some time to staying informed and actively managing their financial future, individuals can avoid neglecting their investments and retirement accounts, ensuring a more secure and prosperous future.

Riding the Wave: Unmasking Market Stampede Trends!

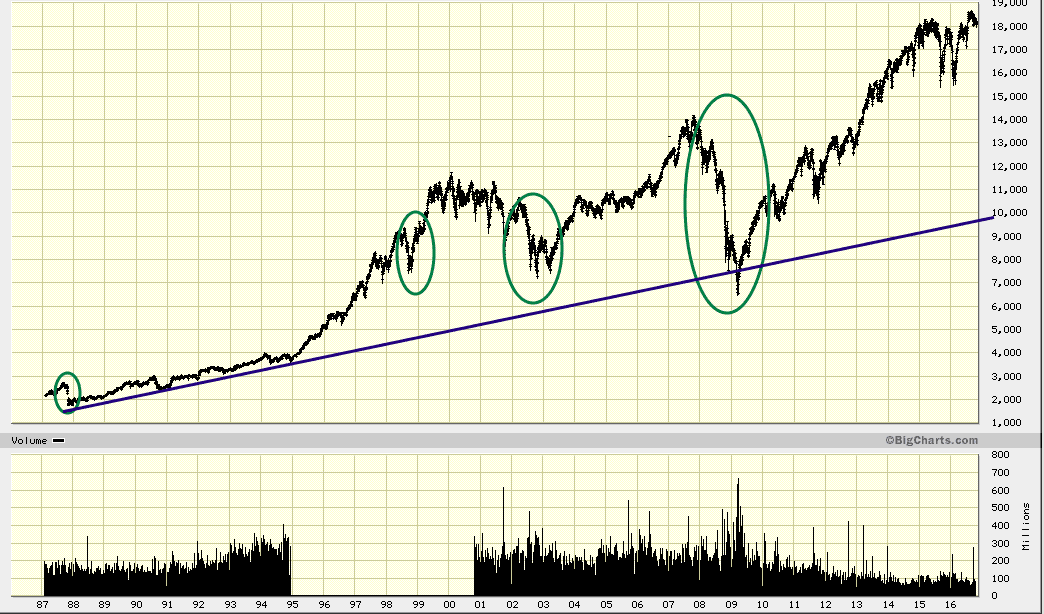

Disasters often present hidden opportunities disguised as challenges. Rather than fleeing from them, pausing and embracing them wholeheartedly is wise. The chart provided below serves as a compelling visual representation, illustrating that stock market crashes and other adverse financial events can be enticing opportunities for long-term investments.

When the financial world mentions Black Monday, referring to the crash of 1987, it is often to amplify fear. However, when viewed on a long-term chart, it becomes clear that it is merely a blip that presents an opportunity rather than a disaster. Historical analysis reveals that sentiment tends to be excessively bullish before significant market pullbacks, indicating a state of euphoria among the crowd. By following the prevailing emotion, one can potentially avoid most disasters, a pattern traced back to the tulip bubble. It is important to note that timing the exact market top is not the focus here; those who attempt to do so often endure prolonged periods of uncertainty and significant losses.

For most people, sharp pullbacks feel like crashes because they tend to buy at the wrong time, purchasing assets when prices are high and selling when they are low. In a future article, we will delve deeper into the concept of opportunities being disguised as disasters, exploring how these moments can be leveraged for potential gains.

Unlocking Success: The Power of Market Sentiment!

The word “disaster” represents an opportunity for astute investors. Only those who lack education in the markets view market pullbacks negatively, often due to a lack of understanding. Studying market history and the events leading to stock market crashes can be highly beneficial. In every instance, it becomes evident that the crowd was bullish, and numerous individuals freely dispensed financial advice. As the saying goes, it may be time to exit the party when the crowd is happy.

Investing some time in exploring market history and understanding market psychology can be invaluable. By doing so, one can better understand the markets than many self-proclaimed financial experts. The phrase “knowledge is power” holds, but it is essential to differentiate between genuine knowledge and worthless information. In stock markets, much of what is marketed as valuable is often garbage, while the aspects that experts may mock can hold significant importance.

Market sentiment is far from bullish despite the stock market trading near its highs. Therefore, any sharp pullbacks should be viewed as buying opportunities. When the crowd fully embraces this bull market, it may indicate it is time to exit the party.

A man’s doubts and fears are his worst enemies.

William Wrigley Jr.

From Novice to Knowledgeable: Crafting Your Personalized Path to Market Success

One of the most common errors made by novice investors, and even those with significant market experience, is failing to truly educate themselves. Merely consuming irrelevant news or blindly following others’ trading ideas does not foster growth. It is essential to recognize that what works for someone else may not work for you. Your unique risk profile, mindset, and discipline (or lack thereof) necessitate the development of a customized strategy.

While incorporating successful traders’ ideas into your trading style can be advantageous, blindly mimicking their every move will eventually lead to losses. Instead, simplicity and a focus on fundamentals are key. Novice traders should begin by identifying the prevailing trend. Investors gain a deeper understanding of market performance and direction by analysing long-term trends and patterns. This empowers them to make informed decisions based on solid analysis rather than guesswork or hearsay.

When examining trends, close attention should be paid to the V readings depicted in the accompanying image. These readings provide valuable insights into market volatility, assisting investors in anticipating potential shifts. Even in a market that appears to be reaching new highs, it remains crucial to monitor the trend and be vigilant for signs of stability or decline.

The wisdom of the ages echoes this sentiment:

Lao Tzu, the founder of Taoism, cautioned against the folly of blindly following intellectual advisors, likening it to the actions of “great thieves” who steal entire kingdoms.

Confucius emphasized the importance of self-cultivation and the pursuit of knowledge, stating that even the sage does not fully comprehend the way of the superior man, which “reaches wide and far, and yet is secret”.

The Vedic sages of ancient India recognized the power of introspection and meditation in gaining profound insights and wisdom, a practice that can be applied to the realm of investing by fostering a deep understanding of oneself and the market.

Remember, the path to success lies in developing your personalized strategy. Dedicate time to learning, adapting, and growing, and you will be well on your way to achieving your financial goals in the dynamic world of the markets. Embrace the wisdom of the ages, temper it with modern knowledge, and forge your path to prosperity.

Journey of the Mind: Unraveling Intriguing Thoughts

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

The Statin Scam: Deadly Profits from a Pharmaceutical Deception

Copper Stocks: Buy, Flee, or Wait?

Dow 30 Stocks: Spot the Trend and Win Big

Coffee Lowers Diabetes Risk: Sip the Sizzling Brew

3D Printing Ideas: Revolutionize Your Imagination

Beetroot Benefits for Male Health: Unlocking Nature’s Vitality

Norse Pagan Religion, from Prayers to Viking-Style Warriors

Example of Out of the Box Thinking: How to Beat the Crowd

6 brilliant ways to build wealth after 40: Start Now

Describe Some of the Arguments That Supporters and Opponents of Wealth Tax Make

What is a Limit Order in Stocks: An In-Depth Exploration

Lone Wolf Mentality: The Ultimate Investor’s Edge

Wolf vs Sheep Mentality: Embrace the Hunt or Be the Prey