Inflation and deflation

Updated Dec 2022

“The four most dangerous words in investing: ‘this time it’s different.’” — Sir John Templeton

Over the short timeline, inflation could be an issue. Still, the long-term outlook does not favour a sustained period of higher prices. This update will provide evidence to illustrate how experts have used the same rhetoric to stoke fear over the years. On each occasion, their predictions never came to pass. One would have been better off listening to a jackass. So, has anything changed in the future? Experts love to argue, “It’s different this time.”

Well, let’s examine the data and determine if it is different this time.

Let’s start with some headlines that have been posted over the years before we answer this question. These headlines will illustrate how many times experts have cried wolf.

2009: “Inflation Scare: Crazy but Real” – American Enterprise Institute

2010: “My Inflation Nightmare: Am I crazy, or is the commentariat ignoring our biggest economic threat?” – Michael Kinsley, The Atlantic Monthly

2011: “Inflation: A high price to pay: Surge in cost of food and other products fuels fears of a re-run of 2008” – The Financial Times

2016: “Inflation will be the biggest economic story in 2016… Inflation is coming down the pike whether the markets believe it or not.” – Business Insider

2017: “Gold Won’t Protect You From Hyperinflation” – Barron’s

2018: “Investors are bracing for a period of consistently higher inflation” – The Wall Street Journal

2020: “The Coronavirus Economy Will Bring Inflation” – National Review

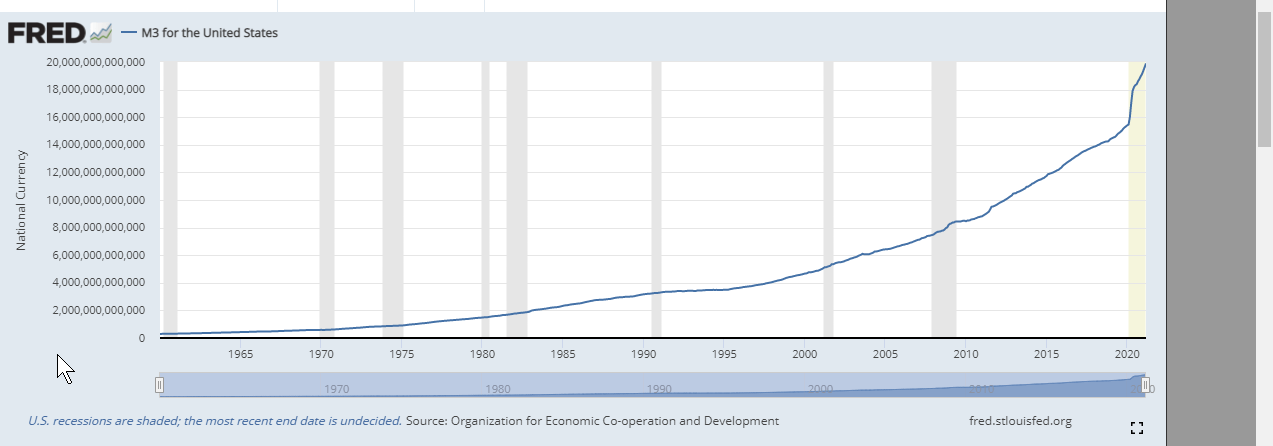

Now, look at the M3 Money supply chart

The actual definition of inflation is an increase in the money supply. Still, today the term has been bastardised, so everyone associates it with increased prices. An increase in the price of goods is a symptom of the disease and does not cover the illness itself. So, we will focus on the bastardised term for the masses who have embraced that definition. The real meaning is almost worthless for all intents and purposes. Inflation and deflation; at this point, the only development that makes sense is that we will see small bouts of inflation, but the long-term trend is deflationary. Innovations in technology equate to deflationary forces gathering traction.

Let’s Nullify The Hyper-Inflation Argument

Hint; in part, the markets have been discounting the power of technology decades in advance. Now they are ignoring the gut-wrenching deflationary forces AI will unleash upon this world.

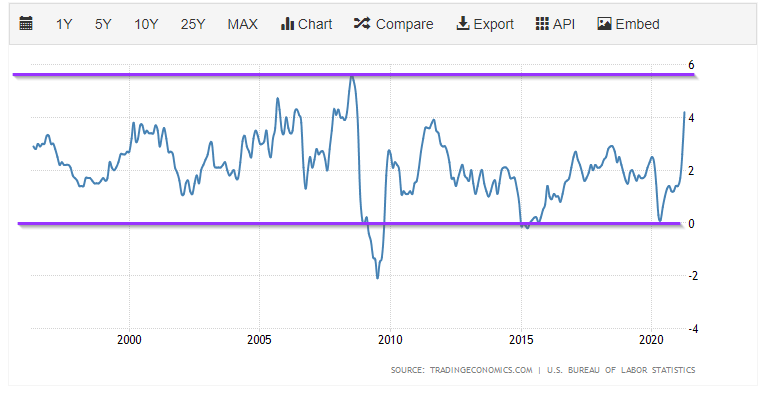

25-year chart of CPI

Looks like a non-event, right? For 25 years, the CPI has essentially done nothing after having peaked roughly in 2009.

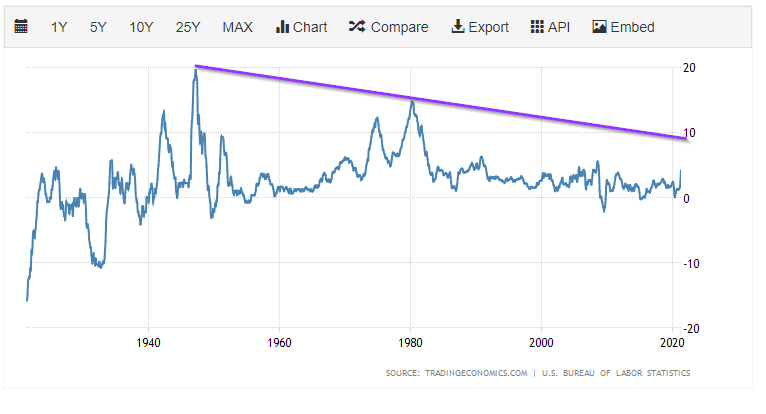

107-year chart of the CPI

This chart effectively puts an end to the Rubbish theory of inflation. The CPI index would have to hit ten before we would start to pay close attention to it. Today, we have a generation of spoilt brats, including the old and the young. Everyone has been brainwashed into believing that any crap published in a respectable journal qualifies as the “word of God”. Less than 10% of the populace attempts to seek the truth. Many of what qualifies as science today should be classified as Pseudoscience. Secondly, most of today’s experts would have been classified as mental retards a few decades ago.

What about inflation in Europe?

Our response is, yeah, what about it?

Europe’s average annual inflation rate over the last five years equates to 0.9%. In 2020, it was 0.69%. Germany, the most significant player in the EU, experienced negative inflation for the second half of 2020. Spain has been floating in and out of the negative territory for years. Almost 70% of European sovereign bonds had negative nominal yields up to roughly Nov 2020.

So, all this big noise in Europe is being made because inflation is now trending slightly upward after sinking to multi-year lows. For example, this so-called inflation wave in Germany started in the 1st quarter of 2021, after five back-to-back months of negative inflation. Energy prices dropped. The numbers on the vertical axis are negative. Remember when Oil futures briefly traded in negative territory? Now energy prices are rising because people are starting to move around again. As they move around, they will use more energy and consume more goods, so it’s natural to expect a rebound, especially when almost all these sectors are hammered.

There was a VAT holiday in Germany due to COVID, which has now been reversed. Hence one should expect a slight increase in prices.

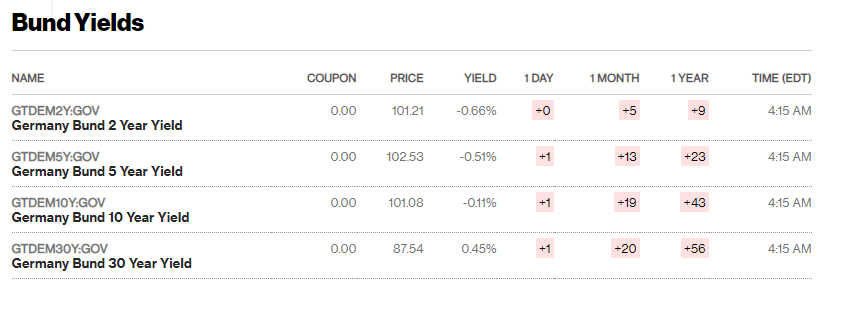

Current German Yields

Why are the 2, 5- and 10-year yields still negative if inflation were an issue? The 30-year bond yield is a whopping 0.45%. At that rate, it would take you almost forever to double your money.

You would think that the experts with access to all this data and more would at least attempt to take a cursory look at it. But then again, why would they, when they know that 90% or more of their audience are brain dead and believe whatever crap they publish. So, keeping up with the style of shoddy journalism, these reporters/experts (AKA digital wenches) do what they are best known for, serving crap under the guise of caviar. Here are some recent headlines that don’t fit the narrative when you look at the long-term charts we posted above.

Should a rising 10-year yield scare you out of stocks? Yahoo- March 4, 2021

Inflation Fear Lurks, Even as Officials Say Not to Worry. New York Times, March 10

ECB plans to ramp up bond buying to tackle surging yields CNBC – March 11

Eurozone inflation continued to surge in March. Reuters – March 31

Eurozone Inflation at Highest Rate Since Start of Pandemic. Financial Times Headline – March 31

Should You Be Worried About Inflation? Forbes- April 19

US: Inflation – to the moon! think.ing.com- May 12

Other random factors to consider

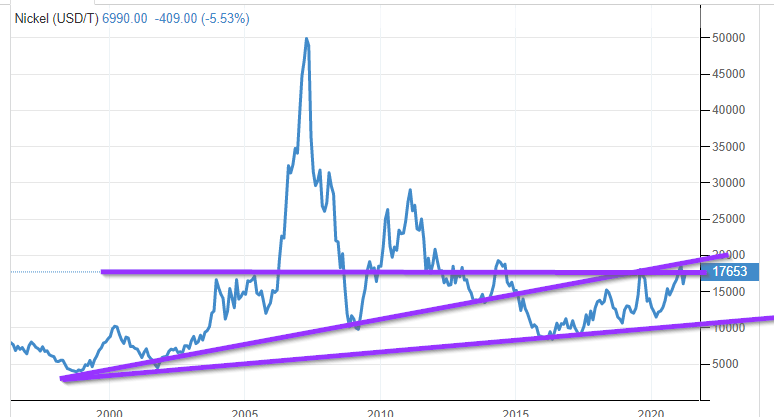

Let’s look at the 25-year chart of Nickel.

Looking at the 25-year chart of Nickel, if inflation were an issue, then prices should be trading above their highs of 50k set on April 5, 2007. The money supply was considerably smaller back then. The M3 money supply stood at 7.3 trillion; today, it’s almost 20 trillion. Using the bastardised definition of inflation, we can see that Nickel prices should be trading at least north of 100K to indicate that inflation is an issue today. Instead, they have been trending downward, illustrating that deflation is the issue. When the price of (almost) every commodity is adjusted for inflation (adjusted to reflect the increase in the money supply), inflation appears to be a non-event. Prices appear to be trending downwards instead of upwards. So, what is going on? It seems to be a simple matter of supply and demand.

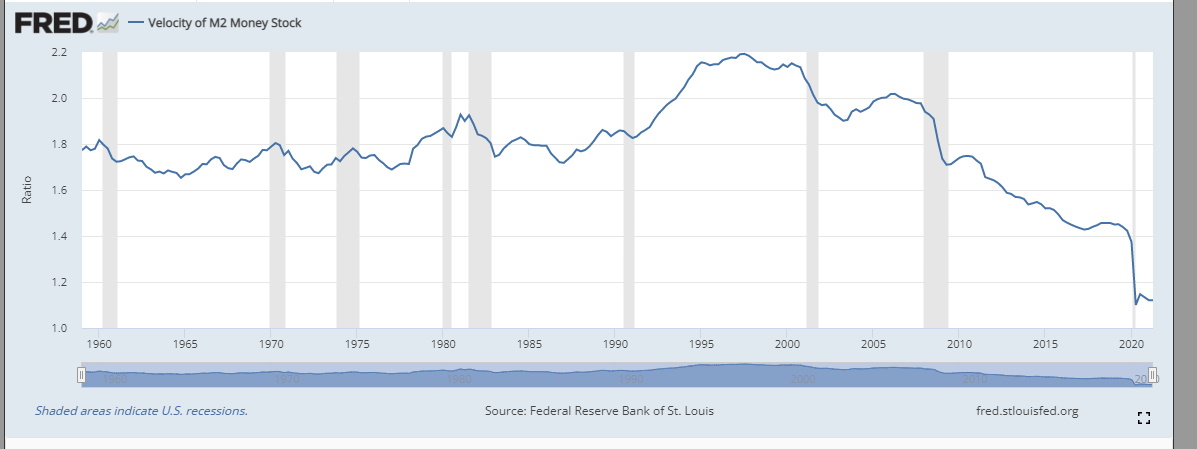

Finally, don’t forget the velocity of money is at a 60-year low. Until the Velocity of capital starts to trend upward, the primary force will be deflation. Also, let’s not forget, Inflation and deflation can coexist. While prices of tech-based products keep dropping, the cost of housing and medical insurance keeps rising. However, the Fed will never admit that Inflation and deflation can coexist, for they need to ramp up the money supply continuously. Hence, they will use whatever means necessary to paint a picture illustrating that inflation is a non-event. However, there is a vast difference between Inflation and hyperinflation. The hyperinflation argument is absolute rubbish.

Research

Here are six articles that discuss the benefits of inflation and deflation:

1. Inflation: advantages and Disadvantages – Economics Help

2. Pros and Cons of Inflation – Economics Help

3. What is inflation: The causes and impact | McKinsey

4. How Inflation and Deflation Impact Your Investments – U.S. News

5. Is Inflation Good Or Bad? – Forbes Advisor

6. The Pros and Cons of Inflation – Investopedia

Other Articles of Interest

Unlocking the Secrets: Mastering How to Read Stock Trends

Cracking the Code: Secrets of Stock Market Timing

BTC vs Gold: Decisive Victory Unveiled

Mind Control Techniques: Mastering Market Dynamics for Success

Bitcoin vs Cousin Ethereum: Unraveling the Cryptocurrency Conundrum

Federal Reserve Unmasked: The Silent Plunderer

When will the stock market bottom, igniting lucrative Rally?

Bitcoin Price Prediction Insights: A Precious Metal-Beating Trail

Bond Crash: To Invest or Not to Invest

Amidst Adversity, the Opportunity Beckons: Invest in A Shares Now

Unleashing Market Fear: The Price of Folly in Investing

Dow Jones Prediction: Roaring or Meowing in 2023

The Patient Investor: Unveiling the Realm of the Strategist

Mastering The Boom and Bust cycle: Buy High, Sell Smart