Bond Crash: Invest or Flee

Updated Nov 8, 2023

We will present a historical backdrop, followed by our up-to-date perspectives. The historical context not only highlights our real-time actions but, more significantly, underscores the importance of learning from history to avoid repeating past mistakes.

In the current landscape of negative interest rates, a bond market crash seems improbable; a correction, on the other hand, remains a possibility. While a market crash may eventually occur, it could be a distant event. Mass psychology instructs us to pay attention to the actions of the masses rather than speculating on uncertain outcomes.

We utilized crowd psychology to craft the following analysis, initially shared with our paid subscribers in February 2016. As a result, all significant corrections should be regarded as potential buying opportunities.

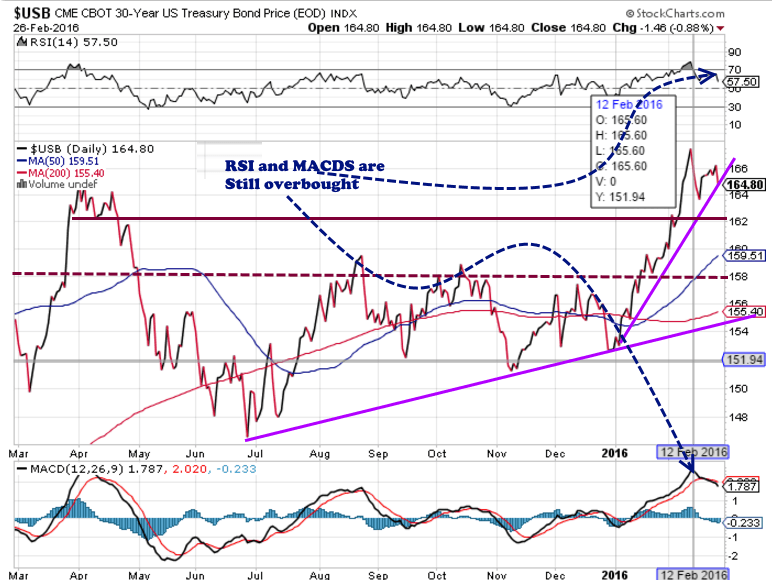

The trend is still up, but bonds are still trading in the overbought ranges; this can be seen by looking at the MACDs and RSI. There is a relatively decent layer of support at 162, but a weekly close below this level will most certainly lead to a test of the 158-159 ranges. At that point, individuals interested in going long bonds could deploy some funds into a bond-based ETF. Market Update Feb 29, 2016

Consider allocating half of your funds if the pullback exceeds your initial expectations. Given the mature nature of this bull market and the notable volatility, exercising caution is advisable.

The bond bull market, while mature, is still quite strong, and bonds could drop below 154 without affecting the bullish outlook. We are not stating that they will drop to 154, but just illustrating that even such a strong move down would not invalidate the bullish outlook. A move to or below 154 would make bonds an excellent buy, and at that point, traders could deploy the 2nd half of their funds into a Bond-related ETF. Market Update Feb 29, 2016

Specific individuals employ scare tactics to negotiate better prices but seldom follow through with the advice they dispense. In the case of the bond market, there was no crash, just a correction similar to what may occur. However, a crash is not on the horizon. It’s essential not to lend an ear to pessimists who seem preoccupied with spreading tales of despair and gloom.

Contrarian Investors Rejoice: TLT Beckons as an Opportunity

In November 2023, the investment landscape presents an intriguing prospect for contrarian investors. The prevailing atmosphere of fear, coupled with the remarkably oversold condition of TLT and the broader bond market, offers a compelling rationale for those who subscribe to the principles of mass psychology to explore opportunities in this sector cautiously. TLT emerges as a prime candidate for investment. Bonds appear poised for a potent rally, and while the longevity of this upswing remains uncertain, its strength is undeniable. TLT is likely to surge into the 120 to 126 range, potentially increasing to 132 before encountering resistance.

Expanding on this notion, the extreme overselling of TLT and the bond market suggests a scenario ripe for contrarian investors. Such investors operate against the prevailing sentiment, recognizing opportunities when conventional wisdom suggests otherwise. In this instance, the fear surrounding the bond market provides an ideal backdrop for contrarian moves. The historical record of market behaviour tells us that substantial recoveries often follow fear-driven selloffs.

Moreover, it’s essential to acknowledge that while the exact duration of this rally is uncertain, the potential for a robust resurgence in the bond market is significant. This is where TLT, the iShares 20+ Year Treasury Bond ETF, shines as a vehicle for investors. It encompasses a diversified portfolio of long-term U.S. Treasuries, making it a strategic choice for those looking to capitalize on the expected bond market upturn.

What’s A Bond Crash?

A bond crash, generally occurs when there is a significant increase in interest rates, resulting in a decline in bond prices. Bonds are fixed-income securities that pay a predetermined interest rate over a specified period. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive to investors. As a result, the market value of existing bonds decreases, leading to a bond crash.

Your example of the U.S. Treasury bond crash in 1981 is a notable case. During that period, the Federal Reserve implemented a series of interest rate hikes to combat high inflation. The rise in interest rates caused bond prices to plummet, generating substantial losses for bondholders.

Currently, bond yields in many countries are indeed at historical lows. Central banks worldwide have implemented accommodative monetary policies, including lowering interest rates, to stimulate economic growth and combat the effects of the COVID-19 pandemic. These low-interest-rate environments have driven investors toward fixed-income securities such as bonds in search of yield.

However, the potential for a future bond crash remains a possibility. Economic uncertainties, policy changes, and shifts in market conditions can affect interest rates and bond prices. If central banks or economic conditions change, leading to a significant increase in interest rates, bond prices may decline, potentially resulting in a bond crash.

It’s worth mentioning that while a bond crash may result in capital losses for bondholders, bonds can still provide income through regular interest payments. Furthermore, bonds with shorter maturities generally have less price sensitivity to interest rate changes than longer-term bonds.

The Risks and Rewards of Investing During a Bond Crash

Investing during a bond crash indeed carries both risks and potential rewards. Here are some considerations regarding the risks and rewards associated with investing during a bond crash:

1. Further Declines: One of the primary risks is the potential for further declines in bond prices. Bond crashes are often accompanied by rising interest rates, which can continue to impact bond prices negatively. If economic conditions deteriorate or interest rates rise significantly, bond prices may continue to fall, leading to capital losses for investors.

2. Credit Risk: During a bond crash, the creditworthiness of issuers may come into question. Economic downturns can increase the risk of default or downgrade by bond issuers, especially for lower-rated or riskier bonds. Investors need to carefully assess the credit quality of the bonds they consider investing in during a bond crash.

3. Liquidity Constraints: Market disruptions during a bond crash can lead to reduced liquidity in the bond market. This can make it challenging for investors to buy or sell bonds at desired prices, potentially resulting in higher transaction costs or difficulties in executing trades.

Rewards of Investing During a Bond Crash:

1. Buying at a Discount: One of the potential rewards of investing during a bond crash is the opportunity to buy bonds at discounted prices. When bond prices decline, yields rise, making bonds more attractive to investors seeking income. By purchasing bonds at a lower price, investors can benefit from capital appreciation if the bond prices recover when market conditions improve.

2. Higher Yields: Rising interest rates during a bond crash can lead to higher yields on newly issued bonds. Investors willing to take on the risk may find opportunities to invest in higher-yielding bonds, which can provide attractive income streams over the bond’s remaining term.

3. Potential for Market Recovery: A contrarian approach argues that market downturns, including bond crashes, can present unique investment opportunities. Investors may benefit from the eventual recovery of bond prices as market conditions stabilize by taking a long-term perspective and identifying undervalued assets.

It’s important to note that investing during a bond crash requires careful analysis, thorough research, and a solid understanding of individual risk tolerance. Timing the market and identifying the bottom of a downturn is challenging, and there is no guarantee of a swift or significant market recovery. Therefore, diversification, risk management, and a long-term investment horizon remain crucial considerations.

Strategies for Investing During a Bond Crash

Indeed, there are several strategies that investors can consider when investing during a bond crash. Here are a few strategies that can be useful:

1. Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the bond prices. This strategy can be particularly helpful during a bond crash because it reduces the impact of short-term market volatility. By consistently investing a fixed amount, investors can buy more bonds when prices are low and fewer when prices are high. Over time, this approach can lower the average cost per bond and potentially result in better long-term returns.

2. Focus on High-Quality Bonds: During a bond crash, credit risk becomes a more significant concern. Focusing on high-quality bonds, such as those issued by governments or financially stable corporations, can help mitigate this risk. High-quality bonds generally have a lower risk of default and may be more resilient during market downturns. By investing in high-quality bonds, investors aim to preserve capital and generate income even in a challenging market environment.

3. Consider Short-Term Bonds: Short-term bonds typically have lower interest rate risk compared to longer-term bonds. During a bond crash, interest rates may rise, which can have a more significant impact on the prices of longer-term bonds. Investing in short-term bonds can help reduce potential losses from rising interest rates. Additionally, short-term bonds tend to mature sooner, allowing investors to reinvest in higher-yielding bonds as interest rates rise.

4. Diversify Across Bond Types and Maturities: Diversification is a fundamental principle of investing and can help manage risk during a bond crash. By diversifying across different types of bonds (e.g., government, corporate, municipal) and maturities (short-term, intermediate-term, long-term), investors can spread their risk and potentially offset losses in one area with gains in another. Diversification can help protect against the idiosyncratic risks associated with specific bonds or sectors.

5. Active Management and Monitoring: During a bond crash, it’s essential to actively manage and monitor your bond portfolio. Stay informed about economic conditions, interest rate trends, and any changes in creditworthiness of bond issuers. Regularly review your portfolio and make adjustments as necessary to align with your investment objectives and risk tolerance.

It’s important to note that these strategies should be considered in the context of an individual’s financial goals, risk tolerance, and investment timeframe. Consulting with a financial advisor can provide personalized guidance and help tailor strategies to individual circumstances.

Investing during a bond crash requires careful consideration, as the market can be volatile and unpredictable. By implementing these strategies, investors aim to mitigate risk, capitalize on opportunities, and position themselves for potential gains as market conditions stabilize.

Conclusion

In conclusion, investing during a bond crash requires careful consideration, diligence, and a willingness to navigate the associated risks. While it can be stressful for investors, it’s essential to recognize that opportunities can arise amidst market turbulence. Investors can benefit from the market’s eventual recovery by carefully evaluating options, seeking professional advice, and making informed decisions.

It’s crucial to approach investing with a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Conducting thorough research, diversifying investments, and staying informed about market conditions are essential to a prudent investment strategy.

Investing inherently involves risk, and a bond crash is no exception. Understanding your financial goals, risk tolerance, and investment horizon is essential before making any investment decisions. Seeking the guidance of a financial advisor can provide valuable insights tailored to your specific circumstances and help you navigate the challenges and opportunities presented by a bond crash.

While investing can be demanding, it can also be a rewarding journey for well-prepared people willing to take calculated risks. By approaching investing with a thoughtful and disciplined mindset, investors can increase their chances of success and potentially achieve their financial goals over the long term.

Remember that investment decisions should be based on careful analysis and individual circumstances. By staying informed, seeking professional guidance, and making informed decisions, investors can navigate the challenges and opportunities of a bond crash and embark on a rewarding investment journey.

Intellectual Feast: Mind-Expanding Articles

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

The Statin Scam: Deadly Profits from a Pharmaceutical Deception

Copper Stocks: Buy, Flee, or Wait?

Dow 30 Stocks: Spot the Trend and Win Big

Coffee Lowers Diabetes Risk: Sip the Sizzling Brew

3D Printing Ideas: Revolutionize Your Imagination

Beetroot Benefits for Male Health: Unlocking Nature’s Vitality

Norse Pagan Religion, from Prayers to Viking-Style Warriors

Example of Out of the Box Thinking: How to Beat the Crowd

6 brilliant ways to build wealth after 40: Start Now

Describe Some of the Arguments That Supporters and Opponents of Wealth Tax Make

What is a Limit Order in Stocks: An In-Depth Exploration

Lone Wolf Mentality: The Ultimate Investor’s Edge

Wolf vs Sheep Mentality: Embrace the Hunt or Be the Prey

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague

Revamping the 60 40 Rule: Unleashing New Strategies for Success