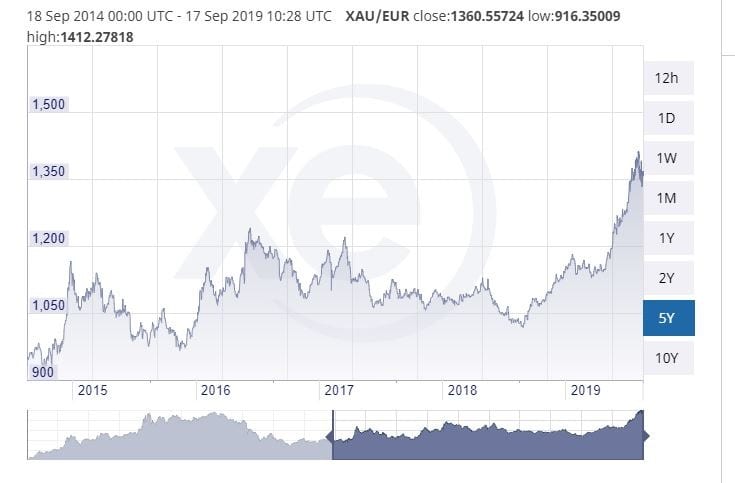

Gold Price Chart Euro

Updated March 2023

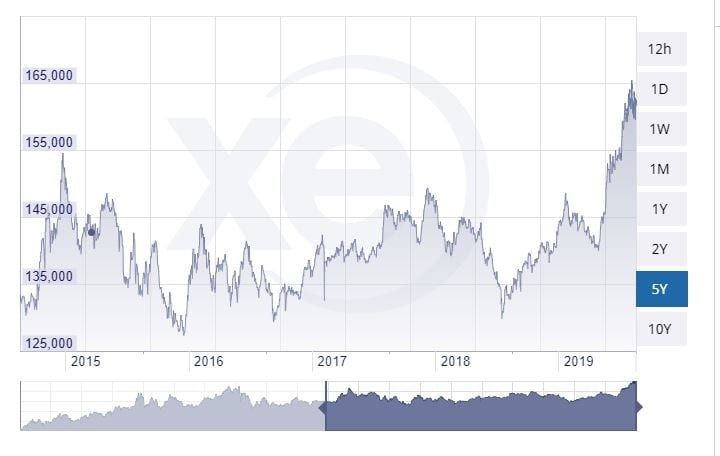

Yen Gold Charts

Before looking at Gold and where it might head, let’s look at how Gold is faring in multiple currencies. If this bull has legs, it should trend higher over a basket of currencies.

Gold Price Chart Euro: Heading up or

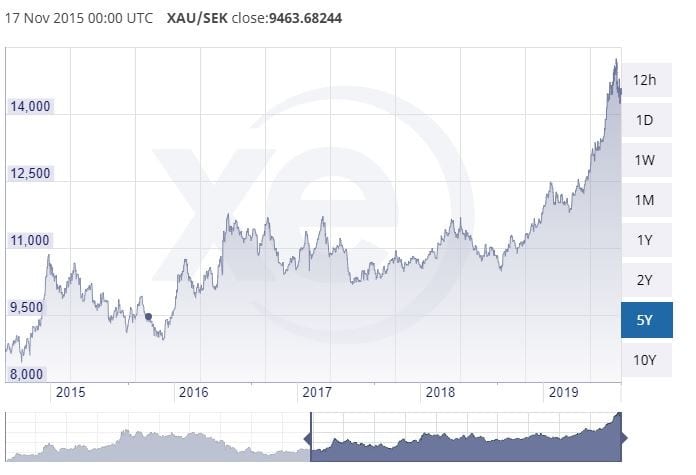

When one looks at the charts of Gold in various currencies, the first thing that comes to mind is that Gold performs very well in certain currencies. For example, the Yen, Swedish Krona and the British pound. What do all these currencies have in common? They are all under pressure. In other words, economic or socio-economic factors push them lower.

The same pattern can be seen if a chart of Gold prices in Yuan is put up. This is yet another explicit confirmation that the currency wars we spoke of years ago are alive and thriving. Now that negative rates are back in play, Gold should hold up well, but it will not be the best-performing market for one simple reason. Most of today’s crowd is no longer familiar with the concept of hard money, and therefore Bitcoin is likely to fare better, but bitcoin is another fad. The best plays will be stocks in the AI and tech sectors.

Sweedish Krona Gold Charts

British Pound Gold Charts

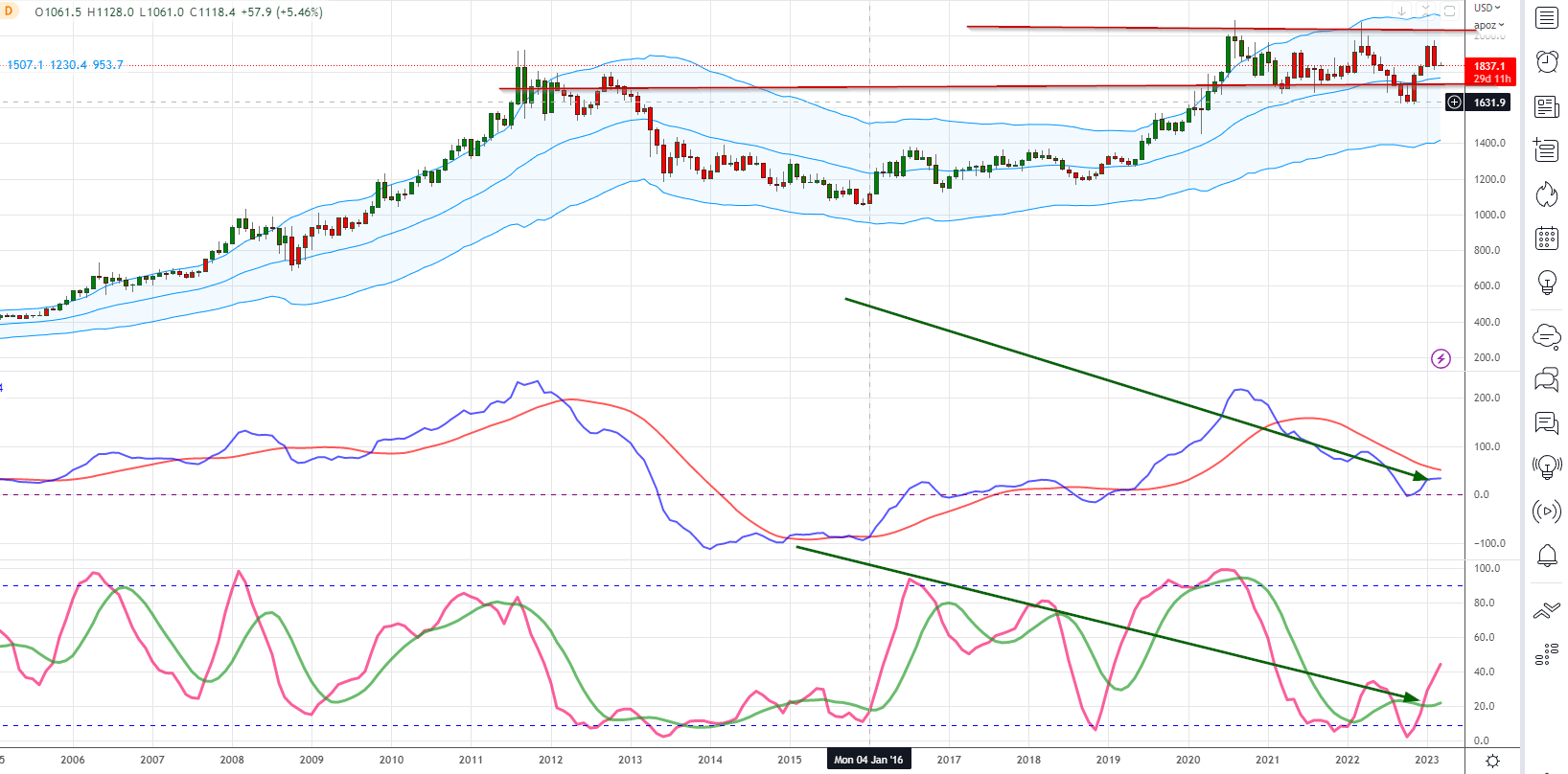

Gold Outlook 2023

According to our analysis, the price of Gold bullion is expected to continue rising for the next 15 to 24 months, with the lowest expected target ranging from 2500 to 2700. It’s worth noting, though, that Gold may test the 3000 range before ultimately reaching its peak. This prediction is based on various factors, including global economic uncertainty, geopolitical tensions, and the ongoing depreciation of fiat currencies.

Research

- “Why Invest in Gold Bullion” by The Balance: https://www.thebalance.com/why-invest-in-gold-bullion-4164756

- “Why Invest in Gold Stocks” by The Motley Fool: https://www.fool.com/investing/stock-market/types-of-stocks/gold-stocks/why-invest-in-gold-stocks/

- “Gold Bullion or Gold Stocks: Which Is a Better Investment?” by U.S. News & World Report: https://money.usnews.com/investing/investing-101/articles/gold-bullion-or-gold-stocks-which-is-a-better-investment

Other Articles of Interest

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)

Experts Finance Predictions for 2019

Stock Market Crash Stories Experts Push Equate to Nonsense (March 4)

Popular Media Lies To You: Don’t Listen To Experts As They Know Nothing (March 3)

Fiat Money; The main driver behind boom & Bust Cycles (March 1)