What Might Cause a Change in the Value of Fiat Money?

Updated Feb 21 2024

The value of fiat money, a currency not backed by physical commodities but by the trust in its issuing government, is a barometer of a nation’s economic health and governance. It’s a fluid measure, sensitive to a spectrum of factors that can shift its worth overnight.

– Economic Indicators: Key drivers are inflation, GDP growth, and interest rates. Hyperinflation can decimate money’s purchasing power, as seen in the Weimar Republic or Venezuela. Strong GDP growth signals a healthy economy, bolstering the currency.

– Geopolitical Events and Policies: Leadership changes or new policies can instil confidence or trigger uncertainty. The 2016 Brexit vote caused a sharp decline in the British pound due to economic uncertainty.

Supply and Demand: The interplay of supply and demand in the economy plays a major role in determining the value of fiat money.

– Public Trust: Fiat currency is backed by faith in the issuing government. Insolvency can drastically reduce its value.

– Digital Currencies: Cryptocurrencies like Bitcoin challenge traditional financial systems and prompt discussions on the future of money.

Navigating Fiat Currency Fluctuations

Renowned investors Warren Buffett and Charlie Munger successfully navigated these shifts through disciplined investing and an understanding of market psychology. Their approach emphasizes:

– Focusing on a business’s intrinsic value, not speculative price movements

– Capitalizing on asset mispricing during economic turbulence

– Investing in companies with solid fundamentals and clear competitive advantages

In essence, the value of fiat money reflects a country’s economic narrative, coloured by the collective actions and reactions of its government, investors, and citizens. Understanding this narrative, as exemplified by investors like Munger and Buffett, is critical to navigating the shifts in the value of fiat money. It’s not just about the numbers; it’s about the story behind the numbers.

Influence of Inflation and Deflation on Fiat Money Value

Inflation and deflation significantly impact the value of fiat money. Inflation, marked by rising prices, diminishes the currency’s purchasing power, while deflation, characterized by falling prices, enhances it. These are not isolated phenomena; they are influenced by broader economic conditions such as financial stability, trade balances, and political stability. For instance, an economy in turmoil or experiencing a trade deficit may see its currency devalue. At the same time, political instability can lead to investor retreat and a subsequent drop in currency value.

Central banks are pivotal in managing inflation and deflation through monetary policy, adjusting interest rates, and regulating money supply. However, these tools can be misused, leading to economic imbalances and exacerbating wealth disparity. Controlled inflation can encourage consumer spending, and deflation can indicate productivity growth and goods abundance. Yet, when left unchecked, both can precipitate economic instability.

Central banks, particularly the Federal Reserve, have been criticized for policies that seemingly perpetuate boom and bust cycles, which do not always align with the broader public interest. These cycles can lead to economic downturns that disproportionately affect the average individual, while those responsible may receive bailouts and profit.

Interest Rates

Interest rates also have a significant impact on the value of fiat money. When interest rates are low, borrowing becomes cheaper, encouraging businesses and consumers to spend more. This increased spending stimulates economic growth but can also lead to inflationary pressures. Conversely, when interest rates are high, borrowing becomes more expensive, which can slow down economic activity and reduce inflationary pressures. Central banks closely monitor interest rates to manipulate the economy’s stability and influence the value of fiat money.

When they observe that the middle class and average Americans prosper, they claim that inflation is getting out of control and promptly begin raising rates to suppress the boom phase. Conversely, when the economic outlook appears bleak (the keyword being “appear”), they start to lower rates, providing their bankster friends with cheap money to snatch up all the assets they compelled mom-and-pop investors to sell. The Fed can be likened to the modern-day vampire, slowly draining its victims.

Economic Growth

Economic growth can significantly impact the value of fiat money, a government-issued currency not backed by a physical commodity. A robust economy, marked by increasing GDP, rising employment, and expanding businesses, can attract investments and boost the value of its currency. This is because a growing economy is seen as a favourable environment for investment, offering the potential for higher returns.

However, economic downturns can erode investor confidence and weaken the currency’s value. During such periods, investors may seek safer assets, leading to a decrease in demand for the currency and potentially devaluing it.

Moreover, the strength of a currency can impact trade balances and economic competitiveness. A stronger currency can make imports cheaper and exports more expensive. Conversely, a weaker currency can make imports more expensive and exports more affordable, affecting a country’s trade balance.

In essence, the state of the economy and its growth prospects play a crucial role in determining the value of its fiat money.

Fiat Money Value: Navigating Government Policies and Trade Balances

Government policies, including fiscal measures like taxation, spending, and budget management, directly impact the value of fiat money. Excessive spending can trigger inflation, while austerity measures may lead to deflation. The government’s ability to maintain economic and political stability also influences investor confidence, affecting currency stability and value.

Trade and current account balances are other critical factors. A trade deficit can devalue a currency due to the higher demand for foreign currencies. In contrast, a trade surplus can increase a currency’s value as foreign buyers convert their funds to the local currency for trade payments.

Central banks use monetary policy to manage inflation and deflation, affecting fiat money value. However, inconsistent or unpredictable policies can lead to market uncertainty and volatility, potentially undermining the currency’s value. Understanding these dynamics is essential for assessing currency market risks and opportunities.

Impact of Geopolitical Events on Fiat Money Value

Geopolitical events can significantly shift the value of fiat money. Wars, political unrest, trade disputes, and diplomatic tensions introduce uncertainty, which can sway investor sentiment and prompt a flight to safety. This often increases demand for perceived safe-haven assets, potentially strengthening their value.

For example, during political conflict or war, investors may move their investments into more stable currencies or assets like gold, leading to depreciation in the affected country’s currency. Conversely, resolving conflicts or successful trade agreements can boost investor confidence and strengthen a currency.

The significance of the event, a country’s economic fundamentals, and the response of monetary authorities all contribute to the impact on fiat money value. Geopolitical risks can also affect economic growth, trade, and investment, influencing currency strength. Understanding these factors is crucial for assessing currency market risks and opportunities.

Deciphering the Dynamics: Unraveling What Might Cause a Change in the Value of Fiat Money

You can buy all the main media outlets if you control the money. When you control the media and the money supply, you are the king of the hill; less than 10% of the populace is strong enough to resist falling for what they have been directed to see. Tactical Investor

Control over fiat money, a currency without intrinsic value, sanctioned by government decree, has historically been a lever of immense power. When combined with influence over media outlets, this control can consolidate power to an unprecedented degree, shaping public perception and decision-making.

The creation of fiat money “out of thin air” has profound implications. It enables rapid wealth accumulation for those with insider knowledge, as seen during the 2008 financial crisis. Banks with the authority to generate money engaged in high-risk lending, precipitating a global economic downturn. This crisis underscored the potential for wealth creation detached from tangible assets to exacerbate societal wealth gaps, with the affluent accruing more wealth and the average person struggling to keep pace.

Market cycles of boom and bust are often perceived as natural economic rhythms but can result from deliberate manipulation by those controlling the money supply. The 2008 crisis is a prime example, where such manipulation and hazardous financial practices triggered a worldwide recession.

The reach of fiat money extends into societal domains, particularly the media. Financially robust media conglomerates can steer public discourse, moulding societal norms and values. This influence is a testament to the power wielded by those controlling the money supply and media narratives.

However, fiat money is not inherently evil. It serves as the lifeblood of modern economies, enabling trade and economic expansion. The crux of the issue lies in its management and the concentration of control. The centralization of wealth and influence, facilitated by fiat money, has led to economic volatility, social inequality, and the manipulation of societal values.

Unravelling the Influence: Manipulation and Direction of the Left and the Right

They are both being played, and none is the wiser. This technique is used everywhere. The strategy employed is to provide the masses with two to three options to give them the illusion of choice, but all the choices lead to the same outcome, which is what they fail to see. When one takes an extreme position, it does not matter whether you are swinging to the right or left; you are being controlled, and that person can’t see anything else besides the data they have been fed.

So, how does this all tie up? All those events we briefly mentioned are being used and will be used to polarise the crowd even more; the big players are masters when manipulating the herd. What is immoral today is moral tomorrow; what changed? The only thing that changed was the perception. So, if you program children young enough with the perception you want, you can make them accept almost anything as moral, which is what the public education system is about. Remember, nothing is free, and what appears to be free usually costs you ten times more. One wise man I knew would often use this sentence when anyone made references to free stuff. He would say I am not rich enough to accept free things.

Examining the Controversial Role of Fiat Money in Modern Civilization

As Fiat money is behind everything, and the money supply continues to go ballistic, we can expect levels of polarization to soar to unimaginable levels today. With an unlimited supply of money and a vast understanding of Mass psychology, there is almost nothing in place to stop the top players from pushing these trends to their limit. The only defence is not to allow your emotions to do the talking, sit down and imagine it’s reality TV minus the Boob tube.

We have gone on record for several years, stating that market crashes are nothing but buying opportunities. Today, we provided a brief glimpse into the reasoning behind this stance. There is no way the Fed will allow the markets to crash and burn. They will create the illusion of a crash, and the crowd will react in the way they have been programmed to respond: dump the baby with the bathwater.

The conniving top players will come in and scoop everything. What separates a correction from a crash? Your entry point is that the early bird gets the worm, and the late bird must contend with the bullet. That is why groupthink psychology states that one should sell when the masses are euphoric and buy when the groups are panicking or uncertain.

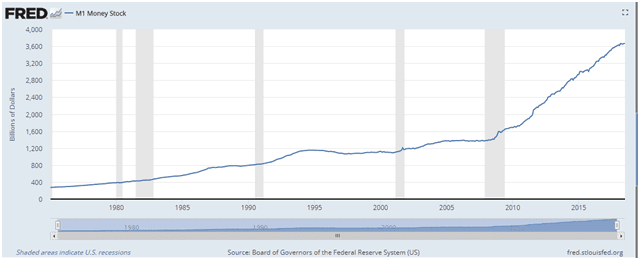

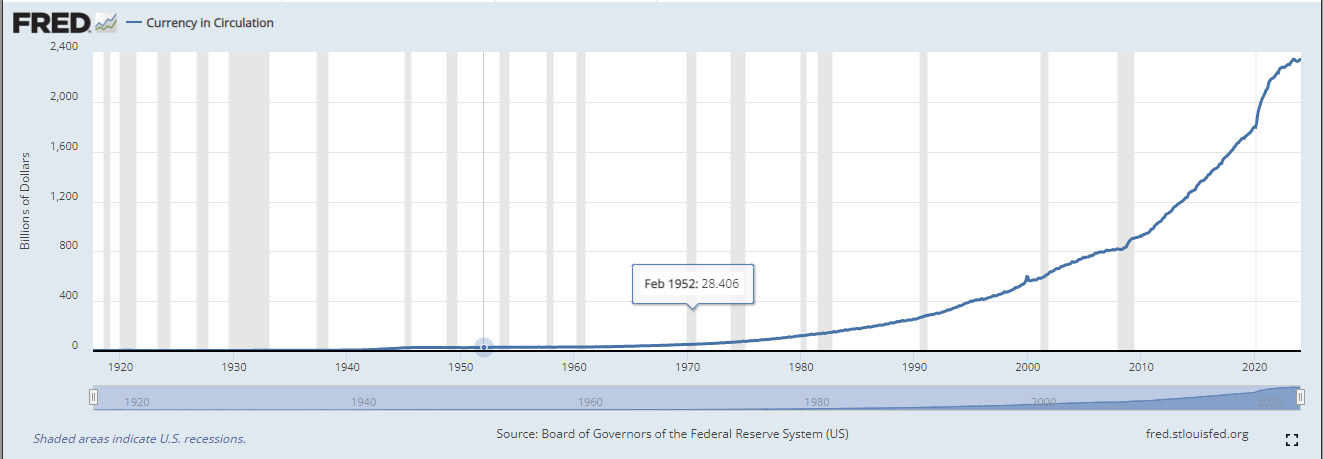

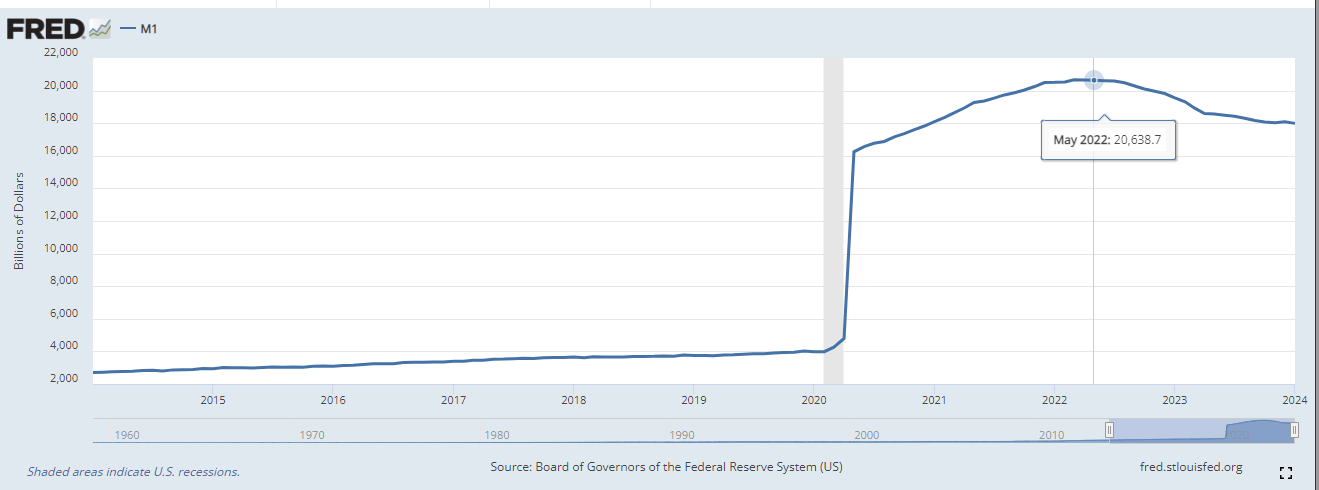

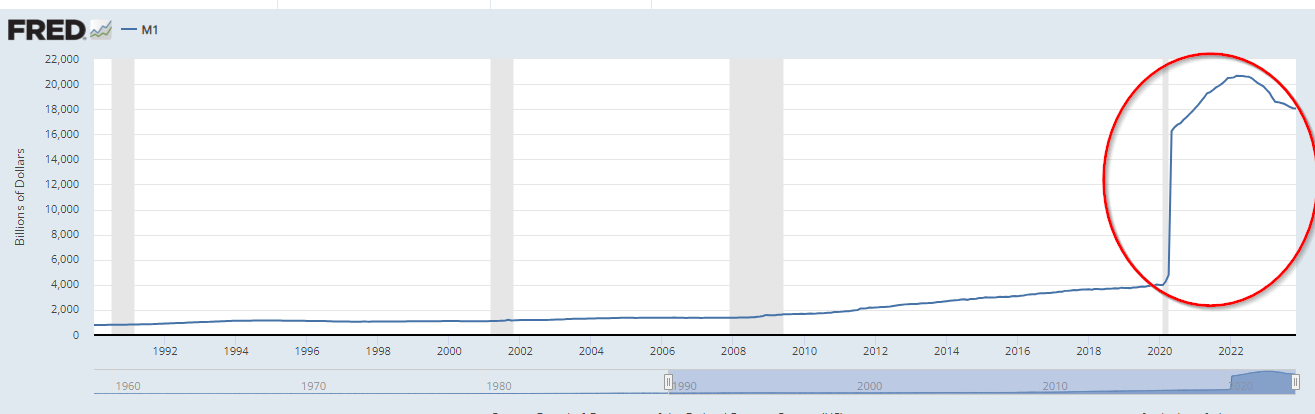

Take a look at these charts, and a pattern will start to emerge.

The shaded areas represent recessions, which usually follow disasters. After each recession, the currency in circulation continued to soar.

The M1 money stock followed a similar trajectory, surging dramatically after each economic downturn. The spike following the 2008 financial crisis was particularly noteworthy, but it pales compared to the astronomical leap from 2015 to 2024. The sheer magnitude of this increase is nothing short of mind-boggling. To compound the issue, the national debt is ballooning at an alarming rate, with approximately 1 trillion dollars added every 100 days. This staggering accumulation of debt, coupled with the unprecedented expansion of the money supply, paints a deeply concerning picture of the nation’s financial health.

Fiat Money: The Mother Of All Destructive Weapons

Moreover, the same can be said of the monetary base, but the move in this chart was explosive after 2008.

In 1790, the national debt was a minuscule $75.4 million; today, we add more than that every month. So, experts, mainly from the “hard money camp”, state that the masses will someday revolt. The only genuine part in that sentence is “one day”, but that day could be decades away from today because their perception has been altered. They believe that the dollar is as good as gold, and as long as they think that, Fiat has no chance of being unseated, and nothing is standing in the way of the national debt moving to $100 trillion. If it could move from $75.4 million to almost $31 trillion without the masses revolting, the move from $20 trillion to $100 trillion is paltry by comparison.

2024: Navigating Fiat Money, Debt, and Potential Unrest

Today, in 2024, the national debt is north of 31 Trillion, yet there is no widespread revolt. This observation supports our original claim that the masses won’t revolt until they are hungry, naked, and don’t have a roof over their heads. Until then, the strategy seems to be to inflate or die trying.

The power of fiat money and the control of the money supply have allowed for this massive debt accumulation. The creation of money out of thin air has led to an economic system where debt is continually inflated. This system benefits those in control of the money supply and those with the knowledge and resources to navigate this complex financial landscape.

However, this system is not sustainable in the long run. The continual inflation of the money supply and the accumulation of debt can lead to economic instability and potential financial crises. Moreover, this system contributes to wealth disparity, as those with the means to increase their wealth do so at the expense of the average individual.

Therefore, while there may not be a widespread revolt now, the potential for future economic instability and financial crises could lead to significant societal upheaval. It is crucial to understand the role of fiat money in our society and economy and to strive for more equitable and sustainable economic systems.

Unending Fiat Money: Await These Conditions

In the intricate dance of global economics, nations, with the United States often leading, amass significant debt, a practice fraught with consequences. To maintain this debt without public outcry, distractions and divisions are sometimes engineered, echoing the age-old divide-and-conquer strategy.

The weight of this debt falls hardest on those least able to bear it. The majority, mainly oblivious to the economic machinations at play, suffers the fallout from these artificial economic crises. The illusion of cost-free benefits is just that—an illusion, with the burden shifted from one group to another.

Faith in government to avert disasters akin to the Great Depression remains strong. Yet, this fear is exploited by those in power to sanction economic measures that, under the guise of preventing catastrophe, disproportionately benefit the few over the many.

Market downturns are often exploited as opportunities for wealth consolidation, with increased money supply inflating the economy and enriching those at the helm. This deliberate cycle of booms and busts fosters instability and exacerbates wealth inequality.

Historically, it takes severe hardship—widespread hunger, homelessness, and acute deprivation—to spark widespread unrest. Until such extremes are reached, the populace remains largely quiescent, even as the spectre of economic upheaval looms.

Engineering a Crisis: Crafting a Solution for the Masses

The orchestration of crises is a time-tested method of manipulation. By creating a severe enough crisis, the public is often willing to accept solutions they would have previously rejected, under the belief that the alternative would be far worse. For those orchestrating these events, it is a dual victory—they capitalize on both the crisis and the solution, frequently at the cost of the general populace.

Yet, capitalizing on these crises is not as straightforward as buying stocks during a market crash. It requires a deep understanding of financial markets and the ability to discern emerging trends. Over a decade of research and development has created indicators that signal impending trend changes or market bottoms.

While financial acumen can allow one to navigate and potentially profit from these cycles, it does not negate that such cycles are detrimental to the economy and the average person. The manipulation of fiat money and the deliberate creation of financial crises contribute to wealth disparity and economic instability. Therefore, pursuing more equitable and sustainable economic systems remains a critical endeavour.

We appreciate your interest in our article “What Might Cause a Change in the Value of Fiat Money?” Now, let’s conclude with suggestions on how individuals can enhance their chances of market success.

Effective Strategies for Enhancing Market Success

To enhance market success, it is crucial to grasp the principles of mass psychology. Markets often react not to news but to how investors perceive news. A strong market pullback, for instance, can induce widespread fear, prompting a sell-off. However, historical data suggests that such moments, while intimidating, may present opportunities. During the 1987 stock market crash, savvy investors who recognized the pullback as an overreaction profited handsomely when the market rebounded. One can discern between warranted concern and irrational fear by studying past market reactions.

Identify and master a few technical indicators that resonate with you. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are examples of technical indicators that many successful traders use to spot trends. For instance, when the RSI indicates an oversold condition, it can signal a potential buying opportunity. Focusing on long-term charts, such as weekly and monthly, allows you to filter out ‘noise’ and better understand the underlying trend.

Taking on a Corrupt Fed: Winning Financial Challenges

While eliminating the Federal Reserve is not feasible, investors can adopt strategies to counteract the effects of central bank policies. Contrarian investing is a strategy that capitalizes on the market’s psychological cycles. For example, during the dot-com bubble, contrarian investors avoided overvalued tech stocks, and during the 2008 financial crisis, they looked for undervalued assets when fear was at its peak.

The key to contrarian investing is confidence in one’s valuation methods and the patience to wait for the market to recognize an asset’s true worth. Warren Buffett, for example, is renowned for his contrarian approach, often buying when others are selling and vice versa. His investment in Bank of America during the financial crisis, when the financial sector was deeply out of favour, is a testament to the effectiveness of this strategy.

Understanding market psychology and emotional drivers is essential for navigating and profiting from market cycles. While these cycles can harm the economy and individuals, they also present opportunities for those who can identify and act on them. Advocating for fairer and more sustainable economic systems is crucial, as is the ability to navigate the current system with informed strategic decision-making.

Conclusion on What Might Cause a Change in the Value of Fiat Money.

Fiat money, a currency issued by governments without backing by physical commodities, derives its value from the public’s trust and the economic performance of the issuing country. Several factors can influence the value of fiat money:

1. Economic Performance: A robust economy can enhance the value of its currency, as seen with the U.S. dollar’s strength during periods of significant GDP growth. Conversely, economic downturns can diminish a currency’s value.

2. Trade and Current Account Balances: A trade surplus can appreciate a currency, as was the case with the Japanese yen during the country’s export boom in the 1980s. A trade deficit can have the opposite effect.

3. Inflation: High inflation rates can devalue fiat money, as observed in Zimbabwe in the early 2000s, where hyperinflation rendered the Zimbabwean dollar virtually worthless.

4. Monetary Policy: Central banks’ policies significantly impact fiat money’s value. For example, the Federal Reserve’s quantitative easing during the 2008 financial crisis aimed to stabilize the U.S. dollar and the economy.

5. Public Confidence: The value of fiat money heavily relies on public confidence. A loss of confidence can lead to a decline in currency value, as seen during the Weimar Republic’s hyperinflation in the 1920s.

Market wizards like Paul Tudor Jones and Bruce Kovner have thrived by understanding these principles. Jones, for instance, famously predicted and profited from the 1987 market crash by recognizing the signs of an overvalued market. Kovner has been known for his disciplined approach to trading, often taking contrarian positions that capitalize on market overreactions.

What Might Cause a Change in the Value of Fiat Money? The answer lies in a complex interplay of economic, political, and psychological forces which shape the currency’s value in our modern world. By understanding these dynamics, investors can make more informed decisions akin to the strategies employed by market wizards to navigate the fluctuations in the value of fiat money.

Other Articles of Interest

Investor Sentiment in the Stock Market: Riding the Right Wave

When is the Best Time to Visit Colombia? Uncover the Ideal Season

What Is Price to Sales Ratio in Stocks?: A Gem-Spotting Metric

What is Behavioral Psychology?: Secrets of Human Behavior

What’s a Contrarian?: Out-of-the-Box Thinkers and Action Takers

Mass Hysteria Examples in America: Let the Tales Unfold

What is Oleic Acid Good For: Unveiling Its Health Benefits

The Ultimate Guide to Finding the Best Time to Visit Colombia

Stock Market Crash History: Learn from the Past or Be Doomed

How to Invest When the Stock Market Crashes: Embrace the Fear, Buy the Opportunity

Third Wave Feminism is Toxic: Its Impact on America

A Crisis of Beliefs: Investor Psychology and Financial Fragility

Copper ETF 3X: Rock On or Get Rolled Over

Which of the Following Is True of Portfolio Diversification?

What is the Average Student Loan Debt in the US? Understanding the Crisis

Permabear; It Takes A Special Kind Of Stupid To Be One (Feb 21)

US Debt To GDP Means Nothing To Bonds & Stocks (Feb 12)

Technology-Driven Deflation Will Kill The Inflation Monster (Feb 7)