BTC Price Trends

Before we get into the meat of this article, let’s examine what some of the bulls and bears are saying, let’s start off with the bullish scenario

If the pattern of the last two rallies repeats, Bitcoin could rise to $60,000 to $400,000 before crashing 85% again. But today’s crypto market is far different from the ones in 2013 and 2015 when the last two rallies started. It’s much larger, for one thing, $260 billion in market cap compared with $1 billion in 2013 and $3 billion in 2015. There are far more crypto assets and far more users. More than $30 billion of investment capital was spent in 2018 building platforms and code bases. The regulatory picture has clarified considerably, and big companies including JPMorgan Chase & Co. and Facebook Inc. are jumping into the sector.

Of course, that doesn’t eliminate the chance of bubble and crash. Even assets that don’t change, that are as boring as gold or residential real estate, have experienced booms and busts. With the rapid innovation, radical ideas and disruption of crypto, investors have to expect a lot of volatility. But is there a chance they could see a few years of sane returns, with drawdowns limited to, say, 20% instead of 85% or more? Full Story

The super bullish price forecast for Bitcoin

It is currently trading below $8,000, less than half the value it reached in late 2017 when a major price rally saw it almost hit $20,000. Yet experts note that he recent dip does not necessarily mean a market turnaround.

“I believe bitcoin has the potential to hit $25,000 by the end of 2019 or early 2020,” prominent bitcoin analyst Oliver Isaacs told The Independent.

“There are multiple drivers behind the recent resurgence. There are geopolitical, technological and regulatory drivers. The net effect of the trade war between the US and China has led to the sudden interest in bitcoin as a hedge on investments.”Full Story

One expert offers a somewhat balanced view, while the other just shoots his mouth without taking into consideration that bitcoin was in a bubble stage and that it will take some time for the masses to be conned into embracing it with the same gusto as they did before. Hence, it’s unlikely that Bitcoin will take out its old highs in 2019 and possibly even in 2020. However, it appears to have put in a bottom and is generally expected to end the year on a positive note.

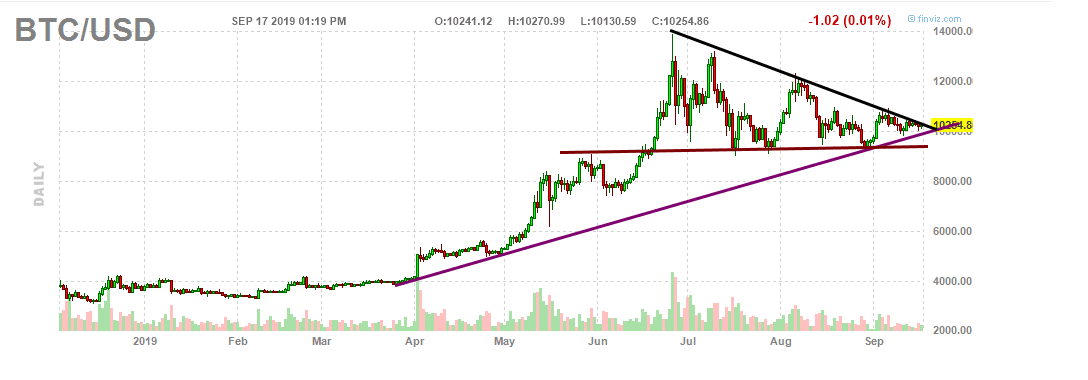

Back To The BTC Price Outlook for 2019

On the monthly charts, Bitcoin is still trading in the overbought ranges and that would be somewhat okay if the weekly charts were trading in the oversold ranges. But as can be seen from the above image, Bitcoin is also trading in the overbought ranges on the weekly charts and so one has to conclude that the main move for the year is over. A monthly close below 8400 could push bitcoin down to the 6500 ranges with a possible overshoot to the 5600-6000 ranges. Bitcoin is a very volatile market and hence the timid should avoid it and possibly consider getting into GBTC as an alternative.

BTC Price: The Short Term Outlook

A weekly close below 9,900 should lead to a test of the 9000-9200 ranges. If it closes below 9000 for three days in a row then a test of the 8400 ranges is virtually guaranteed. At this point in time, the bitcoin market is overbought and silver (the poor man’s gold) makes for a much better investment. Silver could trade as high as 42, with a possible overshoot to the 51 to 54 ranges.

Tactical Investor Notes On the General Markets

The market update will be sent out within the next 24-36 hours, depending on how fast we can process the new batch of sentiment data.

While the masses have remained uncertain for a long time; readings have not spiked into the extreme bearish ranges or extreme bullish ranges for an extended period. The same pattern applies to individuals in the neutral camp; while the number of individuals in the neutral camp has held steady, the readings have never touched the 50 ranges, something that is almost always necessary for the market to break out of a trading range. One could use technical analysis to describe what is going on in the sentiment arena. Sentiment readings are stuck in a wide channel, and at this point, there could be a breakout to the upside in bearish or bullish readings and vice versa.

Looking at the situation from a mass psychology perspective, it suggests that we might be entering into a “new norm”. Much like the new norm we discussed regarding interest rates when we stated that the low to negative rates were here to stay and that the Fed’s stance on raising interest rates were based on pure fiction.

We will discuss this norm in the next issue as there is data to support this position. For example, the BBC global 30 and Major US indices while trending higher are having a hard time of breaking out and so it suggests that the stronger correction we were looking for could still come to pass. Note in the last update we stated we would be very happy if the Dow dropped to the 25,000 ranges.

We would be very happy if the Dow suddenly reversed course and dropped below 25,000; this would knock the living daylights out of the masses and give false hope to the bears, indirectly creating a mouth-watering opportunity for the Tactical Investor. Market Update Sept 15, 2019

We are therefore going to implement some defensive strategies and this will be discussed in the next update. There is no need to worry for if this projected outlook comes to pass; it should be treated as an opportunity.

Other Stories Of Interest

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)

Experts Finance Predictions for 2019

Stock Market Crash Stories Experts Push Equate to Nonsense (March 4)

Popular Media Lies To You: Don’t Listen To Experts As They Know Nothing (March 3)

Fiat Money; The main driver behind boom & Bust Cycles (March 1)