Stock Price Of BABA

Let’s start off by looking at what Alibaba does:

Alibaba Group Holding Limited, through its subsidiaries, provides online and mobile commerce businesses in the People’s Republic of China and internationally. It operates in four segments: Core Commerce, Cloud Computing, Digital Media and Entertainment, and Innovation Initiatives and Others.

The company operates Taobao Marketplace, a mobile commerce destination; Tmall, a third-party platform; Alibaba Health pharmaceutical e-commerce and consumer healthcare platforms; Alimama, a monetization platform; 1688.com, an online wholesale marketplace; Alibaba.com, an online wholesale marketplace; AliExpress, a retail marketplace; Lazada, an e-commerce platform; and Tmall Global, an import e-commerce platform.

It also operates Lingshoutong, a digital sourcing platform; Cainiao Network logistic services platform; Ele.me, a delivery and local services platform; Koubei, a restaurant and local services guide platform; and Fliggy, an online travel platform. In addition, the company offers pay-for-performance and display marketing services; and Taobao Ad Network and Exchange, a real-time bidding online marketing exchange.

Further, it provides elastic computing, database, storage, virtualization network, large scale computing, security, and management and application, big data analytics, machine learning platform, and Internet of Things and other services for enterprises; and payment and escrow services; and movies, television series, variety shows, animations, and other video content. Additionally, the company operates Youku, Yahoo Finance

Stock Price Of BABA Projections Based on Insider Activity

There are no insider transactions so we cannot garner any extra information from this metric, however, the technical picture and EPS long trends look promising. At least Insiders have not been dumping their shares which is a net positive development.

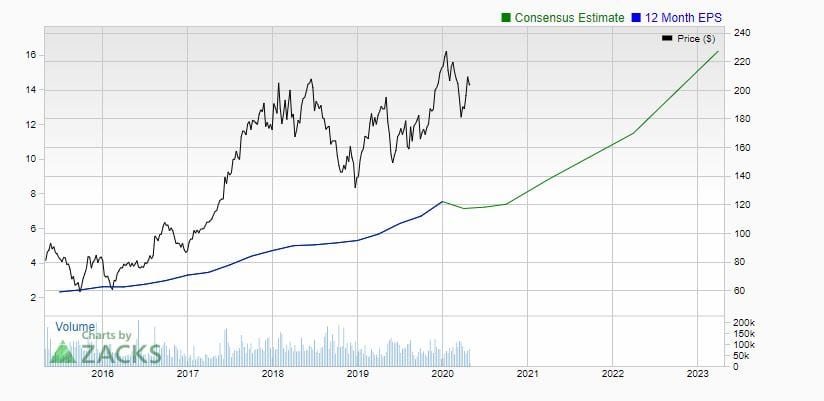

Stock EPS Trend

EPS is projected to increase up until 2023 and from this data point and from the point that BABA is one of the dominant players in Asia it makes for a good long term investment. Traders can use strong pullbacks to add to their positions. However, in terms of AI leaders, we would favour, GOOGL, FB and AMZN over BABA.

Stock Price Of BABA; Where Is It Heading In 2020

On the monthly charts (not shown above) the stock is trading far from the overbought ranges, which means technically it has a long way to go before it trades in the overbought ranges. It needs a monthly close above 216 in order to put in a series of new 52 week highs and challenge the 330 ranges. We would use sharp corrections to add to our position.

Other articles of interest:

BIIB stock Price: Is it time to buy

Stock market crashes timelines

Dow theory no longer relevant-Better Alternative exists

Apple Stock Predictions For 2020 and Beyond

In 1929 the stock market crashed because of

Apple Stock Price Target: Is It Time To Buy AAPL

Anti Gmo: The Anti Gmo Trend Is In Full Swing?

From GMO Foods To GMO Humans: What’s Next

Apple Stock Buy Or Sell: It’s Time To Load Up In 2020