Unveiling the Potential of Black Gold Oil

Feb 3, 2024

As we move forward into 2024, the energy landscape is evolving, with a shift in focus from traditional fossil fuels to more sustainable and renewable energy sources. However, the role of fossil fuels, particularly oil, remains significant.

Oil production in the U.S. has been surging, with the country producing more oil than any other nation in history by the end of the previous year. This increase in domestic production has helped to shield the U.S. from fluctuations in global oil prices and has reduced the country’s dependence on foreign oil.

While coal was once the primary source of power generation in the U.S., accounting for 49-54% of power generation, the focus has shifted towards cleaner and more sustainable energy sources. However, coal still plays a role in the energy mix, particularly in regions with abundant coal reserves.

The demand for electricity in the U.S. continues to rise, with projections indicating a significant increase in demand by 2025. To meet this demand, a diverse mix of energy sources will be needed, including coal, natural gas, nuclear, and renewable energy sources.

The construction of new coal-fired power plants has been a topic of debate, with concerns about the environmental impact of coal combustion. However, advancements in clean coal technologies have made it possible to reduce the emissions from coal-fired power plants, making them a more viable option for power generation.

The use of coal for oil generation is another potential application for this abundant resource. With the U.S. having one of the largest coal reserves in the world, this technology could further reduce the country’s dependence on foreign oil.

However, it’s important to note that the energy landscape continually evolves, with new technologies and resources emerging. The focus on sustainability and reducing carbon emissions will continue to shape the energy sector in the future. As such, the role of fossil fuels, including coal and oil, will likely continue to evolve in response to these trends.

The Future of Energy: Uranium and Coal

The United States is indeed blessed with vast coal reserves, which have historically been a significant source of power generation. However, the energy landscape is evolving, and the role of coal is changing. While coal still plays a part in the energy mix, there has been a shift towards cleaner and more sustainable energy sources, including nuclear power.

Uranium, the primary fuel for nuclear power, is in high demand. Despite this, there are sufficient uranium resources globally to support the long-term, sustainable use of nuclear energy for low-carbon electricity generation and other uses, such as industrial heat applications and hydrogen production. However, the impact of the ongoing COVID-19 pandemic on the industry and recent reductions in uranium production and exploration could affect available supplies. Timely investment in innovative mining and processing techniques would help ensure uranium resources are brought to market when needed.

The United States imports most of the uranium it uses as fuel. Economically recoverable uranium reserves are located in the western United States, Australia, Canada, Central Asia, Africa, and South America. Uranium production in the United States peaked in 1980, and uranium purchases by U.S. nuclear power plant operators from domestic suppliers peaked in 1981. Since 1992, most uranium U.S. nuclear power plant operators purchased was imported.

The global nuclear industry is reliant on Russian supplies for approximately 14% of uranium concentrates, 27% of conversion, and 39% of enrichment. This reliance highlights the security of supply risk associated with the growing primary supply gap and shrinking secondary supplies while increasing the focus on the origin of supply.

In 2021, 20 countries produced 77%, 48,303 tons, of the world’s uranium. Kazakhstan, Canada, and Australia alone produced three-fourths of the world’s production from their mines. Global uranium production decreased to the lowest level in 2020 due to COVID-19 mine closures. While production has increased, clean energy sources have caused the demand for uranium to grow disproportionate to its current supply. The depletion of Cold War stockpiles of uranium has further strained production. It is forecasted that uranium mining will not meet the reactor demands for at least 15 years.

In conclusion, while the United States has vast coal supplies, the energy landscape is evolving, and the role of coal is changing. At the same time, the demand for uranium, the primary fuel for nuclear power, is growing. Despite this, there are sufficient uranium resources globally to support the long-term, sustainable use of atomic energy. However, the impact of the ongoing COVID-19 pandemic on the industry and recent reductions in uranium production and exploration could affect available supplies.

The Evolving Energy Consumption in the U.S.

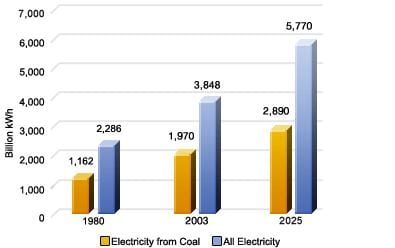

As we look towards 2025, the energy consumption landscape in the United States will continue evolving. The projection of over 5770 billion kWh of electricity consumption is a testament to the country’s growing energy needs. Coal, which has historically been a cornerstone of U.S. energy production, is anticipated to contribute a significant portion of this electricity. However, its share in the energy mix has been declining.

There has been a notable shift in the U.S. energy sector in recent years, with a decrease in coal’s contribution to total energy consumption. In 2022, coal accounted for around 19.7% of utility-scale electricity generation, a marked reduction from previous decades. This trend is expected to continue as the energy industry moves towards more sustainable and environmentally friendly sources.

Renewable energy sources are rising, with substantial growth in solar and wind power generation. The U.S. Energy Information Administration’s data indicates renewables accounted for approximately 21.3% of the total utility-scale electricity generation in 2022. This shift is driven by a combination of factors, including technological advancements, policy incentives, and increasing societal demand for cleaner energy.

The nuclear sector also remains a critical component of the U.S. energy mix, providing a substantial portion of the country’s electricity. While uranium supply and demand dynamics are complex, the global market has the resources to meet the current and future needs for nuclear power generation. The industry adapts to these challenges through innovation and strategic planning to ensure a reliable uranium supply for the burgeoning atomic energy sector.

The U.S. energy system is transforming, with a clear trend towards diversification and sustainability. The country’s vast natural resources, including coal and uranium, continue to play a role. Still, the emphasis is increasingly on reducing carbon emissions and harnessing renewable energy sources to meet the growing electricity demand responsibly and sustainably. As we approach 2025, the energy landscape will likely be characterized by a blend of traditional and modern energy sources, each contributing to a balanced and secure future.

http://www.eia.doe.gov/neic/infosheets/electricgeneration.htm

Black Gold Oil Supplies and the Role of Coal

The United States is home to the world’s most extensive coal deposits, which could last for several centuries given the current consumption rate. These coal reserves are vast and strategically distributed across the country, often in proximity to major transportation networks, facilitating efficient delivery to the market.

Coal’s contribution to the U.S. power supply has historically been significant. Still, its share has been in a state of flux due to various factors, including environmental concerns and the rise of alternative energy sources. While coal accounted for a substantial portion of power generation in the past, its role in the future energy mix is expected to evolve.

The projection that coal’s share of power supply production could increase by 2030 must be contextualized within the broader energy landscape. The anticipated increase in coal usage considers the overall rise in power consumption projected for the United States. However, this projection may not fully align with recent trends and policy shifts favouring cleaner energy sources.

In the past, coal usage for electricity generation saw significant growth. For instance, there was a marked increase from 1980 to 2001. The demand for coal has been rising, and if this trend were to continue unchecked, the consumption by 2030 could be substantial. However, the energy sector is transforming, with increased emphasis on reducing carbon emissions and transitioning to renewable energy sources.

The comparison with nuclear energy highlights the challenges of growing demand for energy. While nuclear power is a low-carbon energy source, it comes with its own challenges, including managing radioactive waste and the need for a secure supply of uranium.

It’s important to note that the energy industry is not static, and projections can change with technological advancements, policy decisions, and shifts in market dynamics. The role of coal in the future U.S. energy mix will likely be influenced by these factors and the country’s commitment to addressing climate change and investing in sustainable energy infrastructure.

In summary, while the United States has significant coal reserves that could potentially support future energy needs, coal’s role in the energy mix is subject to various influences, including environmental policies, market forces, and the competitive landscape of energy technologies. The energy sector’s future will likely be characterized by a diversified portfolio that includes both traditional and renewable energy sources.

Black Gold: A Rising Demand and Complexities Unveiled

As we approach 2024, the energy landscape continues to shift, with a surge in demand for various forms of energy. The United States, for instance, has seen a decline in coal-based power plants with a stronger focus on cleaner energy sources, contradicting the plans years ago to open a plethora of new high-tech fired coal plants.

Company plans may have changed due to market transitions, policy directives, and public pressure. For instance, Vistra Corp, the company that acquired Dallas-based TXU, announced in 2020 that it would close all seven of its remaining coal plants in Illinois and Ohio by 2027.

The ongoing global transition towards renewable energy sources, driven by concerns about climate change and improvements in renewable technologies, has decreased reliance on coal for electricity generation. Coal’s share in the U.S. power generation dropped to 19.7% in 2022, down from 33% in 2015.

A Balancing Act: Coal’s Pollution Predicament and Soaring Demand

The situation is more complex in countries like India and China. These rapidly developing nations have an increasing middle class demanding more energy. While nuclear power is part of their energy portfolio, they rely heavily on coal.

Despite being the world’s largest emitter of greenhouse gases, China is the world’s leading producer and consumer of coal. However, China has taken significant steps toward a cleaner energy future, pledging to reach peak carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060. On the other hand, India is still heavily reliant on coal and is also making strides in renewable energy, particularly solar power.

The global coal market is undergoing significant changes, with many coal mines closing operations due to economic reasons and environmental concerns. While coal demand remains high in certain regions, the broader trend is toward reducing coal use, especially for power generation.

In conclusion, while there is still a demand for coal, global trends indicate a significant move towards cleaner, renewable energy sources. The data and projections from the past have shifted, and the energy landscape of 2024 looks different from what was anticipated. The future of energy appears more renewable, with coal playing a less dominant role.

Black Gold Oil and Coal Options

As we approach 2024, the energy landscape continues to evolve, with significant shifts in the natural gas market. Over the past few years, natural gas has seen a substantial rally, and it’s projected to continue its upward trend. However, the exact price range for natural gas in the future is subject to various factors, including geopolitical events, macroeconomic variables, policy changes, and technological advancements.

The media often shifts to different energy sectors based on market trends and developments. While the focus may currently be on natural gas, it’s possible that attention could shift to coal in the future, especially if natural gas prices continue to rise. However, it’s important to note that media attention often follows market trends, and by the time a sector is in the spotlight, the initial phase of growth may have already occurred.

Looking at the global energy landscape, the demand for coal and natural gas is influenced by various factors, including economic growth in developing countries like India and China. However, the trend in recent years has been towards cleaner energy sources, with a decrease in reliance on coal for electricity generation. Coal’s share in the U.S. power generation dropped to 19.7% in 2022, down from 33% in 2015.

Natural gas prices plunged in 2023, posting the most significant loss in the energy sector. The low price level presented an opportunity as the natural gas futures market moves into 2024. European prices will likely influence U.S. futures as geopolitical tensions continue to impact global energy markets.

In the first quarter of 2024, natural gas prices are expected to increase, then drop below 2023 prices. In 2024, additional dry natural gas production increases, which will outpace higher LNG exports and slightly lower domestic consumption than in 2023, will put downward pressure on natural gas prices.

In conclusion, the energy market is complex and dynamic, with various factors influencing the demand and price of different energy sources. While coal and natural gas continue to play a role in the global energy mix, the trend is towards cleaner and more sustainable energy sources. As we move into 2024 and beyond, these trends will continue to shape the energy landscape.

Conclusion: The Future of Energy: Coal’s Controversial Role

In the intricate tapestry of global energy, coal’s enduring presence is a testament to its historical significance and current necessity, particularly in the developing world. Despite the crescendo of voices advocating for a reduction in greenhouse emissions, coal remains a bedrock for those without access to more affordable alternatives. Natural gas, often touted as a cleaner counterpart, has faced its own set of challenges, with some Western nations expressing reservations about its environmental footprint.

Take Germany, for example, once the stalwart of industrial might, now grappling with soaring energy prices that have placed an unprecedented strain on businesses, some teetering on the brink of bankruptcy or contemplating relocation. This stark reality underscores the complexity of transitioning to a sustainable energy model without destabilizing economies.

At the Tactical Investor, we recognize the enduring significance of traditional energy sources. Oil, coal, and natural gas are not relics of a bygone era but staples that will continue to energize our world for years. The allure of green solutions is undeniable, and nuclear energy stands out as a beacon of low-carbon potential. However, constructing nuclear power plants is a marathon, not a sprint, compounded by the scarcity of uranium—a challenge we are poised to navigate.

As we cast our gaze to the horizon, we remain steadfast in our investment strategy, acknowledging the dual reality of our times: the imperative of environmental stewardship and the unyielding demand for energy that powers our daily lives. In this delicate balance, we find our path forward, investing wisely in sectors that will fuel the future while keeping a pulse on the evolving energy production and consumption landscape.

Growth for the sake of growth is the ideology of the cancer cell.

Edward Abbey 1927-1989, American Writer

I find that a significant part of my information was acquired by looking up something and finding something else on the way.Franklin P. Adams 1881-1960, American Journalist, Humoris

Tasty Treats

Inductive Versus Deductive reasoning

Portfolio Management Suggestions

The Good And the Ugly On Trading Futures

Introduction to Mass Psychology