A little and a little, collected together, becomes a great deal; the heap in the barn consists of single grains, and drop and drop make the inundation. Saadi

Coffee Trends: Americans Prefer Coffee To Stocks

Updated Aug 2023

Coffee, a ubiquitous beverage, has become an integral part of the daily routine for many Americans. Recent data shows that 61% of Americans consume coffee daily. This statistic is a testament to the nation’s love for caffeine and an indicator of a broader trend. Compared to the 48% of Americans who actively invest in the stock market, it becomes evident that the ritual of coffee drinking is more prevalent than financial investing.

The reasons behind this disparity are multifaceted. For one, coffee is a daily necessity for many, providing a much-needed energy boost. It’s a simple pleasure that requires little knowledge or skill, making it accessible to all. On the other hand, investing in the stock market can be a complex and intimidating endeavour. It requires a certain level of financial literacy, risk tolerance, and, often, disposable income, which not everyone possesses.

Moreover, the immediate gratification of a cup of coffee starkly contrasts the long-term, often uncertain benefits of stock market investing. While the latter can lead to significant financial growth over time, it doesn’t offer the instant satisfaction of a morning caffeine fix.

While coffee consumption and stock market investing are standard practices in America, the former is more widespread. This could be attributed to coffee’s simplicity and immediate rewards, compared to the complexity and delayed gratification of investing. This trend underscores the need for increased financial literacy and investment education to make the stock market as approachable and commonplace as a daily cup of coffee.

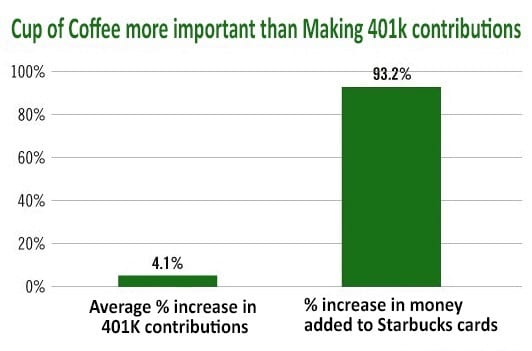

Coffee Trends and Starbucks Prepaid cards

The prepaid Starbucks card usage surge is a testament to the growing coffee culture worldwide. Coffee has become more than just a morning pick-me-up; it’s a lifestyle choice, a status symbol, and a social activity. The speciality coffee market has grown significantly, with consumers seeking unique, high-quality coffee experiences. This trend is not just limited to Starbucks; independent coffee shops and other chains also benefit from this shift in consumer behaviour.

The Power of Branding and Consumer Behavior

Starbucks’ success with its prepaid cards is also a testament to the power of branding and understanding consumer behaviour. The company has successfully positioned itself as a premium brand, and its prepaid cards are seen as a convenient and desirable product. This has led consumers to load money onto these cards, even at the expense of other financial priorities.

While the rise in Starbucks card usage is an interesting trend, it also raises concerns about personal finance habits. The fact that people are choosing to spend more on coffee than investing in their future is a worrying sign. It highlights the need for better financial education and awareness, particularly when it comes to long-term savings and investments.

The Investment Landscape

Despite the reluctance of many to invest in the stock market, there are still opportunities for those who are willing to take the plunge. The rise of robo-advisors and other fintech innovations has made investing more accessible and less intimidating. These platforms can provide a stepping stone for those who don’t have enough money or knowledge to invest.

Coffee consumption trends and personal finance will likely continue to evolve. As consumers become more discerning about their coffee choices, businesses will need to adapt to meet these changing demands. At the same time, the need for better financial education and tools will become increasingly important. The intersection of these two trends presents exciting opportunities for businesses, investors, and consumers alike.

The rise in Starbucks prepaid card usage reflects broader trends in consumer behaviour, personal finance, and the coffee industry. It’s a fascinating case study of how our daily habits can have far-reaching implications.

Coffee Choices vs. Investment Hesitations: Exploring Financial Attitudes

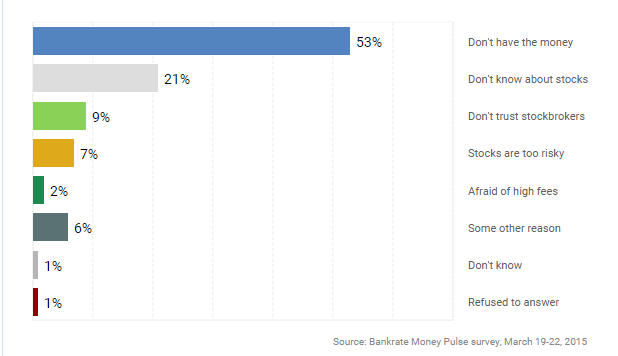

From a psychological perspective, it becomes apparent that a significant majority has yet to embrace the world of markets fully. Insights from bankrate.com highlight that a substantial portion of the population cannot invest in stocks due to financial constraints. Examining the chart below, 53% lack the financial means to acquire supplies, and 21% admit insufficient knowledge about them – a concerning stance for the current generation’s economic prospects. Interestingly, this demographic seems undeterred when indulging in pricy coffee purchases, even though these could easily be recreated at home.

Source: www.bankrate.com

Negative Interest Rates

We have extensively discussed this subject. As previously mentioned, the slight and unfortunate rate increase that the Fed initiated does not mark the onset of a new trend; rather, it reflects the Fed’s desperate attempt to convince the public that this economic recovery holds true. Anyone with even a modicum of common sense comprehends that the sole driving force behind this economic resurgence is the influx of hot money; should the supply of hot money dwindle, the recovery will promptly cease.

This is precisely why one nation after another is adopting the concept of negative interest rates, and it’s merely a matter of time before the Fed is compelled to follow suit. When negative rates eventually reach the US, they will push corporations towards assuming even more significant risks. We anticipate that share buybacks will soar to levels that could render current purchases appear rational in comparison.

Concluding Insights: Coffee Trends & Investing

Coffee trends and investing have intriguing connections that shed light on broader consumer behaviours and financial attitudes. Recent data reveals that 61% of Americans consume coffee daily, showcasing a deep-rooted love for caffeine. This inclination towards coffee consumption surpasses the 48% of Americans actively investing in stocks, illustrating a notable societal trend.

Several factors contribute to this disparity. As a daily essential, coffee offers an immediate energy boost and uncomplicated enjoyment. Its accessibility starkly contrasts the intricate world of stock market investing, which demands financial knowledge, risk tolerance, and disposable income that not all possess.

Moreover, the instant gratification from a cup of coffee contrasts the long-term, uncertain gains of stock investing. The allure of immediate satisfaction that coffee provides further explains its widespread adoption.

The prepaid Starbucks card usage surge underscores the global coffee culture’s growth, where coffee has evolved into a lifestyle choice and status symbol. Speciality coffee experiences have surged in popularity, not limited to Starbucks, benefiting both independent coffee shops and other chains.

Starbucks’ prepaid card success is a testament to effective branding and understanding of consumer behaviour. These cards, associated with the premium Starbucks brand, offer convenience and desirability, leading consumers to prioritize them over other financial needs.

Despite reservations about stock market investing, opportunities exist through robo-advisors and fintech innovations, making investing more accessible. As coffee preferences and personal finance habits evolve, businesses must adapt to changing demands. Simultaneously, the call for improved financial education and tools becomes imperative.

Psychologically, there’s a notable hesitation towards investing, primarily due to financial constraints and lack of knowledge. The population’s inclination towards indulgent coffee purchases while shying away from investments raises questions about financial priorities.

The concept of negative interest rates adds another layer to this discussion. The slight rate increase by the Fed doesn’t herald a new trend; instead, it highlights the economy‘s reliance on hot money. The adoption of negative rates by various nations, including a potential future move by the Fed, could drive corporations to take more significant risks.

Play not with paradoxes. That caustic which you handle to scorch others may happen to sear your fingers and make them dead to the quality of things. George Eliot

Originally published on July 13, 2016, this piece has undergone continuous updates over the years, with the most recent update conducted in August 2023.

Other Articles of Interest

Putin to the world; I know who created ISIS

Is Israeli Secret service Intelligence ISIS

Ted Cruz master Con Man & Master of Lies

Saving for retirement: Invest in stocks & retire rich

Muslim Migrants unleashed make Sweden Rape Capital of West

China reform: powering ahead with supply-side reforms

Can China attract foreign talent via green card Program

China Corruption Still Running Rampant

Currency Wars & Negative Rates Equate To Next Global Crisis

China’s Rural Transformation creating Boom Towns

Control Group Psychology: Stock Crash of 2016 Equates To Opportunity

Erratic Behaviour Meaning:Dow likely to test 2015 lows

India vs China: Can India surpass China

Interest rate wars-Fed stuck between a hard place & Grenade

India overtaking China just a pipe dream

Serenade for Your Heart: The Symphony of a Nourishing Breakfast