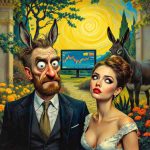

Mainstream Media: Peddling Panic and Propaganda

Emotion is primarily about nothing, and much of it remains about nothing to the end. George Santayana

July 11, 2024

Introduction: The Mainstream Media Mirage

In the age of information overload, the mainstream media plays a pivotal role in shaping public opinion and influencing financial markets. However, this influence is not always benign or truthful. This essay delves into the complex relationship between media, behavioural psychology, and investment decisions, drawing upon historical and contemporary examples to illustrate the often deceptive nature of mainstream media narratives.

The Power of Media Manipulation: A Historical Perspective

The manipulation of information for personal or political gain is not a new phenomenon. As far back as ancient Rome, Julius Caesar used his “Acta Diurna” (daily public notices) to shape public opinion and bolster his image. Fast forward to the 21st century, and we see similar tactics employed on a global scale, albeit with far more sophisticated tools at the media’s disposal.

Renowned media theorist Marshall McLuhan once said, “The medium is the message.” This profound statement underscores the importance of understanding not just the content of media but also how the medium shapes our perception and behaviour.

The Illusion of Knowledge: Cognitive Biases in Media Consumption

The constant barrage of information from mainstream media creates what psychologist Daniel Kahneman calls an “illusion of understanding.” This cognitive bias makes individuals believe they comprehensively grasp complex situations based on limited, often sensationalized information.

In his seminal work “Thinking, Fast and Slow,” Kahneman explains how our brains are wired to make quick judgments based on readily available information, a process he terms “System 1” thinking. This tendency makes us particularly susceptible to media manipulation, especially in the fast-paced world of financial markets.

The Amplification of Noise: Social Media and Information Overload

Social media has exponentially increased the volume of information available to investors. While this democratization of information can be beneficial, it amplifies what behavioural economist Richard Thaler calls “noise trading” – trading based on irrelevant or misinterpreted information.

Thaler’s research on behavioural economics highlights how cognitive biases can lead to irrational decision-making in financial markets. The constant stream of news, opinions, and speculations on social media platforms exacerbates these biases, making it increasingly difficult for investors to separate signals from noise.

The Erosion of Fundamental Analysis: Short-termism in Media Coverage

The media’s focus on breaking news and sensational stories has contributed to what finance professor Andrew Lo calls the “Adaptive Markets Hypothesis.” This theory suggests that market efficiency is not constant but fluctuates based on market conditions, including the impact of media narratives.

Lo argues that the media’s short-term focus can lead to a neglect of fundamental analysis, causing market inefficiencies and potential mispricing of assets. This erosion of fundamental analysis is particularly concerning in an era where algorithmic and high-frequency trading dominate market movements.

Case Study: The 2008 Financial Crisis and Media Complicity

The 2008 financial crisis provides a stark example of media complicity in market manipulation. In the years leading up to the crisis, mainstream media outlets often parroted the optimistic narratives of financial institutions, failing to critically examine the underlying risks in the housing and derivatives markets.

Pulitzer Prize-winning journalist Matt Taibbi, in his book “Griftopia,” argues that the media’s failure to adequately investigate and report on the systemic risks in the financial system contributed to the severity of the crisis. He writes, “The financial crisis of 2008 was about many things, but at its core, it was about the total failure of our system of oversight, regulation, and common sense.”

The Underperformance of Hedge Funds: A Symptom of Media Influence

The consistent underperformance of many hedge funds in recent years can be partially attributed to the influence of mainstream media on investment decisions. Behavioural finance expert James Montier argues that the media’s focus on short-term events and sensational stories can lead to what he calls “behavioural alpha” – the potential outperformance that can be achieved by exploiting the behavioural biases of other market participants.

Montier suggests that successful investors must learn to tune out the noise of mainstream media and focus on long-term fundamentals. He states, “The key to successful investing isn’t forecasting; it’s discipline.”

The Herd Mentality: Media’s Role in Market Bubbles and Crashes

The media plays a significant role in fostering herd mentality among investors, which can lead to market bubbles and subsequent crashes. Robert Shiller, Nobel laureate in economics, explores this concept in his book “Irrational Exuberance.”

Shiller argues that media narratives can create feedback loops that amplify market movements. He writes, “The news media are fundamental propagators of speculative price movements through their efforts to make news interesting to their audience.”

Mainstream Media: A Recipe for Losing

The story of Bill Dillard’s hedge fund closure illustrates how the general public and money managers can be influenced by the media. Dillard’s experience underscores the danger of relying too heavily on mainstream media narratives when making investment decisions.

As behavioural finance expert Meir Statman noted, “Cognitive errors plague professionals as well as amateurs.” This observation highlights the need for all investors, regardless of their level of expertise, to be aware of the potential biases introduced by media consumption.

Transforming Hedge Funds: The Shift Towards Inclusivity

The shift towards a more inclusive approach in hedge funds, as discussed at the SALT conference, reflects a growing recognition of the limitations of traditional investment strategies. This transformation aligns with the ideas of complexity theorist Nassim Nicholas Taleb, who argues for more robust, “antifragile” investment strategies that can withstand the unpredictability of financial markets.

Taleb’s concept of “skin in the game”—the idea that decision-makers should have a personal stake in the outcomes of their decisions—is particularly relevant to hedge fund management and media influence on investment decisions.

Mainstream Media Distortion: A Look Back at Market Behavior

The media’s tendency to exaggerate market risks and predict crashes that never materialize is a recurring theme in financial history. Behavioural economist Dan Ariely’s research on decision-making under uncertainty helps explain why investors often overreact to negative news.

Ariely’s work suggests that the pain of potential losses is psychologically more powerful than the pleasure of possible gains. This “loss aversion” bias, amplified by sensationalist media coverage, can lead investors to make poor decisions during market downturns.

Mastering Market Volatility: Lessons from Key Events

Events like Brexit demonstrate the media’s power to amplify market volatility. However, as noted by legendary investor Warren Buffett, “Be fearful when others are greedy, and greedy when others are fearful.” This contrarian approach requires investors to look beyond media narratives and focus on long-term fundamentals.

Psychologist Paul Slovic’s research on risk perception offers insights into why investors often overreact to media-hyped events. Slovic argues that our perception of risk is influenced not just by facts but also by emotional and cultural factors—factors that the media is adept at manipulating.

Conclusion: Navigating the Media Landscape

In conclusion, the relationship between mainstream media, behavioural psychology, and financial markets is complex and often fraught with pitfalls for unwary investors. By understanding the cognitive biases that make us susceptible to media manipulation and drawing on the insights of behavioural finance and psychology experts, investors can develop strategies to navigate this challenging landscape.

As we move forward in an age of information overload, the ability to discern truth from fiction becomes increasingly crucial. By combining timeless wisdom from legendary investors with cutting-edge insights from behavioural science, investors can develop a more robust approach to interpreting media narratives and making sound financial decisions.

Remember, as the philosopher George Santayana famously said, “Those who cannot remember the past are condemned to repeat it.” By studying the patterns of media deception throughout history and understanding our psychological vulnerabilities, we can better prepare ourselves for the challenges in the ever-evolving landscape of financial markets.

Each of us makes his own weather and determines the colour of the skies in the emotional universe which he inhabits.

Bishop Fulton J. Sheen

Other Stories Of Interest