US dollar vs Japanese Yen

Updated June 2023

The US dollar vs Japanese Yen is a significant currency pair that attracts the attention of traders and investors worldwide. Analyzing its performance and outlook provides insights into the global foreign exchange market.

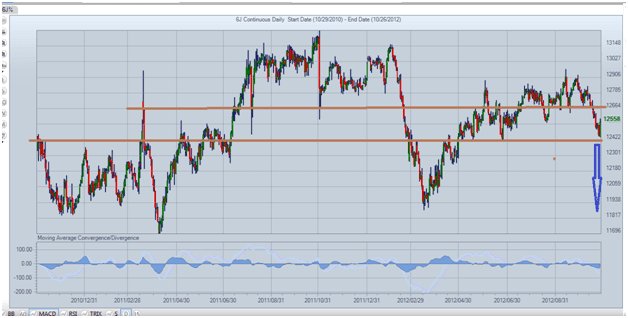

The update indicates a weak long-term outlook for the US dollar against the Japanese yen. However, the midterm outlook suggests a potential test of recent highs. On September 14th, the pair reached a high of 129.67 but quickly retreated, erasing all its gains in the following days. Despite attempting another rally, it failed to surpass 129.22 on September 28th and closed the day at 128.32, indicating a bearish sentiment.

With time to test its previous highs, the pair appears poised to explore the 124 range. If it experiences another rally and fails to break the 129.00 level, it would likely lead to a downward move towards the 120-122 range. This suggests that the US dollar may continue to weaken against the Japanese yen.

US Dollar vs Japanese Yen: Long-term Outlook

The long-term outlook is still weak, but the midterm outlook called for a test of the recent highs. It traded as high as 129.67 on the 14th of September and shed all its gains a few days later. The yen attempted to mount another rally after that but could not trade past 129.22 on the 28th of September and ended the day in the red when it closed at 128.32. It is running out of time to test its highs and appears ready to test the 124 ranges. If it rallies again and fails to take out 129.00, the next move down should lead to a test of the 120-122 ranges—market update Oct 24, 2012.

In the subsequent developments, the yen failed to retest its previous high and broke below the 126.00-126.25 support-turned-resistance range. It reached a low of 124.50 before reversing its course. It must overcome the hurdle at 126.25 and attempt to surpass the 129.00 level to regain momentum. Failure to close above 126.25 could further decline, potentially breaking the 124.00 level and heading towards the 118.70-119.00 range.

The significance of surpassing 126.25 lies in the yen’s ability to reclaim lost ground and challenge the 129.00 level. If it reaches 129.00, it may open up the possibility of shorting the yen through options on FXY, a bearish signal for the currency. Looking at the longer-term perspective, the yen’s inability to trade even within the 130-130.50 range, despite repeated attempts above the 128.50-129.00 range, suggests a bearish development. This implies that the yen may continue to strengthen against the US dollar in the long run, potentially leading to a test of the 94.00-104.00 range.

Exploring Contrarian Investing and the US Dollar vs Japanese Yen Outlook

Apart from the US dollar vs Japanese yen analysis, other stories of interest in the financial realm include contrarian investing. This investment strategy involves going against prevailing market sentiment, where investors take positions that oppose popular beliefs. Contrarian investors believe that markets tend to overreact to news and events, creating opportunities for profitable trades when they diverge from the consensus view.

In summary, the US dollar vs the Japanese yen pair is experiencing a weak long-term outlook, with a potential test of recent highs in the midterm. However, multiple failed attempts to break key resistance levels and the yen’s potential to strongly suggest a bearish sentiment. Traders and investors closely monitor these developments to make informed decisions in the dynamic foreign exchange market.

Derived from the October 28, 2012 Market Update but subsequently revised over the years, the most recent update was conducted in December 2022.

Random Reflections on the Market: June 2023

Perilous Similarities Ignored: The Illusion of Uniqueness

It is disconcerting how little attention is paid to the dangerous parallels with historical events such as the dot-com bubble, the housing bubble, and the crisis of 1973-1974. This disregard stems from a collective belief that the current circumstances are fundamentally different. However, we must heed the lessons of the past, for we have heard similar assertions during the housing crash.

Deceptive Peaks and Revealing Rebounds

In truth, the markets reached their pinnacle in 2007, only to experience an unexpected resurgence in 2008, a familiar tale echoing the present situation. This resurgence created an illusion that deceived many, leading them to overlook the impending danger. It is important to recognize that history has a way of repeating itself, and the striking similarities between then and now cannot be ignored.

The subsequent plunge in 2009 brought the markets to their lowest point, catching numerous individuals off guard. This shock was particularly severe for those who had entered the market during the robust rally phase, as the magnitude of the decline forced them to remain sidelined for years, nursing the wounds inflicted by their misplaced optimism.

Investor Frenzy and Echoes of the Past

Investor participation in today’s market mirrors the levels observed during the fateful year of 2008, with indications that the numbers will soon surpass those of that tumultuous period. A staggering 61% of individuals are currently active participants in the market, and even a significant portion of individuals over the age of 85 have thrown themselves fully into the fray. This surge in investor fervour evokes memories of the exuberance that preceded the previous market downturn.

Bullish Readings and Historical Averages

The most recent week’s bullish reading has finally breached the 50 mark, marking a significant milestone. This achievement also signifies five consecutive weeks during which bullish readings have exceeded the historical average of 38.5, albeit dropping slightly from the previous average of 39. This development is noteworthy, considering the preceding 18 months spent below this critical threshold.

Essential Pillars of Successful Trading

A comprehensive trading system cannot afford to overlook the influence of mass psychology. Understanding the collective emotions and behaviours that drive market trends offers valuable insights for making well-informed investment decisions. By deciphering the intricate interplay between human psychology and market dynamics, traders gain a distinct advantage in navigating the unpredictable waters of the financial world.

Mastering multiple tools of Technical Analysis (TA) while avoiding their standardized usage is a crucial skill set. Recognizing that each tool offers subjective interpretations allows traders to harness their inherent flexibility and adaptability. Such an approach facilitates a more nuanced understanding of market dynamics, leading to enhanced effectiveness in decision-making based on TA.

Patience and Discipline: The Keys to Long-Term Success

The cultivation of patience and discipline is of paramount importance for traders. One must acknowledge that certain periods necessitate waiting for months before entering a position. However, exercising patience during these phases can yield substantial rewards in a matter of weeks. Withstanding the waiting game while adhering to a disciplined approach is essential for long-term success in trading.

Originally published in 2012, this article has been consistently updated over the years, with the most recent update conducted in June 2023.

Intellectual Treats: Delectable Articles for the Inquisitive Reader

the Level Of Investments In A Markets Indicates