Editor: Vlad Rothstein | Tactical Investor

Breaking stock market news

he US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

The world is effectively on a US-dollar-standard, and the US Federal Reserve (Fed) has risen to the unofficial status of the world’s central bank. The rise of the Greenback has to a large extent been propelled by international banking, which has basically “dollarized” in terms of it’s lending and issuing activities.

Breaking stock market news: The Fed Sets Global Policy

The Fed’s policy not only determines credit and liquidity conditions in the US but does so in many financial markets around the world as well. For instance, movements of long-term US interest rates regularly have effects on credit and equity markets in, say, Europe and Asia. The Fed’s actions are the blueprint for monetary policymaking in many countries around the world.

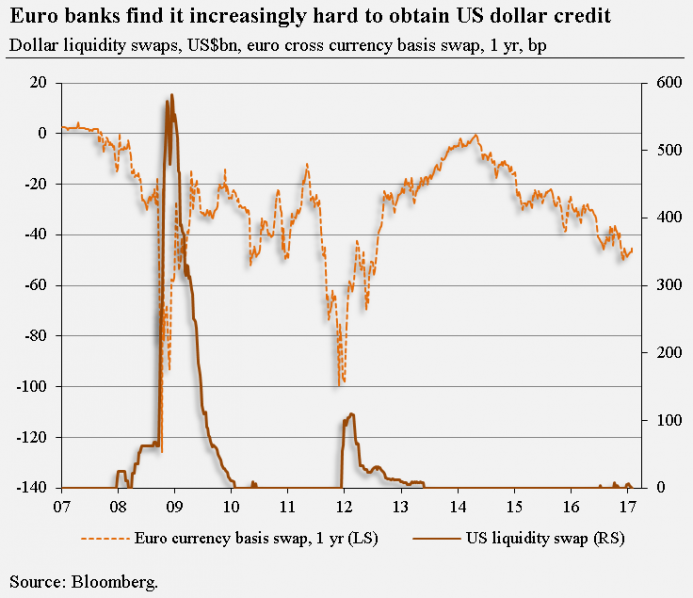

The graph shows the Fed’s supply of newly created US dollar liquidity sent to other central banks around the world. It also shows the so-called “euro cross-currency basis swap,” which can be interpreted as a “stress indicator”: If it drops into negative territory, it means that euro banks find it increasingly difficult to obtain US dollar credit in the free market place. The Fed’s injection of new US dollar balances into the financial system has helped to reduce the euro currency basis swap. Since late 2016, however, it has started to venture again into negative territory — potentially signalling that euro banks are again heading for trouble. Full Story

Breaking stock market news: Cartel Charges Leveled Against Deutsche Bank

The charges relate to a 2015 effort by ANZ to raise funds. At the time, the bank sought to raise capital extremely rapidly, as a government report led many banks to believe (some would argue incorrectly) that new regulations would be imposed on banks that failed to meet certain monetary requirements:

When [former Commonwealth Bank of Australia chief David] Murray delivered his final report on December 7, 2014, the essence of his message was that while we were reliant on foreign funding, our banks had to be ‘unquestionably strong”. He doubted this was the case. Murray’s inquiry also called for an end to the free kick given to the biggest banks that allowed them to hold less capital per dollar of mortgages on account of their advanced risk models.

While the main charges here relate to ANZ, the presence of Deutsche Bank’s name in the case adds further misery for the Frankfurt-based German lender at the end of a disastrous week.

On Thursday, rating agency S&P downgraded its view of Deutsche Bank’s financial stability, down from A- to BBB+. The agency attributed its decision on Germany’s largest lender to the fact that it believes the bank’s latest restructuring is riskier than had been expected.

The regulator, which oversees the safety of New York banks, has asked whether there are any personal guarantees by Jared Kushner on the financing arrangements, to understand the banks’ risk if there is a default and the Kushners are unable to pay. The letter is also seeking information about whether any collateral was provided to secure the loans, this source added. […]

With questions about the financing of Kushner Companies’ investments and Robert Mueller’s special counsel investigation looming, the regulator is focusing on the safety of the small banks, which could be affected if the Kushners or their business has trouble paying their debts, the person familiar with the matter said. Full Story

Other articles of interest

Far-right parties gaining momentum worldwide (Feb 25)

Fear equates to Stock Market Buying Opportunity (Feb 25)

Great books on life and Investing: Short, sweet & simple (Feb 25)

Observer’s perspective on Religion-Short & Sweet (Feb 24)

Why do financial services flood subscribers with unnecessary emails ( Feb 10)

Modi’s party unfairly targets Bollywood Star Khan for criticising them ( Feb 10)

Brain dead expert states Millennials should prepare for Dow 50K ( Feb 10)

Worldwide IQ scores dropping but Stupidity rising rapidly ( Feb 10)

Radical Pakistani Anjem Choudary locked up in U.K for supporting ISIS ( Feb 10)

China Warns America against Allowing Taiwanese President into country ( Feb 10)

America’s 21st Century Energy Story ( Feb 10)

Alt-Right movement gaining momentum across Europe & America ( Feb 9)

Observer Vs regular perspective regarding Russia’s alleged hacking of US elections (Jan 25)