The War on cash

We are in the midst of a full-blown currency war as a nation after nation jumps on the negative interest bandwagon. There is no stopping this destructive race to the bottom; a nation can only hope to slow down the destruction of their currency.

The Fed is on a mission, and that mission is only possible because the masses have given up; they feel that the Government and the Fed will take care of them. Even though all the evidence to date illustrates that the Fed is only out to wreak havoc on the working middle class.

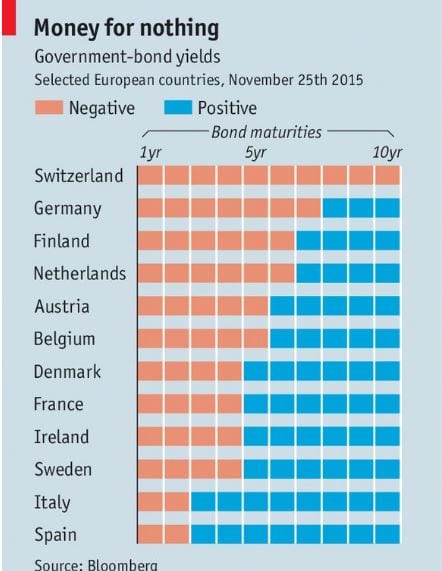

Central bankers worldwide have banded together to declare war on cash as they gleefully embrace negative rates. Take a look at the chart above and see how the economic landscape is changing. Once upon a time, if you spoke of negative rates people would have looked at you as if you lost your mind. Today in the midst of all this new money, we have deflation instead of inflation. Better take the time to understand how the nefarious Fed operates.

It is just a matter of time before this dance with negative rates becomes a worldwide hit and central bankers around the world are forced to implement these destructive policies. In such an environment, resistance is futile, and that is why we are sure it’s just a matter of time before the Fed reverses course and starts to lower rates.

Economic recovery is nothing but an illusion

- 76% of families are living from paycheck to paycheck.

- According to CBS 33% of families earning $75,000 per year; this phenomenon is not restricted to just the so-called working poor.

- While the official unemployment rate is currently below 5%, the unofficial rate is close to 23% according to shadow stats.

Random notes on the War on Cash

The phrase “war on cash” suggests a parallel to the “war on drugs” and aptly so. In both wars, traditional civil liberties are shunted aside in the criminalization, surveillance, and prosecution of victimless private activities.

The main indictments of large-denomination currency notes by anti-cash warriors are built on guilt by association: criminals use large notes, so anyone who uses them might be a criminal. It is, of course, true that the notes are used by tax evaders, money launderers, terrorists, human traffickers, drug dealers, and any other horrible type of criminals you might like to name.

But large notes are also used by noncriminals. While it is no doubt true that banning high-denomination notes would “make life harder” for criminal enterprises (Sands 2016), it would also, as I have previously written (White 2016), “make life harder for everyone else.” The rest of us also find high-denomination notes convenient now and again for completely legal and noncontroversial purposes, like buying automobiles and carrying vacation cash compactly. A serious survey of eurozone currency use finds that “in Italy, Spain and Austria . . . almost one-third of the interviewees always or often use cash for purchases between €200 and €1,000” (ECB 2011).

A Deutsche Bundesbank webpage (2016) has noted that, in the eurozone, “Cash in circulation has more than quadrupled since the euro currency was introduced; it now stands at more than €1 trillion.” Is this because crime has quadrupled? No. More likely, it is because cash is a convenient payment method, and cash has become less costly to hold with the euro bringing lower inflation to the formerly high-inflation member countries. Full Story

Other Interesting articles:

Negative Thinking: How It Influences The Masses (Oct 29)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)