Uranium Market Outlook: Shining Prospects in Energy’s New Era

April 5, 2024

The uranium market is poised at a pivotal juncture, with supply and demand dynamics suggesting a potential for significant price increases. As the world increasingly turns to clean energy solutions, nuclear power is stepping into the limelight, bolstering the demand for uranium. This shift is occurring while the industry is experiencing a notable supply shortfall, setting the stage for a possible dramatic rise in uranium prices.

Demand and Supply Dynamics

The demand for uranium is on an upward trajectory, driven by the growing number of nuclear reactors worldwide and the expanding role of nuclear energy in the clean energy transition. According to the World Nuclear Association, demand for uranium in nuclear reactors is expected to climb by 28% by 2030 and nearly double by 2040. The global push for low-carbon energy sources has renewed interest in nuclear power in established markets and emerging economies. This is reflected in the projected increase in uranium demand over the next two decades.

On the supply side, the story is quite different. The uranium market has been experiencing a tightening supply, primarily due to reduced mine production. In 2020, mine production of uranium covered only 74% of global reactor requirements. This reduction is a consequence of persistently low uranium prices over the past years, which have rendered a significant portion of global uranium resources uneconomic to extract. Moreover, geopolitical tensions and supply chain disruptions have further exacerbated the situation, leading to concerns over the security of supply.

Nuclear Power Plant Construction and Uranium Demand

The construction of new nuclear power plants is expected to impact the demand for uranium in the coming years significantly. With more than 54 reactors under construction and 100 reactors planned worldwide, the demand for uranium is set to grow. However, the uranium supply is not keeping pace with this increasing demand. The World Nuclear Association predicts that by 2020, mined production will account for 90% of global uranium supply, compared to 75% today. This widening gap between supply and demand could lead to a surge in uranium prices.

Shortfall and Price Implications

The current market dynamics indicate that mine uranium production is not meeting global reactor requirements. This shortfall is significant, as recent figures suggest that mine production covers only a fraction of global demand. The market faces a structural deficit, and secondary sources are unlikely to bridge this gap indefinitely.

This supply-demand imbalance has the potential to catalyze a substantial increase in uranium prices. As utilities and other end-users seek to secure their uranium supplies, the competition for available resources could drive prices upward. Should this trend continue, uranium could surpass its historical high, challenging the all-time peak price.

The uranium market outlook is one of today’s most compelling narratives in the commodities space. With an apparent supply shortfall and escalating demand, the stage for a potential price revolution in the uranium market is set. As the world commits to a cleaner energy future, the role of uranium becomes increasingly critical, and the market dynamics at play could very well propel prices to unprecedented heights.

Uranium Market Outlook: Pricing Targets and Trends

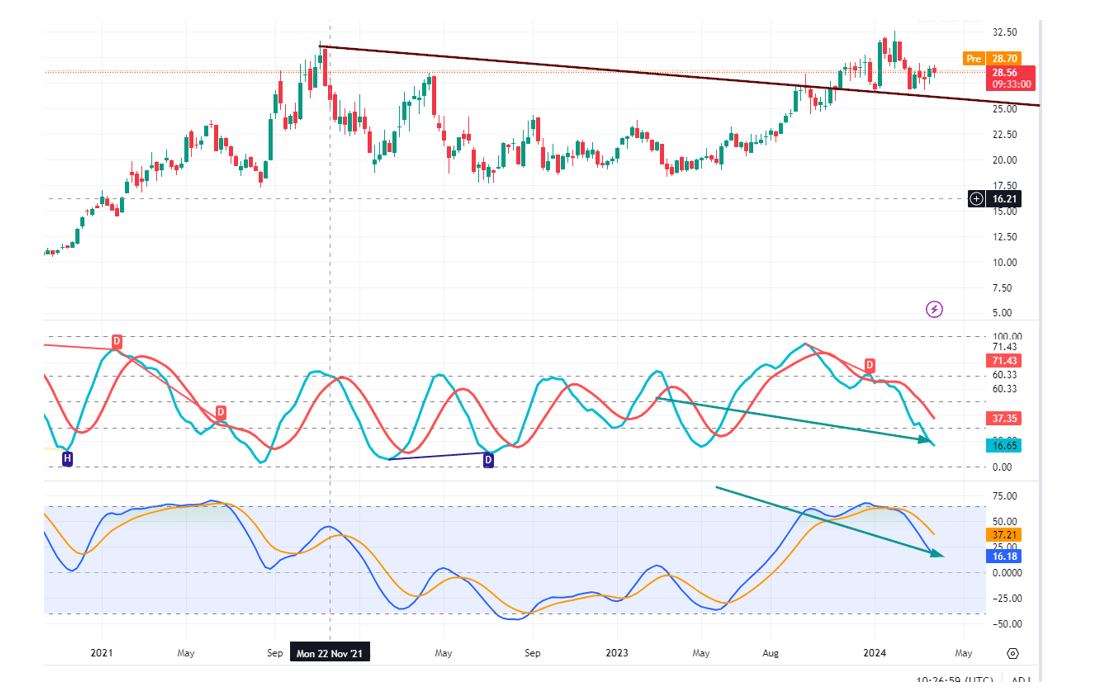

Following the COVID crash, many indices and sectors have tended to trade into the extremely overbought territory before experiencing a pullback. This pattern has been particularly prominent after the pandemic-induced market turmoil.

Interestingly, despite moving into the overbought range on monthly charts, commodities such as uranium, gold, and silver have not yet reached the extremely overbought zone. This suggests a likelihood of consolidation on the weekly charts followed by a surge to new highs.

Taking the weekly chart of URA, which serves as a proxy for the uranium market, as an example, we observe a bullish pattern emerging, mirrored in other stocks like NXE and CCJ. These indications hint at the potential for explosive moves before a more significant correction sets in. We await a small trigger before initiating New buy recommendations for URA, CCJ, and other related plays.

The long-term outlook for uranium remains promising, with the potential to soar to surpass the $150 mark. However, along this upward trajectory, we anticipate encountering corrections of varying degrees, from mild to wild.

Engaging Articles to Enrich Your Mind

Living the Dream: How Much Money Do You Really Need for a Life of Comfort?