The Impact of Hot Money on Morality

June 07, 2023

We stated long ago that we are in the age of hot money. Where the majority will cease to frown on doing any right or wrong deed will cease to matter as long as it pays well. The only factor determining if they do the act, no matter how immoral or evil, will be the number of zeros you end your question with. Anything is for sale now if the price is right. The situation will only worsen; nothing can stop it now. The trend is gathering steam, and an explosive top will eventually be put in, but we are not there yet. So do not be surprised by anything. Everything is for sale.

On that note, expect the sale of the body part market to take off and legalised prostitution to gather steam; what is legalised prostitution? Some of the marriages today fall under this category. Watch with shock as an option to lease before buying or the opportunity to hire and terminate starts to become associated with the act of marriage. Other things will transpire; nations will rent their militaries to the highest bidder. Hackers will become the new Gods and wreck terror on many government networks.

A new group of Hackers is emerging. These chaps will seek to kerb the power of big brother, and this war will not be friendly. These unknown hackers will not be the nerds that everyone assumes them to be; they will be able to fit anywhere and look like the in-crowd. The biggest shocker, though we cannot lay a date for this event, will be the collapse of religions worldwide when several corporations release technologies that will significantly increase one’s lifespan, bringing us one step closer to the age of immortality. Then watch a new level of chaos unfold as all those who pretended to be religious let go and allow the wild and untamed side of themselves to manifest. Companies already have life-altering technologies, but they are holding from releasing them.

What does this rant have to do with the copper ETF market?

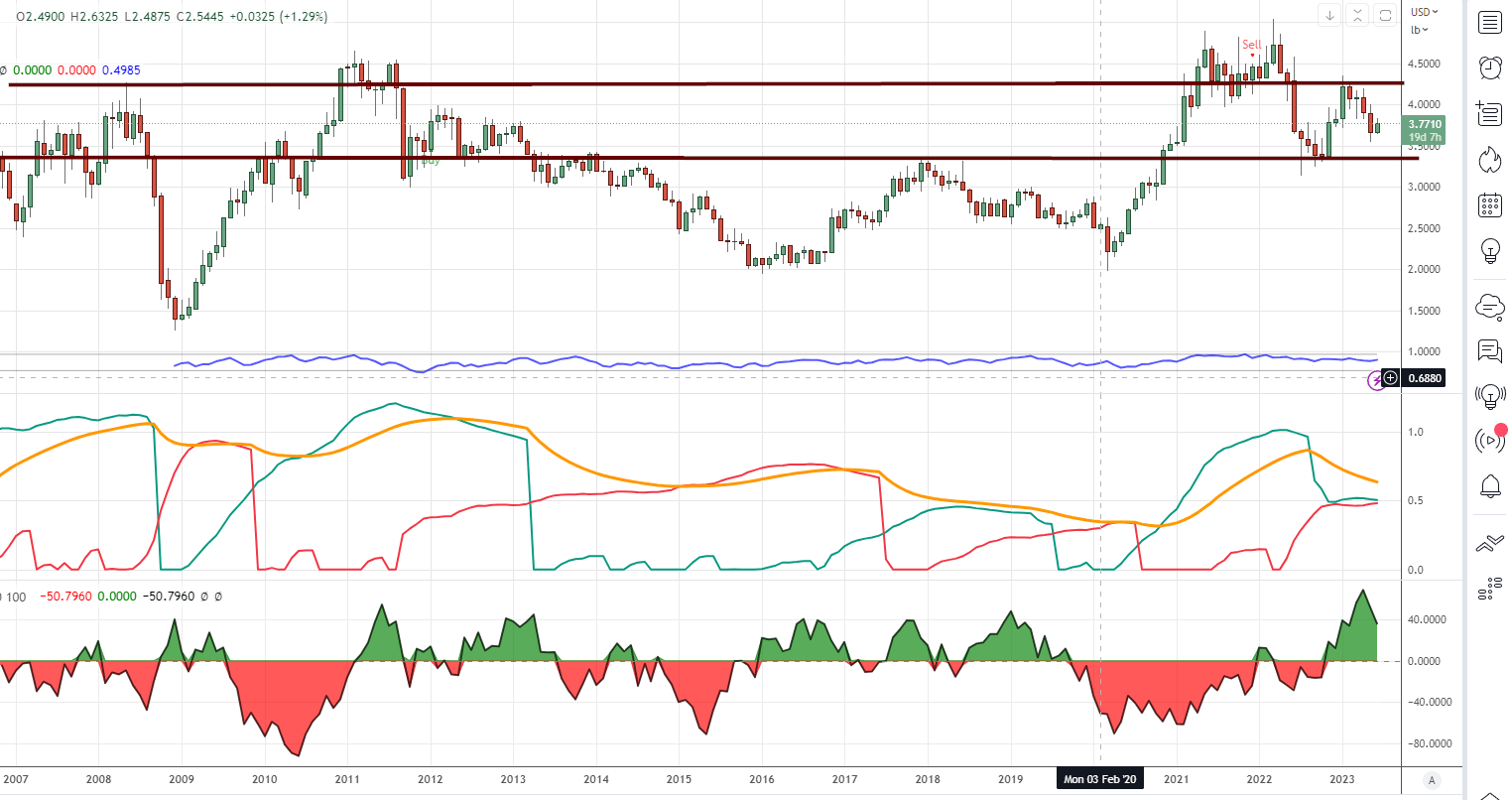

Copper is a leading economic indicator, and one of the easiest ways to track copper is via the copper ETF JJC. So if copper shows signs of strength, the economy is expected to improve. People only focus on the licit economy but not the illicit one. If the economy does indeed start to improve, expect the illegal economy to explode, and some of the things we mentioned are in the early stages of a massive bull market. Even if you are a contrarian investor, it’s too early to get into a Copper ETF like JJC.

Seizing the Opportunity: Investing in Copper Amidst

Copper is currently consolidating and gaining momentum for its next upward move. As long as it does not close below 3.70 on a monthly basis, the outlook will remain bullish. Consequently, a close at or above 4.35 should lead to a series of new highs. Additionally, it is trading in a highly oversold range on the weekly charts, indicating a strong potential for a breakout.

Individuals can play the copper market by investing in FCX, JJC, COPX, and other stocks in this sector. These companies are poised to benefit from the anticipated growth and potential upswing in the copper market.

Fake News & Hot Money Distort Leading Indicators

The masses have been lulled into complacency, blinded by the illusion of democracy and freedom. The real power players, the ones who pull the strings behind the scenes, have been able to manipulate the masses through a carefully crafted system of propaganda and brainwashing. They have convinced the masses that their actions are necessary for the greater good when they only benefit themselves and their wealthy allies.

As the masses continue to be distracted by these fake wars and manufactured crises, society’s real problems are ignored. The wealth gap continues to widen, the middle class continues to shrink, and the poor continue to suffer. The real power players continue to amass wealth and power while the rest of society fends for themselves.

But there is hope. As more and more people wake up to the reality of the situation, they are beginning to demand change. They are demanding an end to the corruption and greed that has brought us to this point. They are demanding a system that works for the people, not just for the wealthy elite.

So while the future may seem bleak, there is reason to be hopeful. The people have the power to create change, and as they wake up to the reality of the situation, they will begin to demand a better future for themselves and future generations.

Conclusion

In this era of hot money, where financial gain takes precedence over ethics, morality is being compromised. The lure of wealth has led to a disregard for right and wrong, with everything seemingly up for sale. As the trend intensifies, society is witnessing unsettling developments such as the commodification of body parts, the rise of legalized prostitution, and the renting of militaries to the highest bidder. Additionally, the emergence of powerful hackers and the potential collapse of religions further contribute to the chaotic landscape. Amidst this disheartening reality, copper ETFs serve as an economic indicator, yet caution is advised.

While the masses are manipulated by fake news and the influence of hot money, there is hope for change. As awareness grows, people are demanding an end to corruption and inequality, striving for a future that prioritizes the well-being of all. It is a critical moment for society to reflect and redirect its path towards a more ethical and just world.