Navigating the Minds of Investors: Understanding Investor Behaviour

Investor behaviour has long been a topic of discussion among experts in finance, economics, and psychology. Despite the availability of information, individual investors are often prone to making errors in their investment decisions due to a lack of knowledge, an excess of emotion, and a tendency to imitate others. Studies have shown that overconfidence and a tendency to overreact to short-term market fluctuations can result in the purchase of assets at high prices and the sale of the same at low prices, often exacerbated by media and peer influence, leading to herd behaviour and market volatility.

Additionally, the desire to conform and the aversion to loss can result in investors avoiding underperforming assets and missing out on long-term opportunities. This phenomenon, known as the disposition effect, causes individuals to dispose of profitable investments and retain unprofitable ones. Emotional biases, such as fear and greed, also play a significant role in investment decisions and can lead to impulsive actions driven by momentary emotions instead of long-term goals.

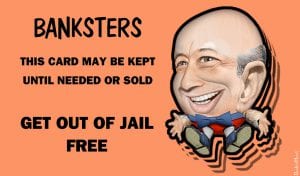

Therefore, it is important for aspiring investors to approach investing with a disciplined, long-term perspective so as to minimize the impact of biases and achieve investment success. This counsel is of utmost importance in the present moment, as leading players are known to fashion new narratives and create a false illusion that the Bull market has perished forever. However, if one is able to resist succumbing to panic and maintain a rational state of mind, they may reap abundant profits in the long term. History attests to this truth. Those who do not prepare themselves mentally for such antics risk losing everything.

Mastering Your Emotional Biases: A Key to Successful Investor Behaviour

Investor behavior is a complex subject that continues to fascinate experts in finance, economics, and psychology. Although access to information has never been easier, individual investors often make investment errors due to a lack of knowledge, emotional biases, and a tendency to imitate others. Studies have revealed that overconfidence and a tendency to overreact to short-term market fluctuations can result in buying assets at high prices and selling them at low prices, leading to herd behavior and market volatility. Moreover, investors’ desire to conform and aversion to loss can result in avoiding underperforming assets and missing out on long-term opportunities. This phenomenon, known as the disposition effect, leads individuals to dispose of profitable investments and retain unprofitable ones.

Emotional biases, such as fear and greed, also play a significant role in investment decisions and can lead to impulsive actions driven by momentary emotions instead of long-term goals. Aspiring investors must approach investing with a disciplined, long-term perspective to minimize the impact of biases and achieve investment success. This advice is crucial in the present moment, as leading players are known to fashion new narratives and create a false illusion that the Bull market has perished forever. However, if one can resist succumbing to panic and maintain a rational state of mind, they may reap abundant profits in the long term. History attests to this truth.

Those who do not prepare themselves mentally for such antics risk losing everything. Investment success requires more than just knowledge and rational decision-making. It also requires a deep understanding of one’s own emotional biases and how to overcome them. An investor must be willing to do the hard work of introspection and self-awareness to identify their emotional biases and learn how to manage them effectively. For example, an investor prone to overreacting to short-term market fluctuations may need to develop a long-term investment plan that aligns with their goals and risk tolerance. Another effective way to overcome emotional biases is to work with a professional financial advisor. Financial advisors can provide unbiased advice and help investors develop a long-term investment strategy that aligns with their goals and risk tolerance. They can also provide ongoing support and guidance to help investors stay on track and avoid emotional decision-making.

Conclusion

Investor behavior is a crucial element of investment success. Emotional biases can lead to impulsive decisions that harm investment performance, but with self-awareness and the guidance of a professional financial advisor, investors can overcome these biases and achieve long-term investment success.

Other Articles of Interest

Trumps win shows Mainstream media is done-Social Media will dominate

Weak AI & Financial singularity: What it means for Stock Markets

Global warming hoax proof? Top US Scientist Resigns

Stock Market Patterns and Donald Trump’s Chances Of Winning

Two Professors with Incredible Track Record Predict A Trump Win

Trump-The New Stock Market vix Factor

Millennials Would Work For Less With Socially Responsible Company

Trey Gowdy States Harry Reid on Drugs regarding Hillary Email Scandal

Crude Oil Market-Higher prices or Market Crash

Trump Meltdown: The Establishment’s Attack on a Political Outsider

Tactical Investor Election Polls-Updated Constantly Until Election day

Trump Trumps Clinton in Third Debate