Finding Your Trading Zone: How to Stay Calm and Profitable in a Volatile Market

Updated Jan 2023

The markets will recover as they have always done in the past. Those who panicked and dumped their shares will live through the same regret they and their ancestors lived through for giving away something valuable for next to nothing.

Crashes always end for one reason; the money and 2x more that left the markets always return. The only remnant from this crash will be all the smashed egos, portfolios, etc., for those who let fear rule the roost. The big players never lose. You know the folly of jumping out of the markets if you understand that. If you are not using the money you need for your daily living expenses (which you should never do), you can do what the rich guys are doing, sit it out and walk away with a nice bundle. The top players never try to buy at the bottom; their idea is to get in at a reasonable price. Over the short term, they can take paper losses of up to 50%, for they know the long-term outcome in advance, as do you. Market Update, May 11, 2022

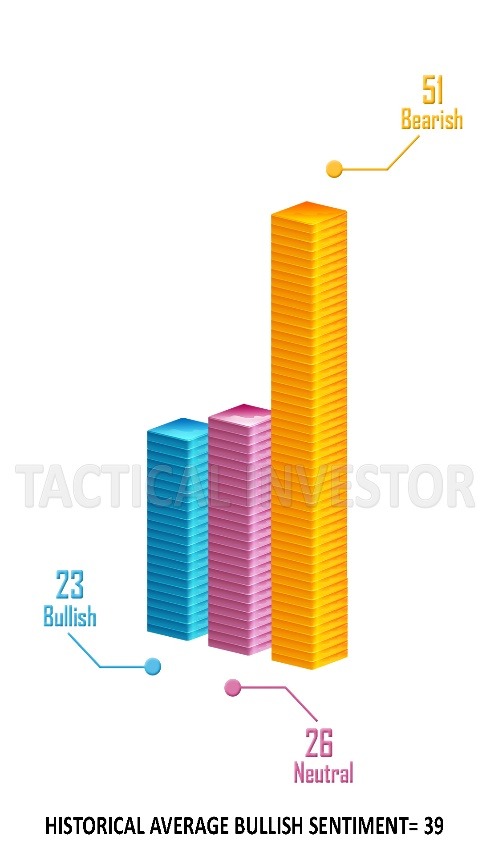

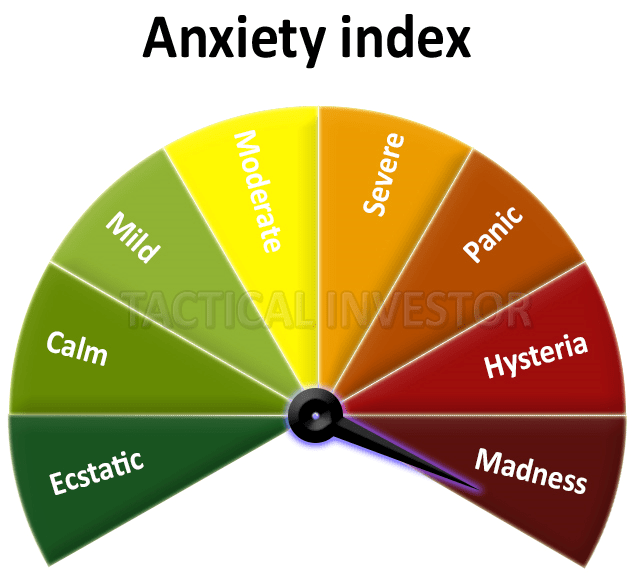

The needle on the anxiety gauge shifted even deeper into the madness zone. One more tiny move and the needle will be in the most extreme point of this zone. The latest sentiment data just came in—bulls: 16, Neutral: 30, Bears: 54.

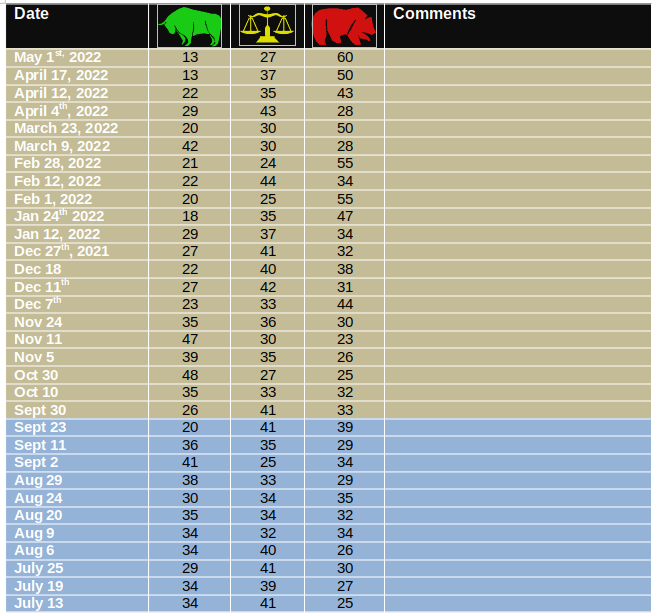

Historical Sentiment values

Inflation and Sanctions: The Trading Zone Conundrum

The market is now very close to entering the long-term Normal zone (corresponding to a neutral state). Historically it is at a critical juncture, and one of two outcomes is now possible

Reverse course and rally strongly, but the subsequent correction will be much stronger as the markets did not complete the normal overbought to oversold cycle.

The market completes the normal cycle, moving from the overbought to the oversold ranges. This takes more time, but the rally is also more potent.

Trading Zone conundrums

The market is currently stuck in a trading zone with limited upside potential due to inflationary pressures. Unfortunately, many of the issues surrounding inflation were self-inflicted, but there is a potential solution to help alleviate the situation. Lifting sanctions on Russia would bring down food and energy prices overnight, potentially avoiding a scenario where individuals could starve due to the sanctions. It is important to balance the needs of the many against the few, and lifting sanctions could positively impact the economy and the stock market.

If nothing is done to resolve the energy crisis, stock prices will continue to drop. However, the cure for low prices is lower prices; sooner or later, the market will rebound. From a long-term perspective, stocks are currently trading at a potential screaming buy range. While a rally appears to be building momentum, it’s essential to remain vigilant and prepared for a potential correction after the 1st quarter of 2023.

In Europe, the situation is more concerning as they have no low-priced alternative to Russian Gas. Cheap energy is crucial for Europe to remain competitive, and any disruption to their energy supply could significantly impact their economy. However, this is a story for another day. For now, keeping a close eye on the market is essential as being prepared for any potential changes.

FAQ on The market is stuck in a Trading Zone

Q: Will the markets recover from the crash?

A: Yes, historical evidence shows that markets have always recovered in the past. Panic-selling leads to regret, as money that left the markets eventually returns.

Q: What is the approach of big players during crashes?

A: The top players do not try to buy at the bottom. Instead, they aim to enter at a reasonable price. They are willing to tolerate short-term paper losses of up to 50% because they understand the long-term outcome.

Q: What is the current sentiment in the market?

A: According to the latest sentiment data, the bull sentiment is at 16, neutral sentiment at 30, and bear sentiment at 54.

Q: What are the possible outcomes at this critical juncture?

A: The market could reverse course and rally strongly, leading to a subsequent correction. Alternatively, it could complete the normal cycle, moving from overbought to oversold ranges, resulting in a more powerful rally.

Q: What is the current situation in the trading zone?

A: The market is currently stuck in a trading zone with limited upside potential due to inflationary pressures. Lifting sanctions on Russia could help alleviate the situation by reducing food and energy prices.

Q: What is the potential impact of the energy crisis?

A: If the energy crisis is not resolved, stock prices may continue to drop. However, lower prices can eventually lead to a market rebound. Stocks are currently trading at a potential buying range from a long-term perspective.

Q: How does Europe’s situation differ in terms of energy supply?

A: Europe lacks a low-priced alternative to Russian Gas, and any disruption to their energy supply could significantly impact their economy. Monitoring the market closely is crucial, as changes may occur.

Q: What should investors be prepared for?

A: Investors should remain vigilant and prepared for a potential correction after the first quarter of 2023, despite the building momentum of a rally.

Other Articles of Interest

Unveiling the Dynamics: What is Inflation in Business

Plunder from Down Under- Catch the trend before it explodes

Market Sentiment Indicator: To Dance or Not to?

Why Gold is a Good Investment: A Comprehensive Outlook

What are negative interest rates: how they fueled a housing crisis

Foreign banks Dump whopping 356 billion in US Debt

Tragic Loss: 300,000 Vets Die Awaiting Critical Medical Care

College Debt: Graduates’ Luxury Habits Amidst Struggle

Market Opportunity: Buy The Fear & Sell The Noise

RSX: Great Play on Russia’s Improving Economy

HAL Stock Price Outlook: A Robust Long-Term Perspective

Stock Market Outlook Today: A Journey through time

Opposing viewpoints: Analysis of Interesting Topics

Aroon Indicator: An Essential Tool for Technical Analysis