Trading Zone: Maximizing Gains During Market Lulls

Updated August 30, 2024

Introduction: Finding Your Trading Zone in a Volatile Market

Navigating the volatile seas of the stock market requires technical understanding and psychological resilience. As Voltaire once said, “Uncertainty is an uncomfortable position. But certainty is an absurd one.” This sentiment is particularly relevant in trading, where market crashes and corrections are inevitable. However, history has shown that these periods of turmoil often present the most fantastic opportunities for those who remain calm and strategic.

The markets will recover as they have always done in the past. Those who panicked and dumped their shares will live through the same regret they and their ancestors lived through for giving away something valuable for next to nothing. Crashes always end for one reason: the money and 2x more that left the markets always return. The only remnant from this crash will be all the smashed egos and portfolios of those who let fear rule the roost. The big players never lose. If you understand this, you know the folly of jumping out of the markets. If you are not using the money you need for your daily living expenses (which you should never do), you can do what the rich guys are doing: sit it out and walk away with a nice bundle. The top players never try to buy at the bottom; they aim to get in reasonably priced. Over the short term, they can take paper losses of up to 50%, for they know the long-term outcome in advance, as do you.

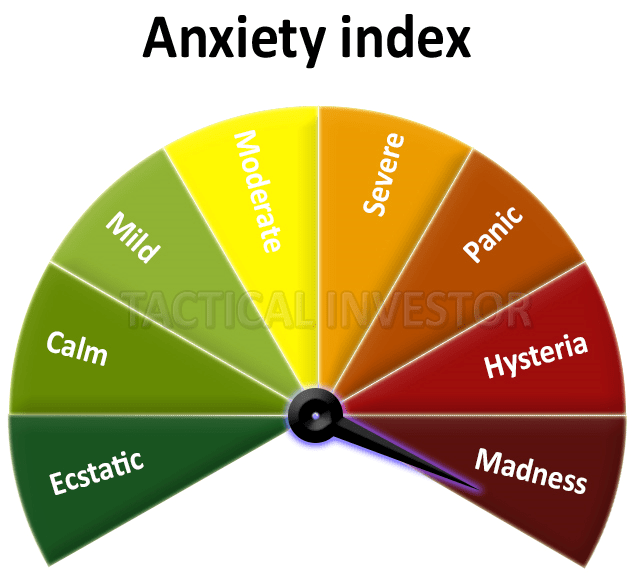

Michel de Montaigne, the French Renaissance philosopher, emphasized the importance of maintaining composure in the face of adversity. He wrote, “A wise man sees as much as he ought, not as much as he can.” This wisdom is crucial for traders who must navigate the anxiety and fear often accompanying market downturns. The needle on the anxiety gauge shifted even deeper into the madness zone. One more tiny move and the needle will be in the most extreme point of this zone. The latest sentiment data just came in—bulls: 16, Neutral: 30, Bears: 54.

Peter Lynch, one of the most successful investors of all time, famously advised, “The real key to making money in stocks is not to get scared out of them.” This perspective aligns with the notion that market crashes are temporary and that the money that leaves the markets always returns. Inflation and sanctions have created a trading zone problem, but history shows that markets eventually find their equilibrium. The market is now very close to entering the long-term Normal zone (corresponding to a neutral state). Historically, it is at a critical juncture, and one of two outcomes is now possible: reverse course and rally strongly, or complete the normal cycle, moving from the overbought to the oversold ranges.

Sir John Templeton, a pioneer of global investing, believed that “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” This principle underscores the importance of contrarian thinking in trading. The market is currently in a trading zone with limited upside potential due to inflationary pressures. However, lower prices cure low prices; the market will rebound sooner or later. From a long-term perspective, stocks are currently trading at a potential screaming buy range.

Now, let’s step back so individuals can learn from history and simultaneously see what actions were taken in real-time.

The markets will recover as they have always done. Those who panicked and dumped their shares will experience the same regret they and their ancestors felt for giving away something valuable for next to nothing.

Crashes always end for one reason; the money and 2x more that left the markets always return. The only remnant from this crash will be all the smashed egos, portfolios, etc., for those who let fear rule the roost. The big players never lose. If you understand, you know the folly of jumping out of the markets. If you are not using the money you need for your daily living expenses (which you should never do), you can do what the rich guys are doing: sit it out and walk away with a nice bundle. The top players never try to buy at the bottom; they aim to get in reasonably priced. Over the short term, they can take paper losses of up to 50%, for they know the long-term outcome in advance, as do you. Market Update, May 11, 2022

The needle on the anxiety gauge shifted even deeper into the madness zone. One more tiny move, and the needle will be in the most extreme point of this zone. The latest sentiment data just came in—bulls: 16, Neutral: 30, Bears: 54.

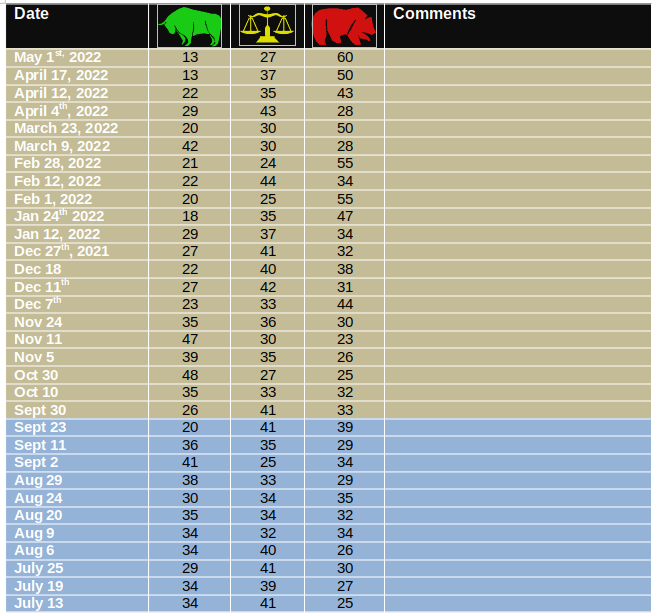

Historical Sentiment values

Inflation and Sanctions: The Trading Zone Conundrum

The market is now very close to entering the long-term Normal zone (corresponding to a neutral state). Historically, it is at a critical juncture, and one of two outcomes is now possible.

Reverse course and rally strongly, but the subsequent correction will be much stronger as the markets did not complete the normal overbought to oversold cycle.

The market completes the normal cycle, moving from the overbought to the oversold ranges. This takes more time, but the rally is also more potent.

Trading Zone conundrums

The market is currently in a trading zone with limited upside potential due to inflationary pressures. Unfortunately, many of the issues surrounding inflation were self-inflicted, but there is a potential solution to help alleviate the situation. Lifting sanctions on Russia would bring down food and energy prices overnight, potentially avoiding a scenario where individuals could starve due to the sanctions. It is essential to balance the needs of the many against the few, and lifting sanctions could positively impact the economy and the stock market.

If nothing is done to resolve the energy crisis, stock prices will continue to drop. However, lower prices cure low prices; the market will rebound sooner or later. From a long-term perspective, stocks are currently trading at a potential screaming buy range. While a rally appears to be building momentum, it is essential to remain vigilant and prepared for a potential correction after the first quarter of 2023.

In Europe, the situation is more concerning as they have no low-priced alternative to Russian Gas. Cheap energy is crucial for Europe to remain competitive, and any disruption to their energy supply could significantly impact their economy. However, this is a story for another day. For now, keeping a close eye on the market is essential as being prepared for any potential changes.

Conclusion: Embracing the Wisdom of the Ancients

In conclusion, navigating volatile markets successfully demands a blend of historical perspective, psychological fortitude, and strategic discipline. Voltaire’s observation, “The perfect is the enemy of the good,” reminds us that waiting for the perfect opportunity often leads to missed chances. At the same time, action guided by wisdom and preparedness can yield significant results. Similarly, Peter Lynch emphasized the value of patience, famously saying, “In the stock market, the most important organ is the stomach, not the brain.” His words underscore the need for emotional resilience when faced with market downturns.

The bandwagon effect, where investors follow the crowd in moments of panic, is a recurring phenomenon in market history. For instance, the 1929 crash saw much selling in fear, only for those who remained calm—such as famed investor Sir John Templeton—to make significant gains in the recovery period. The big players thrive on these moments of widespread fear, orchestrating panic to lower prices and acquire undervalued assets from panicked sellers.

To defeat this cycle, as John D. Rockefeller wisely put it, “The way to make money is to buy when blood is running in the streets.” Traders who keep their emotions in check and stay committed to their strategy are best positioned to transform adversity into opportunity, ensuring they capitalize on market rebounds.

By embracing this timeless wisdom and resisting the allure of following the crowd, investors can maintain their composure and trust in market recovery and ultimately enjoy the rewards of their disciplined, long-term approach.

Other Articles of Interest