What are negative interest rates?

Updated Aug 2023

Sweden is already in the mature stages of experiencing a housing crisis. Take a look at the chart below. Home prices are surging simply because it is cheap to borrow money. The lower the interest payments, the more you can borrow. Hence, individuals throw caution to the wind and start chasing property because they believe prices will continue trending upwards. What they forget is that no market can trend upward forever.

More and more nations are embracing negative rates. Therefore, as rates head into the negative zone, it will have the unintended consequence of fuelling another housing bubble. Suddenly, property that appeared out of reach could be within reach only because the monthly payment seemed affordable.

Eventually, the U.S will lower lending standards, and when they do, expect the housing market to explode as there is a lot of pent-up demand. The public has been shut out of the markets for a long time, and when you give someone freedom after locking them up for a lengthy period, they go insane, and that is what lies in store for the housing market. The Fed has laid the path out, which was planned years in advance. Look at the Swedish real estate market as depicted in the chart below. The Chart for the US and UK housing markets will look 5 to 10 times worse.

What are negative interest rates & how are central bankers embracing them

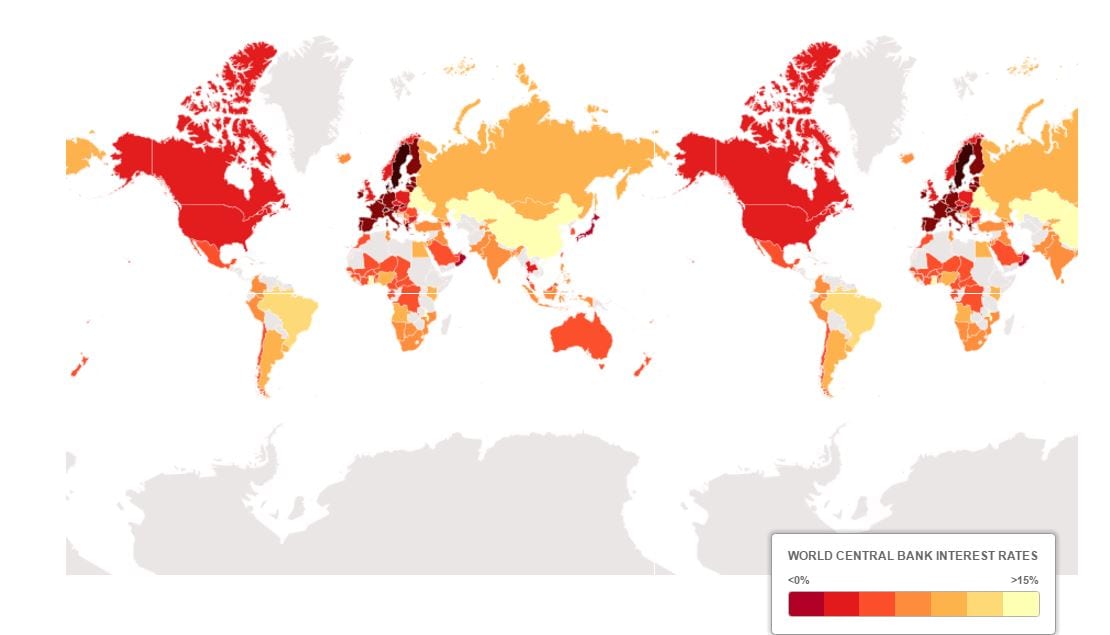

The map below illustrates that the war on interest rates is gathering momentum

Source: The Telegraph

Additional dangers of negative rates

As more nations embrace the era of negative rates, no government will be able to resist. The slogan will be “surrender or die”, and countries will opt for submission as no one wants to die. Negative rates will also fuel a massive new round of share buybacks. The Fed is trying to put on a brave act, but you can already see them backtracking from the firm stance they took last year. They state that all is not well, and the economic outlook is weaker than expected. They will have no option but to join the rat pack; in this instance, resistance is futile.

The corporate world has gone on a massive share buyback binge, and this binge is not showing any signs of letting up. It allows corporations to borrow money for next to nothing and then use these funds to buy back massive amounts of shares and boost the EPS (Earnings per share). Negative rates will provide rocket fuel to share buyback programs. Corporate debt will soar to insane levels; if you think today’s levels are crazy, you are in for a rude awakening as debt levels will soar beyond anyone’s imagination.

Suggested Plan of Attack

We live in a world of extreme greed, and our government seems to favour corporation fraud; against this backdrop, you need to do that which appears insane from a logical point of view. All substantial Market corrections should be seen as buying opportunities. From a mass psychology perspective, this is still the most hated bull market in history, and until the masses embrace it, it is destined to run a lot higher than most envision.

Additionally, it would be advisable to hold a core position in Gold; at some point in time, Gold will start to react strongly to this massive form of currency debasement. Currencies are being destroyed globally at a level never seen before. This will not end well, but as we have often pointed out, being right does not equate to market success. One has to look at the time factor, and most individuals do not have the staying power to bet against the Fed. Wall Street is full of tombstones of good men who were right but could not stay solvent long enough to benefit from their insights. Hence, we would not bet the house on Gold, nor should you? No matter how good an investment appears, one should never put all of one’s eggs in one basket.

An updated view on Negative rates

Around 30% of investment-grade securities have negative yields, indicating that investors who purchase this debt and hold it until maturity are guaranteed to experience a financial loss. Nevertheless, buyers continue to flock in, hoping to benefit from further increases in bond prices and favourable cross-currency hedging rates, or at the very least, to avoid more significant losses in other areas.

This negative-yield phenomenon is causing a significant shift in financial markets, raising concerns about a potential bond bubble. It is also depleting valuable sources of income for pension funds and encouraging riskier companies to leverage their assets. Meanwhile, banks are pressured to assure their customers that they will not suddenly impose charges for storing their money.

Investors are willing to pay a premium and accept eventual losses because they value the reliability and liquidity offered by the government and high-quality corporate bonds. For more prominent investors like pension funds, insurers, and financial institutions, there may be limited alternative options for securely storing their wealth. Full Story

Other Articles Of Interest

Dividend Capture ETF: The Lazy Investor’s Dividend Strategy

What Was the Panic of 1907: A Triumph of Folly Over Reason

What Time is the Best Time to Invest in Stocks? When Fools Panic

The Volatility Paradox: Calm Markets but Soaring ‘Fear Gauge’ Trading

Which of the Following is a Characteristic of Dollar-Cost Averaging

Synthetic Long: Unlock Extreme Leverage Without the Risk

Best Ways to Beat Inflation: Resist the Crowd, Gain Insight

Gambler’s Fallacy Psychology: The Path to Losing

Dividend Harvesting: A Novel Way to Turbocharge Returns

Capital Market Experts: Loud Mouths, No Action

Modern Investing: Innovative Approaches in the Stock Market

Adaptive Markets Hypothesis: Master It to Win Big in Investing

Stock Market Crash Michael Burry: Hype, Crap, and Bullshit

Mainstream Media: Your Path to Misinformation and Misfortune

Market Dynamics Unveiled: Stock Market Is a Lagging Indicator

Mass Media Manipulates: Balancing Awareness & Trend Adoption

What Are Two Ways Investors Can Make Money from Stocks: A Holistic Approach

Embracing Facial Recognition Technologies: The Future of Payments!

This doesn’t paint a tru picture – each country is different depending on variables such as ; Landmass (availability to build houses) density of housing within a country, population of a country and this leads to supply and demand (how many houses are built – how many want to buy one)

In the UK where the human density is the highest in Europe, immigration is almost 1 million per year, only a few thousand houses are built each year – there is pent up demand for houses/accommodation – supply cannot keep up with demand and this will not ease until all immigration is stopped and more houses are built…. aka… not in the next 10 years.