Trade War News

The status quo is changing and the heyday of easy global pickings is over. The threat of an all-out trade war with the US, slower global growth and an imminent end to world super-stimulus raises the odds that China’s growth rate is already grinding to a much slower pace than Beijing would like.

The greatest danger in the short term is the spectre of the US-China trade dispute spiralling out of control, with the potential to knock growth expectations on both sides. US President Donald Trump is unlikely to back down, especially since he is in high spirits over the US economy expanding at its fastest pace in nearly four years, with second-quarter GDP growth increasing to 4.1 per cent. No matter that the spurt was due to one-off factors, with soybean farmers rushing to beat retaliatory trade tariffs and US consumers blowing their recent tax-cut bonanzas.

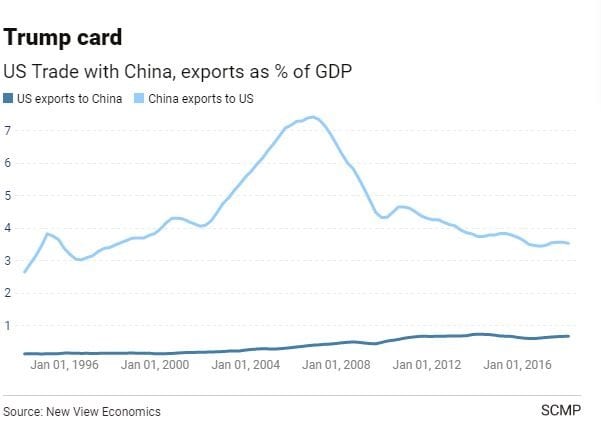

According to estimates by the International Monetary Fund, a full-blown trade war could knock as much as 1-1.5 per cent off China’s growth rate, while the impact on the US might be more limited, to the tune of 0.1-0.3 per cent shaved off growth, thanks to the US economy’s relatively greater domestic dominance. Given the rapid pace of US growth right now, it is a price Trump probably thinks worth paying to intensify pressure on China. Full Story

Trade War News: US Stock Markets Stating US is the Winner

China can’t match this total since it imports only $178 billion in U.S.products, so it retaliated promptly by letting the yuan slide below the previous boundary of 7 per dollar. China’s aim obviously is to offset Trump’s tariffs by reducing the dollar cost of Chinese exports while encouraging local production by raising the yuan prices of imports and discouraging the purchase of foreign goods. European producers of handbags and other luxury products are already feeling the negative effects of the falling yuan.

If Chinese GDP were always overstated by 10%, the growth pattern would be unaffected. Nevertheless, there’s probably more pressure to overstate the numbers now with growth slowing than earlier when the Chinese economy was actually growing at double-digit rates. I conclude that second-quarter real GDP growth was closer to 3%, half the reported 6.2%.

Other data also suggest that Chinese growth is slowing faster than the reported small decline from 6.4% in the first quarter to 6.2% in the second. Real retail sales in the first half rose6.7%, the weakest since at least 2011 and real per capita spending grew only 5.2% in the first half from a year earlier, down from 5.4% in the first quarter. Full Story

Trade War

A U.S. cybersecurity group called Fireye has, according to The Financial Times, identified a well-financed hacking cell within China that has been spying on numerous industries and individuals since 2014 at the behest of the government while carrying out for-profit cyber intrusions, apparently tolerated or condoned by the state. Called Advanced Persistent Threat 41, the spy group has operated in 14 countries, including the U.S., and targeted industries important to the success of Beijing’s five-year economic plan like telecom, AI and semiconductors.

The most interesting thing about the Times story, to long-time critics of the West’s interactions with China, is that it was reported at all. There was a time when media companies were intimidated by Beijing and reluctant to expose the government’s role in cyber crimes and intellectual property theft or, indeed, a host of other misdeeds such as the persecution of the Uighurs.

You can hardly blame them.

It wasn’t just U.S. firms; the entire world turned a blind eye to Beijing’s bad practices, convinced that China’s sheer size and rapid transformation into an open, industrial society would deliver huge benefits to every nation. That was the premise for inviting China’s participation in the World Trade Organization in 2001; the member nations, which embrace market economies, hoped Beijing would behave. That proved a false hope.

In the wake of tariffs being levied on Chinese imports, American and European firms are reordering their sourcing. It’s high time. Depending on a country that scorns the rule of law is foolhardy. In the past few years, Chinese officials have “disappeared” any number of prominent business leaders in China and harassed and threatened to hold foreign executives hostage for political purposes. Full Story

Other Stories of interest

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)