Silver vs Gold investment: Are Both Dead?

Jan 03, 2025

Investing in Gold and Silver: Navigating the Precious Metals Market

Picture this: it’s the early 2000s, and you’re sitting on a gold mine. Gold and silver prices are soaring, and you feel like a Midas. Fast forward to today, and the shine has dulled. The once-unstoppable precious metals market seems to have hit a wall, leaving investors scratching their heads and wondering, “Is this the end of the line for gold and silver?”

But hold on—don’t start melting down your jewellery just yet. Like any good roller coaster, the gold and silver market is full of twists, turns, and unexpected drops. And if there’s one thing we’ve learned from history, it’s that what goes down must come up—or something like that.

In this wild ride of an essay, we’ll dive into the turbulent world of gold and silver investing. We’ll explore the forces driving demand, the psychological games, and the age-old question: which metal will come out on top? Buckle up because we’re about to embark on a journey filled with geopolitical drama, market mayhem, and more plot twists than a Hollywood blockbuster.

So, grab your pickaxe and dig into the future of gold and silver. Will they rise from the ashes like a phoenix, or will they be relegated to the annals of investment history? Only time (and this essay) will tell.

Gold Outlook

A Battle Between Gold and Crypto

In today’s shifting financial landscape, gold and crypto are vying for dominance as safe-haven assets. Despite predictions that gold might retreat to the $2200 level, it has defied expectations, recently trading near its 52-week highs after surpassing $2600. This resilience underlines gold’s long-term bullish trajectory, though the ride promises to be volatile. For savvy investors, this means one thing: embrace sharp pullbacks in precious metals.

As of the September 15, 2024 market update, gold tested the $2500 range twice in November but refused to fall to the anticipated $2200 level, even in the face of a surging dollar. Ideally, a test of the $2400 level 2-3 times would offer an optimal setup, shaking out weak hands and building momentum to challenge the $2900–$3000 range. If gold revisits the $2100–$2200 zone, it will present a golden opportunity for bold investors.

Gold’s strength amidst dollar rallies is remarkable. However, investors must understand the importance of optimal entry points to maximize risk-to-reward ratios. While such setups are ideal for outsized gains, they don’t always appear, making flexibility and foresight crucial for market participants.

Rising Demand for Gold and Silver

The demand for gold and silver is surging, driven by geopolitical and economic factors. The Russia-Ukraine conflict has accelerated the de-dollarisation trend, with Russia and other nations diversifying reserves into commodities like gold and silver. This move not only reflects a shift away from the US dollar but also reinforces the appeal of precious metals as safe-haven assets during volatile times.

Moreover, mass psychology plays a pivotal role in this growing demand. As investor awareness of herd behaviour and sentiment grows, gold and silver are increasingly viewed as reliable inflation hedges and portfolio diversifiers. This mindset fosters a self-perpetuating cycle of demand, further solidifying their positions as indispensable assets in uncertain economic climates.

Supply and Demand Prospects

Understanding the supply and demand dynamics of gold and silver is critical for gauging their investment potential. Gold has a relatively inelastic supply, with mine production adding only a fraction to above-ground stocks annually. Conversely, silver boasts a more elastic supply, with mine production significantly contributing to available stocks.

On the demand side, both metals enjoy widespread use across sectors. Gold, as a premier safe-haven asset, attracts investors during economic uncertainty or stock market volatility. Silver, while sharing some safe-haven traits, is more tied to industrial demand. Its versatility in electronics, solar panels, and advanced technologies amplifies its appeal, especially as the world moves towards greener energy solutions.

In conclusion, the intersection of rising demand, geopolitical trends, and unique supply dynamics underscores the long-term investment case for both gold and silver. The potential rewards could be monumental for those with the courage to embrace volatility and seize strategic entry points. Gold isn’t just shining—it’s blazing. Will you harness its glow?

Central Bank Actions and Currency Wars

Central banks’ actions can significantly influence gold and silver prices. In recent years, several central banks have been net buyers of gold, adding to their reserves. This trend underscores the enduring appeal of gold as a store of value and a potential hedge against currency devaluation, especially in ongoing currency wars. As nations engage in competitive devaluations to maintain their competitive edge, the value of precious metals as a stable asset class increases.

Technical Analysis and Percentage Gains

From a technical analysis perspective, gold and silver have experienced significant corrections since their highs in 2011. Gold, in particular, has been in a prolonged correction phase, allowing investors to accumulate positions at attractive price levels. While gold has more vital safe-haven characteristics, silver tends to offer higher percentage gains during bull markets due to its more volatile nature.

Examining historical price movements and market trends is essential when considering investment prospects. Gold has traditionally been viewed as a stable and reliable store of value, often outperforming other assets during economic downturns. On the other hand, Silver has a history of more significant price fluctuations, making it attractive to investors seeking higher returns and presenting more significant risks.

Now, let’s take a step back in time and look at what we did in real time before Gold broke out in 2003. Those who learn from history won’t be doomed to repeat their mistakes.

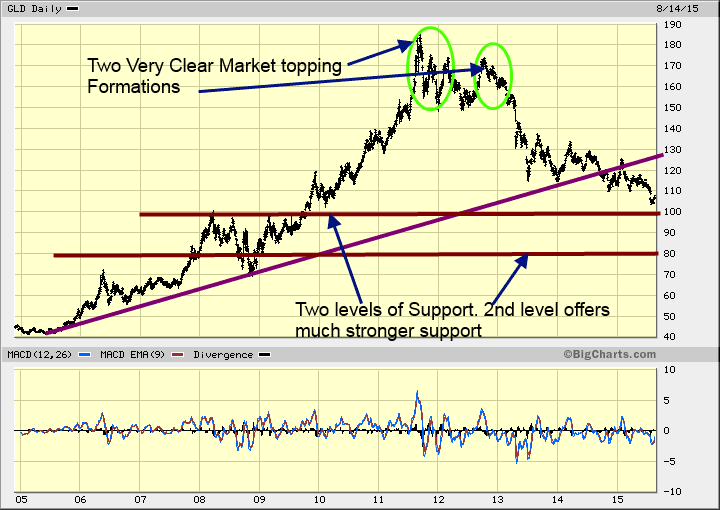

Silver vs Gold investment: Gold looks spunkier

Gold has violated its long-term uptrend line, indicating that the bottoming phase will likely be relatively volatile and frustrating. The chart above illustrates the Gold ETF (GLD), which mirrors Gold relatively well, give or take a few points—the first level of support kicks in at 100, which correlates roughly to $1000 for Gold. A weekly close below this level will likely result in Gold testing the $960 range.

A test or a break of $1000 should be viewed as an enticing opportunity to purchase this precious metal. In this era of extreme volatility, there is always the possibility that Gold could overshoot; conversely, it could refuse to buckle and trade down to the $960 range. It is unwise to fixate on absolute prices. If it is a bargain, take advantage of the opportunity to buy rather than attempting to save a penny and lose a pound. The astute investor will use this phase to build and add to their position instead of complaining. Only the foolish complain and then state that they would have acted differently. The reality is that they will never change and will always respond in the same manner. Tactical Investor Aug 2015

The drug pushers in the media are giving the news junkies their daily fix, catering to the twaddle scenario that the world will end. Step back and reflect on how lucky you are that individuals of such calibre exist, ones that seem to feed and thrive on this rubbish. Every time you run into an idiot, be grateful that it’s those idiots who make your life infinitely easier. Most do not see this part of the equation or story; they focus on the false premise that idiots make their lives harder when, in fact, the opposite is true. Market Update July 17, 2015

Instead of relying on the same old fundamental arguments, we encourage investors to pay attention to market trends, sentiment, and technical indicators to guide their investment decisions. By taking a holistic approach incorporating multiple factors, investors can make more informed decisions and improve their chances of success in the market.

The Technical Outlook

Based on technical analysis, there is still a potential for a further decline as our reliable trend indicator has not yet signalled a bullish trend. However, we have been recommending that our subscribers allocate small amounts of money to Gold because we sold our positions near the peak and are reinvesting our profits. In August 2011, we advised our subscribers to close most of their Gold, Silver, and Palladium bullion positions. We did not intend to sell precisely at the highest point, and we attribute our success more to luck than skill.

Attempting to time the market ideally is a fool’s errand, as knowing the exact top or bottom is impossible. Instead, investors should focus on identifying a change in trend and act accordingly. In today’s highly leveraged markets, finding the precise bottom is even more challenging. Trying to do so is akin to searching for a needle in a haystack.

For investors who believe in Gold at higher price points such as $1800, $1600, or even $1200, the current price of $1100 should be a cause for excitement. It’s important not to follow the crowd, who often sell when they should be buying and buy when they should be selling. Many investors express regret that they didn’t buy when markets were experiencing a downturn. However, when the opportunity finally presents itself, these individuals are often the first to flee.

Silver vs Gold Investment: Mass Psychology Take

From a mass psychology and trading perspective, the bottom line for gold seems not too far away. Sentiment readings are bearish, Gold bugs are in despair, and many contrarian investors are unsure of their footing. These factors bode well for the precious metals sector in the long run. From a technical analysis perspective, Gold has one more leg down, but it may not be too steep.

This will only reinforce the foolish notion that the Gold bull market is dead. It is important to remember that every bull market undergoes a back-breaking correction, and Gold is no exception. We believe that the next leg up will yield even more significant profits. As for

Typically, the back-breaking correction phase ends when the 50% mark has been hit, meaning that Gold would need to dip to around $960. If this scenario were to occur, it would be wise to back up the truck and buy like the world will end. It’s important to remember that trying to predict the exact bottom is like finding a needle in a haystack, so it’s essential to focus on bottoming or topping action and changes in the direction of the trend. It’s also important not to mimic the crowd’s mindset, whose sole function is to sell when it’s time to buy and buy when it’s time to sell. Instead, take a contrarian approach and look for opportunities when others are fearful.

Some market technicians and analysts are discussing lofty gold price targets, but it’s essential to question their feasibility. While some analysts have predicted targets of $10,000, $15,000, or even beyond $20,000, it’s important to note that gold has not yet traded at $2,000.

Conclusion

Investing in gold and silver requires a nuanced understanding of market dynamics, global events, and investor psychology. While both metals offer unique opportunities, gold is a more stable and reliable investment option, particularly during uncertain economic times. Silver presents a riskier but potentially more rewarding prospect with its industrial applications and higher volatility. Ultimately, a well-diversified portfolio that includes precious metals can help investors mitigate risks and capitalize on the benefits offered by these commodities.