Stock Market Forecast for Next 3 Months: Trends Over Predictions

April 4, 2025

Introduction: Market Sentiment, Corrections, & the Trap of Extremes

Normally, the current bullish sentiment would all but guarantee a bottom. But we live in a world of extremes, and most assume those extremes only apply to the upside. That’s why everyone was chasing TSLA, AMD, TSM, QCOM, AMAT, ASML—stocks at or near their highs—believing the AI hype spewed from every so-called expert was gospel. The assumption? These stocks had nowhere to go but up, destined for the next solar system.

What they forget is that the equation must balance, whether they accept it or not. When the belief in endless upside cracks—and it will—those same cognitive biases flip. Suddenly, investors embrace the idea that prices must plunge much further before stabilizing. The problem? Once trapped in this psychological loop, it’s hard to break free. By the time they finally snap out of it, the market has already bottomed, just as they missed the signs when they were blindly chasing stocks that seemed ready to touch the sun but instead plunged toward the abyss.

Bottom line: The S&P 500 dropping 10% in 20 trading days has only happened five times in history, and in every instance, the market rebounded—often to new highs—even if it initially dipped into bear territory. Our primary hypothesis remains intact: The crowd must be manipulated into believing this bull market is eternal. Now, doubt is creeping in—investors question whether the bull is dead. That’s exactly what we want.

The next step? Convincing them they were wrong to doubt and that “buy the dip” is the only winning strategy. Once they fully commit, piling in every chance they get, sentiment will surge past 55, then 60, and potentially even 70. That’s when the proverbial hammer drops.

The big players will start unloading when bullish sentiment holds above 51 for three weeks. As euphoria escalates to 60+, they’ll use every rally to sell, keeping a small portion to unload near the top—triggering a topping pattern before the inevitable downturn. More on that when sentiment enters the euphoric zone.

For now, the strategy remains simple: use pullbacks as buying opportunities. When it comes to options, long-term positions with low premiums are the key. The Dolphin Club confirmed what we already suspected—options with sky-high premiums, especially in tech and AI stocks, are a slaughterhouse. The better move? Sell puts on overvalued plays or simply buy the stock and sell covered calls when possible. Occasionally, we get rare setups like HIMX, etc in the tech sector, but those are the exception, not the rule. But opportunities abound in the non-tech sector.

Sentiment and stranger days

A bullish sentiment reading of 18 isn’t just low—it’s exceptionally rare. As we highlighted in the last market update, there have been only seven instances in the past few decades where bearish sentiment reached such extremes. But that’s where the similarities end.

This could be the first time in history that we’re seeing such pessimism while the markets remain in overbought territory on the monthly charts—without a meaningful correction in over two years and trading near all-time highs. TBS update March 6, 2025

Markets have shifted into neutral territory—no longer overbought but not yet deeply oversold. From here, the SPX either grinds sideways, pushing key oscillators into oversold territory, or drops to the 4800 range, triggering full-blown panic which will serve as the bedrock for the next stupendous rally. As for the exact path sideways or drop? Only entities from the next dimension have that insight.

However, we now have three consecutive weeks of bullish sentiment trading over 20 points below its historical average. Last week marked a 24-month low. That does not align with a long-term correction or crash. But as the saying goes, no pain, no gain. The FOMO crowd has once again learned the hard way—chasing stocks at euphoric highs only to be stripped of everything, pants, shirts, underwear, and more.

Yet, they never learn. Stupidity knows no limits. The crowd repeats history like a broken record, always convinced, “This time is different.” But the truth? It has never been different. Only the costumes change—the outcome remains the same.

The Harsh Reality: Why Most Traders Deserve to Get Wrecked

Let’s be clear—the stock market isn’t complicated. The real problem is the emotional herd trying to play it. Most traders act on hype, ignore data, and panic at the worst moments. They chase noise and fold when it matters most. Harsh? Yes. Deserved? Absolutely.

Winning boils down to Patience, Discipline, and Psychological Awareness. Most lack the mental endurance to stick with any of them. They jump strategies, seek shortcuts, and crumble under pressure.

Want to win? Ditch the herd mindset. Lock in those three principles and you’ll thrive while others get destroyed.

Markets run on cycles—fear, greed, euphoria, despair. The crowd gets it wrong at every turn—buying tops, selling bottoms. Real winners don’t chase trends—they shape them.

This isn’t about gambling or forecasts. It’s about strategy and execution.

The Ruthless Edge: Core Principles for Market Domination

Psychology Moves Markets

Markets aren’t logical—they’re emotional—fear and greed rule. Read the crowd, anticipate their moves, and exploit them. When they panic, you buy. When they chase, you sell.

Contrarian Investing

Big wins come from going where others won’t. When the masses flee, step in. The best plays are in fear-soaked markets.

Spot Trends Early

The best trades happen before headlines. Identify breakout sectors before the herd wakes up. Enter early, exit when they pile in.

Pick the Leaders

A strong sector isn’t enough. Use tools like Finviz and BarChart to find the stocks with real momentum. Skip the hype—buy strength.

Technical Analysis: Your Edge

TA isn’t prophecy—it’s probability. Learn to read charts, time entries/exits, and ignore emotion. The market rewards skill, not feelings.

Most still cling to experts and wild predictions. Yet time and again, random guesses beat the “pros.” And still, the herd follows blindly.

The takeaway?

Ignore noise. Exploit fear. Stay sharp. Take what’s yours.

Crash Buying: When Blood in the Streets Pays

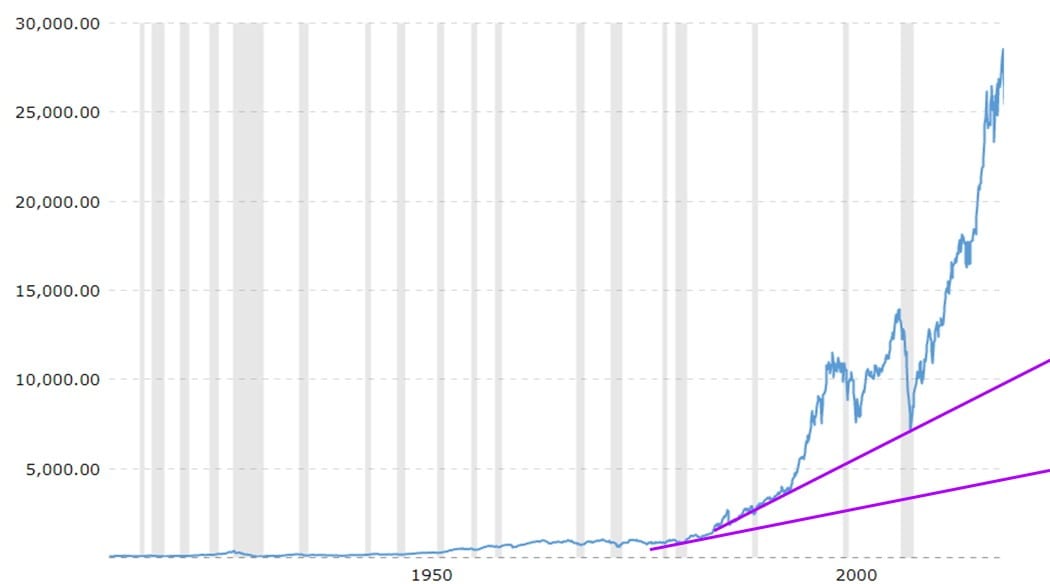

Market crashes and deep pullbacks aren’t threats—they’re opportunities. Use long-term charts and trend lines to spot major support zones. A dip slightly below trend—combined with bearish sentiment above 55—can signal a strong buy. These moments are rare. Be ready.

Charts spanning 15–20 years often test trend lines more frequently, offering more chances to buy when the market overshoots to the downside.

But no system guarantees success. Risk is real. Protect yourself with research, multiple indicators, and a diversified portfolio.

Institutional moves may shake the short term, but long-term focus wins. Deep dips under major trend lines, confirmed by sentiment data, often lead to high-reward setups.

Final Strike: Vector Shift and the Anatomy of a Setup

Zoom out. Strip away the noise. A battlefield of vectors remains—each move a calculated force, each correction a recalibration. The market is not chaos; it’s controlled asymmetry, and those who survive don’t predict—they position. The masses obsess over what happens next quarter. We? We track where the psychological momentum must break. And right now, it’s bending.

We’re in the late-stage accumulation of a manipulated belief system. The game isn’t about earnings, inflation, or Powell’s next hiccup—it’s about belief management. Sentiment manipulation is the final lever, and the system is tugging hard. Three straight weeks of suppressed bullish sentiment while indexes flirt with all-time highs? That’s not a market losing steam—it’s a setup. A deliberate one.

This isn’t some textbook correction. It’s a vector inversion, a psychological whiplash forming in real time. On the surface, the market appears flatlining, digesting gains. Underneath? Sentiment divergence is fracturing reality. Volatility compression, extended optimism fatigue, and sudden sector rotations aren’t random. They’re pressure points. When the break comes, it will be sharp, surgical, and profitable—for those positioned before the turn.

Most won’t be. Most never are.

The crowd still believes they’re navigating a map, unaware that the terrain keeps shifting beneath them. They are wired to chase strength and panic on weakness—forever late, always leveraged. They’re not in the market to win; they’re in it to feel like they’re winning. Until they’re not.

We don’t trade feelings. We trade vectors.

And those vectors converge into something rare: a sentiment vacuum amid record highs. It’s a warning shot. Not for a crash, necessarily—but for a phase shift. The next three months won’t be about direction. They’ll be about extraction. This is when professionals offload inventory into the hands of overconfident people. Again.

The signal isn’t just price—it’s behavior. Retail traders flooding into options with inflated premiums. Tech names priced for perfection. The narrative overload around AI. These aren’t signs of strength; they’re signs of setup. The same way HIMX, quietly poised, slips through the cracks while attention is glued to ASML’s every tick.

We’re not predicting a crash but a sentiment inversion event. First, we grind. Then we trap. Finally, we lacerate.

When? When the crowd goes all in. When the sentiment lines cross 55. Maybe 60. Maybe higher. Then—distribute. Offload. Exit before the herd even realizes they were baited.

Don’t get seduced by calm. The bigger the silence, the sharper the snap. The vector doesn’t lie.

This market doesn’t belong to those who wait for permission. It belongs to those who read the shift and strike before the echo.

We’ve been here before. And we’ll be here again. The only question is: are you already in position?

Because when the cycle flips, you don’t want to be thinking.

You want to be done.

Click the link below for a historical view of our 2023 stock market forecast. Explore insights and past predictions.

Stock Market Forecast: Historical outlook