Mastering Money

Feb 13, 2023

The stock market is a complex and dynamic entity that can be difficult to predict, even for the most experienced investors. While some market players may aim to manipulate the market by setting up both the bulls and the bears for a so-called “massacre,” a contrarian approach to investing can hedge against such market manipulation and be a valuable addition to any financial playbook.

Contrarian investing is based on going against the crowd and taking a counterintuitive approach to invest. This means investing in assets that are out of favour or undervalued and avoiding overvalued or popular investments. This strategy can be a valuable component of a financial playbook, particularly for investors looking to reduce the impact of market manipulation.

For example, in the scenario described above, where market players aim to trick bullish and bearish investors by breaking through downtrend lines and creating the illusion of a new bull market, a contrarian investor may choose to go against the trend and avoid buying into the market at this time. Instead, they may wait for a pullback or look for opportunities to short the market, potentially profiting from its subsequent decline. This approach is just one example of how a contrarian strategy can be incorporated into a financial playbook.

Cons of Contrarian Investing

Of course, it’s important to note that contrarian investing is not without risk, and a contrarian approach may not always be successful. It’s also crucial for individual investors to do their research and consult with a financial advisor before making any investment decisions.

While market manipulation can lead to significant volatility in the stock market, a contrarian approach to investing can hedge against such manipulation and potentially offer an opportunity for profit. Incorporating a contrarian approach into your financial playbook can help diversify your investment portfolio and potentially reduce the impact of market manipulation.

Conclusion

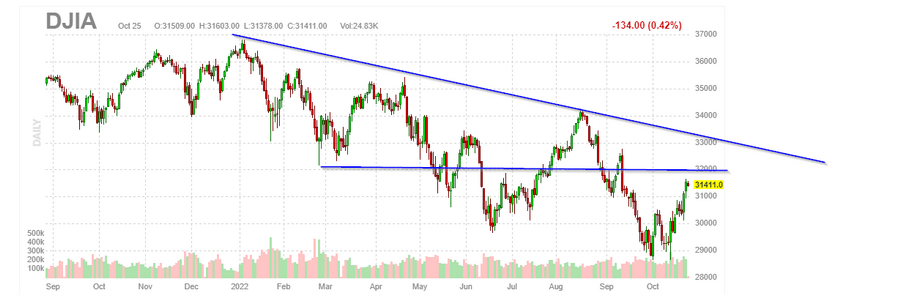

This chart provides an overview of how the big players will probably try to set both the bulls and the bears for a massacre.

The notion that market manipulators face limitations in profits when they single out one particular group of investors is a prevalent belief among the investment community. It is quite possible that these manipulators, in a bid to maximize their profits, may resort to using some of the tricks from their financial playbook to deceive both bullish and bearish investors.

Manipulators don’t make as much coin when they target only one group. One sure way to trick the bears and the bulls would be to make the Dow and several other indices break through their downtrend lines and create the illusion of a new bull. In this case, this would correlate to a move to the 34,300 to 34,650 range. In pulling off this feat, the bears would throw in the towel, propelling the markets higher due to short covering. The bulls, thinking that all is well, would buy the rip, and then when everything looks fine and dandy, the guillotine is likely to fall.

Other Articles of Interest

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?