Stock market crash 2020 Predictions & Mass Insanity

Updated April 2023

The image of the V-indicator illustrates just how severe the surge of 999 points is, in case you missed the change. The fist is now coloured in red, indicating that one should be ready to expect an all-out surge in violence, extreme market volatilely (most of the action will be to the upside), unpredictable and in some cases unbelievable action both in and out of the markets. Expect the crowd to act insane, and this will be especially true in North America and most of Western Europe. The action will be muted in Eastern Europe and most of South America. There will be almost no fallout in Asia other than the looming confrontation between China and the USA and eventually the rest of the Western world.

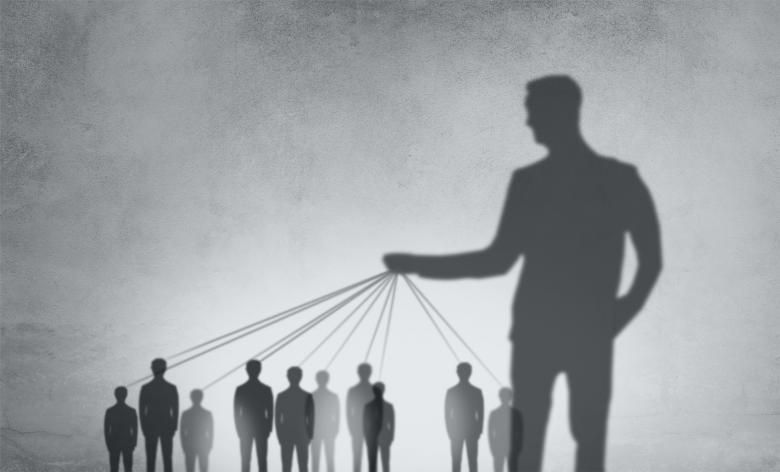

In this environment of chaos and disorder, it is so effortless to give in or give up If one allows the noise to filter in. If one examines the situation with ordinary eyes, nothing makes sense, and it appears that the most natural thing in the world would be to throw the towel in, which is (precisely) what the big players want the masses to do.

Unveiling the Illusion: The Manipulation of Mass Psychology by the Financial Elite

For the record, don’t confuse rich players with astute players; many of the so-called top sharks are fat Tuna and will be stripped to pieces by piranhas with very sharp teeth. Rich players are overweight pigs waiting for their day in the slaughterhouse. Ignore their stock market crash 2020 predictions and instead focus on the accuracy of their past predictions. One will note that most naysayers have a record that would make the common burro look like a genius in comparison.

COVID or whatever other chaotic events that shadow this pandemic (and there will be more) are part of the planned demand destruction process. The very top players you never hear of are outstanding trend players, and they, unfortunately, understand the concept of Mass Psychology only too well. They know exactly what needs to be done to make the masses feel that what’s occurring is inevitable. One of the best ways to rob a man is to make him believe he only has a set of given choices and to make him choose from the ones you have given him.

Stock market crash 2020 predictions: The Illusion of Choice

All those options by design lead to an adverse outcome, but it creates the illusion of choice, and that’s all the masses need to feel empowered. The way out of this loop is to look outside the presented options. How do you do this? First, you never accept anything being pushed out by the media. The media’s only function is to create a false narrative for the masses, and once the crowd accept this narrative as the word of God, it’s game over. The masses have no choice; they have the illusion of choice. Similarly, the Fed’s sole purpose is not to help stabilise the economy but to sow the seeds of destruction for the next bubble.

Mass Insanity and stock market crash 2020 Predictions

The attack against the masses will be brutal, so be prepared to deal with tremendous negativity and projections/predictions that border on the insane.

The slaves who toil in our offices and factories are invariably unaware of their enslavement. If they have any dreams, they are merely of ways of improving their slavery: having a good time on a Sunday; going to a dance in the evening; dressing up like a gentleman; and getting more money. Even if they are dissatisfied with their life, they think only of shortening the hours of work or increasing their salaries and holidays—in a nutshell, all the trappings of the Socialist Utopia. They could never mentally bring themselves to revolt against work itself.

It is their God, and they do not dare oppose him even in thought. But Hugh was made of other stuff. He hated slavery. He always said that being a slave to work was the wrath of God. The very fibers of his being stirred with an awareness of this octopus, penetrating him with its tightening stranglehold. Quite apart from this, the thought of embellishing his slavery would never have occurred to him, nor was he the sort to delude himself with cheap distractions. https://bit.ly/30NiDyg

That’s the mass mindset for you, always hoping for a brighter tomorrow but never actually doing anything to make that tomorrow come to fruition. They hope, pray, rant and rave but never do anything that will change the outcome. Pluto’s allegory of the cave summarises the mass mindset quite aptly.

Seizing Opportunities in Market Pullbacks: Embrace the Bull and Know Yourself as a Trader

The markets are finally pulling back, so don’t let the opportunity go to waste. As we stated in this new paradigm, sharp pullbacks equate to buying opportunities. Hence, don’t throw this opportunity into the toilet. Don’t act like the crowd always praying for a chance, but when the opportunity arrives, they view it as a disaster, so the never-ending cycle of misery and false hope continues.

To become a better trader, one needs to know oneself and not try to act like another. If you try to emulate another person, the real you will wither and disappear, and you will need the other person forever. Your eyes will only see what they are directed to see. In other words, a glorified blind man.

This is why the masses are destined by design to repeat history forever. They look but don’t see, they hear but don’t understand, and they think but can’t formulate a single original thought; one would be almost tempted to call them the “living dead”. Market Update May 24, 2020

As stated in the last update, the Fed and its friends would do whatever it took to create the impression that shorting the market is a recipe for disaster. The idea as we stated, was and is, to force every Tom, Dick and Harry to embrace this bull. Interim Update June 17 2020

Regulatory Changes Enable Banks to Expand Venture Capital Investments

The Volcker Rule, which governs banking regulations, has undergone amendments approved by the Federal Reserve and other financial agencies. These changes now permit banks to enhance their participation in venture capital funds. The Federal Reserve, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corp. (FDIC) have introduced these revisions to provide more explicit guidelines on permissible activities. Consequently, banks can now increase their investments in venture capital funds and access funds previously held to support derivatives trades.

This development reflects further easing restrictions during President Donald Trump’s tenure. The previous year, the Federal Reserve, OCC, and FDIC relaxed the Volcker Rule to enable lenders to engage in proprietary trading, allowing institutions to make independent market investments rather than solely acting on behalf of clients. UPI.com

Stock market crash 2020 predictions: Any crash should be embraced

The Fed is willing to do whatever it takes to juice this market. We would not be surprised if Volcker’s rule is overturned. What a great way to boost the needs; give the fox the keys to the hen house. Allowing banks to invest in the markets would be tantamount to throwing rocket fuel on a raging inferno. They could borrow the money for next to nothing from the Feds and then dump it into the markets, generating insane amounts of profits. The rich will get richer, and the poor will continue to inherit the earth with all the worms that come with it. People forget that back then, the word earth referred to soil (also known as dust) and not planet Earth.

Ignoring Historical Parallels: A Risky Move

Forget about stock market crash predictions for 2020, 2022, or 2023. In the long run, our attention should be on recognizing opportunities. Unfortunately, many people consider themselves long-term investors, but they quickly shift to short-term thinking and speculation when faced with challenges. In reality, they are speculators while claiming to be long-term investors in theory. One crucial aspect is understanding the collective mindset of the masses. The following story serves as a clear example of how confusing wants with needs can lead to unfavorable outcomes.

It seems that the alarming parallels with historical events, such as the dot-com bubble, the real estate bubble, and the pattern seen in 1973-1974, are being overlooked. This is largely due to the prevailing belief that the current situation is unique. We encountered similar claims during the real estate crash. In truth, the markets peaked in 2007 and saw a vigorous recovery in 2008, misleading many, much like the current scenario. The markets hit rock bottom in 2009, but the subsequent plunge left many who had joined the market during the strong rally phase so stunned that they stayed away from the market for years.

Current Market Participation: A Reflection of the Past

The current number of market participants is on par with, and soon to surpass, the figures from 2008 (with over 61% engaged in the market). Even a considerable segment of individuals aged 85 and above are almost fully invested. This week’s optimistic reading has finally hit the 50 mark. Consequently, we now have five consecutive weeks of optimistic readings exceeding their historical average of 38.5 (down from 39), after being below this level for 18 months.

A Case Study: The Sriracha Shortage

The ongoing shortage of sriracha hot chilli sauce, which has lasted for over a year, has caused prices to skyrocket, with bottles going for over $70 on the secondary market. The persistent scarcity has led to high demand for the beloved sauce. Opportunistic resellers are capitalizing on the situation, with some selling bottles for even higher prices, such as $100 on Amazon and $70 on eBay. This situation underscores both the robust consumer demand for sriracha and the extended duration of the shortage. e

The Collective Mentality: Desire vs. Need

In essence, the group mindset tricks the mind into mistaking wants for necessities. At least once this occurs, cost becomes a non-issue until individuals deplete their financial means. Now, let’s draw a parallel with the markets. The prevailing belief is that AI will transform the world, and investing in the markets is the guaranteed path to wealth. As a result, people plunge in and purchase, ignoring the cost, assured that it will keep soaring indefinitely. This mirrors one of the earliest historical bubbles, the tulip mania.

The Emotional Rollercoaster: Elation to Dread

This mindset lays the groundwork for a new way of thinking, making it easier to succumb to the “it’s different this time” fallacy. It also amplifies feelings of elation and happiness, which will inevitably stoke intense levels of dread and panic when the tide turns.

History’s Echo: A Likely Scenario

While history may not exactly repeat itself, it often comes perilously close. A likely scenario is that the AI sector will see a sharp downturn while cyclical stocks and crucial commodities register higher lows during the next downturn.

Advice for Low to Medium-Risk Investors

If you are a low to medium-risk investor, it would be prudent to proactively offload a substantial portion of your long positions in any stocks that are currently in or have been part of the AI frenzy.

Reading the Market: Bullish to Bearish

With rising Bullish levels, the likelihood of hitting 55 becomes evident, which inherently suggests a significant increase in Bearish readings when the sentiment changes. When Bearish readings begin to rise, it will be time to act.

Originally published on November 30, 2020, this piece has been continuously updated over the years, with the latest revision completed in April 2023.

Interesting Reads

US bank stocks and Psychological Ploys in the stock market

How to Become A Better Trader?

Market Timing Strategies: All fluff or?