Dealing With Reality after the stock market crash

July 21, 2023

Despite their repeated failures, it’s astonishing how many still believe in unreliable stock market forecasts. Studies show that even monkeys with darts fare better than most experts, emphasizing the need to think beyond short-term predictions.

The stock market is complex and unpredictable. Making a precise market forecast is generally a waste of good energy, and even in the best of times, it’s challenging. Instead of relying solely on projections, focusing on trends as more reliable indicators of stock market performance is crucial.

Navigating the Post-Stock Market Crash Landscape

Navigating the tumultuous waves of a stock market crash can be daunting. However, you can transform these seemingly disastrous events into golden opportunities with a well-structured strategy and a calm mindset. It’s crucial to remember that, much like life itself, the stock market operates in cycles, with its highs and lows. And during these lows, the seeds of future prosperity are often sown.

In the face of a market crash, many individuals are ensnared in a web of loss and shock. Such a reaction is natural, as our brains are wired to respond to immediate threats. Nevertheless, it’s essential to rise above this instinctive response and focus on the bigger picture. This is where understanding mass psychology becomes critical. The market is driven by collective sentiment, and fear often reigns supreme during a crash. However, as contrarian investors know, it’s precisely in these moments of widespread panic that the greatest opportunities arise.

Contrarian investing is all about going against the grain, about finding value where others see only despair. It’s about recognizing that the market’s mood swings are often more extreme than the underlying reality. When everyone else is selling in fear, a contrarian investor sees the chance to buy quality stocks at a discount.

History has shown that every stock market crash has ultimately proved to be a buying opportunity in the long run. This is not to downplay the short-term pain that crashes can cause but rather to highlight the potential for long-term gain. The key is to maintain a level-headed approach, stay informed, and make decisions based on rational analysis rather than emotional reactions.

Mastering Post-Crash Recovery: Strategic Steps for Investors”

- Understanding Mass Psychology: Gain an edge by comprehending collective market sentiment and how it influences behaviour.

- Embracing Contrarian Investing: Seek opportunities in undervalued assets and adopt a different perspective from the majority.

- Spotting Emerging Trends: Anticipate market shifts by identifying breakthrough sectors and staying ahead of mainstream trends.

- Identifying Strong Stocks: Utilize tools like Finviz and Barchart to pinpoint robust sectors and focus on promising investment opportunities within those sectors.

- The Basics of Technical Analysis (TA): Master TA fundamentals to fine-tune your entry and exit points and enhance decision-making with technical indicators.

One should remember there is no magic bullet, but integrating and applying these strategies can significantly improve your odds of being on the right side of the market.

Post-Crash Market Patterns: Novice to Knowledgeable

One of the most significant errors made by inexperienced investors, and even those who have spent considerable time in the markets, is the failure to learn and educate themselves genuinely. Simply absorbing useless news or blindly following other people’s trading ideas does not lead to growth. It’s essential to remember that what works for someone else may not work for you. Your risk profile, mindset, and discipline (or lack thereof) are unique; therefore, you must develop your customized strategy.

Incorporating ideas from successful traders into your trading style can be beneficial, but blindly following their every move will eventually lead to losses. Instead, keeping it simple and focusing on the trend, technicals, and mass sentiment is advisable. Novice traders should start by identifying the trend. Investors better understand the market’s performance and direction by analyzing long-term trends and patterns. This enables them to make informed decisions rather than relying on guesswork or hearsay.

When analyzing trends, pay close attention to the V readings, as displayed in the accompanying image. These readings offer valuable insights into market volatility, aiding investors in anticipating potential shifts. While the current market may be at an all-time high, monitoring the trend and watching for signs of stability or decline remains crucial.

Remember, the key to success lies in developing your personalized strategy. Invest time in learning, adapting, and growing, and you’ll be on your way to achieving your financial goals in the markets. Remember, the trend is your friend; everything else is rubbish or noise.

Articles That Challenge Conventional Wisdom

Elon Musk AI Robot: Revolutionizing the Future

US Recession 2023: The Looming Threat to Global Economies

Health Benefits Of The Tribal Diet

Millennials Retirement Reality: Less Than $100K in Savings

The little book of Common sense investing- focus on the Trend

Anti Aging Superfoods: Rejuvenate Your Way to Youthfulness

Mastering Record Keeping: Ensuring Investment Success

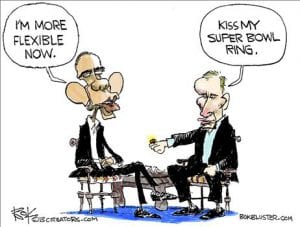

Russia’s Foreign Policy: A Resolute and Disciplined Approach

When To Buy The Dip: Your Path to Investment Success

The China USA war: The Trade War of the Century.

Cool Superpower Ideas: Exploring Excellence in Various Fields

Unleashing the Bear: Russia Strikes Syria with Impact

Igniting Passion: The Thrilling Digital Sex Revolution

Navigating Fear & Opportunity in the October Stock Market Crash