Editor: Vladimir Bajic | Tactical Investor

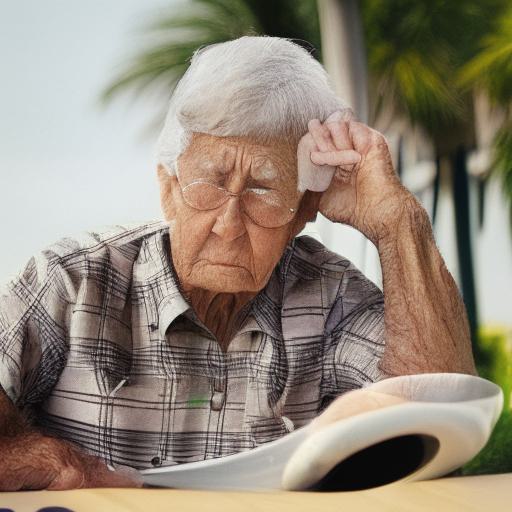

Saving Struggles: Unveiling the Retirement Crisis in America

Introduction

The retirement crisis in America has become a pressing issue that demands immediate attention. As individuals live longer and the cost of living rises, many Americans are ill-prepared for retirement.

Understanding the Retirement Crisis in America

A variety of reasons have contributed to America’s present retirement issue. Firstly, inadequate savings and investment practices have left many individuals with insufficient funds to support themselves in retirement. The decline in traditional pensions and retirement benefits has further exacerbated the problem. Additionally, the increasing life expectancy means that retirees need more savings to sustain themselves over a longer period. Economic instability, including recessions and market volatility, has also had a detrimental impact on retirement savings.

Challenges Faced by Americans

One of the critical challenges Americans face is the lack of sufficient savings and low retirement plan participation. Many individuals struggle to set aside a portion of their income for retirement, resulting in a significant gap between what they have saved and what they will need in the future. Furthermore, the rising costs of healthcare pose a substantial burden on retirement savings. Medical expenses can quickly deplete savings and hinder retirees’ ability to maintain a comfortable lifestyle. Concerns surrounding the future of Social Security add to the uncertainty, making it crucial to explore potential reforms and ensure the system’s sustainability.

Strategies to Overcome the Retirement Crisis in America

To address the retirement crisis, individuals need to take proactive steps towards securing their financial future. Here are some strategies that can help overcome the challenges:

Start saving early and prioritize retirement contributions: Time is a valuable asset for retirement savings. Starting early allows for the power of compound interest to work in your favour. By consistently setting aside a portion of your income for retirement and making it a priority, you can gradually build a substantial nest egg.

Financial literacy and education programs: Understanding personal finance and investment basics is crucial for effective retirement planning. By enhancing your financial literacy through workshops, courses, or online resources, you can make informed decisions about saving, investing, and managing your money. Seeking professional financial advice can also provide valuable guidance tailored to your specific circumstances.

Encouraging employer-sponsored retirement plans: Take advantage of retirement plans, such as a 401(k). These plans often include benefits like automatic enrollment and employer matching contributions, which can significantly boost your savings. For workers without access to employer-sponsored plans, explore alternatives such as Individual Retirement Accounts (IRAs) or other retirement savings options available in your country.

Government initiatives and policy reforms: Governments play a crucial role in addressing the retirement crisis through policy reforms. Advocating for strengthening Social Security is essential, which serves as a safety net for retirees. Exploring ways to expand retirement savings incentives and tax benefits can also incentivize individuals to save more for retirement.

The Role of Technology in Retirement Planning

Technology can be a powerful tool for retirement planning. Digital tools such as retirement calculators and goal-tracking apps can help individuals assess their current financial situation, set realistic retirement goals, and track their progress. Robo-advisors and automated investment platforms provide affordable and accessible investment options, making it easier for individuals to grow their retirement savings. Online resources offer financial education materials and retirement planning guidance, empowering individuals to make informed decisions.

Overcoming Psychological Barriers to Retirement Planning

Retirement planning involves not only financial considerations but also addressing psychological barriers. Misconceptions and fears about retirement can hinder individuals from taking the necessary steps. By dispelling myths, educating oneself, and seeking support from family, friends, and professionals, individuals can develop a positive mindset towards retirement planning. Setting achievable goals and regularly reviewing and adjusting them can help individuals stay motivated and on track.

The Importance of Long-Term Financial Wellness

Building a secure retirement goes beyond savings and investment strategies. Long-term financial wellness includes building emergency funds to handle unexpected expenses, managing debt responsibly, and considering healthcare planning and long-term care options. Diversifying income streams in retirement, such as through part-time work, rental income, or passive investments, can provide added financial stability.

Retirement Crisis in America- Call to Action

The retirement crisis in America demands urgent attention and proactive measures from individuals, employers, and policymakers. Individuals can work towards a more secure retirement future by understanding the challenges, implementing effective strategies, and embracing technology and financial education. It is crucial to take advantage of employer-sponsored retirement plans, explore various savings options, and advocate for policy reforms to ensure the sustainability of retirement systems. By collectively addressing the retirement crisis, we can strive towards a future where everyone can enjoy a dignified and comfortable retirement.

FAQ On Retirement Crisis in America

Q: What is retirement planning?

A: Retirement planning refers to setting financial goals and making necessary arrangements to ensure a secure and comfortable retirement. It involves determining how much money you will need, strategizing savings and investment plans, and making decisions about pensions, Social Security, and healthcare coverage.

Q: Why is retirement planning important?

A: Planning for retirement is crucial as it enables you to uphold your preferred standard of living and achieve financial autonomy during your retirement phase. It guarantees that you possess adequate savings and income to cater to essential expenditures, medical expenses, and other financial responsibilities when you cease employment.

Q: At what point should I commence my retirement planning?

A: It is never too early to start planning for retirement. Ideally, it is recommended to begin retirement planning as soon as you start earning income. Starting early gives you the advantage of time, allowing your savings to grow through compounding interest and investment returns.

Q: What is the recommended amount of savings for retirement?

A: The required savings for retirement vary based on multiple factors such as your desired lifestyle, projected expenses, healthcare expenditures, and life expectancy. It is advisable to target saving around 70-80% of your pre-retirement income. Seeking guidance from a financial advisor can assist you in determining a more precise estimate tailored to your individual situation.

Q: What are some retirement savings options?

A: There are several retirement savings options available, such as employer-sponsored plans like 401(k) or pension plans, Individual Retirement Accounts (IRAs), Roth IRAs, and annuities. Each option has its advantages and consideration. Understanding each plan’s features and eligibility requirements is crucial before deciding.

Q: How much should I contribute to my retirement savings?

A: The amount you should contribute to your retirement savings depends on your income, expenses, and retirement goals. Experts recommend setting aside a minimum of 10-15% of your gross income for retirement. However, the greater the amount you can contribute, the more effectively you will be prepared for your retirement years.

Q: How does Social Security contribute to retirement planning?

A: Social Security is crucial in retirement planning as it financially supports individuals during retirement. This government program offers retirement benefits based on an individual’s work history and contributions to the system. Social Security benefits supplement retirement savings and ensure a steady income stream. It is essential to consider

Q: How can I ensure my retirement investments are diversified?

A: Achieving diversification is crucial for effectively managing investment risk, particularly in retirement planning. To ensure that your retirement investments are properly diversified is best to diversify your investments among asset types such as equities, bonds, mutual funds, and real estate. You might potentially lessen the impact of market swings and improve the overall stability of your retirement portfolio by diversifying your assets across asset types. Diversifying within each asset class by investing in different industries or geographic locations is also recommended.

Q: What options do I have if you don’t have enough money set up for retirement?

Evaluate your present financial situation: Examine your income, spending, and existing savings or assets. Understanding your financial situation can enable you to make more educated decisions.

Create a budget and cut expenses: Stick to a budget and keep track of your income and spending. Look for places where you might make cuts and save more money for retirement.

It’s crucial not to panic if you haven’t saved enough for retirement. Begin by assessing your present financial condition and making any required budget modifications. Consider boosting your retirement payments, looking into alternative income streams, and getting expert assistance to help you catch up on your savings.

Q: Can I continue working during retirement?

A: Yes, many individuals choose to continue working during retirement, either part-time or freelance. Continuing to work can provide additional income and help you stay socially engaged. However, it’s essential to factor in the impact of continued work on your retirement benefits, taxes, and overall financial plan.

Q: How often should I review my retirement plan?

A: You should examine your retirement plan at least once a year or anytime you have major life events, such as marrying or having children.

Lost in Thought: Stimulating Articles That Encourage Reflection

Unlocking Insights: Data For Deeper Understanding

Forever Quantitative easing continues with no end in sight

Netherlands to Ban Gasoline-Powered Cars

Dow Jones Industrial Average Today: Is It Set To Crash