Nickel Investing: Begining of A New Bull

Updated March 2023

If you look at a shorter-term chart of 1-3 years, the primary move is underway already. However, looking at a ten-year chart, we can see that Nickel is at a critical junction. It needs to close above 1100 on a monthly basis; failure to achieve this could push it back down to the 820-855 ranges over rather quickly. If one is looking for a solid confirmation, then a monthly close over 1200 should do it; this would set the pace for a test of the 1500 ranges with a possibility of trading to 1800.

We looked at several large nickel producers, whose charts illustrated that the stocks were consolidating. This suggests that Nickel is likely to pull back before trending higher unless the metal diverges and trends in the opposite direction.

Let’s take a look at some Nickel Producers

VALE SA (VALE)

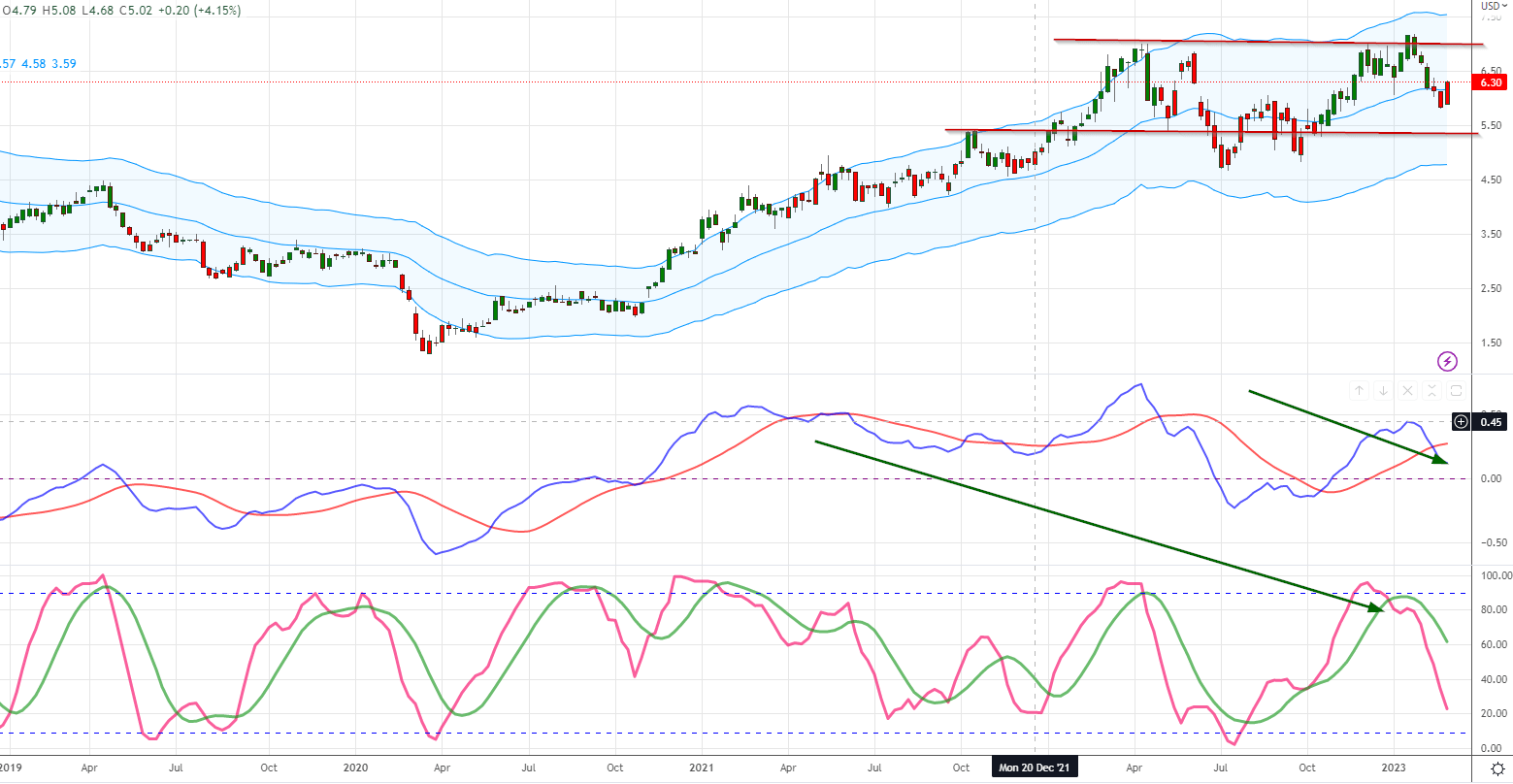

VALE, the world’s second-largest producer of Nickel, appears to be consolidating while nickel prices trend higher, and the same seems true of NILSY (Norilsk Mines). What could be taking place here is that the stocks are pulling back and building energy for the next phase upwards.

On the monthly chart of VALE, we can see that the stock is holding up quite well while our indicators are letting out some steam. If one were willing to take some risk and wanted to act before our indicators moved into the oversold range, capital could be deployed in the 9 to 10-dollar ranges

Glencore (GLCNF)

Courtesy: Tradingview.com

The pattern is quite interesting here; this is one of the few stocks in the sector that has not experienced a nice upward move. The other stocks are now consolidating, building steam for the next leg up. However, this chap is still trading in the extremely oversold ranges and technically could mount a rally at any moment. However, note that this is a speculative play.

This company also trades in London under the symbol GLEN (LSX: GLEN), and it is currently the world’s 4th largest nickel producer. Risk-takers could deploy some capital in the 2.30 to 3.50 range and another lot deployed if it drops to the 2.90-3.00 range. We would hold onto the third and deploy it after one of our customer indicators generates a buy signal.

Investing in Nickel March 2023 Update

Nickel is an essential component in manufacturing stainless steel, used in various industries such as construction, automotive, and aerospace. It is also used to produce electric vehicle batteries and as a critical component in other renewable energy technologies such as wind turbines. Therefore, with the growing demand for stainless steel and the increasing shift towards renewable energy, the need for Nickel will rise in the long term.

Furthermore, the supply of Nickel is limited and geographically concentrated in a few countries, such as Indonesia, Russia, and the Philippines. This makes it vulnerable to supply disruptions and geopolitical risks, which could further increase its price.

In addition, the COVID-19 pandemic has caused disruptions in the global supply chain and affected mining operations, reducing Nickel production. As the world recovers from the pandemic, demand for Nickel is likely to increase, but the supply may take time to catch up, leading to a potential supply deficit and higher prices.

Overall, increasing demand from various industries, limited supply, and potential supply disruptions make Nickel an attractive long-term investment opportunity for investors. However, investors should also consider the risks associated with investing in commodities and conduct thorough research before making any investment decisions.

Other Articles of Interest

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)

Stock Market Crash Stories Experts Push Equate to Nonsense (March 4)

Popular Media Lies To You: Don’t Listen To Experts As They Know Nothing (March 3)

Fiat Money; The main driver behind boom & Bust Cycles (March 1)

Permabear; It Takes A Special Kind Of Stupid To Be One (Feb 21)

US Debt To GDP Means Nothing To Bonds & Stocks (Feb 12)

Technology-Driven Deflation Will Kill The Inflation Monster (Feb 7)