Brexit Effect: Market Manipulators’ Exaggerations

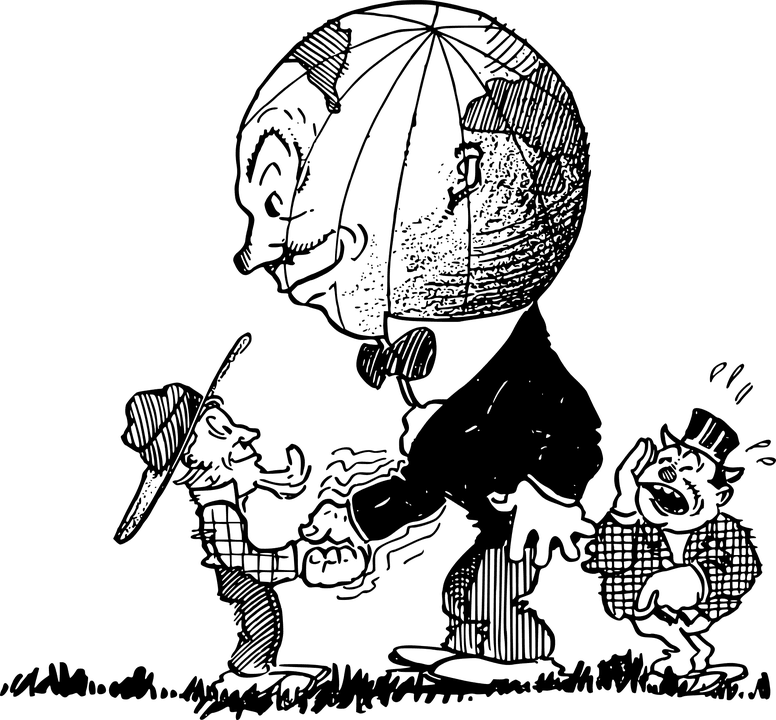

The story below, in its excerpts, indicates that fools and idiots are running the press. They keep chirping the same nonsense repeatedly, preaching doom and gloom. However, the outcomes are always different, as the press ends up getting slapped in the face. Yet, they persist with the same line of rubbish because the masses never react. Until the masses take a stance and tell these morons to stop, nothing will change. Bombastic and outrageous titles and allegations will continue to be the order of the day. Why would they stop when there are no consequences for doing so? A week later, the masses forget everything and are ready for a new dose of lies, hence the saying, “Tell me sweet lies.”

The first question concerns the economic consequences of leaving. Many international companies, including the Japanese conglomerate Hitachi, have announced that if “leave” wins, they might relocate some of their European business outside the U.K. Some American banks based in London have privately stated that London’s legal status in providing banking activities to the EU is an indispensable part of their business model. At the same time, the U.K.’s primary trading partner is the European Union. A decision to leave the European Union could have significant economic consequences.

The extent of the economic consequences will hinge on the negotiations that follow a decision to leave. If the U.K. opts to formally commence the process of leaving, it could take two years to agree on the divorce terms. This might be followed by several years of negotiations to establish new trade deals between the U.K. and all the major economic partners with which the EU currently holds trade and investment agreements. Full Story

Navigating the Currency War: Brexit’s Unforeseen Advantage

Whenever the mass media begins to emphasize an issue, one can almost guarantee they are on the wrong side. While the pound may have experienced a drop and could potentially continue to do so, this should not be a cause for concern. Why, you might ask? We find ourselves amidst a currency war, often referred to as “the race to the bottom,” a topic we have discussed extensively in the past.

Britain has managed to lower its currency value without resorting to flooding the system with additional money or lowering interest rates, as some other nations are being compelled to do. Therefore, the concern over a weaker currency is essentially moot, as is the notion of a crisis endangering Britain’s competitive edge. In fact, Britain will likely be in a stronger position to negotiate favourable trade agreements and develop a more resilient strategy for addressing the immigration crisis. They will no longer need to heed the counsel of individuals in Belgium who seem oblivious to the ongoing situation and are more preoccupied with safeguarding their hefty paychecks than with finding meaningful solutions to the myriad problems afflicting this contentious alliance.

It’s crucial to disregard these empty vessels and focus on the overarching trend: Brexit should not be a source of fear.

Other Articles of Interest

Zero Percent Mortgage Debuts setting next stage for Stock Market Bull (July 27)

Long Term Stock Market Bears Always Lose (July 27)

Putin Crushes CNN Reporter Fareed Zakaria Biassed Question on Trump (July 13)

Negative rates will fuel the biggest Bull Market rally in History (25 May)

Media Manipulates Financial Markets via Good & bad News (21 May)

Negative rates in Denmark means banks Pay you money for taking a mortgage (20 May)

Good Money management-Better Solution than Gold standard (14 May)

Most Hated Bull Market ever not Ready to Crumble (May 10)

$1 trillion worth of shorts set to drive Dow higher (May 5)