Your Financial Playbook: How Patience & Discipline Shape Financial Success

Jan 13, 2025

The stock market is not for the faint of heart. It’s a battlefield, a brutal arena where fortunes are won and lost with the precision of a blade. The complex and volatile nature of the market—ever-shifting, unpredictable—tests the resolve of even the most battle-hardened investors. In this arena, patience is your shield, discipline your sword, and without these, the grave might be your only ally.

The Real Market Game: War, Not Lottery

You’re in the wrong game if you’re waiting for the market to hand you a fortune with no risk. The stock market is neither a lottery nor a place where you blindly follow the crowd and hope to hit it big. It’s a battleground where the big players—those with more power, money, and influence than you could ever dream—are always looking to manipulate the market, playing both sides of the fence and setting traps to trap the unsuspecting investor.

For too long, those “experts” on TV and in your Twitter feed have peddled the same song: buy the dip, sell the rally. But let’s cut through the nonsense. The market doesn’t care about your feelings or hopes for easy gains. The market is ruthless; the sooner you accept this, the better off you’ll be.

Every rise has a fall, and every fall has a surge. The true warrior in the market can see through the smoke and mirrors, one who understands the nature of the game—and plays it to win.

Contrarian Investing: The Path of the Warrior Who Walks Alone

When everyone runs in one direction, you stop and ask: “Is this where I want to go?” It’s easy to follow the herd. It’s comforting. But comfort will get you nowhere in this game. Comfort is for those who are content to be slaughtered at the hands of those who know how to manipulate the masses.

Contrarian investing is the antithesis of the herd mentality. It is the strategy of the lone wolf, the investor who dares to go against the tide. It’s not about being a rebel for the sake of rebellion—it’s about recognizing the signs, understanding the trends, and making the cold, calculated decision to buy when others are scared, or short when others are euphoric.

Contrarian investors thrive on the market’s misdirection. When the crowd panics, you buy. When the crowd is euphoria-driven, you sell. And when the big players are setting traps for the bulls and the bears, you are the one who’s already seen it coming.

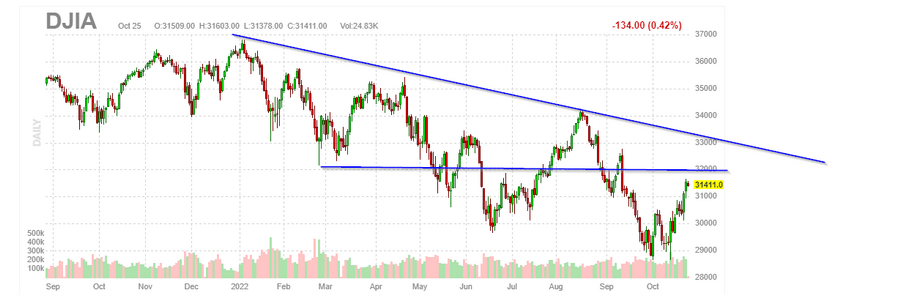

Take, for instance, the false signals the market throws out to trick both bulls and bears. Picture a market that appears to be on the cusp of a new bull market, but you’re not buying into it. Why? Because you’ve seen this game before. The big players will create a mirage—breaking through downtrend lines, sending the bulls into a frenzy and forcing the bears to surrender their short positions. You think you’re about to witness a rally that’ll soar into the 34,300–34,650 range, but that’s exactly when the guillotine drops.

Contrarians don’t buy the hype. They wait. They don’t fall for the tricks. And when everyone else is scrambling to follow the false signals, they step in and play the long game, waiting for the dust to settle and the real opportunities to reveal themselves.

The game is psychological, and if you don’t have the discipline to think for yourself, you’ll be led straight into the slaughterhouse.

Market Manipulation: Playing the Opposite Game

Let’s get this clear: the market is manipulated, and it always has been. To think otherwise is to be willfully ignorant. The bigger players who control the tides will set up traps, using every tool at their disposal to get you to buy at the wrong time or sell at the wrong time. The more fear they create, the more they profit. The more greed they stir, the higher they can push prices before letting them fall again.

In the world of market manipulation, fear and greed are the two greatest weapons. A well-timed panic will send stocks plummeting, while an orchestrated rally can make a fortune as the masses buy in. This is not a game for the weak. This is war, and only those who know how to read the battlefield will survive.

Imagine you’re watching the market approach a potential breakdown. The news is all doom and gloom. The talking heads on TV are blaring their predictions of disaster. The herd is panicking, selling in droves. But then, something strange happens: prices start to rise. The market breaks through a key downtrend line, and suddenly, everyone thinks a new bull market is coming. It’s a trap.

The market manipulators know this: if they can get the bears to cover their shorts and the bulls to pile in with their buying, they can take the market higher—only to rip it right back down once they’ve taken their profits. And when you’re left holding the bag, you’ll realize too late that you were just another pawn in their game.

But for the contrarian, this is where the opportunity lies. You don’t follow the panic. You don’t buy into the euphoria. Instead, you wait. You take advantage of the noise and confusion because this is when the real opportunities lie—when everyone else is too blinded by fear or greed to see what’s actually happening.

The Price of Patience: Mastering the Game Through Discipline

The true investor—the one who masters the game—does not make hasty decisions. The warrior investor understands that timing is everything. Patience and discipline are the foundation of success; without them, you are bound to fail.

It’s easy to get caught up in the hype, to think you’re missing out on the next big thing. But remember this: the market rewards patience, and punishes the impatient. There is no rush in this game. If you chase every fleeting opportunity, you’ll end up exhausted, broke, and frustrated.

Instead, the disciplined investor takes a step back. They understand that wealth is built over time, not overnight. They wait for the perfect opportunity. They wait for the right moment to strike, when the market is at its weakest or most manipulated, and they strike with precision. They don’t buy into the noise; they don’t buy into the panic. They wait for the pullbacks, the corrections, the moments when the herd is led astray. That’s when the contrarian moves in and capitalizes.

The grave is for those who fail to control their emotions. Those who let their greed, fear, and impatience dictate their actions will end up buried in a market that doesn’t care about their personal feelings.

The true warriors understand that the market will always provide opportunities—but only for those who have the patience and discipline to wait for them.

Conclusion: The Market Does Not Care About You

Let’s be clear: the market doesn’t care about your portfolio. It doesn’t care about your retirement. The market is indifferent to your hopes, fears, and dreams. It is a cold, calculating machine that feeds on emotions, trends, and psychology.

You need to stop thinking like the average investor to survive in this game. Stop following the crowd. Stop reacting to every bit of news, every dip, every rally. Start thinking like the few who truly control the market—the ones who understand that manipulation is part of the game, and who are willing to walk alone when everyone else is following the herd.

Patience, discipline, and a cold-blooded approach are your greatest allies. If you don’t have these qualities, you might as well hand your money over to those who do.

The grave waits for those who lose their nerve. But the rewards are limitless for the warrior—who plays the game with skill, strategy, and patience.