Patience and Discipline: Keys to Investment Success

Introduction:

Investment success is often misconstrued as a product solely of complex strategies and market timing. Yet, fundamental virtues such as patience and discipline are the true cornerstones of prosperous long-term investing. These qualities transcend the volatile market climate and technological advancements, providing a stable foundation for investment decisions. This essay delineates the essential roles that patience and discipline play in the context of traditional market dynamics and amidst the burgeoning AI landscape, highlighting their importance in achieving sustained investment triumphs.

The Timeless Tenets of Patience in Investing

The Virtue of Long-Term Perspectives

The Virtue of Long-Term Perspectives Patience in investing is fundamentally about adopting a long-term perspective, focusing on the gradual appreciation of assets rather than immediate profits. History has repeatedly shown that investments over extended periods typically outperform those subjected to frequent trading, as exemplified by Warren Buffett’s storied buy-and-hold strategy. His acquisition of Coca-Cola shares in 1988 and his refusal to sell them even during market downturns demonstrates the value of this approach, as the investment has grown multifold since then. The long-term perspective allows investors to ride out the volatility of markets, benefitting from the underlying value of high-quality assets as they incrementally increase over time.

Endurance Through Market Cycles

Investors who exhibit patience understand that markets move in cycles and that downturns are inevitable. Patient investors tend to capitalize on eventual recoveries by enduring through bear markets. A historical illustration of this is the resilience of investors who held onto their stocks during the dot-com bubble burst in the early 2000s and the financial crisis of 2007 and 2008. Those who maintained their composure and held onto fundamentally sound investments eventually saw a reversal of fortunes as markets recovered. Patience is thus not simply waiting; it’s a strategic embrace of market cycles, recognizing that downturns often present opportunities to acquire valuable assets at lower prices.

Compounding as the Silent Partner

Compounding—the process of reinvesting an asset’s earnings to generate additional earnings over time—is a testament to the power of patience. Albert Einstein famously referred to compound interest as the world’s eighth wonder, highlighting its capacity to grow wealth exponentially. A hypothetical illustration of this can be seen in an investor who starts with a modest sum and regularly contributes to their portfolio. With a consistent rate of return, the growth of their investment over decades can be dramatic, demonstrating that time is a crucial ally in wealth accumulation. Patient investors leverage the magic of compounding, allowing time to multiply their returns manifold.

The Indispensable Role of Discipline in Market Participation

Discipline begins with clear, achievable investment goals aligned with the individual’s financial situation and future needs. This involves calculating the investment time horizon, expected returns, and the necessary savings rate. A real-life example of disciplined goal setting is the retirement planning approach of many successful investors. Take, for instance, the case of an individual who begins contributing to a retirement account early in their career, setting precise milestones for savings. They continue to contribute a fixed percentage of their income regularly, adjusting their contributions over time to meet their retirement goals, regardless of market fluctuations.

A disciplined investor must also have a deep understanding of their risk tolerance. This refers to the degree of variability in investment returns an investor is willing to withstand. By assessing their risk tolerance, an investor can avoid taking on too much or too little risk, which can be detrimental to achieving their financial goals. A historical example of risk tolerance mismanagement can be seen in the case of the investors who suffered significant losses during the 2000 dot-com bubble. Many had overextended themselves into high-risk tech stocks without adequately considering their risk tolerance, resulting in substantial portfolio damage when the bubble burst.

Another hallmark of disciplined investing is the practice of dollar-cost averaging. This strategy involves investing a fixed amount of money at regular intervals, regardless of the price. Over time, this can lower the average cost per share of the investment. A real-world illustration of this strategy is the consistent investment in mutual funds of countless individuals. Even though the markets were volatile during the early 21st century’s financial crises, those who maintained their regular investment schedule generally fared better than those who attempted to time the market.

Discipline in investing also manifests through regular portfolio rebalancing. This is the process of realigning the weightings of a portfolio of assets to maintain a desired level of asset allocation. For instance, if one part of a portfolio has grown significantly and now comprises a more significant percentage than intended, a disciplined investor would sell off portions of those assets to reinvest in other underweighted assets to maintain their original investment strategy. A hypothetical example would be an investor with a target allocation of 60% stocks and 40% bonds who finds that their stock allocation has increased to 70% after a bull market. They would then sell some stocks and buy bonds to return to their target allocation.

Patience and Discipline A Must Amidst AI’s Dynamic Landscape

As Artificial Intelligence (AI) propels us into a new era of technological innovation, the investment landscape is becoming more dynamic and, at times, unpredictable. The lessons of the past, such as those learned from the dot-com bubble and the housing market crash, are invaluable to investors navigating this new terrain. These historical events underscore the necessity of patience and discipline in rapid market changes.

For example, companies like CMGI experienced meteoric rises in stock value during the dot-com bubble, only to suffer dramatic collapses when the bubble burst. Investors driven by the fear of missing out (FOMO) and abandoning their disciplined investment strategies often faced significant losses. CMGI, once a top internet investment company, saw its stock price plummet from a peak of $163 to under $1, illustrating the dangers of speculative investment without a disciplined approach.

In contrast to previous technology-driven market upheavals, the AI revolution presents challenges and opportunities. The AI sector is characterized by swift expansions and contractions, influenced by machine learning, natural language processing, and robotics breakthroughs. The rapid pace of these developments can lead to overvaluations as investors rush to back what they perceive as the next big thing. However, investors must maintain discipline, conducting thorough due diligence rather than being swayed by hype.

For instance, patient and disciplined investors may look beyond short-term trends and identify companies with solid fundamentals, a clear vision for AI integration, and a sustainable business model. These are the potential leaders that could shape the future of technology.

The AI market’s volatility requires a disciplined investment strategy with a well-diversified portfolio to mitigate risk. Investors should also be prepared to hold their investments through periods of short-term uncertainty, with the understanding that the actual value of groundbreaking AI technologies may take time to be fully realized.

Patience and discipline are more than just virtues; they are essential to a successful investment strategy. By adhering to these principles, investors can navigate the complexities of the AI market and potentially reap the rewards as new technological leaders emerge and transform industries.

Conclusion:

Patience and discipline are not just prudent investment attributes but the bedrock upon which enduring success is built. These virtues empower investors to navigate traditional market dynamics and the rapidly evolving AI landscape with foresight and stability. By embodying patience and discipline, investors can transcend the noise and enthusiasm of short-term market trends and capitalise on long-term market evolutions’ transformative potential. In the fast-paced world of AI and beyond, these timeless principles remain the keys to unlocking the vault of investment success.

In-Depth Insights: Beyond the Headlines

The Mob Psychology: Why You Have to Be In It to Win It

What Is Collective Behavior: Unveiling the Investment Enigma

What is the Rebound Effect? Unlock Hidden Profits Now

Dividend Collar Strategy: Double Digit Gains, Minimal Risk, Maximum Reward

Dividend Capture Strategy: A Devilishly Delightful Way to Boost Returns

BMY Stock Dividend Delight: Reaping a Rich Yield from a Blue-Chip Gem

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

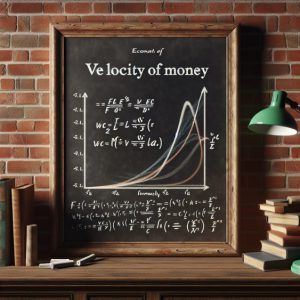

What Is the Velocity of Money Formula?

What is Gambler’s Fallacy in Investing? Stupidity Meets Greed

Poor Man’s Covered Call: With King’s Ransom Potential

How to Start Saving for Retirement at 35: Don’t Snooze, Start Now

The Great Cholesterol Scam: Profiting at the Expense of Lives

USD to Japanese Yen: Buy Now or Face the Consequences?

How is Inflation Bad for the Economy: Let’s Start This Torrid Tale