Market Sentiment: Excessive Bullishness on the Rise

Updated May 2024

September has, in part, lived up to its name as one of the worst months of the year. While September might be the worst month of the year, the most volatile month is October. This year, the volatility might extend to early November. Hence, traders should prepare themselves to deal with extra volatility. Still, the markets are expected to mount a robust rally after this phase. Market Update September 30, 2021

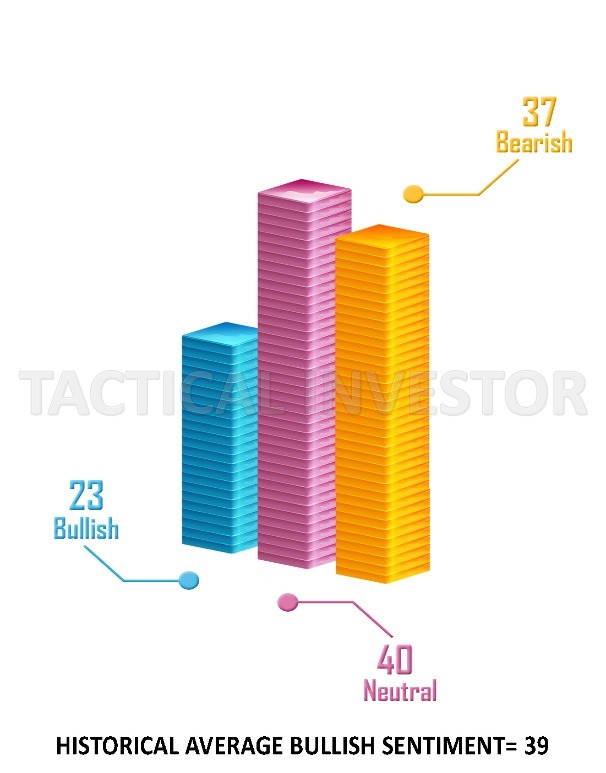

This pattern of rising volatility will continue until the MACDs undergo a bullish crossover or the bullish sentiment drops below 20. One final option is for neutral sentiment to soar to the 48 to 51 ranges; the higher, the better. If one or more of these conditions are met, volatility levels should drop significantly and potentially trigger an explosive upward move.

The deeper the MACDs and the RSI move into the oversold zones, the better the opportunity. The markets are holding up remarkably well since the MACDs and RSI are trending downwards. Once this corrective phase is over, the most likely follow-through outcome is a potent rally.

Bearish sentiment surged upwards, so the markets could/should rally for another 3 to 6 days. The clock started on Friday. Market Update September 30, 2021

The above outlook has come to pass. The Dow has tacked on roughly 1000 points since the last update. We are tabulating the current data, but the bullish sentiment will fall below its historical average. This volatile action should remain in effect until the 21st of this month. Ideally, it continues until early November, when the masses will be driven insane with uncertainty. If Neutral sentiment soared to 48 or higher, we would take it as a clear signal that a bottom is in and that the old highs will be removed.

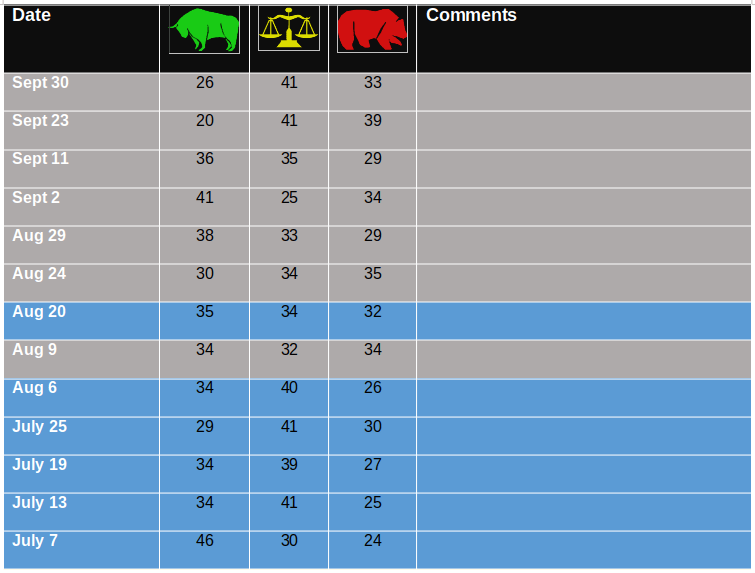

Historical Sentiment values

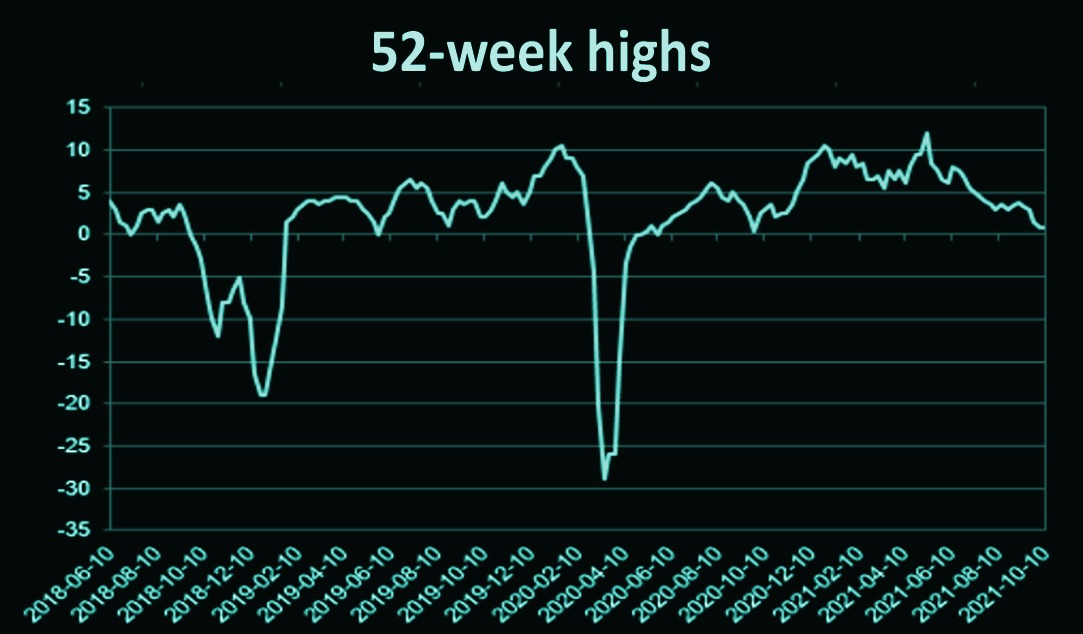

The silent correction theory continues to gain traction. Market Update September 30, 2021

The silent correction hypothesis continues to hold true. The two charts below add more credibility to this hypothesis. Additionally, as previously stated, many tech stocks took it to the chin. They shed in some cases, more than 30% from high to low. We also noted that many of these stocks would recover from those losses twice as fast. Look at the stunning recovery many Tech Stocks have mounted over the past few weeks.

The experts were almost sure the markets would crash in September, but they barked with no bite, as usual. The current pullback, at its worst point in September, cannot even be classified as a minor correction. At best, it was nothing but a hiccup.

The Dow would have to shed at least 7% before one could hope to label the pullback a minor correction. However, many stocks sometimes experience brutal corrections, shedding over 30%. Two things stand out here. The markets traded lower in September, but the McClellan Index made a higher low. Secondly, we have a positive divergence signal.

Navigating Market Turbulence: Why Volatility is Your Secret Weapon

When uncertainty rules the roost, market volatility is a trader/investor’s best friend. The trend is your friend; everything else is your foe. Market Update September 30, 2021

The current pullback is a non-event. We would not blink until the Dow shed at least 4500 points. Until then, everything that occurs should be classified as a hiccup or a non-event. However, many stocks had shed enormous weight, validating the silent correction theory we put forward before the markets started to pull back.

Our anxiety index has moved deeper into the panic zone. Bullish sentiment readings are well below their historical average. The experts all claim that a brutal correction is around the corner. The likely outcome is that the markets continue trending sideways to further confound the bulls and the bears. In this day and age, sideways action entails a lot of volatility. The markets could trade between a narrow range but experience rapid moves of 250 to 600 points in both directions within a 24-to-48-hour period. Such action would drive most individuals insane, and the uncertainty levels would soar. This is the most favoured outcome as its effects are long-lasting. By the time the crowd snaps out of its stupor, the markets will be trading close to new highs. Higher Neutral sentiment readings equate to a rise in uncertainty.

The Power of Mass Psychology in Market Movements

Mass psychology plays a crucial role in shaping market trends and investor behaviour. The concept of “narrative economics,” popularized by economists like Dr. Robert Shiller, explains how financial media and prevailing narratives can significantly influence investor sentiment. This is evident in the current market situation, where experts claim a brutal correction is imminent, potentially swaying investor behaviour despite contrary indicators.

The impact of mass psychology is particularly noticeable in the anxiety index moving deeper into the panic zone and bullish sentiment readings falling well below their historical average. These psychological factors can lead to irrational market behaviours, such as panic selling or excessive optimism, often causing markets to deviate from fundamental values. Understanding these psychological dynamics can help investors navigate market fluctuations more effectively and potentially identify profitable opportunities amidst the noise of mass sentiment.

Profiting from Market Extremes: The Contrarian Approach

The essay’s analysis supports a contrarian investing approach, which involves going against popular market trends. This strategy is particularly relevant in the current market environment, where uncertainty and volatility reign supreme. As the essay states, “When uncertainty rules the roost, market volatility is a trader/investor’s best friend.”

Historical examples demonstrate the effectiveness of this strategy:

1. The current market situation: Despite expert predictions of a brutal correction, the essay suggests that the markets might continue trending sideways, confounding both bulls and bears. A contrarian investor might see this as an opportunity to buy quality assets while uncertainty paralyses others.

2. The “silent correction” theory: The essay notes that many tech stocks experienced significant drops (over 30% in some cases) but recovered these losses twice as fast. This scenario presents an opportunity for contrarian investors willing to buy during periods of extreme pessimism in specific sectors.

3. The non-event pullback: While many expected a market crash in September, the pullback was minimal. Contrarian investors who didn’t succumb to the prevailing negative sentiment would have avoided unnecessary selling and potentially capitalized on the subsequent recovery.

These examples illustrate how understanding and leveraging mass psychology can lead to significant investment success. By recognizing extreme market sentiments and acting contrary to the crowd, investors can potentially buy quality assets at discounted prices during panics and maintain their positions when others are driven by fear or uncertainty.