Stock Market Graph; Market Crash Talk Amounts to Gossip

It seems like groundhogs day when it comes to experts and their stock market crash predictions; not a month has gone by since the markets bottomed in 2009, without some expert stating that the end is nigh. So far the only thing that has crashed is the egos of all these brain surgeons. When the market does finally crash, watch all these guys that got it wrong for years on end come rushing out to proclaim they are geniuses.

We have written more than a dozen articles since the markets bottomed stating over and over again that this bull market will only end when the masses finally decide to embrace it. Even though the masses are slowing jumping on board this bull market, they are still not euphoric, and until they are, all strong pullbacks should be viewed as buying opportunities

The Crowd Is Not Embracing Experts Market Outlook

In the articled titled Market Crash 2018 just another buying Opportunity we made the following comments:

Ask a madman how he is, and he might respond by telling you that “ the road needs to be fixed”. The answer has nothing to do with your question and on the surface has no pattern whatsoever, but if you turned around and looked at the road, maybe you would notice that it is in need of repairs. All you had to do was alter the angle of observance, and in doing so, you spotted something that most would have missed.

Nothing has changed since we penned that article and as we have stated so many times in the past, nothing will change until the masses start to jump up with joy. Note the bitcoin bull market ended when everyone and his grandma thought Bitcoin was a superb investment. When Idiots masquerading as experts started to issue targets of 1 million we knew the end was nigh and warned our subscribers to bail out and avoid bitcoin. The rest, as they say, is history.

This bull market is unlike any other bull market

It’s unlike any other Stock market bull because almost every ounce of free-market forces has been drained from this market. The Fed has been indirectly propping up this market via several rounds of Quantitative easing, and when that stopped, they kept rates low so the Corporate world could keep up the baton. How did the corporate world do this? They started to plough larger and larger amounts of money into their share buyback programs. Today these programs are so large that collectively the amount of funds allocated on an annual basis to these programs is bigger than the GDP of many Nations. Hence, market crash 2018 will have to wait until there is a feeding frenzy and only then will the markets put in a top.

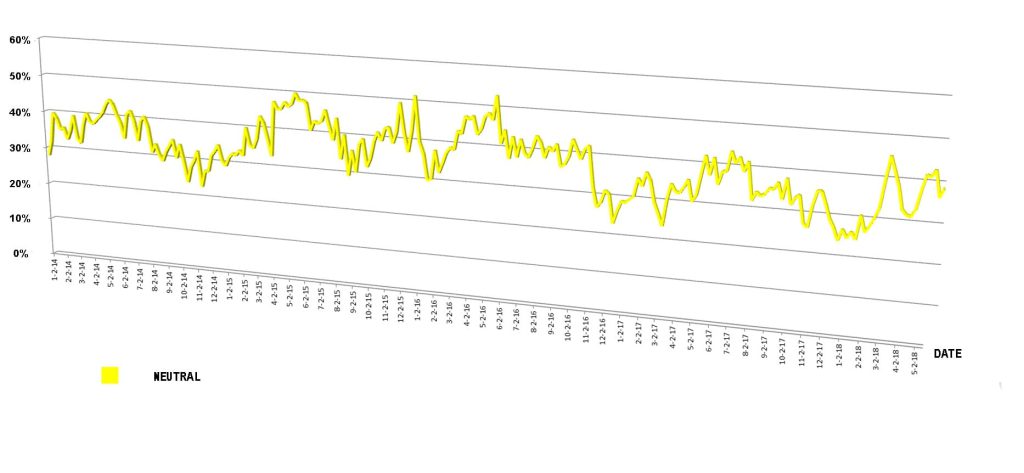

As can be seen from the above gauges, the crowd still has a long way to go before they embrace this market

This chart is, even more, telling for its a long-term chart of the number of individuals in the neutral camp. Individuals move to the neutral camp because they are uncertain of what the future holds. Uncertainty is a form of fear and from a mass psychology perspective its a very bullish long-term development. No bull market has ever ended on a note of uncertainty and as we can see the readings here are towards the high-end ranges. Hence instead of the markets crashing in 2018, they are more likely to correct and then rebound higher.

Stock Market Graph is not pointing to a crash

Hence, the Market outlook 2018 calling for a crash is based on Fiction:

History never changes; the markets will experience one very strong correction before this bull keels over. The problem is that the masses have been waiting for a strong correction since roughly 2013. The ironical part is that the markets will pull back strongly, but most likely they will be trading at a higher level than they were at 2013. In 2013 the Dow was trading in the 12,800-13,000 ranges. While it is possible that the Dow could drop to this level, it is a low probability event as the masses are far from Euphoric at the moment. Most likely the Dow will shed 25%-30% from its highs. Assume the Dow trades to 22K; at the extreme end, the Dow could drop to the 15,600 ranges. Market Update June 18, 2017

Until the trend turns negative, don’t listen to the experts for at best they are making uneducated guesses that they don’t even believe. Anything that comes from mainstream media should be taken with a jar of salt and a shot of whiskey. Until Fiat is eliminated, every massive correction should be viewed through a bullish lens for the Feds will be pouring even more copious amounts of money to resolve the next created financial disaster. Until the masses are ready to reject Fiat, boom and bust cycles are here to stay.

Stock Market Crash Update Oct 2019

The Stock Market Graph (at least of the major indices) is not supporting a crash. A strong correction is always a possibility as this market has been on a tear for a while and needs to let out some steam.

It takes zero effort to panic and the reward is exactly zero; those that panic in the face of adversity are given what they deserve. In terms of the market that means less than zero, as the masses always sell at the bottom and buy at the top. The astute individual that does not panic walks away with a huge reward and that is how it’s been for millennia and nothing is going to change for another 1000 years.

The markets are volatile (Sept to Oct period) and the crowd tends to overreact to the news. Remember, every disaster becomes a disaster because the masses were conned into believing a false narrative. You say no way; well then how come reacting to disasters pays so poorly. The stock market is the best barometer for the disaster-prone. If disasters paid off well, then the Dow should be closer to zero than 27K.

As always the masses are panicking at precisely the wrong time. We also see new subscribers overreacting to the current pullback, and this informs us that we are on the right side of the markets. While the trend is up, there are going to be hiccups along the way as no market trends in a straight line. The higher it moves the more volatility one can expect. Volatility is a Trend player’s best friend; in this case, it’s up so astute players can use strong pullbacks to add to current positions or open new positions.

If one looks closely at the Stock Market Graph of the Dow, one can see that the long term trend is still positive and that sharp pullback should be viewed through a bullish lens.

Stock market outlook march 2020

Go back to any bubble or market top and there is always one element present, the masses were in a state of ecstasy before the market plunged; even the tulip mania where the mass media element was missing ended on a note of euphoria. Without going further, we have to agree with some of the emails from subscribers that are long term investors stating that this is a generational buying opportunity. Forget about a great buying opportunity, for the current sell-off is based all suppositions and presumptions.

We will finish tabulating all the results of the sentiment data tomorrow and send another update out within 48 hours of gathering the data. The 1987 crash and 2008 crash fell into the category of the “mother of all buying opportunities” a small move now and we will be there, but we could get a setup that could blow these setups and create the “father of all opportunities”. Such an event is so rare that it might occur only once during an individuals lifetime. In the short term, there is no denying the landscape looks like a massacre but if one is going to focus only on the short term then one has no chance of banking massive gains.

Other Articles Of Interest

Ron Paul- Biggest Stock Market Bubble in History (July 20)

Stock Market Bull 2018 Still In Play; Buy The Dip (July 15)

Stock Market Crash 2018 Revisited (July 12)

Uranium Bull Market 2018; The Crowd psychology Outlook Updated (July 2018)

Stock Market 2018 Playbook; Follow The Trend (June 29)

Bear Market Fears-are they overblown? (May 28)

Stock Market Crash: Imminent or does this Stock Market Bull still have legs? (Apr 25)

Good Time To Buy IBM or Should You Wait? (Mar 15)

Is the Bitcoin Bull Market dead or just taking a breather? (Mar 8)

Is this the end for Bitcoin or is this a buying opportunity? (Jan 24)