Creative Strategies: How to Achieve Financial Freedom Before 30

April 11, 2024

Numerous experts tackle the question ‘How to Achieve Financial Freedom Before 30’ with intricate lists of tasks. Still, the answer can be distilled down to something quite simple: it begins with patience and discipline. Without these foundational traits, even the most comprehensive plans will falter.”

Achieving financial freedom is a goal for many, but reaching such a milestone before 30 can seem daunting, if not implausible. However, with innovative strategies and a keen understanding of market dynamics, it’s a target that can be hit with surprising accuracy. How to Achieve Financial Freedom Before 30 is not just a catchy phrase; it’s a practical aim that, with the right approach, can be within your grasp.

The journey towards financial independence must begin with a solid educational foundation. Market crashes, such as those in 1987, the dot-com bubble, the 2008 housing crash, and the COVID-19 pandemic, have historically presented unique buying opportunities. Bertrand Russell, the British philosopher and Nobel laureate, once noted, “The fundamental cause of the trouble is that in the modern world, the stupid are cocksure while the intelligent are full of doubt.” This rings particularly true in investing, where the masses often panic and sell, while the astute investor recognizes these moments as opportunities.

The Principles of Mass Psychology

Mass psychology suggests the crowd is typically wrong when fear and panic are palpable. It’s at these junctures where the contrarian investor, armed with knowledge and resolve, steps in. The past financial crashes have shown that assets can and do recover, often robustly, over time. As H.L. Mencken, the American journalist, satirist, and cultural critic, said, “The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary.” In investing, replace ‘politics’ with ‘market sentiments’, and you have a recipe for investment success: buy when others are unduly fearful.

A prime example of this is the 2008 financial crisis. When the masses were selling their stocks in a panic, savvy investors recognized undervalued assets and bought them at significantly lowered prices. As the market eventually rebounded, those who dared to go against the tide reaped substantial rewards.

The Art of Contrarian Investing

Contrarian investing isn’t just about going against the grain; it’s about understanding and acting on the discrepancies between an asset’s intrinsic value and market price. The Scottish Enlightenment philosopher David Hume emphasized the importance of reason and evidence. When applied to investing, one must look at the evidence of historical market recoveries and use reason to invest when others are fleeing the market. A notable example of contrarian investing is Warren Buffett’s decision during the 2008 downturn to invest $5 billion in Goldman Sachs. Buffett identified the intrinsic worth of the investment banking giant and took a position that many considered risky. This move paid off handsomely as the market stabilized and confidence in financial institutions was restored, illustrating the power of contrarian thinking in practice.

Technical Analysis and the Bandwagon Effect

Technical analysis incorporates various psychological elements, providing tools to gauge market sentiment and identify potential trend reversals. It’s at the heart of avoiding the ‘bandwagon effect’ — the tendency to do something merely because others are doing it. As John Law, the Scottish economist who believed in the psychological nature of financial markets, once said, “Money is not the value for which goods are exchanged, but the value by which they are exchanged.” This principle applies to stocks and assets; their true worth is not in their temporary market price but in what they represent in the underlying economy.

The famous adage attributed to banker Nathan Rothschild, “The time to buy is when there’s blood in the streets,” perfectly encapsulates the essence of contrarian investing and mass psychology. The best time to buy is often when fear is at its peak, a tactic employed by some of the greatest investors, including Warren Buffett. They recognize that market overreactions create price inefficiencies that can be exploited.

Buffett’s Wisdom and the Path Forward

Buffett said, “Be fearful when others are greedy, and greedy when others are fearful.” This simple yet profound advice is the cornerstone of achieving financial freedom before 30. By mastering the concepts of mass psychology, contrarian investing, and technical analysis, you can identify the moments when the market is ruled by fear and capitalize on them.

In conclusion, the path to financial freedom before 30 is not a straight line but a journey marked by learning, understanding, and the courage to counter the herd. It requires discipline, patience, and an unwavering belief in the principles of mass psychology and contrarian investing, bolstered by the insights provided by technical analysis. By embracing these strategies, especially during market turmoil, you can reach financial independence and achieve it earlier than you ever thought possible.

Conclusion: How to Achieve Financial Freedom Before 30

In conclusion, pursuing financial freedom before 30 is not merely a fanciful notion but an attainable goal grounded in innovative strategies and a profound comprehension of market dynamics. Alexander the Great once said, “There is nothing impossible to him who will try.” This sentiment resonates deeply in finance, where courage and determination often lead to extraordinary outcomes.

Throughout history, market crashes have presented unique opportunities for those who dare to defy the crowd. Bertrand Russell’s observation that “the stupid are cocksure while the intelligent are full of doubt” underscores the importance of rationality in the face of fear-induced hysteria. Similarly, H.L. Mencken’s insight into the nature of mass psychology reminds us to remain vigilant against the allure of herd mentality.

Contrarian investing, exemplified by Warren Buffett’s sage advice to “be fearful when others are greedy, and greedy when others are fearful,” offers a pathway to financial independence. Investors can confidently navigate turbulent waters by embracing this approach and incorporating technical analysis to discern market sentiment.

In the words of David Hume, “Reason is, and ought only to be, the slave of the passions.” Investing means leveraging reason to temper emotional impulses and seize opportunities when others recoil in fear. Nathan Rothschild’s timeless adage, “The time to buy is when there’s blood in the streets,” encapsulates the essence of contrarian thinking and the potential for substantial gains during periods of market distress.

Ultimately, achieving financial freedom before 30 requires wisdom, courage, and unwavering resolve. By heeding the lessons of history and embracing the principles espoused by the great minds of the past, individuals can embark on a journey towards prosperity and self-reliance. As we navigate the complexities of the financial landscape, let us remember that true wealth is not merely measured in monetary terms but in the freedom to live on our terms.

In the words of H.L. Mencken, “The urge to save humanity is almost always a false face for the urge to rule it.” Let us strive not only to attain financial freedom but also to wield it responsibly for the benefit of ourselves and future generations.

Engaging Articles to Enrich Your Mind

Long-Term Gold Targets: Exploring the Path to the Moon

Capitalizing on the Oil to Gold Ratio: An Ideal Time to Invest in Oil

Trading Chart Patterns Cheat Sheet: Mastering the Key to Success

Abu Bakr al-Baghdadi: The Rise and Fall of the ISIS Leader

Gold bullion bars prices: Trend Projections

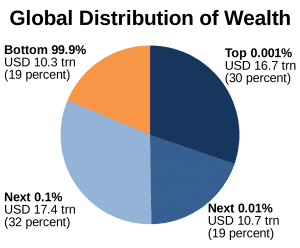

The Poor Get Poorer And The Rich Get Richer: Deepening Inequality

The Kurds: Defying Extremism and Paving the Path to Peace in Syria

Volatile Markets: Conquer Market Turbulence and Thrive

Is Religion Dying: Shaping Beliefs with New Discoveries

Exploring the Depths of the Unconscious Mind

Day Late and a Dollar Short: Lessons in Timing and Consequence

Fake Currency: Central banks Print money & buy bullion with it

Food for thought Archives

Is Religion a Scam? Unveiling Truths and Myths