Unveiling Fake Currency Realities in 2024: Debates, Risks, and Alternatives

Updated Jan 2024

He who trims himself to suit everyone will soon whittle himself away.

Raymond Hull

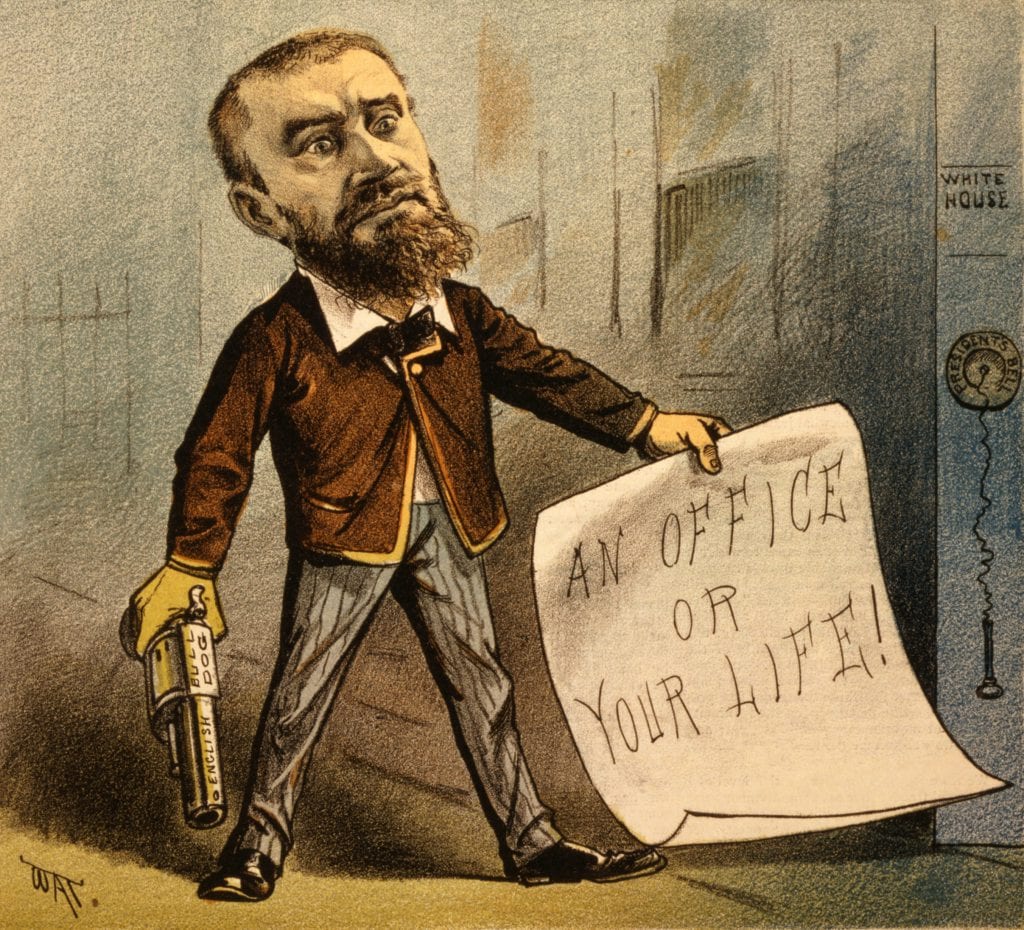

Currently, the discourse around the creation and use of fiat currency continues to be a contentious issue. Critics argue that central banks, with their power to print money at will, create ‘fake’ or ‘worthless’ currency and drive inflation. They believe this to be a manipulative process that devalues the hard-earned money of the common man while allowing central banks to purchase tangible assets such as gold, silver, and other commodities that retain real value.

According to a 2023 report from the Federal Reserve Bank of St. Louis, the U.S. M2 money supply, which includes cash, checking deposits, and easily convertible near money, increased by an unprecedented 25% in 2020. This surge was mainly due to the central bank’s response to the economic crisis caused by the Covid-19 pandemic. However, the increase in money supply led to inflation fears, as more money chasing the same amount of goods and services can lead to higher prices.

Even as economies recover, central banks worldwide keep interest rates low. They buy large government and corporate bonds, injecting more money into the economy. Critics argue that this rampant money creation could lead to hyperinflation, a scenario where money becomes worthless and only tangible assets retain value.

Proponents of alternative currencies like gold or cryptocurrencies believe these assets offer a hedge against the inflationary effects of fiat currency. Gold has been a store of value for thousands of years, and despite price fluctuations, it has maintained its worth over time. On the other hand, cryptocurrencies have a built-in scarcity mechanism, such as the 21 million coin limit for Bitcoin, which could potentially shield them from inflation.

However, it’s important to note that these alternative forms of currency are not without their issues. Cryptocurrencies are notoriously volatile, with prices that can swing wildly within short periods. And while gold has been a reliable store of value, it’s not practical for everyday transactions in a digital age.

In conclusion, the ongoing debate about fiat currency and its alternatives highlights our financial system’s complexity and potential pitfalls. While critics argue that central banks’ ability to create money amounts to a ‘scam,’ it’s crucial to remember that any currency system, whether based on gold, crypto, or fiat, requires trust and stability to function effectively. Furthermore, while alternative currencies offer potential advantages, they are not immune to issues such as volatility and practicality. As such, a balanced and informed approach is needed when considering the future of our monetary systems.

We will first adopt a historical perspective by analyzing this article from this point on. Those who neglect to learn from history are destined to relive it. Additionally, this article provides real-time insights into the positions we took and our performance. We believe that those who talk the talk should walk the walk, and this piece serves as a testament to our actions matching our words.

Fake Currency: Deceptive Tactics Unveiled

Many argue that every primary currency in the world falls under the “fake currency” category since governments can print new money at will without anything to back it up other than promises. This practice raises questions about the value of money and its impact on other assets, such as gold.

Recently, gold has closed above $1230, suggesting that a bottom is in or close at hand. While India’s decision to maintain taxes on gold and potentially increase them has dealt a blow to the gold markets, this news may be overshadowed by a more positive development concerning central bankers.

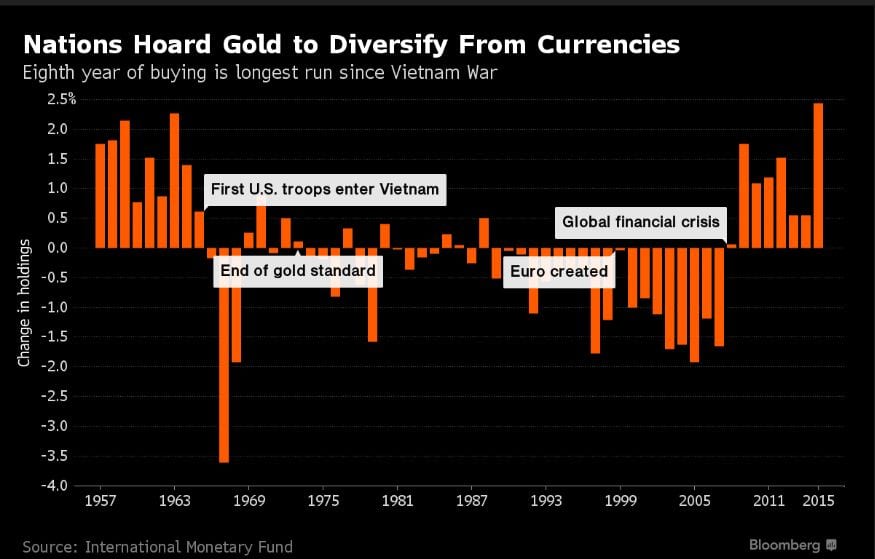

Over the past 24 months, central bankers have been purchasing gold, particularly in Russia, China, and Kazakhstan. Meanwhile, central bankers in the West are embracing negative interest rates, which may drive more investors towards gold as a safe-haven asset.

Source: www.bloomberg.com

According to the World Gold Council’s report for the 4th quarter of 2015, three factors stood out:

- Mining production fell for the first time since 2008

- Central bank buying remained strong – up 25% from Q4 2014. Q4 was the 20th consecutive quarter of net purchasing by central banks.

- The ETF market saw a slowdown in outflows: 133t in 2015, compared to 185t in 2014.

Euro and Dollar

The trend in the Euro has turned neutral from negative, and until it turns positive, all rallies are destined to fail. The Euro and Gold tend to trend in the same direction, and as the trend in the euro is still neutral, we have to assume that Gold will start to face some headwinds soon. However, there is a silver lining; Gold and the dollar have trended in unison in the past, and hence a weak euro does not mean that Gold bullion cannot continue trending upwards in the face of a stronger dollar.

On the other hand, the trend in the dollar is neutral, but not too long ago, it was up (bullish), and until it turns negative, the outlook favours a resumption of the dollar bull.

Negative interest rates major hurdle for Gold

A rate war seems to have begun as negative interest rates become more prevalent. In such a low-interest environment, gold tends not to fare well, and it will be interesting to see how it holds up as the rate war gains traction. However, the current action in the market looks promising, as gold is holding up well, and several gold stocks have experienced strong moves.

For those interested in investing in the gold market, here is a list of the top gold stocks based on price action.

Gold Update Nov 2019

We have a bullish MACD crossover on the monthly charts, and the trend is mildly positive for the first time in years. Now, if Gold manages to close above 1500, then a test of the 1800 ranges with a possible overshoot to 1920 is likely. Silver is a laggard and will only start to take off after the action begins to heat up in the Gold markets, but Silver is expected to outperform Gold Bullion in percentage terms.

The pattern (currently) is more robust for Bitcoin than it is for Gold; however, things could change fast. In the short term, though, Bitcoin investors should consider waiting for Bitcoin to release steam before deploying new capital.

Regarding Gold stocks, GFI looks interesting, and it is also the fourth-strongest stock in the sector in terms of relative strength. Entry points in the 4.50-4.70 range would be an excellent place to establish a position.DRD is another exciting play, albeit one that carries a bit more risk due to its volatile nature, and it would make for a good long in the 2.90-3.00 ranges.

Please all, and you will please none.

Aesop

Fake Currency: Update Feb 2023

It must be noted that some oppose the concept of fiat currency, alleging that it embodies a manifestation of government tyranny and exploitation. These dissenters argue that the government’s ability to print money is a tool of subjugation, resulting in inflation, currency devaluation, and the plundering of the common man’s hard-earned savings.

Furthermore, some proponents of alternative currency systems, such as gold or cryptocurrency, maintain that they provide a superior alternative to fiat currency due to their decentralized and transparent nature. They assert that such systems are less vulnerable to government meddling and market manipulation.

Nevertheless, it is crucial to remember that valid criticisms of these alternative currency systems also exist. For instance, cryptocurrency’s volatility remains a significant concern, while the practical challenges of using gold as a standard currency are substantial.

While fiat currency has been a bedrock of modern economies for decades, its merits and demerits must be evaluated prudence. Alternative currency systems, though intriguing, may not be the cure-all that some proponents claim. Ultimately, the best course of action is to weigh the pros and cons of each system and endeavour to establish a monetary framework that benefits all members of society.

Other articles of interest:

Achieve Financial Independence & retire Young by not being a Lemming (March 9)

Fed Will Shock Markets; Expect Monstrous rally in 2016 (March 6)

How to Profit from Misery & Stupidity (March 4)

Religious wars set to Rip Europe Apart (March 4)

Oil prices: bottomed out or oil prices heading lower (Feb 28)