Has the Market Bottomed? Assessing the Current State

April 26, 2023

Introduction

When investing, the focus should not solely be on determining whether the market has bottomed out. Instead, it is crucial to pay attention to the behaviour of the masses, as it plays a significant role in making profitable investment decisions.

Mass behaviour is important because emotions often drive the actions of investors. When the masses are panicking, it can be a favourable time to buy, as history has shown that they tend to be on the wrong side of the market in the long run. On the other hand, if the masses are not in a state of panic, it is wise to exercise caution and wait for a clearer market direction.

The euphoria among the masses serves as a warning sign. It indicates an overvaluation of assets and an unsustainable market rally. Moving into cash or exploring short-selling strategies may be prudent in such situations.

Focusing solely on the market bottom can be misleading. Various factors influence the market, and investor sentiment is one of them. It is crucial to be patient, wait for the right opportunity, and pay attention to the behaviour of the masses to make well-informed investment decisions.

In conclusion, understanding and considering the behaviour of the masses is essential for successful investing. Observing whether panic, caution, or euphoria prevails among the crowd can guide investors in navigating the ever-changing market landscape.

Has the Market Bottomed? Unravelling the Million Dollar Question

In pulling off this feat, the bears would throw in the towel, propelling the markets higher due to short covering. The bulls thinking that all is well, would buy the rip, and then when everything looks fine and dandy, the guillotine is likely to fall. Tactical Investor

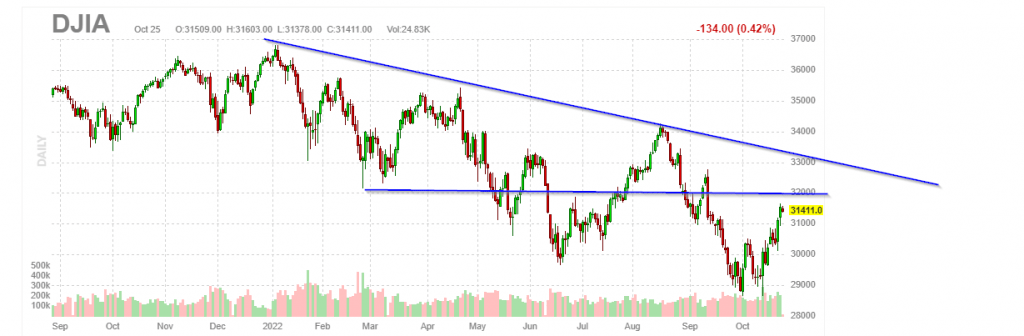

This chart provides an overview of how the big players will probably try to set both the bulls and the bears for a massacre. They don’t make as much coin when they target only one group. How would they do this? One sure way to trick both the bears and the bulls would be to make the Dow and several other indices break through their downtrend lines and create the illusion of a new bull. In this case, this would correlate to a move to the 34,300 to 34,650 range. In pulling off this feat, the bears would throw in the towel, propelling the markets higher due to short covering. The bulls thinking that all is well would buy the rip, and then when everything looks fine and dandy, the guillotine is likely to fall.

The Borrowed Playbook: Lessons from 2008-2009

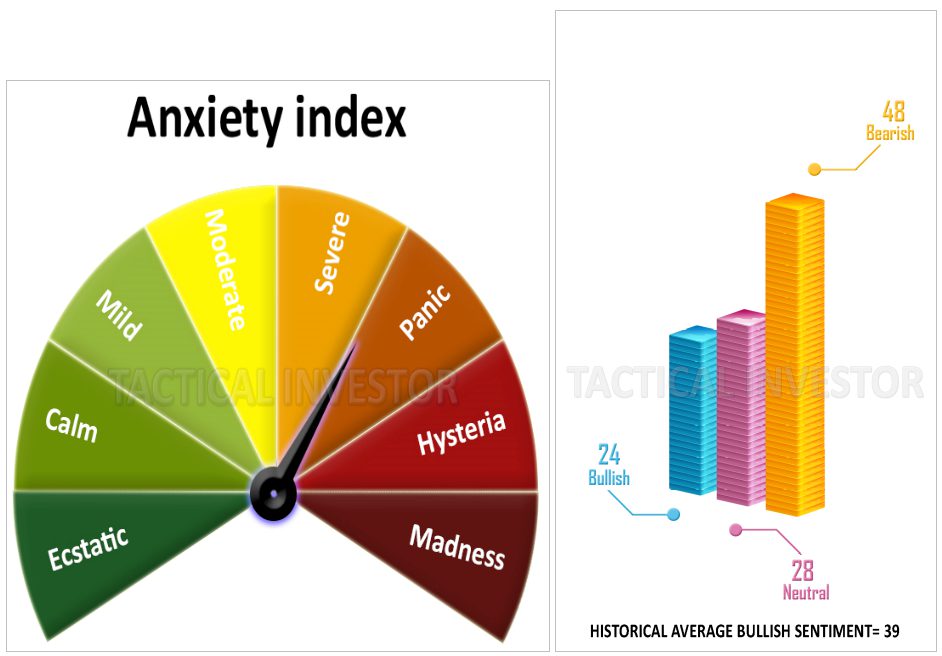

Interestingly, despite the strong rally the markets have mounted, bullish sentiment is trading significantly below its historical average, informing us that the big players borrow from the playbook used during the 2008-2009 correction. More importantly, it seems to be working magnificently, we might add.

Has the market bottomed, and what is the playbook? Scare the masses so severely that they refuse to invest in the Market for years. While the masses sit on the sidelines, the big players can continue accumulating shares in the best companies at a fraction of their original price. This technique can’t be used all the time. Otherwise, the crowd would catch on. It appears that it is employed every 12 to 14 years.

Confusion and Opportunities in Market Sentiment

Another factor contributing to confusion in the market is the recent attempt by the AAII Investor Sentiment site to create their version of a “Greed Indicator.” While measuring the spread between the Bulls and the Bears may be a commonly used method, we believe it is not the best measure of fear. Instead, we suggest combining the neutral camp with the bearish camp and subtracting that total from the number of bulls to get a more accurate picture of investor sentiment.

The neutral camp comprises individuals who are hesitant to take a position, including defanged bears and dehorned bulls. By overlooking these individuals, we risk misinterpreting the market sentiment. However, this confusion can also provide opportunities for savvy investors to build long-term positions.

Conclusion

Understanding and considering the behaviour of the masses is essential for successful investing. While determining whether the market has bottomed out is a common concern for investors, it is crucial to shift the focus to the behaviour of the masses as a more reliable indicator. Mass behaviour plays a significant role in making profitable investment decisions, as emotions often drive the actions of investors.

When the masses are gripped by panic, buying can be an opportune time. Historical evidence suggests that the masses tend to be on the wrong side of the market in the long run. Thus, panic indicates a potential reversal in market sentiment and presents an attractive opportunity for contrarian investors to enter the market.

Conversely, if the masses are not panicking, it is wise to exercise caution and wait for a clearer market direction. Deploying large sums of money into the market during periods of uncertainty may lead to increased risk and potential losses. Patience becomes crucial in waiting for the right opportunity to enter or exit the market.

Moreover, euphoria among the masses serves as a warning sign. When the crowd becomes excessively optimistic, it often signifies an overvaluation of assets and an unsustainable market rally. Moving into cash or exploring short-selling strategies may be prudent in such circumstances.

Focusing solely on the market bottom can be misleading, as various factors and investor sentiment influence the market. Investors can gain valuable insights into market sentiment and make more informed investment decisions by observing whether panic, caution, or euphoria prevails among the crowd.

In conclusion, understanding and considering the behaviour of the masses is essential for successful investing. Observing the masses’ panic or lack thereof can signal potential buying or selling opportunities. By going against the herd mentality and employing a contrarian approach, investors can take advantage of market fluctuations and navigate the ever-changing market landscape.

FAQ

Q: Why is it important to pay attention to the behaviour of the masses when investing?

A: The behaviour of the masses plays a significant role in making profitable investment decisions. Emotions often drive the actions of investors, and understanding their behaviour can provide insights into market sentiment.

Q: When is it a favourable time to buy in the market?

A: Buying can be a favourable time when the masses are panicking. Historical evidence shows that the masses tend to be on the wrong side of the market in the long run, so their panic can indicate a potential reversal in market sentiment.

Q: What should be done if the masses are not in a state of panic?

A: If the masses are not panicking, it is wise to exercise caution and wait for a clearer market direction. Deploying large sums of money into the market during periods of uncertainty may carry higher risks.

Q: What does euphoria among the masses indicate?

A: Euphoria among the masses indicates an overvaluation of assets and an unsustainable market rally. It serves as a warning sign for investors, suggesting a potential market correction or downturn.

Q: Why is focusing solely on the market bottom misleading?

A: Focusing solely on the market bottom may not provide a clear picture of the market’s direction. Various factors influence the market, and investor sentiment is one of them. By paying attention to the behaviour of the masses, investors can gain valuable insights for making well-informed investment decisions.

Q: What role does patience play in investing?

A: Patience is crucial in investing. Waiting for the right opportunity and observing the behaviour of the masses can help mitigate risk and avoid potential losses during periods of uncertainty.

Q: How does understanding the behaviour of the masses contribute to successful investing?

A: Understanding the behaviour of the masses provides insights into market sentiment and helps investors make more informed decisions. Investors can navigate the ever-changing market landscape more effectively by observing whether panic, caution, or euphoria prevails among the crowd.

Q: How does fear among investors indicate a market bottom?

A: When the masses are scared and running for the exits, it often indicates that a market bottom is near or has already occurred. This is because high levels of fear lead to oversold conditions in the market, creating buying opportunities for contrarian investors.

Q: What factors contribute to confusion in the market?

A: Factors such as the spread between bullish and bearish sentiment and the inclusion of the neutral camp in investor sentiment can contribute to confusion in the market. Overlooking the neutral camp may lead to misinterpretations of market sentiment.

Q: What opportunities can confusion in the market provide?

A: Confusion in the market can provide opportunities for savvy investors to build long-term positions. Investors can identify potential investment opportunities by understanding and analyzing market sentiment accurately.

Other Articles of Interest

Fed Data illustrates Economic recovery is a bad Joke

Nasdaq monthly chart? What is it saying

George Soros Criticises Trump: Protests Funded by His Organisation

Mikhail Khodorkovsky-Corrupt Neocon Oligarch

Trump wins debate- media lose along with Hillary

Why is Obama s purposely allowing radical Muslims into the Country

Russia vs USA: Timeline of US Actions Provoking Russia

Google Finance: What’s The Long Term Outlook For Google

What Is My Socioeconomic Status? Rich vs Poor

Market Rally: Will the Market Rally This Summer

The stock market is stuck in a trading zone

The Rise of Covid Resistance: A Response to Pandemic Fatigue

Fed-Fuelled Frenzy: Unveiling the Asset Bubble Phenomenon