What Is My Socioeconomic Status?

Updated July 2022

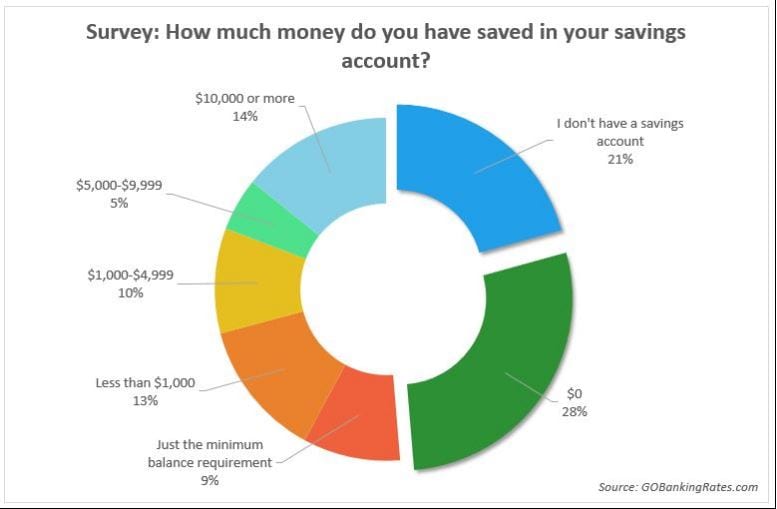

Savings are a crucial component of financial health, indicating preparedness for unexpected expenses. Unfortunately, Americans struggle with budgeting and saving, lagging behind their Asian counterparts in discipline. In fact, over 62% of Americans have less than $1,000 in savings, a startling revelation that shocks foreigners who expect more from a developed nation. Compared to many third-world countries, even their middle-class families often have more money saved than the average American middle-class family. It’s time to prioritize financial preparedness and budgeting to reverse this trend.

According to personal finance expert Cameron Huddleston, it’s worrisome that 62% of Americans have less than $1,000 in savings. This means they are likely unprepared to cover unexpected expenses and may have to rely on credit or other means. Unfortunately, many Americans continue to live beyond their means, spending money they don’t have on things they don’t need. This leaves them vulnerable to financial ruin, and the reality of their situation may not hit until it’s too late. It’s time to start prioritizing financial preparedness and living within our means to avoid disaster.”

What Is My Socioeconomic Status? Chinese Consumers seem to be faring better.

Our recent article illuminates the remarkable savings of China’s middle class, which Credit Suisse estimates to exceed $50,000. Over the past two decades, China’s middle class has expanded at twice the pace of the United States, focusing on evaluating wealth rather than mere income and considering variables like unemployment. This starkly contrasts the typical American worker, who usually holds less than $5,000 savings.

Considering that China constitutes one-fifth of the global population but possesses only 10% of worldwide wealth, it becomes evident that the nation is emerging as a global powerhouse. China already boasts more than a million millionaires, with their numbers increasing at a swifter rate than in the United States. Furthermore, China currently leads the world in the number of billionaires, and it is only a matter of time before it surpasses the United States in the count of millionaires as well. Full Story

The Widening Economic Divide: How Corporations Thrive While the Poor Get Poorer

Economic inequality in the United States is a pervasive and growing problem that has been the subject of much research and debate. Despite the country’s economic growth in recent decades, the gap between the rich and poor continues to widen, with the wealthiest Americans amassing unprecedented wealth and power. Meanwhile, low-income Americans struggle to make ends meet, with many living paycheck to paycheck and facing mounting debt and financial insecurity.

This inequality poses serious risks to the economy. When the bulk of economic gains go to a small fraction of top earners, it reduces the spending power of the vast majority of consumers that drive growth. Stagnant wages and financial hardship mean lower consumer spending, which can drag the economy over the long term. Additionally, inequality may undermine the ability of low-income Americans to invest in education and skills training that allow them to participate fully in the workforce. A less educated population is detrimental to innovation and competitiveness. With economic resources increasingly concentrated at the top, mass consumption that supports employment may falter, further fueling inequality. Urgent action is needed to generate more widely shared prosperity and curb these feedback loops between wealth, wages, and overall economic performance.

The Impact of Economic Inequality on American Society and Democracy

One of the primary catalysts for economic inequality in the United States lies in the consolidation of wealth and influence within a select group of corporations and individuals. The dominance exerted by these entities in the economy has given rise to a system wherein the affluent amass even greater wealth while those with less struggle to keep pace. Within this framework, the interests of a minority take precedence over those of the majority, resulting in a society increasingly divided along economic lines.

The consequences of this widening economic chasm extend far and wide, impacting various facets of life, including access to healthcare and education, as well as political clout and social mobility. Individuals with lower incomes are more prone to encountering adverse health outcomes, reduced life expectancy, and limited prospects for economic progress. Simultaneously, the aggregation of wealth among a select few individuals and corporations has raised concerns about the erosion of democratic principles and the consolidation of economic influence within the hands of a minority.

The Far-Reaching Impacts of Economic Inequality in America

To address this issue, policymakers and researchers have proposed various solutions, including progressive taxation, increased access to education and healthcare, and more robust labour protections. However, these proposals often face fierce opposition from those who benefit from the current system, and progress toward greater economic equality has been slow. If left unaddressed, the consequences of persisting high inequality could further damage American society’s social and economic fabric.

Already, economic inequality is linked to poorer health and social outcomes. Extensive research shows that people in less economically equal societies tend to be unhealthier and die younger than those in more equal nations with similar levels of wealth. This suggests that inequality itself introduces stress and status competition that undermine well-being. High inequality is also correlated with lower levels of social mobility intergenerationally, meaning children from low-income families find it harder to climb the economic ladder. When opportunity is restricted in this way, it hinders human capital development and economic growth over the long run.

Additionally, as the share of national income concentrated at the top continues to rise, it pulls political influence. Wealthy individuals and corporations now have outsized sway over the policymaking process, as campaign donations and lobbying expenditures have soared in recent decades. This distorts policy outcomes away from the preferences and needs of average citizens. If left unchecked, such political capture threatens the integrity of American democracy itself by undermining the principle of one person, one vote. Urgent action is clearly needed to curb these pernicious feedback loops between economic power, political power, and policy outcomes that primarily benefit the few, not the many.

Game Plan: Invest for the future

Stay informed on the latest developments in mass psychology and contrarian investing with our free newsletter, covering everything from financial markets to global food supplies. Learn to invest wisely and protect yourself from the whims of corporations and government-controlled social security. Utilizing mass psychology, we can spot trends in any market and help you benefit from them. Live below your means, invest in the stock market, and remember that in every disaster lies an opportunity. Subscribe now for valuable insights and a better understanding of these essential concepts.

Other Articles of Interest:

Negative rates will fuel the biggest Bull Market rally in History (25 May)

Millennials being Squeezed out of Housing Market (20 May)

The problem is Fractional Reserve Banking-we don’t need Gold standard (15 May)

BBC Global 30 Index Signals Dow Industrial Index will trend higher (11 May)

Stock Market Bull not ready to Buckle (4 May)

Fear mongers are parasites that profit from your fear (2 May)