The Tactical Investor’s Five Minute Financial Insights Project aims to cut through the noise and provide relevant financial data concisely and entertainingly.

The project aims to challenge the status quo of sensationalism and gossip that dominates the financial news industry by utilising principles such as mass psychology, contrarian thinking, and technical analysis. The Tactical Investor’s mission is to provide meaningful insights that can be digested in just five minutes.

In navigating the sea of information and weaponized news, it is essential to maintain a healthy dose of scepticism and consider the source’s credibility. While no single source can be trusted completely, reputable sources with a history of credibility are more likely to provide accurate and trustworthy information.

Overall, the Five Minute Financial Insights Project and the Tactical Investor aim to bring a new level of rigour and elegance to the financial news space, making it easier for readers to navigate the landscape confidently. Focusing on providing financial insights minus nonsense, the project seeks to help readers make informed decisions based on accurate information.

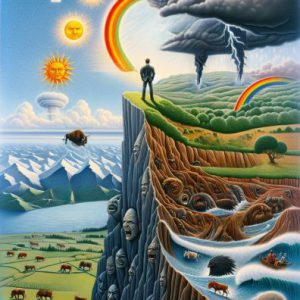

The Psychology of a Market Cycle: Navigating Emotional Turbulence

The Power of Investing: Key to Early Retirement and Well-Being

The Audacious Rise: How much has the stock market gone up in 2016

Palladium History: Pursuing Profitable Trends

From Zero to Stock Market Hero: Stock Investing for Dummies PDF

Percentage of Americans That Own Stock: Unlocking the Data

Real Estate Investing for Dummies: The Straightforward Path to Building Wealth

Tantalizing Uranium Stocks Soaring: A Contrarian Perspective

Refinement and Riches: Uncover the Luxurious World of Financial Freedom Books

Investor Psychology Cycle: Stand Strong Against the Herd

Wisdom in Reverse: Learning the Hard Way How to Lose Money in Stocks

Clear-Cut Investing: Distinguishing Fundamental Analysis from Technical Analysis

Market Psychology Chart: Tips for Informed Investment Decisions

Selling Covered Calls For Income: Elevate Your Income Strategy

Contrarianism: Capitalizing on Dissent in the Market Maze

Market Timing Strategies: Debunking Flawless Predictions

How to boost your immune system: Simple Ideas

Buy When There’s Blood in the Streets: Adapt or Die