Investor Psychology Cycle: Forge Your Path

Updated April 2024

Some would liken today’s markets to Elon Musk; the guy is erratic, and TSLA’s inconsistent stock price action validates this point. However, comparing the stock market to Elon Musk, the CEO of Tesla, is an oversimplification and does not accurately capture the intricacies of the financial world.

While it is true that Elon Musk’s behaviour has been erratic at times, this does not necessarily correlate to the behaviour of the stock market as a whole. Furthermore, while Tesla’s stock price has been volatile, it is essential to note that the company is a disruptor in the automotive industry and is pushing previously thought impossible boundaries.

Additionally, suggesting that one should short Tesla’s stock based solely on its CEO’s behaviour is risky and can result in significant losses. As evidenced by the recent losses of short sellers, betting against the market can prove a costly mistake.

Instead, please focus on the psychological state of the masses when it comes to the market. In the case of Tesla, the stock has a cult-like following, and bad news has not significantly impacted its price. Applying Mass Psychology to this situation would have yielded better results and prevented losses.

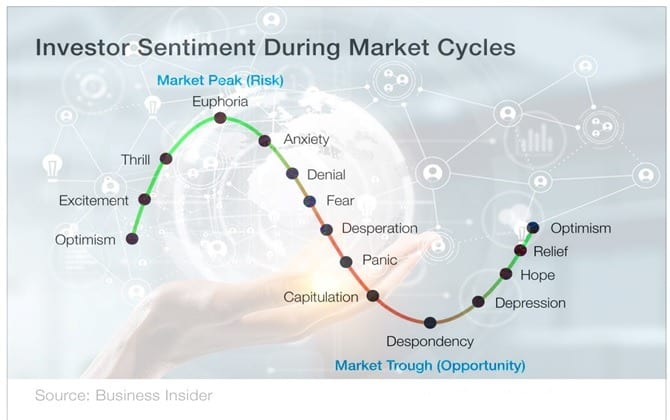

Investor sentiment and Market Cycles

This chart does an excellent job of reflecting the mass mindset regarding the market. However, it is interesting to note that despite its accuracy, very few individuals or organizations use this valuable information.

The Wall Street Journal recently reported a record $3.4 trillion in cash sitting on the sidelines, waiting to be invested in the market. While this influx of money will undoubtedly push markets higher, it is more important to note that the crowd is still far from bullish. Looking at the sentiment below, it is clear that there is no consistency in bullish sentiment, as it has not remained above 60% for three consecutive weeks in years.

We cannot recall seeing sentiment above 60% for three weeks in a row since the beginning of this bull market, and this is a telling development indeed.

Investors must pay close attention to this lack of consistency in bullish sentiment and act accordingly. While there is undoubtedly money to be made in the market, it is essential to approach investing cautiously and consider the psychology of the masses before making any decisions.

This sentiment data was tabulated before Friday’s sell-off; therefore, it appears that the crowd was already spooked before Friday’s sell-off, further cementing the view that a sharp pullback has to be viewed as a blessing in disguise. Market Update Jan 31, 2020

The current sentiment data remains unchanged in bearish readings, but there has been a slight rise in bullish readings compared to the previous update. This seems to be a contradiction; the crowd initially panicked, then turned bullish, resulting in a surge in the market to new highs, yet the bears still seem to dominate. This inconsistency highlights that the central theme dominating the masses is still uncertainty. As investors, it is essential to take note of this and approach the market cautiously.

Investor Psychology: March 2023 update

As we wrap up 2022, the markets managed their best action in about three weeks on Wednesday due to oversold technical conditions and anticipation of a Santa Claus rally attracting buyers. However, market players remain skittish as they digest a slew of gloomy market forecasts for 2023, which has resulted in elevated volatility and some random movement. Mass psychology indicates that the best time to invest in the market is when the masses are in a state of disarray or in panic. This makes me hopeful for some short-term relief during the Santa rally period.

The Santa rally, historically starting the day before the Christmas holiday and lasting until the end of the year, is marked by higher bouts of volatility.

According to a survey released on Monday, wealthy investors expect this year’s stock market nightmare to worsen in 2023, with most predicting a US recession. Bearish sentiment has hit its highest level since the Great Recession, with 56% of millionaire investors anticipating the S&P 500 will post a double-digit loss next year. The gloomy outlook reflects mounting fears on Wall Street that a year of sharp interest rate hikes by the Federal Reserve will topple the US economy into a recession.

Solid majorities in a new survey by State Street Global Advisors say they are worried about ongoing market volatility and inflation, with nearly three-quarters of respondents saying they are concerned about inflation. Sixty-four per cent of respondents expect that stock market volatility will persist for at least another year. While passive funds and ETFs won’t wholly supplant active managers, their market share will continue to rise.

Despite the market’s uncertainty and negative outlook, two-thirds of investors from the latest MLIV Pulse survey believe that holding cash in their portfolios will bolster their performance in the year ahead. Such times of uncertainty present opportunities for strategic investments, and mass psychology supports investing when the masses are uncertain.

Conclusion: Investor Psychology Cycle

We firmly believe that investors with a long-term view should view sharp market corrections through a bullish lens. History has shown that markets tend to revert to the mean, meaning that when fear subsides, markets typically resume their upward trend. Despite the massive sell-off driven by fear, the trend remains positive, according to our Trend Indicator. Therefore, I advise Tactical Investors to view sharp pullbacks as potential buying opportunities.

So why have there been hysteria among the roughly 3,000 individuals who have succumbed to the coronavirus so far? In my opinion, the problem lies with weaponized news. Sensationalized media coverage can trigger irrational fear among the masses, leading to panicked selling and a sharp market downturn. As an investor, staying informed is essential, but it’s equally important to remain level-headed and not let emotions guide investment decisions.

Remember, mass psychology suggests that the best time to invest in the market is when the masses are in disarray or panic. Investors can achieve better returns in the long run by keeping a long-term view and taking advantage of market corrections.

Other Articles of Interest

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

The Statin Scam: Deadly Profits from a Pharmaceutical Deception

Copper Stocks: Buy, Flee, or Wait?

Dow 30 Stocks: Spot the Trend and Win Big

Coffee Lowers Diabetes Risk: Sip the Sizzling Brew

3D Printing Ideas: Revolutionize Your Imagination

Beetroot Benefits for Male Health: Unlocking Nature’s Vitality

Norse Pagan Religion, from Prayers to Viking-Style Warriors

Example of Out of the Box Thinking: How to Beat the Crowd

6 brilliant ways to build wealth after 40: Start Now

Describe Some of the Arguments That Supporters and Opponents of Wealth Tax Make

What is a Limit Order in Stocks: An In-Depth Exploration

Lone Wolf Mentality: The Ultimate Investor’s Edge

Wolf vs Sheep Mentality: Embrace the Hunt or Be the Prey

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague