Challenges in Technical Analysis of The Financial Markets

Updated December 5, 2024

The Fierce Art of Navigating Financial Markets: When Technical Analysis Meets Practical Strategy

Markets are a battlefield, and every trader is a soldier. Yet, most march blindly into the fray, clutching technical analysis (TA) charts as though they are sacred relics, while others, drunk on mass psychology (MP), believe they can divine the market’s soul. Both approaches alone are flawed and dangerous. Like a general who relies only on maps while ignoring the morale of their troops, traders who lean solely on TA or MP are destined to lose the war, regardless of how many battles they win.

Let’s not mince words: the financial markets are unforgiving. They prey on the weak, punish the arrogant, and humble the overconfident. However, opportunities abound for those who understand the interplay between TA and MP and wield strategic tools like selling puts to collect premiums or funding long-term calls (LEAPS) during market corrections.

Let’s cut through the noise and delve into the art of merging technical analysis with practical strategy with a sharp dose of wit and wisdom.

The Mirage of Technical Analysis

Technical analysis is often treated as the holy grail of trading. Look at a chart, spot a pattern, and voilà—profit. But the reality, much like the promises of a slick-talking politician, is far more complicated. The market is not a machine; it’s a living, breathing beast fueled by fear, greed, and manipulation.

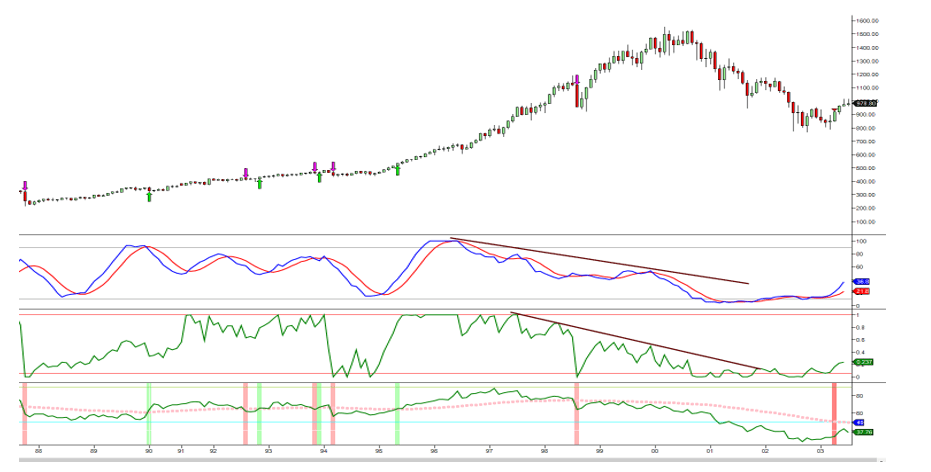

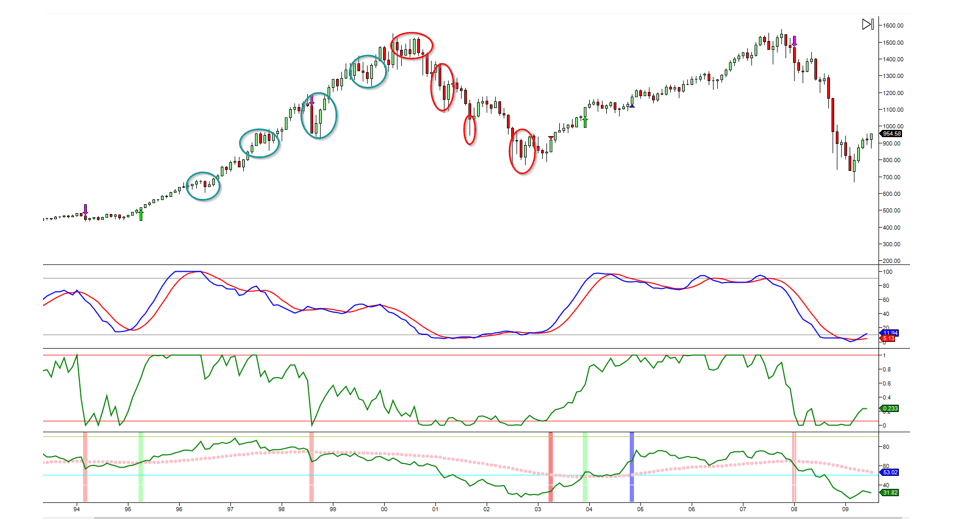

Consider the period from 1996 to 2001. TA screamed warnings of doom as negative divergence signals multiplied. The charts practically begged traders to short the market. But what happened? Those who heeded these signals lost fortunes. The market continued to rise, defying “logic” and TA’s supposed wisdom. Then came the cruel twist in 2001 (shown below): a deceptive buy signal. Investors, bloodied but hopeful, jumped back in—only to watch the SPX drop another 20%. Seven years of false signals and missed opportunities. Would you have had the stomach to keep going?

Let’s zoom out and examine the bigger picture. Technical analysis (TA) didn’t start working well again until March 2003. So, ask yourself this question: Would you have the courage to jump back into the Market after enduring losses for close to seven years?

Moreover, even when TA started to work again, it began giving false sell signals as the SP500 traded in the exceptionally overbought range from 2004 to 2008, issuing numerous misleading sell signals.

In contrast, Mass Psychology (MP) would have prevented this dangerous dance of death, which is precisely why we have unwavering confidence in it.

TA’s failure during this period highlights a brutal truth: Charts lie as often as they tell the truth. They reflect only past movements, not the psychology driving them. Mark Twain might have mused, “History doesn’t repeat itself, but it often rhymes.” The market’s movements are poetry written in the ink of human emotion.

The 1970s, 1980s, 1990s and other periods show the risks of relying solely on TA or fundamentals. The yearly S&P 500 chart illustrates this unpredictable behaviour:

Livermore’s insight is timeless: “There is nothing new on Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Enter Mass Psychology: The Market’s North Star

If technical analysis is the map, mob psychology is the compass. It doesn’t just show where the market is headed—it explains why. Investors are not rational beings, and markets are not efficient. Headlines, rumours, and the grand theatre of human emotion sway them.

Take the COVID-19 crash. TA might have told you to bail out as the market plummeted. But MP—the understanding of fear and greed—revealed the opportunity. Sentiment indicators were screaming “panic,” a classic contrarian buy signal. Those who embraced MP bought at the bottom and rode the recovery to historic highs.

As one wise trader said, “The market is never wrong; it’s just the opinions about it.” MP helps you see through the noise, recognize when the herd is stampeding off a cliff, and position yourself on firm ground.

The Strategic Genius of Selling Puts

Now, let’s pivot to a strategy that combines TA, MP, and a dash of cold, hard logic: selling puts. This strategy is simple at its core: sell a put option, collect the premium, and wait. If the stock drops to the strike price, you buy it at a discount. If it doesn’t, you keep the premium. Either way, you win.

But here’s the twist: sell puts only when the market is in turmoil. When fear grips the market and prices plummet, volatility spikes and premiums soar. This is when you step in, like a predator stalking its prey.

For example, during the COVID crash, the VIX—the market’s fear gauge—skyrocketed. Put premiums through the roof. Selling puts on high-quality stocks at discounted strike prices was a no-brainer. Those who had the courage to do so collected hefty premiums and positioned themselves to buy excellent companies at bargain prices if the market fell further.

This strategy is not for the faint of heart. A deep understanding of TA is required to identify support levels and MP to gauge market sentiment. But for those who master it, the rewards are immense.

Selling Puts and Buying LEAPS: The Ultimate Contrarian Play

Now, imagine taking it a step further. Instead of pocketing the premiums from selling puts, you use them to buy long-term call options (LEAPS) on the same stocks. This strategy is the financial equivalent of turning defence into offence.

Here’s how it works:

- Wait for a Market Crash: Crashes and strong corrections are your playground. When markets are in freefall, fear spikes, and greed vanishes. This is when you strike.

- Sell Puts: Target high-quality stocks that you’d love to own at lower prices. The higher the volatility, the juicier the premiums.

- Buy LEAPS: Use the premiums to purchase long-dated call options on the same stocks. These options expose you to a potential recovery without tying up too much capital.

Let’s break this down with an example:

During the 2020 crash, you could have sold puts on a blue-chip stock like Microsoft at a strike price 20% below its current level. The premium collected could then be used to buy LEAPS on Microsoft, expiring in 2022 or 2023. If the stock recovers, the LEAPS will explode in value, delivering massive returns. You still keep the premium from selling the puts if it doesn’t.

This strategy is not just financially savvy—it’s psychologically empowering. It forces you to embrace corrections rather than fear them. After all, as one contrarian quipped, “The best time to buy is when there’s blood in the streets.”

The Role of Technical Analysis in This Strategy

Technical analysis does have a role to play here, but it’s not the lead actor—it’s the supporting cast. Use TA to identify key support levels, oversold conditions, and reversal patterns. But don’t rely on it alone. Combine it with MP to understand the broader context.

For instance, during the COVID crash, TA might have pointed to oversold conditions on the RSI or a bullish divergence on the MACD. But MP told you why these signals mattered: fear was high, and the market was ripe for a rebound. Together, these tools provided a roadmap for action.

The Seduction of Greed and the Wisdom of Patience

Every trader faces the siren call of greed. It whispers promises of quick profits and easy wins. But as any seasoned investor knows, the market punishes greed mercilessly. The true path to wealth lies in patience and discipline.

Selling puts and buying LEAPS requires both. It would help to wait for the right moment—a market crash or correction—when fear dominates and prices are irrationally low. It would help if you resisted the urge to act prematurely or chase high-flying stocks. And once you’ve executed your strategy, you must wait for the market to prove you right.

One trader famously said, “The big money is not in the buying and selling but in the waiting.”

Lessons from History

History is full of lessons for those who dare to learn. The 1970s saw rampant inflation, the 1980s brought a massive bull market, and the 1990s witnessed the dot-com bubble. In each case, those who combined TA and MP with practical strategies like selling puts and buying LEAPS emerged victorious.

Consider the aftermath of the 2008 financial crisis. Those who sold puts and bought LEAPS on high-quality stocks like Apple, Amazon, or Microsoft during the depths of the crash saw extraordinary returns as the market recovered—the same pattern repeated during the COVID crash.

These examples highlight a timeless truth: Market crashes are not to be feared but embraced. They are the rare moments when the market’s irrationality works in your favour.

Conclusion: Mastering the Art of Trading

Combining technical analysis (TA) and mass psychology (MP) has proven to be a powerful strategy for navigating financial markets. As Peter Lynch noted, “In the stock market, the most important organ is the stomach. It’s not the brain.” Relying solely on TA can lead to significant losses, as seen from 1996 to 2001 when negative divergences and false buy signals misled investors.

Machiavelli’s wisdom applies: “There is nothing more difficult to take in hand, more perilous to conduct, or more uncertain in its success than to take the lead in introducing a new order of things.” After nearly seven years of losses, TA only became more reliable in March 2003. From 2004 to 2008, TA continued to generate false signals in an overbought market.

MP recognizes the role of emotions and biases in driving market sentiment. As Mencken observed, “The men the American people admire most extravagantly are the most daring liars; the men they detest most violently are those who try to tell them the truth.” Big players can manipulate short-term trends but not long-term ones.

The financial markets are a game of strategy, psychology, and timing. Technical analysis provides the tools, mass psychology offers the context, and strategies like selling puts and buying LEAPS give you the edge.

But remember: this is not a game for the timid or the reckless. It requires courage, discipline, and a willingness to embrace uncertainty. As one philosopher-trader put it, “Fortune favours the brave, but the market rewards the prepared.”

So, arm yourself with knowledge, sharpen your skills, and wait for the right moment. When the next crash comes—and it will come—you’ll be ready. And in that moment, you won’t just survive the market’s chaos—you’ll thrive in it.

Horizons of Knowledge: Exceptional Perspectives

Mind Control Techniques: Mastering Market Dynamics for Success