What Might Cause a Change in the Value of Fiat Money?

March 25, 2025

The value of fiat money, unbacked by commodities and reliant on government trust, is sensitive to economic health and governance. Factors influencing its value include inflation, GDP growth, interest rates, and geopolitical events. Leadership changes and policies shape market confidence, as seen with Brexit. Supply and demand, public trust, and the rise of cryptocurrencies also play a role. Understanding these dynamics is crucial for investors to navigate fluctuations and make informed decisions.

The Influence of Inflation and Deflation on Fiat Money Value

Inflation and deflation are critical forces that shape the value of fiat money. Inflation reduces purchasing power as prices rise, while deflation increases it through falling prices. Economic conditions, financial stability, trade balances, and political stability influence these phenomena. Central banks play a pivotal role in managing inflation and deflation through monetary policy, interest rates, and adjustments in the money supply. Missteps in these areas can lead to economic imbalances and wealth disparity.

Interest Rates and Fiat Money Value

Interest rates significantly impact the value of fiat money. Lower interest rates encourage borrowing and spending, stimulating economic growth. Conversely, higher interest rates deter borrowing due to increased costs, reducing economic activity. Central banks manipulate interest rates to influence financial stability and currency value. For instance, they can curb inflation by raising rates, which may disproportionately affect average individuals. Conversely, lower interest rates can stimulate the economy but may lead to increased borrowing and spending, potentially causing inflation.

Economic Growth and Fiat Money Value

Economic growth is a crucial determinant of fiat money value. A robust economy, characterised by rising GDP, employment, and business expansion, attracts investment and boosts currency value. Conversely, economic downturns erode investor confidence, weakening the currency. The strength of a currency also impacts trade balances and economic competitiveness, influencing imports and exports. Thus, the state of the economy and its growth prospects are vital in determining the value of fiat money.

Government Policies and Trade Balances

Government policies, including fiscal measures, directly impact the value of fiat money. Excessive spending can lead to inflation, while austerity measures may cause deflation. Trade balances are also critical; a trade deficit increases demand for foreign currencies, devaluing the local currency, while a trade surplus boosts the currency’s value. Central bank monetary policies influence inflation and deflation, but inconsistent strategies can lead to market uncertainty. Understanding these dynamics is essential for assessing risks and opportunities in currency markets.

Deciphering the Dynamics: Unravelling the Influence of Fiat Money and Media Control

You can buy all the main media outlets if you control the money. When you control the media and the money supply, you are the king of the hill; less than 10% of the populace is strong enough to resist falling for what they have been directed to see. Tactical Investor

Control over fiat money—currency without intrinsic value but sanctioned by government decree—has historically been a powerful lever. When combined with influence over media outlets, this control can consolidate power, shaping public perception and decision-making. This was evident during the 2008 financial crisis when banks with the authority to generate money engaged in high-risk lending, precipitating a global economic downturn. The crisis highlighted how wealth creation detached from tangible assets can exacerbate societal wealth gaps, with the affluent accruing more wealth and the average person struggling.

Fiat money’s reach extends into the media, where financially robust conglomerates can steer public discourse and mould societal norms. However, fiat money is not inherently problematic; it enables trade and economic expansion. The issue lies in its management and concentrated control, which have led to financial volatility, social inequality, and the manipulation of societal values.

Examining the Controversial Role of Fiat Money in Modern Civilisation

Fiat money is behind many societal and economic dynamics we observe today. As the money supply continues to expand, levels of polarization are expected to soar. With an unlimited supply of money and a deep understanding of mass psychology, top players can push these trends to their limits. The only defence against this manipulation is to remain emotionally detached and view these events as a form of reality TV. Market crashes, often perceived as catastrophic, are seen by some experts as buying opportunities.

The Federal Reserve, for instance, is unlikely to allow markets to crash and burn; instead, it creates the illusion of a crash, prompting the crowd to react predictably by selling off assets. Understanding this manipulation, savvy investors can buy assets at a lower price. This perspective aligns with groupthink psychology, which suggests selling when the masses are euphoric and buying when they are panicking or uncertain. Recognising these patterns and understanding the underlying manipulation can provide a strategic advantage in navigating the complexities of modern financial systems.

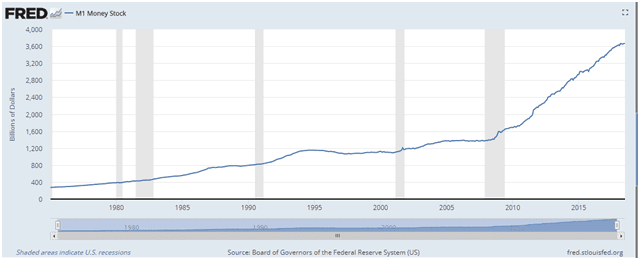

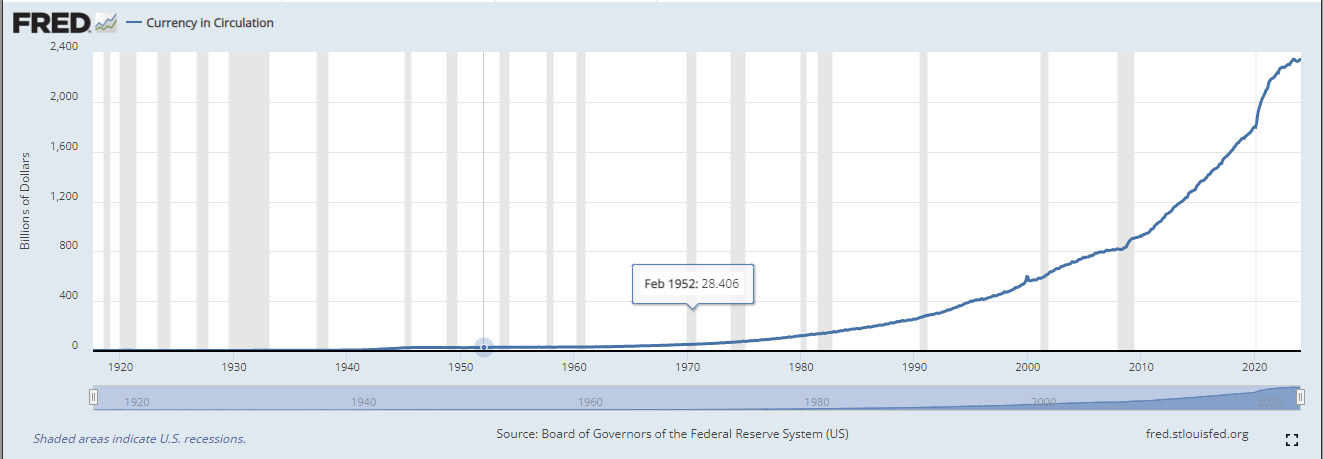

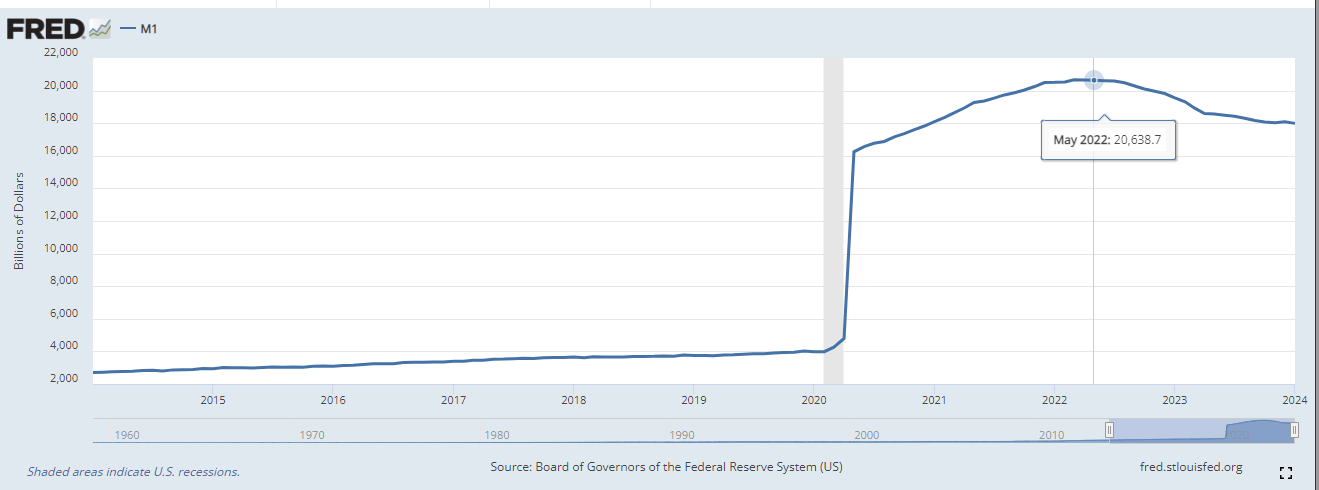

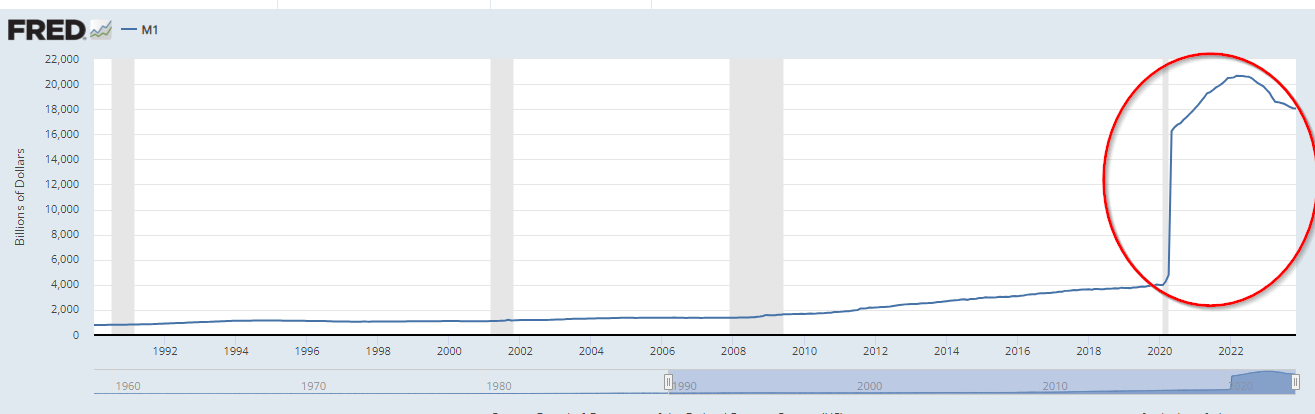

Take a look at these charts, and a pattern will start to emerge.

The shaded areas represent recessions, which usually follow disasters. After each recession, the currency in circulation continued to soar.

The M1 money stock followed a similar trajectory, surging dramatically after each economic downturn. The spike following the 2008 financial crisis was particularly noteworthy, but it pales compared to the astronomical leap from 2015 to 2024. The sheer magnitude of this increase is nothing short of mind-boggling. To compound the issue, the national debt is ballooning at an alarming rate, with approximately 1 trillion dollars added every 100 days. This staggering accumulation of debt, coupled with the unprecedented expansion of the money supply, paints a deeply concerning picture of the nation’s financial health.

Fiat Money: The Mother Of All Destructive Weapons

Moreover, the same can be said of the monetary base, but the move in this chart was explosive after the 2008 housing crises.

In 1790, the national debt was a minuscule $75.4 million; today, we add more than that every month. So, experts, mainly from the “hard money camp”, state that the masses will someday revolt. The only genuine part in that sentence is “one day”, but that day could be decades away from today because their perception has been altered. They believe that the dollar is as good as gold, and as long as they think that, Fiat has no chance of being unseated, and nothing is standing in the way of the national debt moving to $100 trillion. If it could move from $75.4 million to almost $31 trillion without the masses revolting, the move from $20 trillion to $100 trillion is paltry by comparison.

2024: Navigating Fiat Money, Debt, and Potential Unrest

As of 2024, global debt has surpassed $315 trillion, with the US national debt exceeding $34 trillion. The power of fiat money and control over the money supply have enabled governments, particularly the US, to amass significant debt. This accumulation disproportionately affects the most vulnerable, as governments manage public sentiment through distractions and divisions, preventing widespread outcry.

The illusion of cost-free benefits and government interventions to prevent economic disasters maintain public faith. However, these measures often enrich a select few, exacerbating wealth inequality. Market downturns are exploited for wealth consolidation, with increased money supply inflating the economy, creating a deliberate cycle of booms and busts that fosters instability.

Historically, widespread unrest occurs only during extreme hardship, such as hunger, homelessness, and deprivation. Until such conditions are met, the populace remains relatively quiescent despite the looming threat of economic upheaval. The US federal budget for 2024 projects an interest expense of over $1 trillion on the federal debt, indicating a growing debt spiral.

The Federal Reserve accommodates inflation to finance multi-trillion-dollar budget deficits, resulting in a continuous cycle of increasing debt and money supply inflation. While some predict a breakdown of the US debt spiral in 2024, others anticipate a record $10 trillion in US Treasuries entering the market that same year.

Major expenditures, including entitlements and military spending, are expected to increase, further contributing to the debt spiral. This unsustainable economic system benefits those who control the money supply and those with the resources to navigate the complex financial landscape. The potential for economic instability, financial crises, and increasing wealth disparity underscores the need for more equitable and sustainable economic models.

Engineering a Crisis: Crafting a Solution for the Masses

The orchestration of crises is a time-tested method of manipulation. By creating a severe enough crisis, the public is often willing to accept solutions they would have previously rejected, believing that the alternative would be far worse. For those orchestrating these events, it is a dual victory—they capitalize on both the crisis and the solution, frequently at the cost of the general populace.

Yet, capitalizing on these crises is not as straightforward as buying stocks during a market crash. It requires a deep understanding of financial markets and the ability to discern emerging trends. Over a decade of research and development has created indicators that signal impending trend changes or market bottoms.

While financial acumen can allow one to navigate and potentially profit from these cycles, it does not negate that such cycles are detrimental to the economy and the average person. The manipulation of fiat money and the deliberate creation of financial crises contribute to wealth disparity and economic instability. Therefore, pursuing more equitable and sustainable economic systems remains a critical endeavour.

Effective Strategies for Enhancing Market Success and Navigating Financial Challenges

Understanding mass psychology is crucial to enhancing market success. Markets often react to investor perceptions rather than the news itself. Historical data suggests that market pullbacks while intimidating, can present opportunities. For instance, during the 1987 stock market crash, investors who recognized the pullback as an overreaction profited when the market rebounded.

Mastering technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help spot trends. An oversold RSI condition, for example, can signal a potential buying opportunity. Long-term charts, like weekly and monthly, help investors filter out ‘noise’ and understand the underlying trend.

Contrarian investing capitalizes on market psychological cycles. During the dot-com bubble, contrarian investors avoided overvalued tech stocks. Similarly, during the 2008 financial crisis, they sought undervalued assets when fear peaked. The key to contrarian investing is confidence in one’s valuation methods and the patience to wait for the market to recognize an asset’s true worth. Warren Buffett exemplifies this approach, often buying when others are selling. His investment in Bank of America during the financial crisis is a testament to this strategy’s effectiveness.

Philosophical insights from Solon and Plato can also be applied to these strategies. Both stressed that true success comes from understanding and aligning with higher principles rather than succumbing to immediate emotional reactions.

Conclusion: Understanding the Dynamics of Fiat Money and Market Strategies

Fiat money, a currency issued by governments and backed by trust, is influenced by financial performance, trade balances, inflation, monetary policy, and public confidence. Successful investors like Paul Tudor Jones and Bruce Kovner thrive by understanding these principles and market psychology. They recognize that market reactions are often driven by perception and emotional responses, creating opportunities for those who can discern between warranted concern and irrational fear.

Solon and Plato’s wisdom underscores the importance of moderation and philosophical inquiry. Solon emphasized the broader context of events, while Plato cautioned against manipulation by those in power. Their insights align with contrarian investors’ strategies, who capitalize on market overreactions and maintain confidence in their valuation methods. By integrating philosophical wisdom with practical investment strategies, investors can effectively navigate the complexities of fiat money dynamics and market cycles.

Other Articles of Interest

Permabear; It Takes A Special Kind Of Stupid To Be One