Deciphering the Value of Technical Indicators: Useful or Useless?

July 9, 2025

Technical indicators can be brilliant—until they’re not. What once guided traders with precision can suddenly go mute when market regimes shift. The truth is harsh: no tool stays reliable forever. In markets, adaptability isn’t optional—it’s survival.

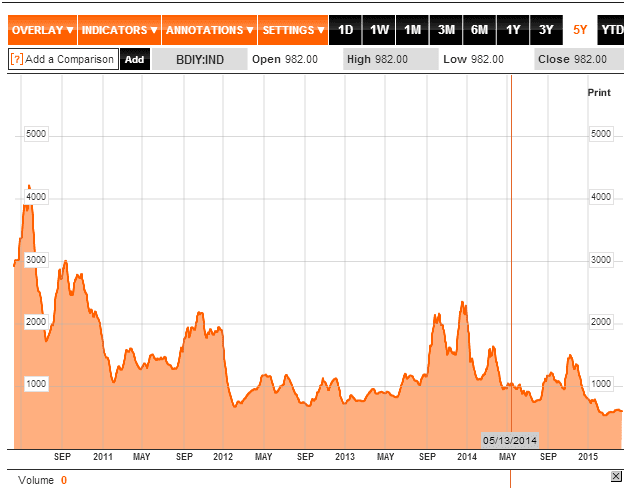

Take the Baltic Dry Index (BDI). From 2011 to 2015, the BDI trended downward relentlessly, even as the stock market roared higher. On the surface, it looked broken. Once hailed as a leading proxy for global trade health, it failed to keep up with asset inflation triggered by the Federal Reserve’s torrent of cheap money. Some dismissed it altogether. But that dismissal missed the point.

The BDI didn’t fail—it was overridden.

When the Fed pumped the system full of liquidity, capital flowed where fundamentals didn’t matter. Speculation outpaced shipping demand. In that climate, no economic barometer could speak louder than central banks. So the BDI wasn’t irrelevant—it was simply drowned out.

When the BDI Speaks Again

Now the silence is cracking.

As of June 2024, the BDI is showing signs of revival. If it pushes past 3,400, it opens the door to test 4,800 or even 5,100—its highest levels in over a decade. For those watching dry bulk shipping stocks like CMRE, that’s a green light—but not a blind one. CMRE sits in overbought territory on the weekly chart, and chasing it now is emotional trading masked as confidence. Let it cool. Then strike.

But the signal goes beyond shipping. A resurgent BDI may mark the pivot point where commodities, fertilisers, and food producers begin to rise higher after years of neglect. These are not momentum plays—they’re asymmetric bets for patient capital.

The Contrarian Signal Hidden in Plain Sight

When an indicator like the BDI drops 90% from its 2008 highs and still limps along for a decade, most investors stop looking. That’s precisely why you should start.

Mass sentiment aligns with dismissal. Nobody believes in the BDI anymore, which is exactly when it becomes interesting. The contrarian sees value where consensus sees noise.

Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.” Applied here, it’s not just about fear—it’s about neglect. When an indicator’s meaning has been written off, its reactivation can catch the market flat-footed. That’s the moment with the edge.

Benjamin Graham taught that margin of safety comes from deep analysis, not blind hope. So if you’re going to bet on a rebound—whether in shipping, commodities, or anything else—base it on facts, not fantasy. Rising freight rates, tightening global supply chains, and renewed industrial demand should show up in earnings and volume, not just vibes.

Seneca would add this: “He who suffers before it is necessary, suffers more than is necessary.” Most traders lose not from strategy but from stress. When tools stop working, they panic. When tools revive, they hesitate. A calm mind reads the shift, while others cling to outdated truths or abandon them too soon.

Critical Crossroads for the Baltic Index: A Defining Moment

One cannot fret over this; one has to adapt, bringing one of the essential sayings of the Tactical Investor to mind ” adapt or die”.

The Baltic Dry Index (BDI) was a reliable indicator of market direction. It would often top out or bottom out before the markets did, making it one of the select few technical analysis indicators consistently producing results.

However, this is no longer the case. The BDI, which worked well over the decades, is now useless and probably not good enough to use as toilet paper. It continues to trade at new lows, and the market continues to soar to new highs, proving market manipulation. Rather than fretting over this, it is crucial to adapt. At Tactical Investor, the saying “adapt or die” is essential.

Two Economic Indicators: Comeback Or Burial Time?

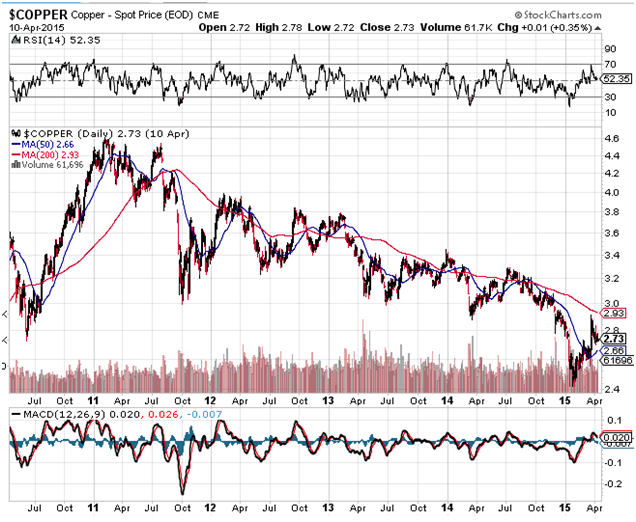

Copper has historically been a reliable indicator of the economy’s direction, but it is no longer as valuable due to the changing global economic landscape. The old rules and laws no longer apply as we enter a new phase of the worldwide currency wars. The market is in a state of maximum overdrive, and traders must adapt or die. The markets and copper prices no longer move in lockstep, and traders must be careful not to be misled by traditional indicators.

The current situation requires traders to be open-minded and embrace the new paradigm, even if it is difficult to understand. Market movements are not random but the result of calculated planning by those in power. It is essential to pay attention to others’ perceptions and plan accordingly to come out on top in any given situation.

Technical Analysis Indicators: Is it Time for Copper to Make a Comeback?

Navigating Market Complexity: A New Framework for Technical Clarity

The BDI’s fall from grace wasn’t an accident—it was a casualty of regime change. Once a bellwether for global trade, it now trades over 90% below its 2008 peak, not because the world stopped shipping goods, but because monetary policy rewrote the rulebook. The Fed didn’t just distort asset prices; it demolished the usefulness of historical correlations. When central banks flood the system with liquidity, traditional indicators lose their predictive edge—not forever, but until the system resets.

And now, signs of that reset are showing.

Copper told a similar story. When it punched past $4.50 in 2022, it wasn’t just reflecting demand—it was calling out policy mismanagement. Inflation, supply crunches, and global gridlock weren’t organic—bad decisions manufactured them. Copper didn’t care about the narrative; it moved anyway. That’s what strong assets do—they pierce through confusion. And even though it failed to hold its gains, the message was clear: supply chains were tightening, demand was rotating, and policymakers were the ones lagging, not the market.

So, where does that leave the modern investor?

Right at the intersection of chaos and clarity.

To operate in this environment, a new framework is needed—one built not on static indicators, but on fluid systems thinking. The game isn’t about “what does the BDI mean” or “where is copper headed.” It’s about how policy, sentiment, and positioning distort signals—and how to exploit those distortions.

Step one: Ditch the binary lens. Indicators aren’t good or bad—they’re context-sensitive. A collapsing BDI may still telegraph opportunity in dry bulk or fertilisers if you view it through a contrarian filter.

Step two: Accept that manipulation is now embedded in the structure. Complaining about central banks is pointless. Adapt your models. When capital is mispriced, relative value becomes king, and sectors with real-world utility (commodities, food, logistics) gain leverage.

Step three: Merge chartcraft with psychological timing. Oversold readings and price bases mean nothing unless you overlay crowd mood, positioning, and catalysts. The best trades today aren’t purely technical—they’re narrative-inflected.

This is where Buffett and Graham still matter—but in updated form. Buffett’s old quote about fear and greed still works, but only when paired with a scalpel. And Graham’s demand for analytical rigour? Still mandatory—but now it includes interpreting liquidity distortions, political incompetence, and the weaponisation of monetary policy.

Copper and the BDI are not dead indicators. They’re evolving messengers. They’re not wrong—they’re speaking a language most traders have forgotten how to hear.

The Real Final Word

Modern markets aren’t random—they’re rigged and reactive. That’s not a problem. It’s a system. And every system has signals—if you know how to filter noise, reinterpret failure, and recalibrate your tools for this age of intervention.

Don’t cling to old truths. Translate them.

And remember: the best indicators aren’t the ones everyone watches. They’re the ones everyone gave up on—right before they mattered again.