Dark Psychology Books: Why Reading Minds Won’t Help You Win the Market

May 10, 2025

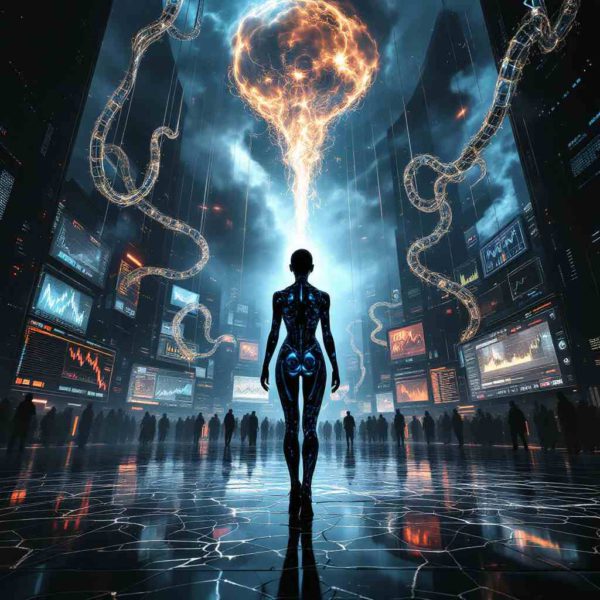

The Forbidden Library: Seduction of the Dark Side

So, you’ve stumbled upon the forbidden library, the section marked “Dark Psychology.” The titles whisper of unmasking manipulators, decoding the puppet masters, and gaining an illicit edge in a rigged game. The allure is undeniable, a siren song for those who suspect the market isn’t a level playing field but a meticulously crafted abattoir for the unsuspecting. These books promise to hand you the predator’s playbook. But here’s the razor’s edge: Are you learning to hunt, or are you merely marinating yourself for a more sophisticated slaughter?

The market is psychological. Raw, amplified, weaponised. These tomes, often penned by shadows or self-proclaimed defectors from the inner sanctum, offer a glimpse into the machinery of sentiment manipulation. They speak of fear, greed, and the herding instinct not as abstract concepts, but as levers to be pulled, buttons to be pushed. You read about engineered panic, orchestrated euphoria, the calculated deployment of narratives designed to make the masses stampede—right into the waiting jaws of those who drew the map.

The vector forces here are unmistakable—they don’t just push; they accelerate along precisely calculated trajectories. When market makers deploy dark psychological tactics, they’re not just influencing price but creating multidimensional force fields that channel emotional energy in predictable directions. Think of it as emotional fluid dynamics—they know exactly how fear propagates through the crowd, velocity, pressure, and breaking points.

X-Ray Vision or Psychological Neurotoxin?

The initial rush is intoxicating; you feel like you’ve been given X-ray vision. Suddenly, chart patterns aren’t just lines; they’re the fresh tracks of behemoths, the residue of carefully orchestrated campaigns. A head-and-shoulders top isn’t a probabilistic outcome; it’s a skull-and-crossbones, deliberately painted to signal your doom, or their entry.

But here’s where the floor drops out. This “knowledge,” if undigested, becomes a potent neurotoxin. Your technical signals, once allies, morph into a gallery of horrors. Every uptick is a bull trap they designed. Every dip is a meticulously planned shakeout. Recency bias latches onto the latest “dark” tactic you’ve read about, and suddenly it’s the only pattern in play. You see it everywhere, the market a canvas for your newfound paranoia.

Vector analysis reveals something crucial: dark psychology creates perpendicular force vectors in your mind. While the masses move along the horizontal plane of obvious narratives, these books pull you vertically into a different dimension. But this perpendicular force doesn’t just give perspective—it can tear your analytical framework apart if you lack the mental infrastructure to handle the strain. The cognitive dissonance between the market you thought you knew and this shadow realm creates tension vectors that can shatter rational decision-making.

The Paranoia Trap: When Dark Knowledge Turns Toxic

Loss aversion, already a powerful distortion, gets supercharged. You’re not just afraid of losing money; you’re terrified of being played, of confirming your status as a mark. This can lead to paralysis, or worse, to reckless counter-gambits based on an imagined psychological chess game where you’re perpetually three moves behind.

And the narrative fallacy? Oh, it feasts on this stuff. These books provide powerful, seductive narratives of control and deception. Soon, every news event, every earnings report, every central bank utterance is filtered through this dark lens, twisted to fit the script. You’re no longer analysing the market; you’re writing fan fiction for a conspiracy thriller, starring yourself as the beleaguered hero who almost sees the truth.

The vector mechanics here operate like a black hole—the gravitational pull of these dark narratives warps your entire information field. Data points that should move in straight lines of logical interpretation get bent around this massive object of paranoia at the centre of your analytical universe. The stronger the dark psychology concepts take hold, the more severe the curvature, until even the most innocent market movements appear sinister, their trajectories distorted by the lens through which you view them.

One-Person Cult: The Ego Trap of Secret Knowledge

The irony is that in trying to escape the “herd,” you risk becoming a one-person cult, enslaved by a narrative far more rigid than the one you fled. Deconstructing crowd behavior is a valid pursuit. Understanding how mass psychology forms bubbles and crashes is crucial. But these books often tempt you with the illusion of transcendence. You read about the sheep and think, “That’s not me. I have the secret.”

This is the ego trap, the subtle vector of these texts pulling you towards a dangerous overconfidence. You’re still in the crowd, just perhaps a more cynical, agitated member, convinced you’re the only one awake in a stadium of sleepwalkers. Mainstream narratives are indeed often flawed, simplistic, or outright misleading. Inverting them can be a source of alpha. But if your inversion is merely a mirror image, a knee-jerk contrarianism fueled by “dark psychology” dogma, you’re just swapping one set of blinkers for another.

The vector forces of contrarianism create powerful momentum, but momentum without proper direction is just chaos. When dark psychology books convert you into a reflexive contrarian, you’re not moving strategically through the market; you’re ricocheting wildly against whatever appears conventional. These oppositional vectors drain energy without creating progress. True edge comes not from automatic opposition but from identifying which vectors are artificial and which represent genuine market forces.

Cognitive Distortion: When Pattern Recognition Becomes Paranoia

The hidden patterns you uncover might be reflections of your own biases, amplified by the echo chamber of these forbidden texts. Consider the vector forces at play. These books exert a powerful emotional charge, a gravitational pull towards a worldview where every interaction is suspect, every motive dark. Historically, such “secret knowledge” has often led to isolation and ruin, not enlightenment.

Spatially, they risk positioning your analytical framework not above the fray, but deep within a narrow, shadowy canyon where the only light is the flickering flame of suspicion. You might think you’re seeing the market’s hidden wiring, but you could just be staring at the intricate patterns of your cognitive distortions, now given a vocabulary of malice.

Vector analysis reveals the most insidious effect: these books create interference patterns in your perception. Like waves colliding in a pond, the interaction between legitimate market signals and dark psychology concepts creates zones of amplification and cancellation. Some market movements appear exaggerated in importance because they align with the patterns these books describe, while other crucial signals get nullified because they contradict the dark narrative. This distortion field makes accurate reading of the market nearly impossible.

The Predator’s Playbook: False Empowerment

Cognitive science would warn of the profound impact of such focused, negative input. Your pattern recognition, a tool honed by evolution, can be hijacked and overfitted to this new deception dataset. Like an AI trained exclusively on images of predators, you start seeing teeth and claws in every shadow. The systemic complexity of markets—a dance of countless variables, genuine innovation, and yes, manipulation—gets flattened into a simplistic “us vs. them” melodrama.

So, when do you walk away? When the book stops being a tool and starts becoming your master. When it breeds not discernment, but a corrosive cynicism that paralyses your decision-making or, conversely, fuels a reckless desire to “fight the manipulators” in arenas where you are outgunned and outmanoeuvred.

The vector dynamics here are critical to understand: dark psychology creates what physicists would call “false equilibrium states”—highly unstable positions of apparent stability. You believe you’ve found solid ground by understanding the manipulation game, but you’ve positioned yourself at an energy peak, not a valley. The slightest perturbation—a market move that doesn’t fit your dark narrative—can put you into even deeper confusion.

Escape Velocity: Breaking Free from the Dark Gravity Well

Walk away when you dismiss all other data points and perspectives because they don’t fit the “dark” script. Walk away when the tension and paradox these books illuminate cease to be intellectual challenges and instead become sources of chronic anxiety and mispriced personal risk.

The real danger isn’t that these books are “wrong”; some of their observations on human frailty and exploitation are chillingly accurate. The danger is that they offer a partial map, mistaken for the entire territory, leading you into a psychological wilderness from which escape is far harder than recovering from a bad trade.

The ultimate misdirection is believing that reading the predator’s playbook automatically makes you immune to predation, or worse, turns you into one. It makes you a more predictable, albeit more agitated, meal more often.

The vector math here is brutally simple: knowledge without proper integration creates force without direction. The dark insights need to be balanced by other vectors—analytical discipline, emotional resilience, and most importantly, a broader contextual framework that doesn’t reduce all market activity to manipulation. When these countervailing forces are absent, the knowledge vector drives you not toward mastery but toward psychological implosion. Achieving escape velocity from this dark gravity requires acknowledging that markets contain both manipulation AND legitimate price discovery, as well as both predators AND genuine opportunities.