Emotional Manipulation Tactics: Navigating the Financial Battlefield

Updated April 30, 2024

Introduction: The Dark Side of Investing

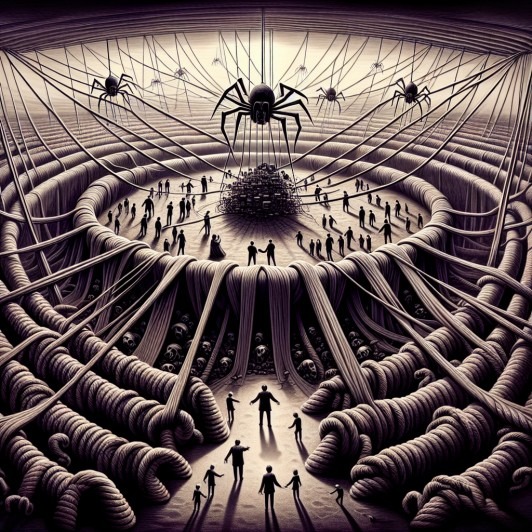

In the intricate world of finance, a subtle yet powerful force lurks in the shadows, pulling the strings of investors’ emotions and clouding their judgment. This force is emotional manipulation, a cunning strategy employed by savvy market players to influence and profit from the decisions of unsuspecting individuals. It’s time to lift the veil and expose the tactics used by these financial puppeteers, empowering investors to make informed and rational choices.

Exposing the Holy Grail Illusion

How often have you encountered investment services promising the elusive “holy grail” of investing, leaving you with significant losses and disillusionment? This is a classic example of emotional manipulation in action. These services prey on investors’ desires for quick and effortless profits, presenting themselves as saviours with secret strategies that guarantee success. However, beneath the alluring facade lies a web of deception designed to exploit your emotions.

Sensational stories and hypothetical scenarios are crafted to evoke a sense of urgency and excitement, distracting investors from the cold, hard facts. In the heat of the moment, it’s easy to get swept away by the promise of riches, ignoring the red flags that signal potential pitfalls. This is precisely the reaction that emotional manipulators seek to elicit, leading investors astray and lining their pockets.

Plato’s Cave and the Media’s Illusion

In his famous allegory of the cave, the ancient Greek philosopher Plato presented a profound insight into the nature of reality and perception. In this allegory, prisoners live their entire lives seeing only shadows on the cave wall, believing them to be reality. This metaphor reflects the modern-day phenomenon of media manipulation, where news outlets and financial pundits create an alternate reality by shaping how people perceive the world.

Much like the prisoners in Plato’s cave, investors can become entrapped by the shadows cast on the wall—the carefully curated narratives and angles presented by the media. This perception manipulation can lead to poor investment decisions, as investors may act based on an illusory reality rather than factual information. Thus, it becomes crucial to recognize this psychological warfare tactic and strive for objectivity and critical thinking.

Defence Strategies: Maintaining a Level Head

Investors must adopt a measured and rational approach to navigate the treacherous waters of emotional manipulation. This involves recognizing when emotions are running high and taking a step back to consider opposing viewpoints. By doing so, investors can avoid making impulsive decisions driven by fear or greed, often resulting in financial losses. Maintaining a level head enables a more comprehensive assessment of the situation, allowing facts and logic to guide investment strategies.

The media plays a significant role in shaping public opinion and can contribute to polarization. It is essential to approach media narratives with a critical eye, evaluating the information presented from multiple perspectives. Jumping to conclusions or committing to a particular camp without thorough examination can limit one’s ability to make informed decisions. Thus, remaining neutral and objective is a powerful defence against emotional manipulation.

Navigating the Sewers of Ever-Changing Opinions

The financial landscape is akin to a complex sewer system, with ever-changing currents of opinion and manipulation. Those who masterfully navigate these sewers are the puppet masters—the elite few who fluidly move from one camp to another, always staying ahead of the trend. They recognize that committing too soon to a particular stance can restrict their ability to adapt to changing market conditions.

As an investor, it’s crucial to avoid wearing your emotions on your sleeve. Instead, strive to examine situations from multiple angles, seeking out diverse perspectives. By doing so, you can avoid becoming a pawn in the psychological warfare waged by the puppet masters. Maintaining neutrality and a broad range of observations allows you to make more informed and timely investment decisions.

The Power of Hot Money

In the aftermath of the 2008 financial crisis, a disturbing trend emerged—the rise of “hot money.” The so-called bailout package revealed the extent to which the masses could be manipulated into accepting anything. While the banks responsible for the crisis were rescued, the victims were left to fend for themselves, highlighting the stark power dynamics.

The financial industry is driven by hot money, fueled by psychological warfare tactics. Investors must recognize how their emotions can be exploited, leading them to make impulsive decisions. By considering different viewpoints and relying on data-driven analysis, investors can avoid falling prey to manipulative narratives.

The growing wealth disparity between the super-elite and the working class further underscores the manipulative nature of the financial system. Hardworking individuals are sold the illusion that hard work leads to success, while the super-elite consolidate their power and influence, often at the expense of the masses.

Overcoming Helplessness: Encouragement and Support

Emotional manipulation tactics aim to instil a sense of overwhelm and helplessness in investors, akin to the rats in a famous experiment. However, just as those rats could turn things around with encouragement and support, investors, too, can take charge of their financial destiny. Seeking knowledge and arming oneself with the right tools can empower individuals to make informed investment and financial planning decisions.

It’s crucial not to succumb to conflicting information and opinions that can paralyze decision-making. Instead, focus on acquiring the skills and insights to navigate the financial landscape confidently. By doing so, investors can transform from overwhelmed spectators to empowered participants in their financial journey.

The Illusion of Resistance: A Cautionary Tale

The implementation of bailout and quantitative easing (QE) programs in recent years has revealed a startling lack of resistance from the public. Much like the Borg in Star Trek proclaiming, “resistance is futile,” these measures were enacted with little opposition, allowing central bankers to print trillions of dollars unchecked.

This dynamic illustrates the power of emotional manipulation on a grand scale. The masses have been led to accept FIAT currency as legitimate, creating the illusion that infinite money printing can solve any crisis. Hard money, a once-valued concept, has faded from the public consciousness, signalling the Fed’s victory in this battle of perceptions.

However, it’s essential to recognize that this illusion will only persist until the masses are entirely drained of their resources. At that point, rebellion and destruction may ensue, but it could take decades for this realization to manifest. In the meantime, investors must focus on the opportunities that arise during market crashes, such as buying stocks at discounted prices.

Market Volatility and the Power of Compounding

Market volatility, often fueled by emotional manipulation tactics, creates opportunities for savvy investors. It’s crucial to maintain a long-term perspective and not get caught up in short-term noise. Volatility can be a powerful tool for those with a solid investment plan, enabling them to buy during market dips and benefit from the power of compounding over time.

Emotions can drive the market to extremes, and sticking to a well-thought-out strategy is essential. Greed and fear are the enemies of rational decision-making. By focusing on fundamentals and adopting a disciplined approach, investors can harness the potential of market fluctuations to build wealth steadily.

Insider Activity and Market Opportunities

Insider trading activity provides valuable insights into market opportunities. During periods of market pullback, insiders often take advantage of lower stock prices to purchase shares at discounted rates. Analyzing the sell-to-buy ratio, a metric that gauges the intensity of insider buying, can offer clues about future market movements.

When the panic subsides, a feeding frenzy will likely ensue, driven by zero interest rates, massive federal injections, and stimulus packages. These factors will propel the markets to unprecedented heights. However, investors must also consider the risks associated with zero rates, forcing those on fixed incomes to take on more significant risks to maintain their purchasing power.

Psychological Warfare and the Financial Industry

Psychological warfare is rampant in the financial industry, with services and mass media employing tactics to shape investors’ perceptions. These manipulators create narratives and scenarios that evoke emotional responses, distracting investors from facts and rational analysis. To counter this, investors must remain emotionally detached, examining situations from multiple angles and relying on data-driven evidence.

The super-elite, a small group of influential individuals, controls a significant portion of America’s wealth. They manipulate public opinion and exploit connections to further their financial gains, often at the expense of the hardworking middle class. This dynamic underscores the importance of recognizing emotional manipulation and seeking objective information sources.

The Dark Side of Hot Money: Exploiting the Vulnerable

Hot money, or easy money, has become a tool for banks and large firms to profit at the expense of the vulnerable. Inflation, a consequence of excessive money printing, disproportionately impacts those on fixed incomes or with limited savings. As prices rise, their purchasing power diminishes, exacerbating financial inequality.

Central banks’ monetary policies, such as lowering interest rates or increasing the money supply, can fuel inflation if not carefully managed. Banks take advantage of low interest rates to borrow cheaply and invest in high-yielding assets, creating asset bubbles that eventually burst, leaving the poor and middle class to bear the consequences.

Banks and big firms also engage in market manipulation and insider trading, further enriching themselves while ordinary investors suffer losses. These practices highlight the need for regulatory intervention to ensure a fair and equitable financial system.

Conclusion: Breaking Free from Emotional Manipulation

Emotional manipulation tactics in the financial industry are pervasive, but investors can arm themselves with knowledge and objectivity to counter these deceptive strategies. By recognizing how emotions can be exploited, investors can make more rational decisions, improving their financial outcomes.

As Plato’s allegory of the cave teaches, seeking truth and objectivity is essential. Investors must strive to see beyond the shadows cast by manipulators, embracing diverse perspectives and factual information. By doing so, they can navigate the financial battlefield with resilience and success, no longer falling victim to the emotional manipulation tactics that permeate Wall Street.

Other Articles of Interest

9-5 Rat Race: Work Until You Die or Break Free?